Market Definition

The market involves exploring, developing, and using heat from the Earth to generate electricity and other heating solutions. This market explores various activities related to geothermal energy, including drilling, reservoir engineering, power plant construction, equipment manufacturing, and maintenance services. The report provides insights into the core drivers of market growth, supported by an in-depth evaluation of industry trends and regulatory frameworks.

Geothermal Energy Market Overview

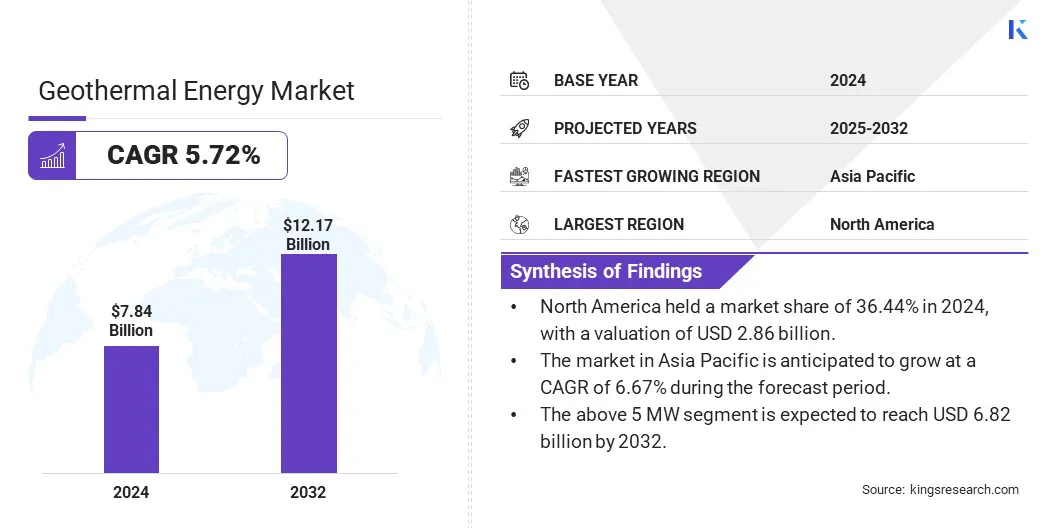

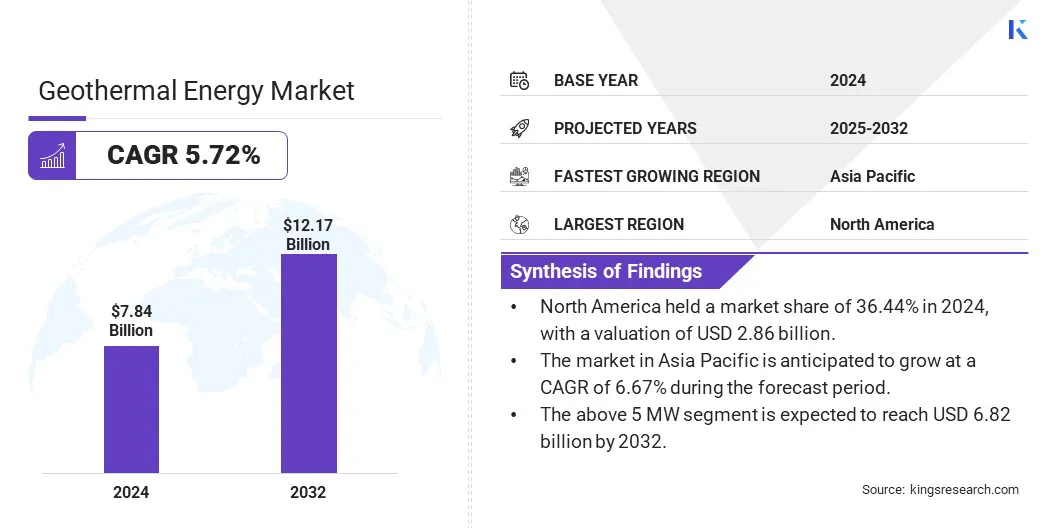

The global geothermal energy market size was valued at USD 7.84 billion in 2024 and is projected to grow from USD 8.24 billion in 2025 to USD 12.17 billion by 2032, exhibiting a CAGR of 5.72% during the forecast period. This growth is attributed to the rising emphasis on clean and sustainable energy solutions, driven by increasing concerns related to climate change and the environmental impact of fossil fuels.

Geothermal energy is gaining traction on account of its ability to provide reliable, low-emission, and continuous power generation, making it a key component in the shift toward renewable energy.

Major companies operating in the geothermal energy industry are Toshiba, Ansaldo Energia, Berkshire Hathaway Energy, Ormat, Halliburton Energy Services, Inc., Calpine Corporation, MITSUBISHI HEAVY INDUSTRIES, LTD., Fuji Electric Co., Ltd., Fervo Energy, First Gen, Baker Hughes Company, SLB, Energy Development Corporation, Cyrq Energy, and Controlled Thermal Resources Holdings, Inc.

The growing demand for stable and efficient energy sources in industrial, commercial, and residential sectors is driving the adoption of geothermal technologies. Additionally, advancements in drilling methods, reservoir engineering, and cost-effective energy conversion systems are enhancing the feasibility and scalability of geothermal projects.

Supportive regulatory frameworks, financial incentives, and continuous innovation in system performance and efficiency are accelerating the market development and expanding the range of geothermal applications.

- In May 2024, Zanskar Geothermal & Minerals secured a funding of USD 30 billion to expand its AI-driven geothermal exploration technology. This investment supports the company’s efforts to discover new geothermal resources and accelerate clean, affordable energy development.

Key Highlights

- The geothermal energy industry size was valued at USD 7.84 billion in 2024.

- The market is projected to grow at a CAGR of 5.72% from 2025 to 2032.

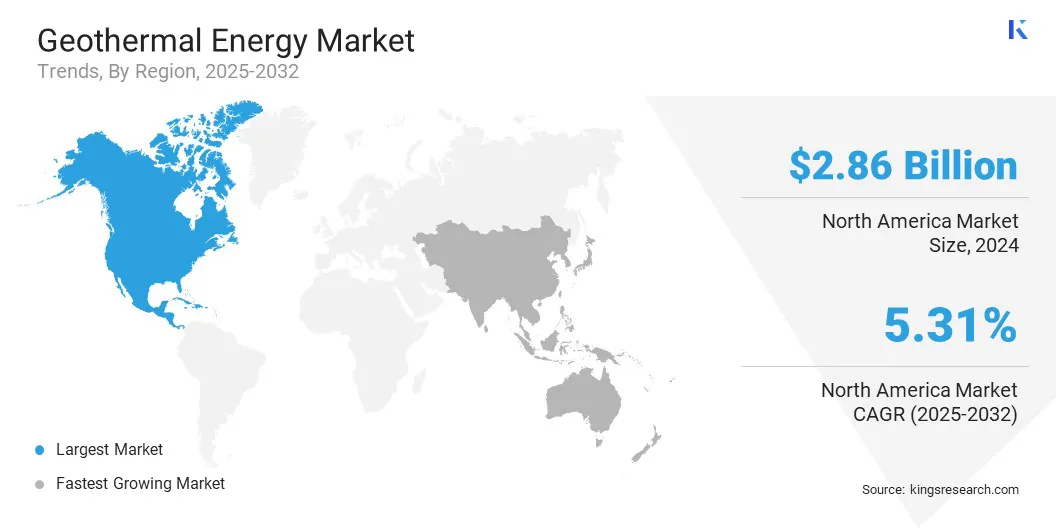

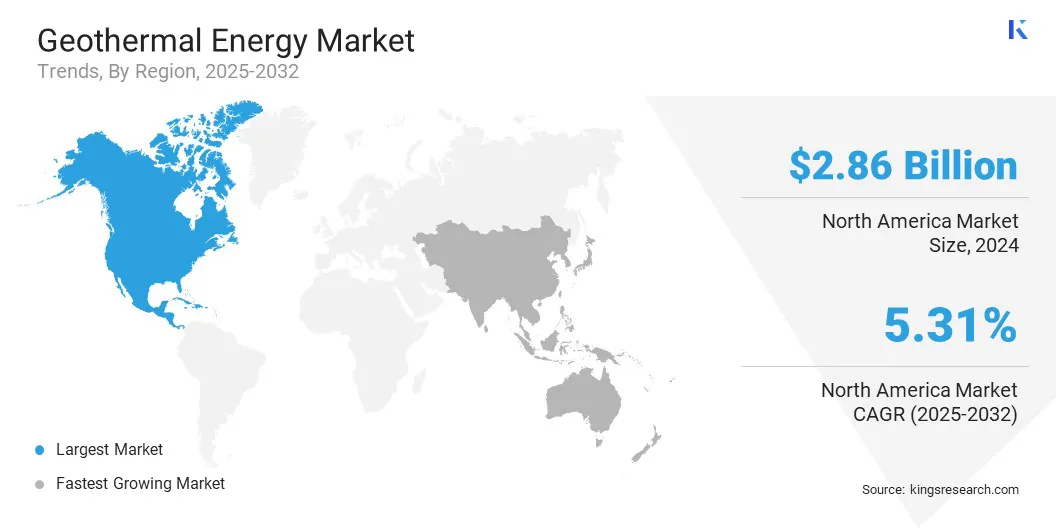

- North America held a market share of 36.44% in 2024, with a valuation of USD 2.86 billion.

- The flash steam segment garnered USD 3.80 billion in revenue in 2024.

- The above 5 MW segment is expected to reach USD 6.82 billion by 2032.

- The commercial heating and cooling segment is anticipated to witness the fastest CAGR of 6.40% during the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 6.67% during the forecast period.

Market Driver

Increasing Global Demand for Clean, Reliable, and Sustainable Energy

The geothermal energy market is propelled by the increasing global demand for clean, reliable, and sustainable energy sources. Governments and industries are prioritizing zero carbon emissions and achieving climate targets. As a result, there is a strong push toward the adoption of renewable energy solutions with a consistent power output.

This demand is driven by expanding populations, urbanization, and industrialization, which require a stable, clean, and efficient energy supply. This demand is supported by advancements in energy technologies and growing infrastructure investments to enhance the accessibility and affordability of sustainable energy options.

The focus on energy security and environmental responsibility is motivating stakeholders to adopt renewable sources such as geothermal energy, accelerating the global clean energy market growth.

- In March 2025, the World Bank approved a $150 million loan to support El Salvador’s geothermal energy project, which includes constructing a 25 MW power plant and investigating opportunities to increase generation capacity by an additional 40 MW. The initiative aims to boost renewable electricity production, provide direct geothermal heat for local industries, create jobs, enhance energy reliability, and reduce reliance on fossil fuels while addressing climate change.

Market Challenge

Geological Uncertainty and Drilling Risk

The presence of geological uncertainty and drilling risks present a significant challenge to the growth and viability of geothermal energy. Locating viable geothermal reservoirs requires complex exploration processes, often involving seismic surveys, geophysical imaging, and test drilling, which can be time-consuming and expensive.

The drilling phase carries inherent risks, as subsurface conditions relating to temperature, pressure, rock permeability, and fluid content are difficult to predict precisely. A miscalculation can result in non-productive wells, leading to financial losses and project delays. These risks can discourage investments and limit the scalability of projects, particularly in regions lacking detailed geological data.

To address these issues, developers are switching to advanced subsurface imaging technologies, 3D reservoir modeling, and machine learning tools to improve resource characterization before drilling. In addition, they are using enhanced geothermal systems to expand resource availability by creating artificial reservoirs in unsuitable locations.

Government support in the form of exploration risk mitigation programs, insurance mechanisms, and technical assistance is also helping to reduce the financial exposure of early-stage geothermal projects and encourage investment in the sector.

Market Trend

Development and Adoption of Enhanced Geothermal Systems (EGS)

The development of enhanced geothermal systems is transforming the geothermal energy market by expanding resource accessibility and improving project viability. EGS technology helps engineer geothermal reservoirs in locations lacking natural hydrothermal activity, overcoming traditional geographic limitations.

This allows the extraction of heat from hot dry rock formations by injecting water to generate steam, extending geothermal power generation beyond conventional volcanic regions. The advancement of EGS is attracting investments and research focus, driven by its potential to deliver reliable, base-load renewable energy at competitive costs.

The advancement of EGS is drawing investment and research for its potential to deliver reliable, cost-effective renewable energy. Moreover, the integration of improved drilling techniques and reservoir management with EGS is enhancing efficiency and scalability.

As enhanced geothermal systems, directional drilling technologies, and digital reservoir monitoring tools continue to mature, they will likely accelerate the adoption of geothermal energy, supporting global energy transition and decarbonization efforts.

- In June 2024, the U.S. Department of Energy announced up to USD 14.2 billion in funding for pilot projects to advance Enhanced Geothermal Systems (EGS) in the eastern U.S. This initiative aims to expand geothermal energy availability in areas without natural hydrothermal resources and support the transition to clean and reliable power.

Geothermal Energy Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

Flash Steam, Dry Steam, and Binary Cycle Power Plants

|

|

By Power Capacity

|

Upto 5MW, Above 5 MW

|

|

By Application

|

Power Generation, Residential Heating and Cooling, Commercial Heating and Cooling, Industrial Process Heat, and Others (Agriculture and Aquaculture, Snow Melting, Balneology)

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Technology (Flash Steam, Dry Steam, and Binary Cycle Power Plants): The flash steam segment generated USD 3.80 billion in 2024, primarily due to the wide availability of high-temperature geothermal resources and the technology’s high efficiency in converting geothermal energy into electricity.

- By Power Capacity (Upto 5MW, and Above 5 MW): The above 5 MW segment held 54.78% of the market in 2024, owing to the higher efficiency and economies of scale offered by large-capacity geothermal power plants.

- By Application (Power Generation, Residential Heating and Cooling, Commercial Heating and Cooling, Industrial Process Heat, and Others (Agriculture and Aquaculture, Snow melting, Balneology): The power generation segment is projected to reach USD 4.14 billion by 2032, following the increasing demand for sustainable and reliable electricity sources across various industries and regions.

Geothermal Energy Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America geothermal energy market share stood at around 36.44% in 2024, with a valuation of USD 2.86 billion. This dominance is attributed to a well-established geothermal infrastructure and investments in advanced exploration and drilling technologies. Additionally, strong government support through favorable policies and incentives that aim to promote renewable energy adoption continues to drive market growth.

- In June 2024, the U.S. Department of Energy announced USD 7 billion in funding to support regional grid modeling studies. The initiative aims to evaluate geothermal energy’s role in enhancing grid stability, economic value, and equitable energy transition across diverse U.S. regions.

Favorable policies and initiatives to reduce carbon emissions further accelerate the adoption of geothermal energy for power generation and heating. Furthermore, growing need for sustainable energy solutions and ongoing technological innovations are enhancing the efficiency and scalability of geothermal projects, supporting market expansion across the region.

- In February 2025, ABB partnered with Sage Geosystems to advance geopressured geothermal systems, aiming to provide up to 150 MW of geothermal power to Meta’s U.S. data centers by 2027. ABB will supply automation and digital technologies to improve efficiency and reliability at geothermal sites worldwide.

The geothermal energy industry in Asia-Pacific is poised for significant growth at a CAGR of 6.67% over the forecast period. This growth can be linked to the increasing energy demand from rapidly industrialization and the focus on diversifying the energy mix to enhance energy security. The expanding renewable energy infrastructure and government incentives are driving the exploration and development of geothermal resources.

- In January 2025, the Asian Development Bank (ADB) approved USD 92.6 billion to support Indonesia’s geothermal expansion, which included an 83 MW plant in West Sumatra. The funding aims to reduce investment risks and accelerate the country’s clean energy transition.

Rising investments and international collaborations are further accelerating geothermal project deployments across various countries. Technological advancements in geothermal extraction and growing environmental awareness are improving the efficiency and adoption of geothermal energy, propelling market growth in this region.

- In April 2025, Google entered its first corporate geothermal energy purchase agreement in Taiwan with Baseload Capital, adding 10 MW of continuous and carbon-free energy to the grid by 2029. This energy will support Google’s data centers and offices as part of its commitment to operate on 24/7 carbon-free energy by 2030. The agreement includes investments in local geothermal infrastructure and workforce development, with plans to explore similar projects in other Asia-Pacific markets.

Regulatory Frameworks

- In the U.S., the Bureau of Land Management (BLM) and the Federal Energy Regulatory Commission (FERC) regulate geothermal exploration, drilling, and operation through licensing and permitting requirements to manage resource access and usage rights.

- In the European Union, the Renewable Energy Directive (Directive (EU) 2018/2001) establishes a common framework to promote the production and usage of energy from renewable sources, including geothermal energy. It sets binding targets for renewable energy consumption and requires member states to implement measures for increasing the share of renewables in their energy mix.

- In Australia, geothermal energy is regulated by individual states through legislation such as the Geothermal Energy Act (Victoria) and the Petroleum and Geothermal Energy Resources Act (Western Australia), administered by respective state departments like the Department of Energy and Resources, focusing on licensing, exploration, and environmental safeguards.

Competitive Landscape

The geothermal energy industry is characterized by a mix of established companies and emerging players, each focusing on expanding their project portfolios and technological capabilities through innovation, strategic partnerships, and market expansion.

- In November 2024, BASF and Vulcan Energy partnered to use geothermal energy at BASF’s Ludwigshafen site. The partnership aims to generate 300 MW of renewable heat annually and cut CO₂ emissions by 800,000 tons. Vulcan will also develop a lithium extraction plant using geothermal brine.

Leading firms are investing in research and development to enhance exploration techniques, drilling efficiency, and the adoption of enhanced geothermal systems. They are also working on developing cost-effective and scalable geothermal solutions to meet the increasing demand for sustainable energy across power generation, heating, and industrial applications.

Additionally, companies are collaborating with governments, technology providers, and financial institutions to mitigate risks and accelerate the deployment of geothermal projects worldwide.

List of Key Companies in Geothermal Energy Market:

- Toshiba

- Ansaldo Energia

- Berkshire Hathaway Energy

- Ormat

- Halliburton Energy Services, Inc.

- Calpine Corporation

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- Fuji Electric Co., Ltd.

- Fervo Energy

- First Gen

- Baker Hughes Company

- SLB

- Energy Development Corporation

- Cyrq Energy

- Controlled Thermal Resources Holdings, Inc.

Recent Developments (Partnerships/Agreements)

- In April 2025, Fervo Energy finalized a 15-year agreement to supply 31 MW of geothermal power to Shell Energy North America from its Cape Station project in Utah. Set to commence power generation in 2026, this initiative represents the largest enhanced geothermal system worldwide, using innovative oil and gas technologies to enhance production efficiency.

- In February 2025, PT Pertamina Geothermal Energy Tbk partnered with Sinopec Star Co, Ltd. to promote the advancement of geothermal energy. This partnership aims to leverage their combined expertise in power generation and district heating, while exploring opportunities in green hydrogen and expanding their presence in international markets.

- In January 2025, SLB and Star Energy Geothermal collaborated to advance geothermal technologies by improving subsurface characterization, drilling, and production processes to reduce project risks and energy costs. This effort combines Star Energy’s geothermal expertise with SLB’s technology to enhance the efficiency and economics of geothermal projects.