Market Definition

Gas separation membranes are selective barriers designed to separate specific gases from mixtures based on differences in permeability and diffusivity. These membranes are commonly made from polymeric or inorganic materials and offer energy-efficient alternatives to traditional separation methods.

The market encompasses the design, production, and application of membrane systems for processes such as carbon dioxide removal, nitrogen generation, and hydrogen recovery.

Gas Separation Membrane Market Overview

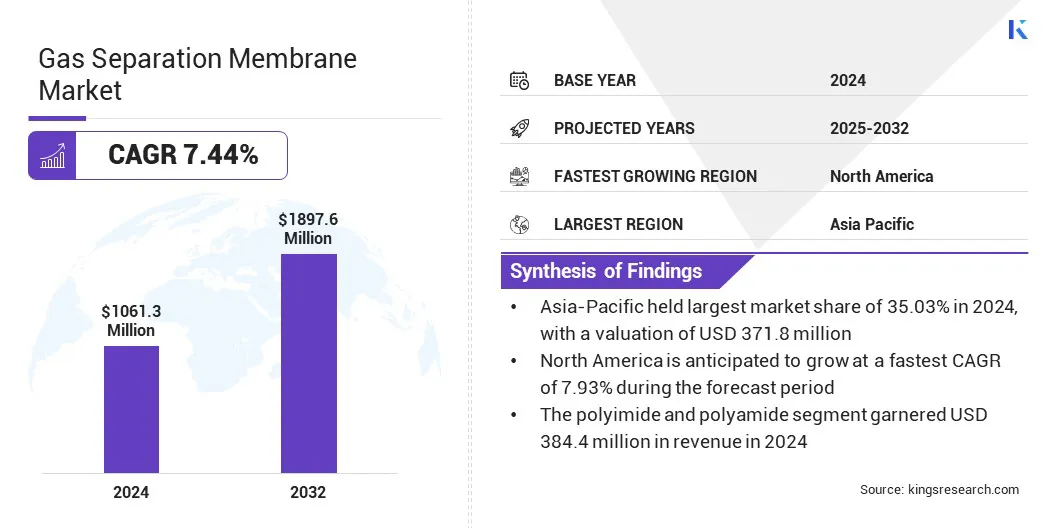

The global gas separation membrane market size was valued at USD 1,061.3 million in 2024 and is projected to grow from USD 1,135.0 million in 2025 to USD 1,897.6 million by 2032, exhibiting a CAGR of 7.44% during the forecast period.

This growth is attributed to the rising demand for energy-efficient gas separation technologies that offer lower operational costs compared to conventional methods. Moreover, the increasing use of membranes for carbon dioxide removal, hydrogen recovery, and nitrogen generation in oil & gas, chemical, and power industries is fueling the market.

Key Highlights

- The gas separation membrane industry size was valued at USD 1,061.3 million in 2024.

- The market is projected to grow at a CAGR of 7.44% from 2025 to 2032.

- Asia-Pacific held a market share of 35.03% in 2024, valued at USD 371.8 million.

- The polyimide and polyamide segment garnered USD 384.4 million in revenue in 2024.

- The nitrogen separation segment is expected to reach USD 568.2 million by 2032.

- The market in North America is anticipated to grow at a CAGR of 7.93% through the forecast period.

Major companies operating in the gas separation membrane industry are Air Liquide Advanced Separations, Air Products and Chemicals, Inc., Parker Hannifin Corp, Honeywell International Inc., FUJIFILM Corporation, DIC CORPORATION, UBE Corporation, GENERON, SLB, Mahler AGS GmbH, Atlas Copco AB, JSC Grasys, GMT Membrantechnik GmbH, Evonik, and Membrane Technology and Research, Inc.

Growing focus on reducing greenhouse gas emissions and complying with stringent environmental regulations is accelerating the adoption of membrane-based systems. Additionally, advancements in membrane materials, enhanced selectivity, and expanding industrial gas applications are contributing to the market’s robust growth trajectory.

- In December 2024, Toray Industries announced the installation of a pilot facility at its Shiga site to advance mass production technology for its all-carbon CO₂ separation membrane. The initiative aims to support the scalable production of compact, high-efficiency membranes for biogas purification, carbon capture, and natural gas processing, while promoting industry collaboration and accelerating commercialization.

Market Driver

Growing Demand for Cost-effective & Energy-saving Gas Separation Technologies

The gas separation membrane market is driven by the increasing demand for cost-effective and energy-efficient gas separation solutions across various industrial applications. Traditional separation methods such as cryogenic distillation and pressure swing adsorption involve high energy consumption and operational costs, prompting industries to shift toward membrane-based systems.

These membranes allow selective gas separation under milder operating conditions, resulting in reduced energy use, lower emissions, and minimized maintenance requirements.

The adoption of membrane technologies is gaining momentum in oil & gas, chemical processing, and power generation industries, where efficiency and sustainability are top priorities. Rising awareness of environmental concerns and the need to optimize resource use are further contributing to the market’s upward trajectory.

Market Challenge

Performance Limitations Under Harsh Conditions

The gas separation membrane market faces several challenges due to the limited durability and stability of membrane materials when exposed to harsh industrial environments. Applications involving high temperatures, aggressive chemicals, or elevated pressures can significantly reduce membrane lifespan and compromise separation efficiency. These conditions are common in petrochemicals and refining sectors, where consistent performance is critical.

Membranes made from polymeric materials often degrade under such stress, while more robust alternatives like inorganic and mixed-matrix membranes incur higher costs and production complexities. This limits the adoption of membrane technologies in demanding applications, constraining the market growth.

Industry participants are focusing on developing advanced materials and protective coatings to improve membrane resilience and enable broader deployment in severe operating conditions.

- In January 2023, Toray Industries announced that its all-carbon CO₂ separation membrane demonstrated strong durability in demanding natural gas refining environments, including exposure to high CO₂ levels and common impurities. The membrane enables energy-efficient CO₂ separation without requiring extensive pretreatment, offering a cost-effective alternative to conventional methods.

Market Trend

Surging Adoption of Carbon Capture Technologies & Hydrogen Economy Solutions

The surging adoption of carbon capture technologies and hydrogen economy solutions is shaping the direction of the gas separation membrane market, as industries seek cleaner and more efficient ways to manage emissions and produce low-carbon energy. Membrane-based systems offer a compact, energy-efficient approach to capturing carbon dioxide from flue gases and purifying hydrogen in large-scale industrial processes, making them integral to emerging sustainability frameworks.

These solutions are gaining traction in power generation, petrochemicals, and refining sectors, where regulatory pressure and decarbonization goals are accelerating investment in cleaner technologies. The role of membranes is further reinforced by advancements in material science that enable higher selectivity, durability, and cost-effectiveness in carbon and hydrogen separation.

Membrane technologies are expected to play a pivotal role in supporting this transition as the global energy landscape shifts toward climate resilience and energy diversification.

- In January 2025, Arkema and Japanese start-up OOYOO announced a partnership to develop high-performance gas separation membranes for carbon capture. The collaboration combines Arkema’s advanced polymer technologies with OOYOO’s membrane design expertise to enhance CO₂ separation efficiency. The initiative supports the development of cost-effective, scalable solutions for reducing greenhouse gas emissions.

Gas Separation Membrane Market Report Snapshot

|

Segmentation

|

Details

|

|

By Material

|

Polyimide and Polyamide , Polysulfone, Cellulose Acetate, and Others

|

|

By Application

|

Nitrogen Separation, Oxygen Separation, Acid gas Separation, Hydrogen Separation, H2S Removal, and Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Material (Polyimide and Polyamide, Polysulfone, Cellulose Acetate, and Others): The polyimide and polyamide segment earned USD 384.4 million in 2024, due to their superior thermal stability, chemical resistance, and high gas separation performance in demanding industrial applications.

- By Application (Nitrogen Separation, Oxygen Separation, Acid gas Separation, Hydrogen Separation, H2S Removal, and Others): The nitrogen separation segment held a market share of 29.90% in 2024, due to the rising demand for high-purity nitrogen across food packaging, electronics, and chemical industries, where membrane systems offer efficient and cost-effective separation.

Gas Separation Membrane Market Regional Analysis

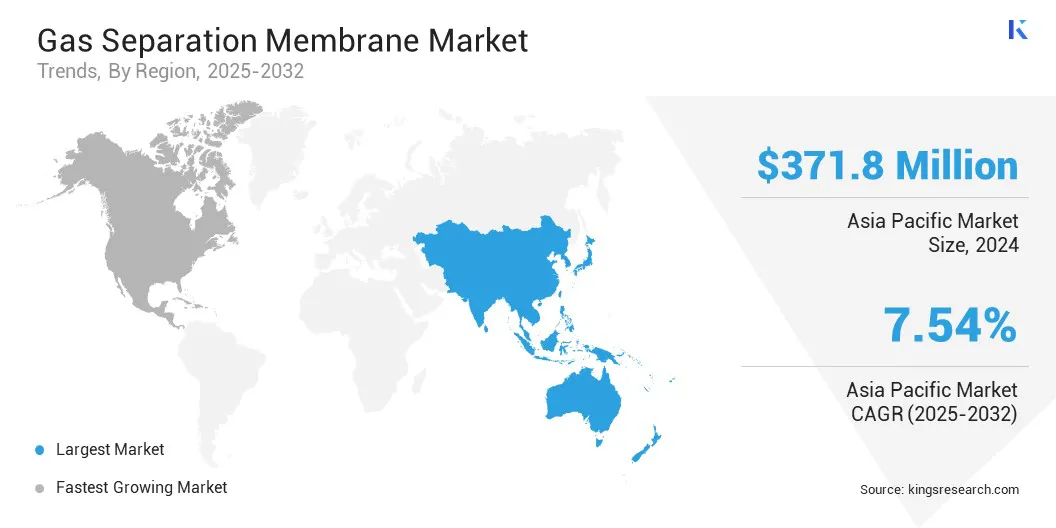

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific accounted for a gas separation membrane market share of around 35.03% in 2024, valued at USD 371.8 million. This market dominance is reinforced by the region’s expanding industrial base, rising energy consumption, and strong government focus on emissions reduction and energy efficiency.

The increasing adoption of membrane-based gas separation systems in natural gas processing, hydrogen recovery, and petrochemical production is supporting the development of low-emission, high-performance operations across key economies.

Strategic investments in clean energy infrastructure and favorable regulatory frameworks are encouraging the deployment of advanced separation technologies in both public and private sectors. The growing presence of domestic manufacturers and research institutions is accelerating material innovation and localized production, enhancing regional competitiveness.

Moreover, ongoing advancements in membrane performance, system integration, and cost optimization are fostering greater commercial viability and sustaining the long-term growth of the market in Asia Pacific.

- In February 2024, Japan-based OOYOO Ltd. entered into a basic agreement with TOPPAN Holdings Inc. to jointly develop and mass-produce advanced CO₂ separation membranes. The collaboration combines OOYOO’s proprietary membrane technology with TOPPAN’s film processing expertise to deliver compact, cost-effective carbon capture solutions. This partnership aims to accelerate the adoption of carbon recycling technologies in Japan and support the country’s transition toward a carbon-neutral society.

The gas separation membrane industry in North America is set to grow at a CAGR of 7.93% over the forecast period. This growth is attributed to the rising need for energy-efficient gas processing technologies and increasing regulatory pressure to reduce industrial emissions across key sectors.

The region’s strong oil & gas infrastructure, coupled with growing demand for hydrogen recovery, carbon dioxide removal, and nitrogen generation, is fueling the deployment of membrane-based separation systems.

Government policies supporting clean energy transitions and carbon capture initiatives are encouraging wider adoption of advanced membrane technologies. Additionally, strategic partnerships among technology providers, energy companies, and research institutions, along with ongoing innovations in membrane materials and system design, are enhancing performance, reducing operational costs, and supporting sustained market expansion across North America.

Regulatory Frameworks

- In the U.S., the Clean Air Act (CAA) regulates emissions from industrial and power generation sources. It promotes the use of gas separation membranes by encouraging technologies that reduce air pollutants and greenhouse gases, particularly in applications like carbon capture and hydrogen purification.

- In the European Union (EU), the Industrial Emissions Directive (Directive 2010/75/EU) regulates pollution from large-scale industrial activities. It supports the deployment of gas separation membranes as part of best available techniques (BAT) to control emissions of carbon dioxide, volatile organic compounds, and other harmful gases.

- In Japan, the Act on Rational Use of Energy regulates energy efficiency in industrial processes. It incentivizes the integration of gas separation membrane technologies to improve energy conservation and reduce carbon emissions in natural gas processing and chemical manufacturing sectors.

Competitive Landscape

Companies operating in the global gas separation membrane market are actively working to strengthen their market position through material innovation, product diversification, and strategic collaborations. Leading players are heavily investing in research and development to improve membrane selectivity, durability, and resistance to harsh operating environments, aiming to deliver efficient, scalable, and cost-effective gas separation solutions across diverse industries.

They are also advancing next-generation membrane technologies such as mixed-matrix membranes, inorganic variants, and smart sensor-integrated systems to meet the evolving demands of applications like carbon capture, hydrogen purification, and natural gas processing.

Additionally, firms are partnering with energy companies, industrial gas producers, and research institutions to accelerate commercialization, expand their application portfolio, and secure competitive advantages in both developed and emerging markets.

- In October 2023, Osmoses secured USD 11 million in funding to advance its novel membrane technology for decarbonizing the industrial gas separation market, projected to reach USD 35 billion. The investment will support technology scaling and commercialization.

List of Key Companies in Gas Separation Membrane Market:

- Air Liquide Advanced Separations

- Air Products and Chemicals, Inc.

- Parker Hannifin Corp

- Honeywell International Inc.

- FUJIFILM Corporation

- DIC CORPORATION

- UBE Corporation

- GENERON

- SLB

- Mahler AGS GmbH

- Atlas Copco AB

- JSC Grasys

- GMT Membrantechnik GmbH

- Evonik

- Membrane Technology and Research, Inc.

Recent Developments (Partnerships/Expansion)

- In March 2025, H2SITE and SNAM announced a collaboration on a hydrogen and natural gas separation project backed by Italy’s ARERA. The initiative involves deploying a large-scale palladium-alloy membrane unit capable of extracting high-purity hydrogen from low-concentration gas mixtures, supporting clean energy applications while preserving natural gas quality.

- In October 2023, Evonik announced the expansion of its production capacity for gas separation membranes at its site in Schörfling, Austria, to meet the growing global demand. The investment supports the increased supply of SEPURAN membranes used in biogas, nitrogen, and hydrogen processing applications.