Market Definition

A gaming chair is an ergonomically designed seat tailored to enhance comfort, posture, and performance during extended gaming sessions. The market includes PC gaming chairs, console gaming chairs, and hybrid models, incorporating features such as adjustable armrests, lumbar support, reclining functions, and integrated audio systems.

It spans residential, commercial, and esports applications, covering both premium and budget segments. The scope extends across offline and online distribution channels, targeting casual gamers, professionals, and gaming enthusiasts.

Gaming Chair Market Overview

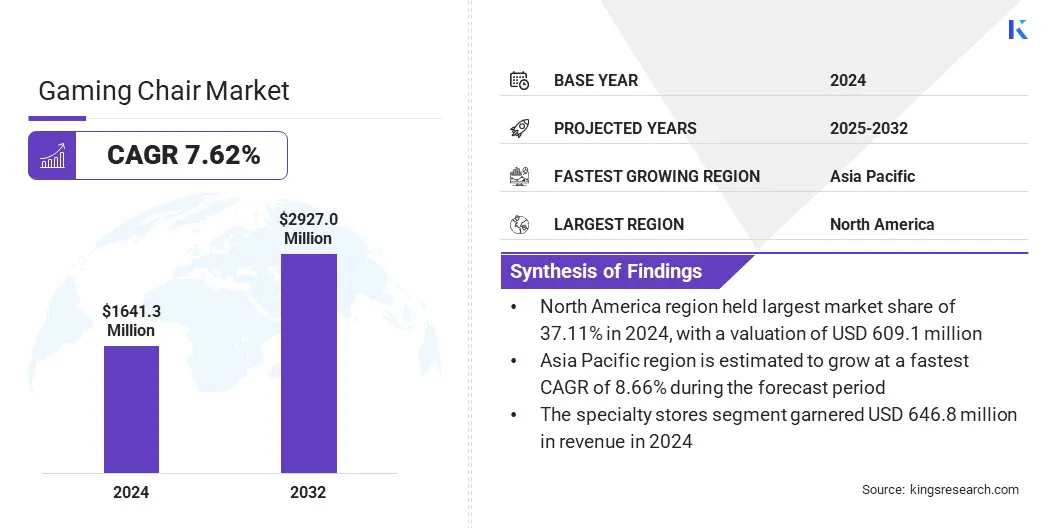

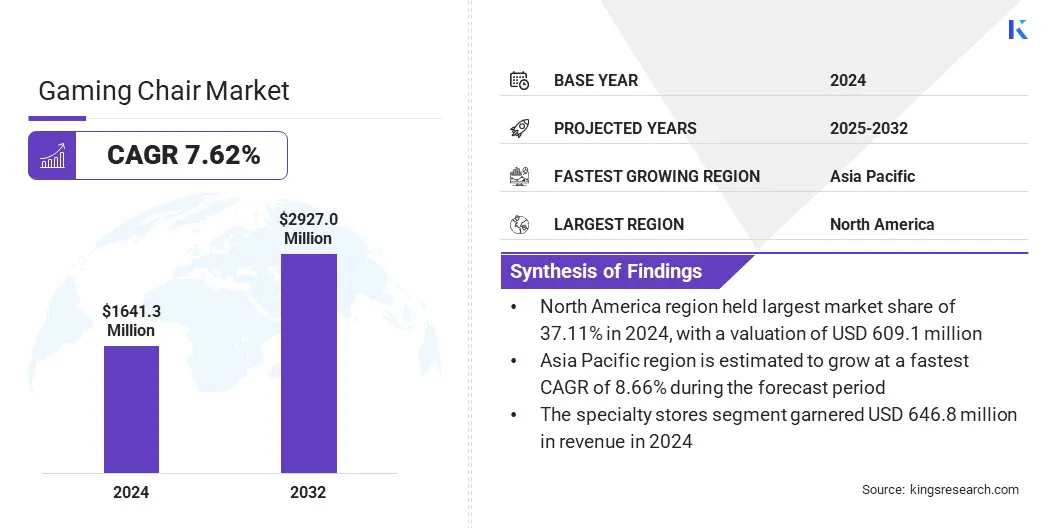

The global gaming chair market size was valued at USD 1,641.3 million in 2024 and is projected to grow from USD 1,750.1 million in 2025 to USD 2,927.0 million by 2032, exhibiting a CAGR of 7.62% during the forecast period.

The market growth is attributed to rising esports integration driving demand for ergonomic gaming chairs that enhance performance and comfort. Additionally, the integration of smart features in gaming chairs further supports market expansion.

Key Market Highlights:

- The gaming chair industry size was recorded at USD 1,641.3 million in 2024.

- The market is projected to grow at a CAGR of 7.62% from 2025 to 2032.

- North America held a market share of 37.11% in 2024, with a valuation of USD 609.1 million.

- The leather segment garnered USD 614.5 million in revenue in 2024.

- The individual gamers segment is expected to reach USD 1,041.4 million by 2032.

- The online retailers segment is anticipated to witness the fastest CAGR of 8.45% during the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 8.66% during the forecast period.

Major companies operating in the gaming chair market are Secretlab, Corsair, DXRACER, GT Omega USA, Vertagear, Haworth Inc., AndaSeat, Razer Inc., blacklyte Inc., Comfort Grid Technologies Private Limited, Wipro Seating Solutions, Cybeart India Pvt. Ltd., Steelcase, Herman Miller, Inc., and Merryfair Chair System Sdn. Bhd.

The growing global gamer population, fueled by rising access to digital gaming platforms, is driving sustained demand for specialized gaming chairs. This expansion includes casual players and professional participants who require enhanced comfort, posture support, and performance during prolonged gaming sessions.

As user engagement deepens across mobile, PC, and console segments, the need for purpose-built seating solutions continues to rise, reinforcing steady market demand and positioning gaming chairs as essential components of the modern gaming environment.

Market Driver

Rising Esports Integration Driving Demand for Ergonomic Gaming Chairs

The rising popularity of esports, fueled by the expansion of professional tournaments, structured leagues, and growing international viewership, is driving substantial demand in the market. Professional gamers require advanced seating solutions that ensure comfort, and physical support during extended competitive sessions.

As esports integrates further into organized sports and commercial ecosystems, demand for specialized chairs across venues, training centers, and personal setups is accelerating, positioning gaming chairs as essential equipment and reinforcing sustained market growth.

- In April 2025, the Esports World Cup Foundation unveiled a USD 70 million prize pool for the 2025 Esports World Cup in Riyadh, marking a USD 10 million increase from 2024 highlighting the rapid growth of esports.

Market Challenge

High Product Costs Limiting Market Penetration

High product costs present a key challenge in the gaming chair market, particularly in cost-sensitive regions. Premium materials, ergonomic features, and integrated technology elevate manufacturing expenses, thereby limiting accessibility for casual users.

To address this, manufacturers are streamlining production, introducing affordable models with core features, and strengthening direct-to-consumer channels. These efforts aim to enhance affordability while maintaining functionality and support market growth across diverse consumer segments despite pricing constraints.

Market Trend

Integration of Smart Features

The market is witnessing a growing trend toward smart technology integration, with manufacturers incorporating features such as posture tracking, haptic feedback, wireless connectivity, and app-based adjustments. These enhancements aim to elevate user comfort, interactivity, and overall experience.

The adoption of connected features is becoming increasingly common in mid-range and premium segments, reflecting a shift toward multifunctional and tech-enabled seating solutions that align with evolving consumer expectations and product innovation in the gaming ecosystem.

- In September 2024, Razer introduced the Freyja HD Haptics Gaming Cushion at RazerCon. It features Razer Sensa HD Haptics with six directional motors, Bluetooth connectivity, and control via the Razer Nexus app and HyperSpeed Wireless.

Gaming Chair Market Report Snapshot

|

Segmentation

|

Details

|

|

By Material

|

Fabric, Foam, Leather

|

|

By End-User

|

Individual Gamers, Professional Gamers, Gaming Cafes

|

|

By Distribution Channel

|

Supermarkets/Hypermarkets, Home Centers/Furniture Stores, Specialty Stores, Online Retailers

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Material (Fabric, Foam, and Leather): The leather segment earned USD 614.5 million in 2024 due to its high durability, premium appearance, and ease of maintenance, which align with consumer preferences for long-lasting and aesthetically appealing gaming chair solutions.

- By End-User (Individual Gamers, Professional Gamers, and Gaming Cafes): The individual gamers segment held 33.61% of the market in 2024, due to increasing demand for ergonomic, durable seating solutions, driven by the growth of personal gaming setups and extended usage durations among solo users.

- By Distribution Channel (Supermarkets/Hypermarkets, Home Centers/Furniture Stores, Specialty Stores, and Online Retailers): The specialty stores segment is projected to reach USD 1,188.2 million by 2032, owing to its ability to offer targeted product selection, in-person consultation, and higher consumer trust in assessing quality and comfort of gaming chairs.

Gaming Chair Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America gaming chair market share stood at 37.11% in 2024 in the global market, with a valuation of USD 609.1 million. The dominance is attributed to high consumer spending on gaming across North America. The region reports strong engagement in digital gaming, supported by robust economic conditions and elevated household income levels.

These factors drive investment in advanced gaming setups, including premium ergonomic chairs in the North America region.

Additionally, the rising demand for immersive home gaming experiences is increasing the demand for high-performance accessories including advanced gaming chairs. These factors continue to position North America as the leading region in the market.

- In January 2025, the Entertainment Software Association (ESA) reported that total consumer spending on video games in the United States reached USD 58.7 billion in 2024, reflecting a growth of over 106% compared to USD 28.4 billion in 2014.

Asia Pacific is poised for a CAGR of 8.66% over the forecast period. This growth is driven by the rising impact of gaming content creators across key Asia Pacific platforms. Influencers on Douyin, YouTube, and Nimo TV are enhancing visibility for advanced gaming setups, including high-performance seating solutions.

Their content is shaping consumer preferences by emphasizing functionality, design, and brand value. The aspirational nature of influencer-endorsed products is accelerating demand across developing economies. These factors are the market growth across Asia Pacific.

Regulatory Frameworks

- In the U.S., the Consumer Product Safety Commission (CPSC) ensures gaming chairs meet safety standards by regulating mechanical risks, flammability, and toxic materials used in their manufacturing and design.

- In China, the State Administration for Market Regulation (SAMR) enforces national safety standards for gaming chairs, focusing on mechanical safety, chemical content, and proper labeling to ensure consumer protection.

Competitive Landscape

The gaming chair market exhibits intense competition, with key players actively engaging in mergers and acquisitions, launching new product lines, and expanding their geographic footprint to maintain market share. Companies are also adopting advanced manufacturing technologies and ergonomic innovations to differentiate their offerings.

Strategic partnerships and targeted marketing campaigns are being utilized to strengthen brand visibility and capture niche consumer segments. These competitive actions are essential for sustaining relevance in a saturated and mature global market.

- In July 2024, CORSAIR Launched TC500 LUXE, the latest flagship in its premium gaming chair lineup. Designed for high-end users, the chair combines advanced adjustability with a refined aesthetic, offering enhanced comfort and elevated design to meet top-tier expectations for both performance and style.

Key Companies in Gaming Chair Market:

- Secretlab

- Corsair

- DXRACER

- GT Omega USA

- Vertagear

- Haworth Inc.

- AndaSeat

- Razer Inc.

- blacklyte Inc.

- Comfort Grid Technologies Private Limited

- Wipro Seating Solutions

- Cybeart India Pvt. Ltd.

- Steelcase

- Herman Miller, Inc.

- Merryfair Chair System Sdn. Bhd.

Recent Developments (Launches/Partnership)

- In May 2025, Razer launched Razer Clio, a gaming chair accessory engineered to provide immersive, headset-free audio. It functions as a standalone speaker delivering clear, powerful sound, or can be paired with existing front speakers via Synapse 4 for an enhanced surround sound experience, simplifying complex audio setups while maintaining high-quality output.

- In May 2025, AndaSeat and NRG Esports launched the Kaiser 4 NRG Edition, a co-branded gaming chair combining advanced ergonomic engineering with competitive design to offer superior comfort, support, and durability for professional gamers.

- In May 2025, Vertagear partnered with Audi to launch a new gaming chair line featuring three models: SL3800 Audi Edition, SL5800 RS Edition, and PL4800 Audi Sport Edition. These chairs incorporate advanced features such as ContourMax lumbar support and the VertaAir Seat System for enhanced comfort. Additionally, they are equipped with HygennX technology, which combines coffee ground nanotech and silver embroidery to ensure long-lasting freshness and durability.