Market Definition

The future of feed industry market refers to the evolving landscape of animal nutrition, driven by advancements in feed formulation, processing technologies, and sustainable ingredient sourcing.

It encompasses the development of precision nutrition, alternative protein sources such as insect meal and algae, and automated feed manufacturing systems to enhance efficiency and quality.

This market focuses on optimizing livestock health, productivity, and environmental sustainability, aligning with regulatory standards and industry demands for high-performance feed solutions across poultry, aquaculture, livestock, and pet food sectors.

Future of Feed Industry Market Overview

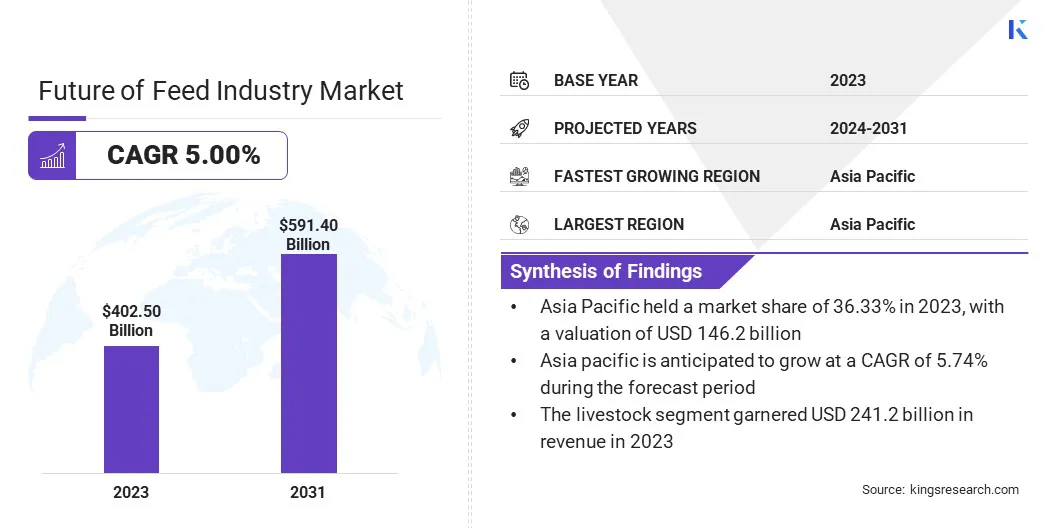

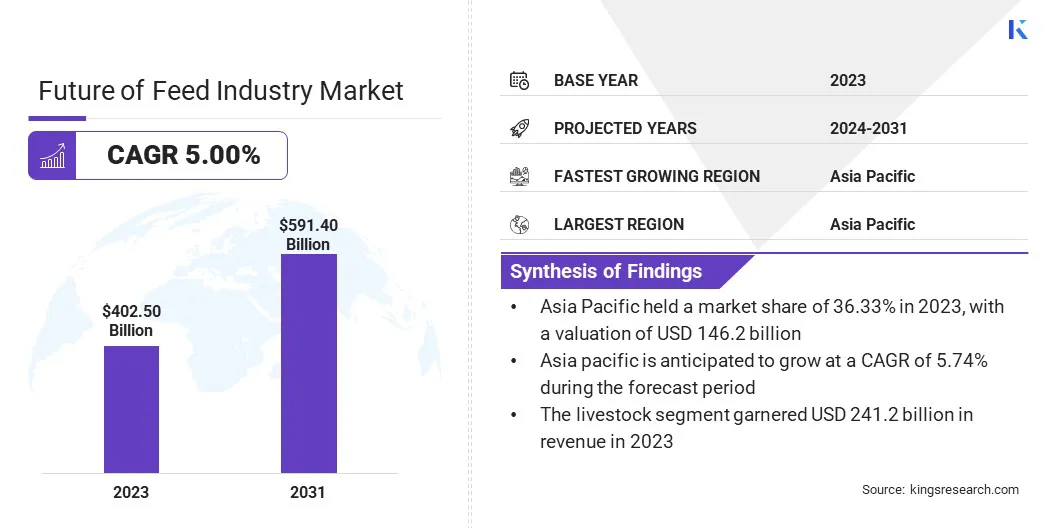

The global future of feed industry market size was valued at USD 402.5 billion in 2023 and is projected to grow from USD 420.4 billion in 2024 to USD 591.4 billion by 2031, exhibiting a CAGR of 5.00% during the forecast period. The market is registering growth, driven by the increasing demand for sustainable and alternative protein sources in animal nutrition.

Innovations in insect-based, algae-derived, and fermented protein feed solutions are gaining traction as companies seek environmentally friendly and nutrient-rich alternatives. Additionally, advancements in precision nutrition and feed additives are improving livestock health and productivity, leading to higher efficiency and cost-effectiveness in animal farming.

Major companies operating in the global future of feed industry industry are Charoen Pokphand Foods PCL, New Hope Liuhe Co., Ltd., Cargill, Incorporated, Land O'Lakes, Inc., Wen's Food Group, Muyuan Foodstuff Co., Ltd., Tyson Foods, Inc., ADM, Wayne-Sanderson Farms, Cal-Maine Foods Inc., Industrias Bachoco, Nestlé Purina PetCare Company, Real Pet Food Co, Seaboard Foods, and ForFarmers Group.

The integration of precision nutrition technologies is transforming feed formulation by enabling species-specific dietary optimization. Advanced analytics, Artificial Intelligence (AI), and real-time monitoring systems are enhancing feed efficiency, reducing nutrient waste, and improving animal performance.

Digital tools are allowing producers to formulate rations tailored to growth stages, genetic profiles, and metabolic requirements. This data-driven approach is increasing production efficiency while minimizing environmental impact.

The ability to precisely balance essential nutrients in feed is addressing challenges related to overfeeding and resource utilization, accelerating the growth of the market by promoting cost-effective and sustainable feeding solutions.

Key Highlights:

- The global future of feed industry market size was valued at USD 402.5 billion in 2023.

- The market is projected to grow at a CAGR of 5.00% from 2024 to 2031.

- Asia Pacific held a market share of 36.33% in 2023, with a valuation of USD 146.2 billion.

- The nutritional additives segment garnered USD 132.8 billion in revenue in 2023.

- The livestock segment is expected to reach USD 241.2 billion by 2031.

- The conventional feed segment secured the largest revenue share of 58.12% in 2023.

- The automated feed mills segment is poised for a robust CAGR of 6.68% through the forecast period.

- The market in Europe is anticipated to grow at a CAGR of 5.23% during the forecast period.

Market Driver

"Expansion of High-performance Livestock Breeds"

The increasing adoption of genetically superior livestock breeds is driving the demand for specialized feed formulations that support optimal growth, reproduction, and overall health. High-performance breeds require precisely balanced diets with enhanced nutrient profiles to maximize productivity while maintaining sustainability.

- In October 2024, BAF Vietnam Agriculture Joint Stock Company announced a strategic high-tech livestock breeding partnership with China’s leading livestock corporation, Muyuan Foods. This collaboration will focus on transferring advanced smart livestock technology and equipment, enhancing BAF Vietnam’s closed-chain system from feed production facilities to barn operations. Through this partnership, both companies seek to deliver clean, fresh, and safe food to Vietnamese consumers while contributing to the growth and advancement of the pig farming industry in Vietnam.

Advances in genetic selection are enabling livestock producers to achieve faster growth rates and improved feed conversion ratios, necessitating feed formulations enriched with essential amino acids, minerals, and functional additives. The shift toward genetic optimization in livestock production is accelerating investments in advanced feed solutions, reinforcing the long-term growth of the future of feed industry market.

Market Challenge

"Rising Feed Ingredient Costs"

The future of feed industry market faces significant challenges, due to the rising costs of key feed ingredients, driven by supply chain disruptions, climate change impacts on crop yields, and fluctuating raw material prices. Higher costs of corn, soymeal, and alternative protein sources put pressure on feed manufacturers and livestock producers, affecting overall profitability.

Companies are investing in sustainable and cost-effective alternatives such as insect-based proteins, algae-derived feed, and fermented ingredients. Additionally, advancements in precision nutrition and feed formulation optimization are helping reduce dependency on expensive raw materials while maintaining nutritional quality and livestock productivity.

Market Trend

"Expansion of Customized and Specialty Feeds"

The increasing need for customized nutrition solutions tailored to specific livestock breeds, production systems, and geographic conditions is shaping feed market strategies. Precision feeding programs are being designed to meet the unique requirements of poultry, ruminants, swine, and aquaculture species. Specialty feeds, including low-phosphorus diets for aquaculture and high-fiber formulations for ruminants, are addressing species-specific digestive efficiency.

Advancements in feed customization are enhancing livestock productivity while minimizing resource wastage. The expansion of tailored nutrition solutions is strengthening market differentiation and driving the future of feed industry market.

- In July 2024, Huvepharma reinforced its commitment to production animal health by establishing a sales and marketing agreement with ADM, a global leader in nature-derived innovative solutions, to expand its ruminant nutrition portfolio. As part of this partnership, three ADM feed additives will be immediately integrated into Huvepharma’s ruminant product line, enhancing its livestock solutions. This collaboration will provide producers with greater access to ADM’s scientifically developed feed additives, which have been shown to improve production efficiencies.

Future of Feed Industry Market Report Snapshot

|

Segmentation

|

Details

|

|

By Additives

|

Nutritional Additives, Performance Enhancers, Gut Health & Immune Boosters, Mycotoxin Binders & Detoxifiers, Antioxidants & Preservatives, Color & Pigmentation Additives, Emulsifiers & Stabilizers

|

|

By Animal Type

|

Livestock, Poultry, Aquaculture, Pets, Others

|

|

By Feed Type

|

Conventional Feed, Specialty Feed, Organic Feed, Alternative Feed

|

|

By Technology Adoption

|

Traditional/Conventional Technology, AI-Driven Feed Formulation, Automated Feed Mills, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Additives (Nutritional Additives, Performance Enhancers, Gut Health & Immune Boosters, Mycotoxin Binders & Detoxifiers, and Antioxidants & Preservatives): The nutritional additives segment earned USD 132.8 billion in 2023, due to its essential role in enhancing animal health, improving feed efficiency, and optimizing growth performance, as livestock producers increasingly prioritize fortified feed solutions to meet industry standards and consumer demand..

- By Animal Type (Livestock, Poultry, Aquaculture, and Pets): The livestock segment held 44.00% of the market in 2023, due to the rising demand for high-quality meat and dairy products, driving the need for nutritionally optimized feed solutions that enhance animal health, productivity, and overall farm efficiency.

- By Feed Type (Conventional Feed, Specialty Feed, Organic Feed, and Alternative Feed): The conventional feed segment is projected to reach USD 340.5 billion by 2031, owing to its widespread availability, cost-effectiveness, and established use in large-scale livestock and poultry production, ensuring consistent nutrition and meeting the growing global demand for animal protein.

- By Technology Adoption (Traditional/Conventional Technology, AI-Driven Feed Formulation, Automated Feed Mills, and Others): The automated feed mills segment is poised for significant growth at a CAGR of 6.68% through the forecast period, attributed to their ability to streamline production processes, minimize waste, and enhance feed quality through precision formulation, supporting large-scale manufacturing efficiency and cost-effectiveness

Future of Feed Industry Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a future of feed industry market share of around 36.33% in 2023, with a valuation of USD 146.2 billion. Asia Pacific dominates global aquaculture production, with countries such as China, Vietnam, and Thailand leading in fish and shrimp farming.

- In June 2023, the Asian Development Bank (ADB) entered into a USD 15 million convertible note agreement with Australis Holdings, Inc. (Australis) to advance climate-resilient, ocean-based barramundi and seaweed aquaculture in Vietnam. This investment will provide working capital to scale up Australis’ operations in Van Phong Bay located in central Vietnam, while facilitating the establishment of a second regional production hub in the southern part of the country.

The rising demand for sustainable and nutritionally balanced aquafeed is driving advancements in protein sources, including algae-based ingredients, insect meal, and plant-derived proteins. Feed manufacturers are increasingly developing species-specific formulations that improve digestibility, enhance growth rates, and minimize water pollution.

The growing emphasis on sustainable aquafeed solutions is accelerating the market growth, positioning Asia Pacific as a key driver of innovation in the market.

Additionally, governments across Asia Pacific are implementing policies to modernize feed production, improve feed safety standards, and reduce reliance on imported feed ingredients.

Subsidies, research grants, and industry partnerships are supporting the adoption of precision nutrition, automation, and alternative protein sources. Countries such as India and Australia are promoting domestic feed production by investing in high-efficiency feed mills and ingredient processing technologies.

The future of feed industry in Europe is poised for significant growth at a robust CAGR of 5.23% over the forecast period. The adoption of precision livestock farming (PLF) technologies across Europe is reshaping feed management practices. Automated feeding systems, real-time nutrient monitoring, and AI-driven feed optimization solutions are improving feed conversion ratios and reducing waste.

In countries like the Netherlands and Spain, large-scale dairy and poultry farms are integrating IoT-enabled feeding systems to enhance efficiency and sustainability. The increasing application of digital tools in feed formulation and distribution is fueling the market.

Furthermore, the European feed industry is increasingly adopting circular economy principles by utilizing agricultural by-products, food processing residues, and surplus food as feed ingredients.

Companies in the UK and Italy are repurposing bakery waste, fruit pulp, and brewery by-products into nutrient-rich feed components, reducing feed costs and environmental impact. This approach aligns with EU sustainability targets and enhances resource efficiency, reinforcing Europe's leadership in the market.

Regulatory Frameworks:

- The U.S. Food and Drug Administration (FDA) regulates animal feed under the Federal Food, Drug, and Cosmetic Act (FD&C Act). The FDA's Center for Veterinary Medicine (CVM) oversees the safety of animal feed, including ingredients and additives. The Food Safety Modernization Act (FSMA) introduced preventive controls for animal feed facilities to enhance feed safety standards.

- The Canadian Food Inspection Agency (CFIA) enforces the Feeds Act and Feeds Regulations, ensuring that livestock feeds manufactured and sold in Canada are safe, effective, and labeled appropriately. The CFIA oversees the approval of feed ingredients and sets standards for feed production.

- The EU regulates animal feed through several directives and regulations, including Regulation (EC) No 178/2002, which lays down general principles of food and feed law. Regulation (EC) No 183/2005 establishes requirements for feed hygiene, mandating that feed business operators implement Hazard Analysis and Critical Control Points (HACCP) systems. The European Food Safety Authority (EFSA) provides scientific advice on feed safety.

- In China, the Ministry of Agriculture and Rural Affairs regulates animal feed, focusing on feed quality and safety standards. Regulations require feed producers to obtain production licenses, and certain feed additives must receive approval before use.

- In Japan, the Ministry of Agriculture, Forestry and Fisheries (MAFF) oversees feed safety under the Feed Safety Law. This law sets standards for feed ingredients, manufacturing processes, and labeling to ensure the safety of animal-derived food products.

Competitive Landscape:

The global future of feed industry market is characterized by several participants, including both established corporations and rising organizations. Market players are actively pursuing strategic initiatives such as acquiring feed mills and expanding their product portfolios to strengthen their competitive position and accelerate market growth.

The acquisition of feed mills enables companies to enhance production capacity, optimize supply chains, and gain access to key regional markets. This approach allows for improved efficiency in feed manufacturing and distribution, ensuring a steady supply of high-quality products to meet the increasing demand from livestock producers, aquaculture farms, and pet food manufacturers.

- In September 2024, Cargill acquired two feed mills in the U.S. to enhance its production and supply of animal and pet nutrition products. The Minneapolis-based company purchased facilities in Denver, Colorado, and Kansas City, Kansas, from Compana Pet Brands. This acquisition strengthens Cargill’s comprehensive animal nutrition portfolio, enabling the company to better serve a diverse customer base, including large-scale farmers, ranchers, and local retailers offering horse treats and pet food.

Furthermore, expanding product portfolios further support market growth by enabling companies to develop innovative feed solutions tailored to specific animal nutrition needs. Companies are investing in advanced formulations that incorporate sustainable ingredients, precision nutrition, and functional additives to enhance animal health, productivity, and feed efficiency.

These developments align with evolving industry trends, regulatory standards, and consumer preferences for high-quality and environmentally responsible feed solutions.

List of Key Companies in Future of Feed Industry Market:

- Charoen Pokphand Foods PCL

- New Hope Liuhe Co., Ltd.

- Cargill, Incorporated

- Land O'Lakes, Inc.

- Wen's Food Group

- Muyuan Foodstuff Co., Ltd.

- Tyson Foods, Inc.

- ADM

- Wayne-Sanderson Farms

- Cal-Maine Foods Inc.

- Industrias Bachoco

- Nestlé Purina PetCare Company

- Real Pet Food Co

- Seaboard Foods

- ForFarmers Group

Recent Developments (M&A/Agreements/Expansion)

- In July 2024, Real Pet Food Co. became the first company in Australia to receive an import permit for the use of Black Soldier Fly (BSF) meal in pet food production. Following more than two years of research into alternative protein sources, the company selected BSF meal as a primary ingredient for its Billy + Margot Insect Single Protein + Superfoods dry dog food. This innovative product will be available exclusively at Petbarn stores across Australia and through online platforms.

- In September 2024, ForFarmers and Team Agrar, a subsidiary of the DLG Group, agreed to merge their feed operations in Germany. The newly formed joint venture, operating under the name ForFarmers Team Agrar, offers a diverse feed portfolio catering to multiple animal species. This collaboration enhances geographical reach, enabling the venture to serve customers more effectively and efficiently across the region.

- In November 2024, Wayne-Sanderson Farms announced the completion of a USD 25 million renovation and upgrade of its Mocksville Feed Mill facility in Oakwood, Georgia. The enhanced plant now has the capacity to produce 4,500 tons of feed per week, supporting over 140 family farms in the region.