Market Definition

The market encompasses the supply chain involved in the production, distribution, and consumption of furfuryl alcohol, a versatile chemical used primarily in industrial applications. It serves key sectors including foundries, construction, automotive, and agriculture, where it is utilized in the production of high-performance resins, adhesives, coatings, and other specialty materials.

The report offers a thorough assessment of the main factors driving market expansion, along with detailed regional analysis and the competitive landscape influencing industry dynamics.

Furfuryl Alcohol Market Overview

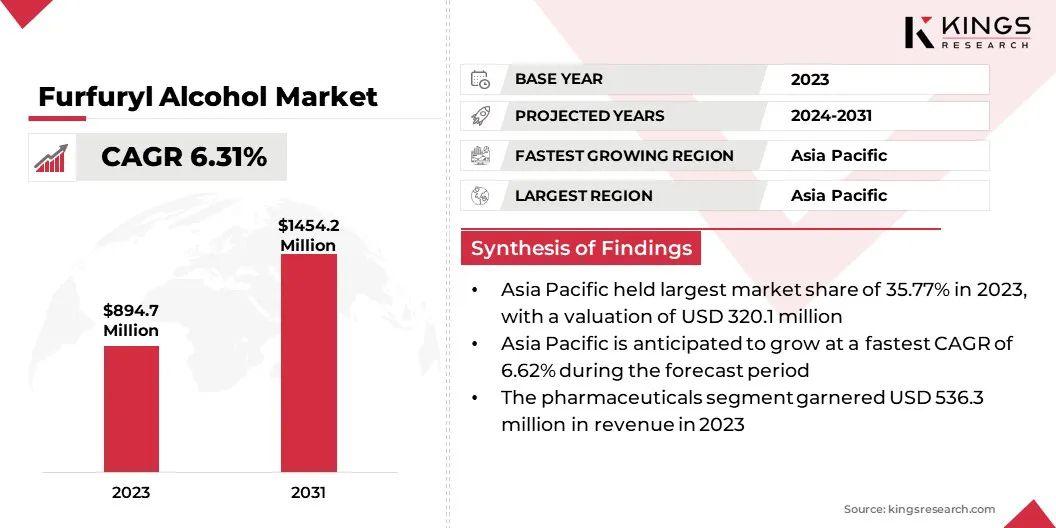

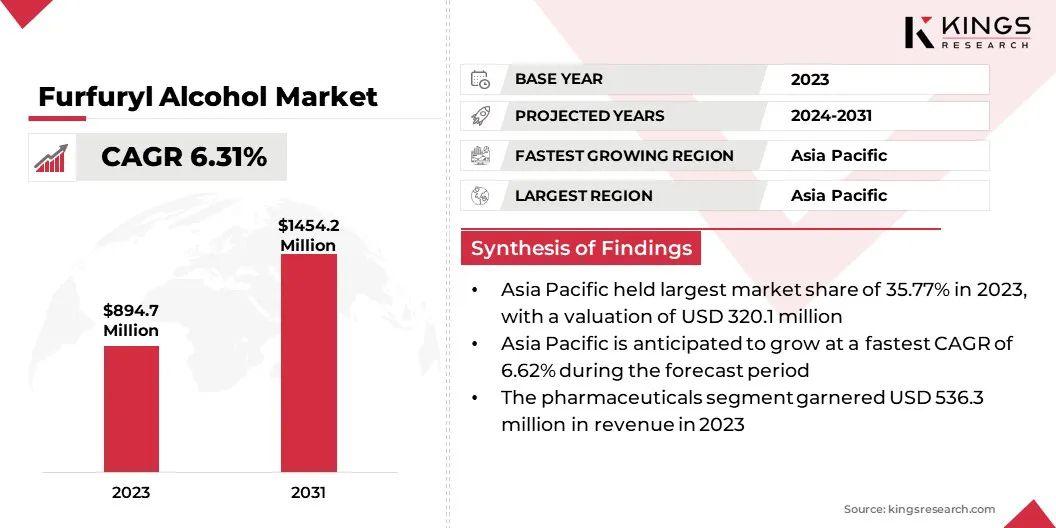

The global furfuryl alcohol market size was valued at USD 894.7 million in 2023 and is projected to grow from USD 947.6 million in 2024 to USD 1,454.2 million by 2031, exhibiting a CAGR of 6.31% during the forecast period.

The market is witnessing steady growth due to rising demand from the foundry industry, where it is widely used in the production of sand binders for metal casting. Increasing construction and infrastructure activities worldwide are further supporting this demand.

Major companies operating in the furfuryl alcohol industry are ILLOVO SUGAR AFRICA, Transfurans Chemicals BV, DalinYebo Trading and Development (Pty) Ltd, Silvateam S.p.a., Shandong Crownchem Industries Co., Ltd., Hongye Holding Group Co., Ltd., Otto Chemie Pvt. Ltd., KANTO KAGAKU, Xian Welldon Trading Co., Ltd, Jinan Future Chemical Co., Ltd, International Furan Chemicals B.V., DynaChem, Inc., Central Romana Corporation, Loba Chemie Pvt. Ltd., and Tokyo Chemical Industry Co., Ltd.

The growing demand for sustainable industrial materials is driving the use of furfuryl alcohol as a bio-based alternative to petrochemical products, particularly in resins and coatings for construction and automotive applications.

Derived from agricultural byproducts, furfuryl alcohol offers eco-friendly benefits while maintaining high performance in industries seeking durable, corrosion-resistant materials. This shift aligns with increasing environmental regulations and the trend toward renewable resources in manufacturing.

Key Highlights

- The furfuryl alcohol market size was valued at USD 894.7 million in 2023.

- The market is projected to grow at a CAGR of 6.31% from 2024 to 2031.

- Asia Pacific held a market share of 35.77% in 2023, with a valuation of USD 320.1 million.

- The pharmaceuticals segment garnered USD 536.3 million in revenue in 2023.

- The resins segment is expected to reach USD 525.3 million by 2031.

- The foundry segment is expected to reach USD 351.6 million by 2031.

- The market in North America is anticipated to grow at a CAGR of 6.22% during the forecast period.

Market Driver

Growth of Furfuryl Alcohol in Foundry Applications

The market is experiencing steady growth, primarily driven by its essential role in the foundry industry. It is increasingly utilized in the formulation of core and mold binders for metal casting, which is crucial for producing complex and durable components used in heavy industries.

This demand is further fueled by the expanding industrial output, where there is an increasing need for materials that offer strong thermal stability, chemical resistance, and mechanical strength.

The growing demand for advanced materials across various industries such as automotive, construction, and chemical processing is also a key driver of market growth, as these sectors require high-performance materials capable of meeting stringent operational requirements.

Market Challenge

Raw Material Price Volatility

One of the significant challenges in the furfuryl alcohol market is the price volatility of raw materials, particularly agricultural by-products like corncobs and sugarcane bagasse. These materials are often subject to fluctuations in supply and demand, as well as external factors such as climate change, crop yields, and global trade dynamics.

To address this challenge, market players are exploring alternative raw materials, investing in more efficient production processes, and securing long-term supply contracts. These strategies aim to mitigate the impact of price fluctuations and stabilize production costs.

Market Trend

Shift Toward Bio-Based Manufacturing

The market is undergoing a transformation as industries increasingly adopt bio-based manufacturing methods. A key trend is the use of agricultural by-products, such as corncobs and sugarcane bagasse, in the production of furfuryl alcohol, supporting the shift toward more sustainable and circular manufacturing practices.

This approach reduces reliance on fossil-based feedstocks and aligns with industry efforts to lower environmental impact through the utilization of renewable resources. As industries strive to reduce their dependence on petrochemical inputs and minimize carbon footprints, the adoption of renewable feedstocks is gaining momentum.

Beyond enhancing the environmental profile of production, this approach offers a cost-effective and abundant resource base, making it an attractive alternative for industries focused on sustainability and long-term cost efficiency.

Furfuryl Alcohol Market Report Snapshot

|

Segmentation

|

Details

|

|

By Grade

|

Food, Pharmaceuticals

|

|

By Application

|

Resins, Solvent, Corrosion Inhibitors, Others

|

|

By End Use

|

Foundry, Agriculture, Paints & Coatings, Pharmaceutical, Food & Beverages

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Grade (Food, Pharmaceuticals): The pharmaceuticals segment earned USD 536.3 million in 2023 due to the increasing use of furfuryl alcohol as an intermediate in drug synthesis and active pharmaceutical ingredient (API) production.

- By Application (Resins, Solvent, Corrosion Inhibitors, Others): The resins segment held 36.22% of the market in 2023, due to its widespread use in manufacturing heat-resistant and durable foundry binders.

- By End Use (Foundry, Agriculture, Paints & Coatings, Pharmaceutical, and Food & Beverages): The foundry segment is projected to reach USD 351.6 million by 2031, owing to rising demand for metal cast components in automotive and industrial machinery sectors.

Furfuryl Alcohol Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific accounted for 35.77% share of the furfuryl alcohol market in 2023, with a valuation of USD 320.1 million. The growth in this region is driven by a strong industrial base and the increasing use of furfuryl alcohol in foundry and construction applications.

China is a leading contributor, supported by the availability of agricultural by-products such as corncobs and sugarcane bagasse, which are widely used as feedstocks in the bio-based production of furfuryl alcohol. Industrial expansion in China, particularly in metal casting and related applications, continues to support market demand.

In India, increasing consumption is supported by the rapid development of the automotive and infrastructure industries. The presence of large-scale producers and exporters across the Asia Pacific also strengthens the region’s ability to meet global demand, contributing to its dominant market share.

The furfuryl alcohol industry in North America is expected to register the fastest growth in the market, with a projected CAGR of 6.22% over the forecast period, driven by the growth of key industries such as automotive, aerospace, and manufacturing. Growth in this region is driven by rising environmental concerns and an industry-wide transition toward renewable and bio-based raw materials.

In the United States and Canada, manufacturers are increasingly investing in sustainable production methods to align with environmental regulations and reduce reliance on fossil-based inputs. The application of furfuryl alcohol in resin manufacturing and metal foundry processes is expanding steadily.

Additionally, the region benefits from advanced research and development infrastructure and a strong base of technology-driven manufacturers, which support the broader adoption of furfuryl alcohol across various end-use industries.

Regulatory Frameworks

- In the US, the primary regulatory agencies for furfuryl alcohol are the U.S. Environmental Protection Agency (EPA) and the Occupational Safety and Health Administration (OSHA). The EPA focuses on environmental aspects, while OSHA sets permissible exposure limits for workplaces.

- In Europe, the regulatory authority overseeing the safety and usage of furfuryl alcohol is the European Chemicals Agency (ECHA). The ECHA manages the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation, ensuring that furfuryl alcohol meets health and environmental safety standards.

Competitive Landscape

The global furfuryl alcohol market is characterized by key players focusing on expanding production capacities to meet the growing demand. Companies in this market are prioritizing sustainable manufacturing processes and investing in bio-based furfuryl alcohol sourced from agricultural by-products.

Strategic partnerships with suppliers and distributors are common, enabling improved supply chain efficiency and market reach. Additionally, market players are diversifying their product portfolios by developing specialized formulations tailored to specific industrial applications, such as high-performance resins for foundries and automotive components.

List of Key Companies in Furfuryl Alcohol Market:

- ILLOVO SUGAR AFRICA

- Transfurans Chemicals BV

- DalinYebo Trading and Development (Pty) Ltd

- Silvateam S.p.a.

- Shandong Crownchem Industries Co., Ltd.

- Hongye Holding Group Co., Ltd.

- Otto Chemie Pvt. Ltd.

- KANTO KAGAKU

- Xian Welldon Trading Co., Ltd

- Jinan Future Chemical Co., Ltd

- International Furan Chemicals B.V.

- DynaChem, Inc.

- Central Romana Corporation

- Loba Chemie Pvt. Ltd.

- Tokyo Chemical Industry Co., Ltd.

so does