Market Definition

Fumaric acid is an organic compound and a dicarboxylic acid used primarily as a food additive and acidulant. It occurs naturally in various fungi and is produced synthetically for industrial use.

The market encompasses its synthetic production, distribution, and applications across industries such as food and beverages, pharmaceuticals, resins, and unsaturated polyester.

Fumaric Acid Market Overview

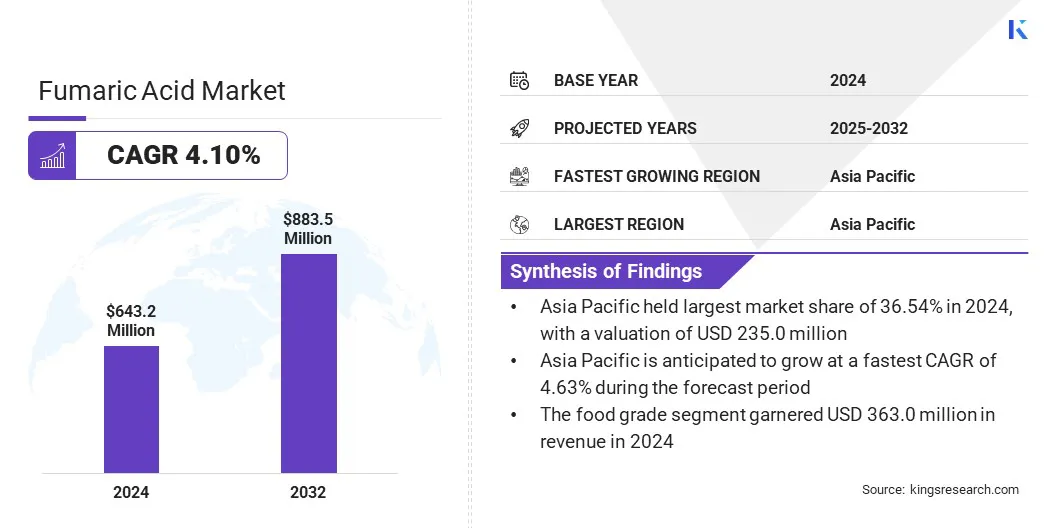

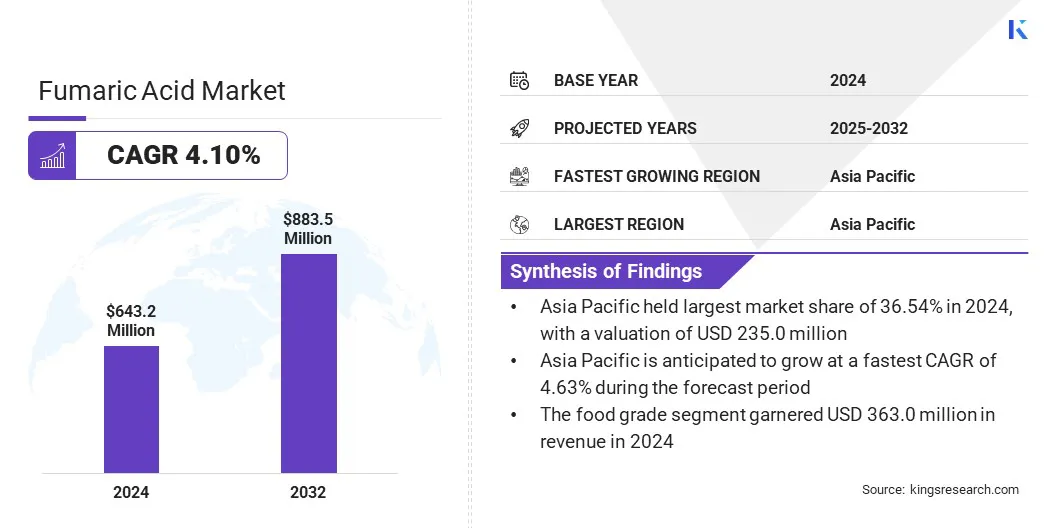

The global fumaric acid market size was valued at USD 643.2 million in 2024 and is projected to grow from USD 666.8 million in 2025 to USD 883.5 million by 2032, exhibiting a CAGR of 4.10% during the forecast period.

The market is experiencing steady growth, mainly due to rising demand from the food and beverage sector, where it is used as an acidulant to enhance flavor and shelf life. Its expanding application in the construction industry, particularly in unsaturated polyester resins for reinforced plastics, further supports this expansion.

Key Market Highlights:

- The fumaric acid industry size was valued at USD 643.2 million in 2024.

- The market is projected to grow at a CAGR of 4.10% from 2025 to 2032.

- Asia Pacific held a market share of 36.54% in 2024, with a valuation of USD 235.0 million.

- The food grade segment garnered USD 363.0 million in revenue in 2024.

- The food additives segment is expected to reach USD 337.0 million by 2032.

- North America is anticipated to grow at a CAGR of 3.80% over the forecast period.

Major companies operating in the fumaric acid market are TorQuest Partners, Polynt S.p.A., Changmao Biochemical Engineering Company Limited, FUSO CHEMICAL CO., LTD., Optimistic Organic Sdn. Bhd., Anmol Chemicals Private Limited, Merck KGaA, NIPPON SHOKUBAI CO., LTD., ISEGEN South Africa (Pty) Ltd, Zibo Anquan Chemical Co., Ltd., AWI-Awell Ingredients Co.,Ltd., Zhengzhou Meiya Chemical Products Co.,Ltd, UPC Technology Corporation, Tokyo Chemical Industry Co., Ltd., and KANTO KAGAKU.

The increased use of the product in pharmaceutical formulations and dietary supplements is contributing to market growth due to its functional properties and stability.

The shift toward sustainable and bio-based production processes aligns with broader industry trends, enhancing its market appeal. Strong demand across end-use industries continues to influence the market’s growth trajectory.

Market Driver

Global Expansion of Food and Beverage Manufacturing

The market is witnessing steady growth, supported by the global expansion of food and beverage manufacturing capacity. As multinational brands expand their production footprints and invest in technologically advanced facilities, the demand for multifunctional ingredients continues to rise.

- In April 2025, Ferrero invested USD 445 million to expand its manufacturing facility in Brantford, Ontario. The expanded facility will focus on increasing output of popular packaged products, particularly those requiring reliable shelf-life and consistent taste profiles.

This large-scale expansion highlights increased production of packaged food products, which typically rely on functional additives such as fumaric acid, to maintain quality and compliance. As manufacturers scale operations, the need for stable, effective, and regulatory-approved ingredients increases.

Fumaric acid is widely used for its role in maintaining pH levels, extending product shelf life, and improving sensory attributes across a range of packaged goods. Its versatility and effectiveness position it as a preferred solution in formulations requiring durability, flavor integrity, and regulatory compliance across diverse end-use categories.

Market Challenge

Regulatory Pressure Related to Emission Control

The expansion of the fumaric acid market is hindered by rising regulatory pressure related to emissions control, waste management, and fossil-based raw materials. Conventional production methods, which rely on petrochemical feedstocks, generate significant carbon emissions and regulated byproducts.

This is increasing compliance costs and creating operational challenges, particularly in markets such as North America and the European Union. These factors are affecting profit margins, delaying permitting processes, and complicating supply chain planning.

In response, manufacturers are shifting toward bio-based production technologies that align with current regulatory frameworks and reduce environmental impact.

- In June 2024, BASF initiated a joint research initiative, FUMBIO, with Saarland University, the University of Marburg, and the University of Kaiserslautern-Landau to develop a CO₂-neutral, bio-based production method for producing fumaric acid . The project utilizes the bacterium Basfia succiniciproducens to ferment sugar and carbon dioxide into fumarate, aiming to reduce carbon emissions and dependence on fossil-based raw materials.

This transition is critical for maintaining market access, meeting customer expectations, and ensuring business continuity amid strict environmental standards.

Market Trend

Expanding Use of Fumaric Acid in Resin and Coating Formulations

The market is experiencing steady growth due to rising demand in resin and coating applications. Fumaric acid is a key intermediate in the production of unsaturated polyester resins (UPRs), which are widely used in the construction, automotive, marine, and electrical industries.

Its ability to enhance thermal resistance, chemical durability, and mechanical strength makes it essential for high-performance resin systems.

The increasing use of lightweight, corrosion-resistant composites in infrastructure and industrial applications is boosting the consumption of UPRs, thereby creating a strong demand for fumaric acid. Additionally, its cost-effectiveness and compatibility with various reactive agents strengthen its role in resin formulation.

As industrial sectors continue to adopt advanced materials, the need for reliable and efficient additives like fumaric acid is expected to grow.

Fumaric Acid Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Food Grade, Technical Grade

|

|

By Application

|

Food Additives, Unsaturated Polyester Resins, Rosin Paper Sizing, Alkyd Resins, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Food Grade and Technical Grade): The food grade segment earned USD 363.0 million in 2024, primarily due to its widespread usage in enhancing taste, maintaining acidity levels, and improving shelf life in food and beverage products.

- By Application (Food Additives, Unsaturated Polyester Resins, Rosin Paper Sizing, Alkyd Resins, and Others): The food additives segment held a share of 36.32% in 2024, attributed to growing consumption of processed foods requiring acidity regulation and flavor stabilization.

Fumaric Acid Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia-Pacific fumaric acid market accounted for a substantial share of 36.54% in 2024, valued at USD 235.0 million. The region’s strong position is supported by rising demand for packaged and processed foods in China, India, Indonesia, and Vietnam, where fumaric acid is used to maintain taste consistency and extend product shelf life.

Additionally, Asia Pacific is a major hub for resin and plastic manufacturing, particularly in China and South Korea, which fuels he demand for fumaric acid in unsaturated polyester resins. Local production advantages, including cost-effective raw materials and labor, have further aided regional market growth.

Rapid industrialization and expanding end-use sectors continue to position the region as a key region for global fumaric acid consumption.

The North America fumaric acid industry is expected to register the fastest CAGR of 3.80% over the forecast period. The U.S. accounts for a significant share of this growth, , as its large food industry uses fumaric acid in baked goods, snacks, and frozen meals to improve taste and preserve freshness.

There is also increasing use of fumaric acid in health supplements and protein products across the U.S. and Canada. Additionally, there is a strong demand from the construction and coatings industries, where fumaric acid is used in making resins and paints.

Furthermore, government support for domestic acidulant manufacturing through strategic investments and infrastructure upgrades is strengthening the regional market outlook.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates fumaric acid in food, pharmaceuticals, and cosmetics, classifying it as Generally Recognized As Safe (GRAS). The Environmental Protection Agency (EPA) governs its industrial use under the Toxic Substances Control Act (TSCA).

- In Europe, the European Food Safety Authority (EFSA) oversees the use of fumaric acid as a food additive, ensuring compliance with safety standards.

Competitive Landscape

The fumaric acid market is characterized by moderately fragmented , with key manufacturers adopting capacity expansion and diversification of production methods.

Investments in bio-based fermentation processes are being prioritized to reduce input cost volatility, lower environmental impact, and align with the sustainability goals of downstream industries such as food and pharmaceuticals.

This transition is influencing buyer preferences, particularly among end users seeking traceable and cleaner input materials. Additionally, companies are optimizing regional distribution networks to enhance supply reliability and service levels.

These strategic initiatives are enabling firms to secure multi-year supply agreements, strengthen customer relationships, and reinforce their market presence across core application sectors.

Key Companies in Fumaric Acid Market:

- TorQuest Partners

- Polynt S.p.A.

- Changmao Biochemical Engineering Company Limited

- FUSO CHEMICAL CO., LTD.

- Optimistic Organic Sdn. Bhd.

- Anmol Chemicals Private Limited

- Merck KGaA

- NIPPON SHOKUBAI CO., LTD.

- ISEGEN South Africa (Pty) Ltd

- Zibo Anquan Chemical Co., Ltd.

- AWI-Awell Ingredients Co.,Ltd.

- Zhengzhou Meiya Chemical Products Co.,Ltd

- UPC Technology Corporation

- Tokyo Chemical Industry Co., Ltd.

- KANTO KAGAKU

Recent Developments (Investment)

- In November 2024, the Government of Canada invested USD 19 million in Bartek Ingredients Inc., a leading producer of fumaric acid, to support the development of an advanced manufacturing facility in Ontario. The project aims to enhance innovation, improve sustainability through reduced emissions and water usage, and reinforce Canada’s position in acidulant manufacturing sector.