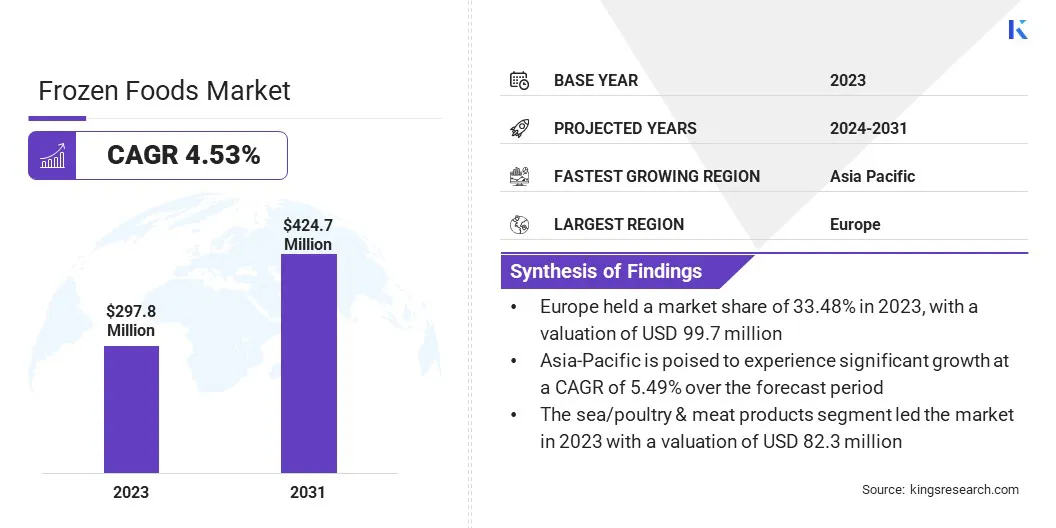

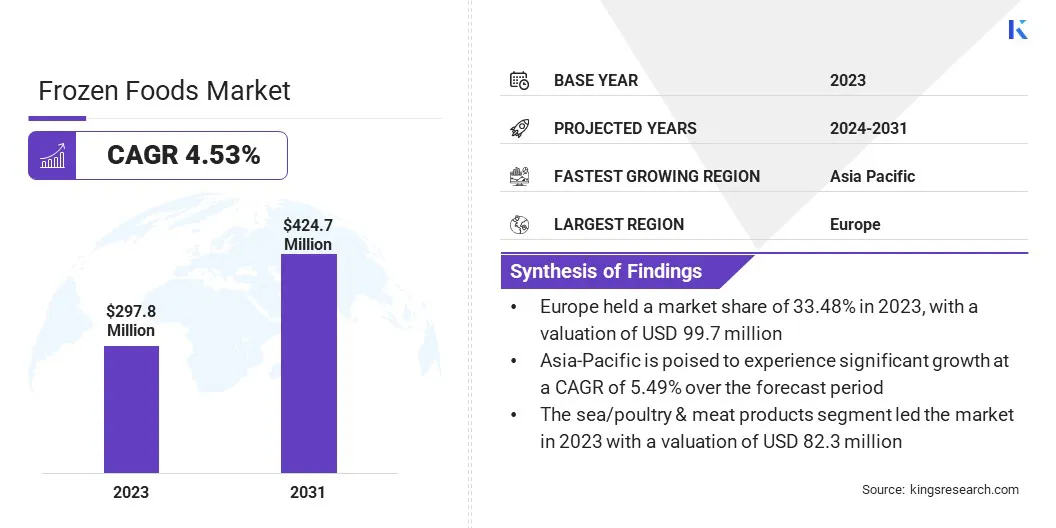

Frozen Foods Market Size

The global Frozen Foods Market size was valued at USD 297.8 million in 2023 and is projected to reach USD 424.7 million by 2031, growing at a CAGR of 4.53% from 2024 to 2031. The increasing demand for convenience food is reshaping the global frozen foods market landscape, driving a shift toward healthier and innovative solutions. This trend fuels the development of advanced freeing and preservation technologies, thereby expanding their presence and demand across various regions.

In the scope of work, the report includes products offered by companies such as General Mills Inc., Conagra Brands, Inc, Nestle, Unilever, Ajinomoto Co. Inc., Cargill, Incorporated, Kellogg Co., McCain Foods Limited, The Kraft Heinz Company, Associated British Foods Plc and others.

The frozen foods market is experiencing substantial growth, fueled by growing consumer preference for convenient food products that are nutritionally balanced and offer various options. Technological advancements in freezing methods to preserve the quality and nutritional integrity of foods significantly contribute to enhancing their appeal.

The market caters to a diverse range of consumers with different dietary preferences, including organic and plant-based options, thereby meeting the demands of health-conscious consumers. The introduction of new cuisines due to globalization has expanded food preferences, impacting the market.

The rising prevalence of online retail platforms and the efficiency of distribution networks have made frozen foods more accessible. Despite facing challenges such as competition from fresh foods, the market outlook is promising, driven by ongoing innovation and a focus on integrating sustainability into its practices.

Frozen food is extensively utilized in households, food service, retail, manufacturing, institutions, catering, and international markets. It offers convenience, longer shelf life, and consistent quality. In households, it provides an option for quick, easy meals. Restaurants and cafes rely heavily on frozen ingredients for efficiency.

Grocery stores dedicate shelf space to a variety of frozen goods. Food manufacturers use frozen ingredients in production. Institutions utilize frozen foods for mass meal provision. Catering services employ frozen items for event catering. Frozen food serves as a flexible solution to meet the demands of modern lifestyles and the global markets.

Analyst’s Review

Frozen Foods Market Growth Factors

The evolving demographics in the developing regions comprise more working individuals and generally smaller households, which drives the consumer towards frozen food products. Frozen foods offer convenient, easy-to-prepare meal options that align well with busy schedules and smaller cooking spaces.

Moreover, as an increasing number of people seek healthier options, market players are expanding their range to offer a variety of nutritious choices, including frozen fruits, vegetables, and whole meals. This shift toward convenience and health-consciousness positively impacts the growth of the frozen foods market, catering to the changing needs and preferences of consumers worldwide.

Innovations in freezing and packaging technologies have revolutionized the frozen food industry. Advanced freezing techniques preserve the nutritional content, flavor, and texture of foods, ensuring sustained quality over extended periods. Additionally, improvements in packaging materials and designs ensure better protection against freezer burn and contamination, thereby enhancing the overall shelf life and safety of the product.

These technological advancements extend the reach of frozen foods into emerging markets and address environmental concerns by reducing food waste and improving sustainability throughout the supply chain. As a result, the frozen food market continues to expand, driven by ongoing improvements in freezing and packaging technologies.

Frozen Foods Market Trends

The frozen food market is experiencing a notable surge in plant-based offerings, particularly tailored to cater to health-conscious consumers. An increasing awareness regarding environmental sustainability and health benefits associated with plant-based diets, prompting consumers to seek a wide range of plant-based frozen food product offerings.

Companies are responding by introducing a diverse range of plant-based frozen meals, including veggie burgers, meat substitutes, and plant-based frozen desserts. Moreover, there is a growing demand for healthier frozen food options, such as low-sodium, low-sugar, and organic frozen products. This trend reflects a broader shift toward healthier eating habits and ethical consumerism, thereby fostering innovation and growth in the frozen foods market.

There is a notable rise in the availability and popularity of ethnic and international flavors. Consumers are exhibiting a growing inclination toward culinary exploration, actively seeking authentic flavors from diverse global cuisines.

As a result, frozen food companies are diversifying their product portfolios to include a wide array of ethnic cuisines and international flavors, such as Thai curries, Mexican street food, and Indian dishes, among others. This trend highlights the growing multiculturalism in societies and the preference for convenient, ready-to-eat options that offer a taste of global cuisine. It further presents significant opportunities for innovation and differentiation within the frozen foods market.

Segmentation Analysis

The global frozen foods market is segmented based on product type, distribution channel and geography.

By Product Type

Based on product type, the market is segmented into dairy & frozen desserts, bakery products & snacks, sea/poultry & meat products, fruits & vegetable, convenience food & ready meals, and others. The sea/poultry & meat products segment led the market in 2023 with a valuation of USD 82.3 million and is anticipated to dominate the market over the forecast period. This growth can be attributed to several factors such as high demand, convenience, extended shelf life, versatility, and food safety.

Sea/poultry & meat products are staples in many diets, catering to diverse consumer preferences. Additionally, frozen seafood, poultry, and meat products serve as versatile ingredients suitable for various culinary applications. Stringent quality control measures across the industry ensure food safety, thereby fostering consumer trust and satisfaction in these frozen offerings.

By Distribution Channel

Based on distribution channel, the market is divided into foodservice (HoReCa sector), food retail, online retails, and other retail formats. The foodservice (HoReCa sector) segment secured the highest revenue of approximately USD 133.3 million in 2023. The growth of the segment is mainly driven by its cost-effectiveness, convenience, and efficiency.

Frozen foods reduce operational costs by minimizing waste and storage expenses. They can be prepared quickly, enhancing service efficiency and customer satisfaction in fast-paced restaurant environments. Maintaining consistent quality throughout their shelf life is imperative to ensure menu uniformity, a crucial factor in preserving customer loyalty. Additionally, frozen foods provide versatility by overcoming seasonal ingredient constraints and enabling diverse menu offerings.

Frozen Foods Market Regional Analysis

Based on region, the global frozen foods market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Europe Frozen Foods Market share stood around 33.48% in 2023 in the global market, with a valuation of USD 99.7 million and is expected to hold its position over the forecast period. This dominance can be attributed to the growing consumer preference for convenience, supported by advancements in food processing technologies.

A robust distribution infrastructure ensures widespread availability, while ongoing product innovation caters to diverse tastes and dietary needs. Stringent health and safety standards, coupled with environmental awareness, further bolster consumer trust. Changing demographics, including aging populations and smaller households, are set to further drive regional market growth.

Asia-Pacific is poised to experience significant growth at a CAGR of 5.49% over the forecast period. This growth is primarily fueled by rapid urbanization, increased disposable incomes, and a shift toward westernized dietary patterns. Improved cold chain logistics and retail infrastructure contribute to enhanced accessibility, whereas the rising demand for convenient options in food preparation aligns with consumer preferences.

Localization efforts by industry players, including the introduction of frozen versions of traditional Asian dishes, further attract consumers. Additionally, increased health and nutrition concerns drive the development of healthier frozen options. With these factors converging, the Asia-Pacific region emerges as a hotspot for frozen food market expansion, offering lucrative opportunities for both domestic and international food producers.

Competitive Landscape

The global frozen foods market report will offer valuable insights, highlighting the industry's fragmented landscape. Key market players are prioritizing various strategic approaches, including partnerships, mergers, acquisitions, and product enhancements, to broaden their product offerings and increase their market presence globally.

Strategic endeavors, such as increased investment in research and development, the establishment of new manufacturing facilities, and optimizing the supply chain, present substantial potential to drive market expansion and unlock opportunities for growth.

List of Key Companies in Frozen Foods Market

- General Mills Inc.

- Conagra Brands, Inc,

- Nestle

- Unilever

- Ajinomoto Co. Inc.

- Cargill, Incorporated

- Kellogg Co.

- McCain Foods Limited

- The Kraft Heinz Company

- Associated British Foods Plc

Key Industry Developments

- July 2023 (Investment): Nomad Foods signed a deal to purchase power with Grastim JV. This move offered Nomad access to 2.4 MW of solar energy per year for its manufacturing site in Cisterna di Latina. It also allowed Nomad Foods to reduce its annual carbon emissions by approximately 1180 tonnes.

- January 2024 (Partnership): Sweetkiwi announced its partnership agreement with Broadus Foods. Additionally, the company introduced a new line of Frozen Greek Yogurt Bars, featuring flavors inspired by Snoop Cereal. This marks an innovative step forward in the company’s product offerings.

The Global Frozen Foods Market is Segmented as:

By Product Type

- Dairy & Frozen Desserts

- Bakery Products & Snacks

- Sea/Poultry & Meat Products

- Fruits & Vegetable

- Convenience Food & Ready Meals

- Others

By Distribution Channel

- Foodservice (HORECA Sector)

- Food Retail

- Online Retails

- Other Retail Formats

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America