Forklift Battery Market Size

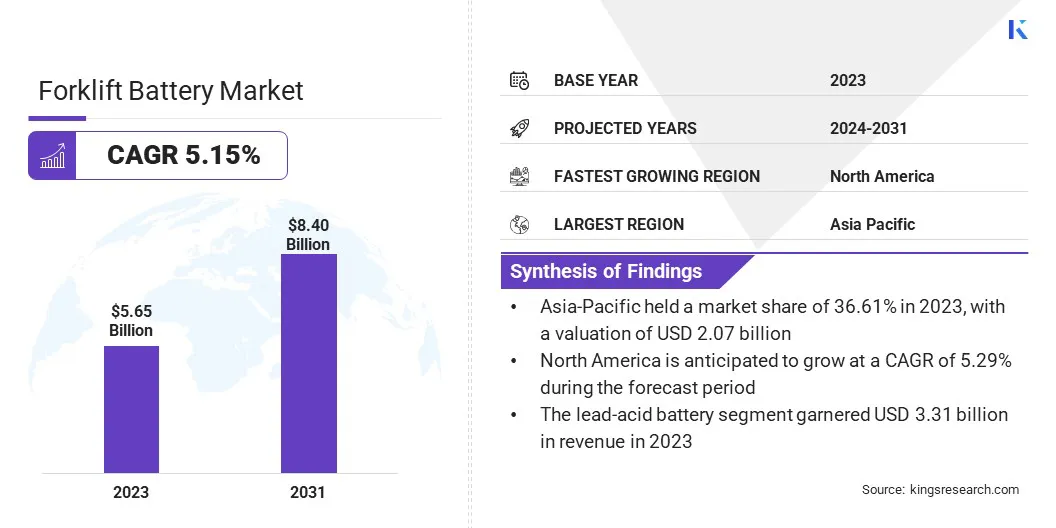

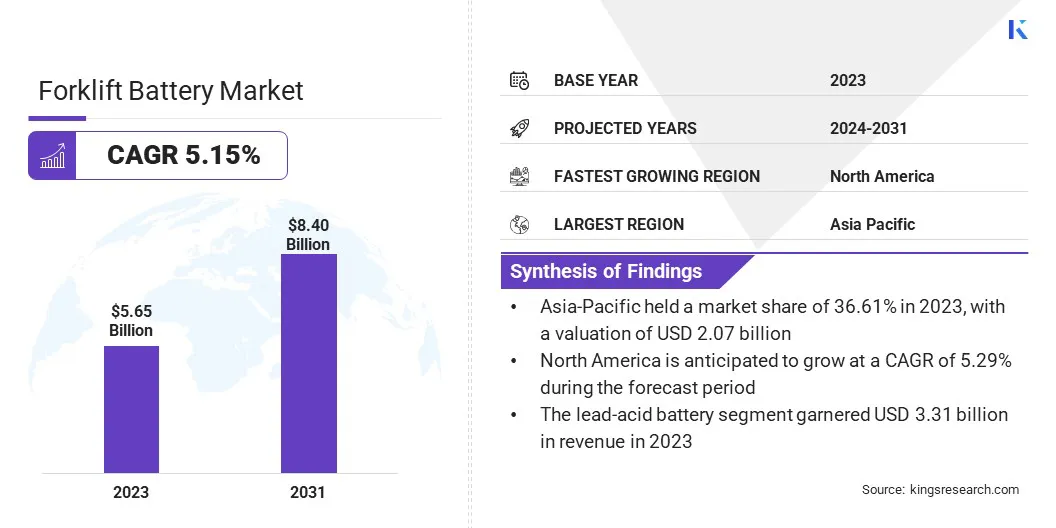

The global Forklift Battery Market size was valued at USD 5.65 billion in 2023 and is projected to grow from USD 5.91 billion in 2024 to USD 8.40 billion by 2031, exhibiting a CAGR of 5.15% during the forecast period. The growth of the market is driven by the increasing adoption of electric forklifts, ongoing advancements in battery technology, and the transition to reducing carbon emissions in material handling operations.

In the scope of work, the report includes solutions offered by companies such as Amara Raja Energy & Mobility Limited, Crown Equipment Corporation, East Penn Manufacturing Company, EnerSys, Exponential Power, Flux Power, Zhejiang Narada Power Source Co., Ltd., C&D Technologies, Inc, HOPPECKE Batterien GmbH & Co. KG, EXIDE INDUSTRIES LTD., and others.

The expansion of the forklift battery market is primarily fueled by the rapid expansion of the e-commerce and logistics sectors. As companies strive for operational efficiency, the demand for electric forklifts, which require reliable battery solutions, is rising. Additionally, the shift toward reducing carbon emissions and adopting green technologies is prompting industries to transition from internal combustion engine forklifts to electric variants.

Advances in battery technology, such as lithium-ion batteries, offer longer operational life and reduced maintenance costs, thereby boosting market growth. Government incentives and subsidies for electric vehicles are playing a significant role in fostering the adoption of electric forklifts, thereby propelling the demand for forklift batteries.

- For instance, in July 2024, Hyster Company introduced the E80XNL, an 8,000-pound electric forklift equipped with integrated lithium-ion power. The model is distinguished by its improved ergonomics, energy efficiency, and zero emissions. It features various battery sizes, fast charging, and regenerative braking. The design provides a spacious operator compartment and includes Hyster Reaction technology to optimize both performance and safety.

The forklift battery market is witnessing substantial growth due to the increasing adoption of electric forklifts across various industries. The market encompasses different battery types, including lead-acid and lithium-ion, each catering to specific industry needs. Lithium-ion batteries are gaining immense traction due to their efficiency and longer lifespan compared to traditional lead-acid batteries.

The Asia-Pacific region is dominating the market, supported by rapid industrialization and the presence of major manufacturing hubs. Stringent environmental regulations and the growing trend of automation in warehouses and distribution centers are transforming the market landscape.

The market refers to the industry segment dedicated to providing batteries specifically designed for powering electric forklifts used in material handling and warehouse operations. These batteries are critical components that influence the performance, efficiency, and operational costs of electric forklifts. The market includes various battery technologies, such as lead-acid, lithium-ion, and other advanced chemistries, each with distinct advantages and applications.

Lead-acid batteries are traditional and widely used, while lithium-ion batteries are increasingly preferred due to their superior energy density and lower maintenance requirements. The market serves diverse end-users, including manufacturing, retail, logistics, and construction sectors, aiming to enhance productivity and sustainability in material handling operations.

Analyst’s Review

Manufacturers in the forklift battery market are actively investing in research and development to enhance battery performance and efficiency. These efforts further include the introduction of advanced lithium-ion batteries, which offer faster charging times and longer lifespans. Furthermore, companies are focusing on integrating smart battery management systems to optimize battery usage and maintenance.

- For instance, in March 2024, EnerSys introduced an Accelerated Throughput Package (ATP) for select NexSys TPPL batteries, which increased their daily energy throughput. This development allowed NexSys TPPL batteries to better support demanding Class 1 and 2 equipment, thereby reducing the need for battery changes. The ATP upgrade enabled faster and more efficient energy uptake during brief charging periods by improving thermal management in the product.

New products, such as modular and scalable battery solutions, are being introduced to cater to diverse industrial needs. It is recommended that businesses consider transitioning to lithium-ion batteries to benefit from reduced maintenance costs and higher efficiency. Additionally, leveraging government incentives for green technologies is expected to enhance the return on investment for adopting advanced forklift battery solutions.

Forklift Battery Market Growth Factors

The growing shift toward electric forklifts in the material handling industry is boosting the demand for forklift batteries. Companies are increasingly adopting electric forklifts due to their lower operational costs and reduced environmental impact compared to internal combustion engine forklifts. Electric forklifts are quieter, produce zero emissions, and require less maintenance, making them ideal for indoor operations.

Additionally, advancements in battery technology, particularly lithium-ion batteries, are enhancing the performance and efficiency of electric forklifts. This shift is further supported by government regulations and incentives aimed at promoting the use of environmentally friendly technologies, thereby creating a robust demand for forklift batteries.

A significant challenge hampering the development of the forklift battery market is the high initial cost of lithium-ion batteries compared to traditional lead-acid batteries. This cost barrier often deters small and medium-sized enterprises from transitioning to lithium-ion technology. However, manufacturers are overcoming this challenge by highlighting the long-term benefits and cost savings associated with lithium-ion batteries.

These batteries offer longer operational life, reduced maintenance, and higher energy efficiency, which results in lower total cost of ownership over time. Additionally, financing options, leasing programs, and government subsidies help mitigate the initial cost burden, making lithium-ion batteries a more viable option for a broader range of businesses.

Forklift Battery Market Trends

The increasing adoption of lithium-ion batteries is a notable trend in the market. Companies are recognizing the advantages of lithium-ion technology, which include faster charging times, longer lifespan, and lower maintenance requirements compared to lead-acid batteries. This trend is further fueled by the need for higher efficiency and productivity in warehouse and logistics operations.

Additionally, lithium-ion batteries are more environmentally friendly, which aligns with the growing emphasis on sustainability. As battery technology continues to advance and production costs decrease, the shift toward lithium-ion batteries is expected to become more pronounced, thereby augmenting market growth.

The integration of smart battery management systems (BMS) is another significant trend in the forklift battery market. These systems monitor and manage the performance, health, and safety of forklift batteries in real-time, thereby enhancing their efficiency and lifespan. BMS provides critical data on battery status, including charge levels, temperature, and usage patterns, allowing for predictive maintenance and minimizing downtime.

This technology is particularly beneficial for large fleets, where managing battery health is crucial for operational efficiency. The adoption of smart BMS is increasing as companies actively seek to optimize their material handling operations and reduce overall operational costs.

Segmentation Analysis

The global market is segmented based on type, application, and geography.

By Type

Based on type, the market is categorized into lead-acid battery and lithium-ion batteries. The lead-acid battery segment led the forklift battery market in 2023, reaching a valuation of USD 3.31 billion. This expansion is largely propelled by its cost-effectiveness and established technology. This growth is further bolstered by its widespread use across various industries. Lead-acid batteries are known for their reliability, ease of recycling, and lower initial costs compared to lithium-ion batteries.

Despite advancements in battery technology, numerous companies, particularly those in cost-sensitive regions, continue to prefer lead-acid batteries for their forklifts. Additionally, the existing infrastructure and the widespread familiarity with lead-acid batteries contribute to their dominance in the market, thereby ensuring steady demand.

By Application

Based on application, the market is classified into warehouses, manufacturing, construction, and others. The warehouses segment is poised to witness significant growth at a CAGR of 5.90% through the forecast period (2024-2031). This growth is mainly attributed to the booming e-commerce industry and the increasing need for efficient material handling solutions in distribution centers.

As companies aim to optimize logistics and inventory management, the demand for electric forklifts powered by reliable batteries is rising. The growing shift toward automation and the widespread adoption of advanced technologies in warehouses are further bolstering the demand for efficient battery solutions. Moreover, the emphasis on reducing operational costs and improving sustainability in warehousing operations is contributing to the growth of the segment.

Forklift Battery Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

Asia-Pacific forklift battery market held a considerable share of around 36.61% in 2023, with a valuation of USD 2.07 billion. This dominance is reinforced by rapid industrialization and urbanization in countries such as China and India, which are leading to increased demand for efficient material handling solutions.

The region's strong manufacturing base, particularly in electronics, automotive, and consumer goods, is creating a robust demand for electric forklifts and, consequently, forklift batteries. Additionally, government initiatives that promote green energy and enforce stricter environmental regulations are promoting the adoption of electric forklifts, thereby boosting regional market expansion. The presence of major battery manufacturers in the region further solidifies Asia-Pacific's position as a leading market for forklift batteries.

North America is poised to experience significant growth at a CAGR of 5.29% through the projection period. This growth is facilitated by the increasing adoption of electric forklifts in warehouses and distribution centers to enhance operational efficiency and reduce emissions. The region's strong emphasis on automation and technological advancements in material handling is fueling the demand for advanced battery solutions.

Additionally, supportive government policies and incentives for green technologies are prompting businesses to transition to electric forklifts. The growing e-commerce sector in North America is contributing to the rising demand for efficient and reliable forklift batteries, thereby supporting regional market growth.

Competitive Landscape

The global forklift battery market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Forklift Battery Market

- Amara Raja Energy & Mobility Limited

- Crown Equipment Corporation

- East Penn Manufacturing Company

- EnerSys

- Exponential Power

- Flux Power

- Zhejiang Narada Power Source Co., Ltd.

- C&D Technologies, Inc

- HOPPECKE Batterien GmbH & Co. KG

- EXIDE INDUSTRIES LTD.

Key Industry Developments

- July 2024 (Launch): Flux Power Holdings, Inc. introduced the L36 battery pack specifically designed for Class 1 3-Wheel Counterbalance forklifts, featuring 630 Ah and 840 Ah capacity options. The L36 battery pack has been approved by a major OEM in the material handling industry. This new battery pack optimizes efficiency and performance through its integrated heaters, cooling, and an advanced battery management system. It offers improved safety and a longer lifespan compared to traditional lead-acid batteries.

- June 2024 (Expansion): Narada inaugurated its Smart Energy Storage Manufacturing Base in Jiuquan, China, with a USD 276.2 million investment. The facility, spanning 200 acres, is designed to produce 4GWh of lithium batteries, PACK, and energy storage systems annually, aiming to boost the local economy and advance the new energy industry in Jiuquan.

The global forklift battery market is segmented as:

By Type

- Lead-Acid Battery

- Lithium-Ion Batteries

By Application

- Warehouses

- Manufacturing

- Construction

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America