Market Definition

Food pathogen testing involves the identification and detection of harmful microorganisms that can cause foodborne illnesses. These tests help ensure that food products meet safety regulations and quality standards. It includes testing at various stages of the food supply chain to prevent contamination and protect public health. They are widely applied in food manufacturing, processing, and packaging to maintain reduce recall risks and safeguard consumer trust.

Food Pathogen Testing Market Overview

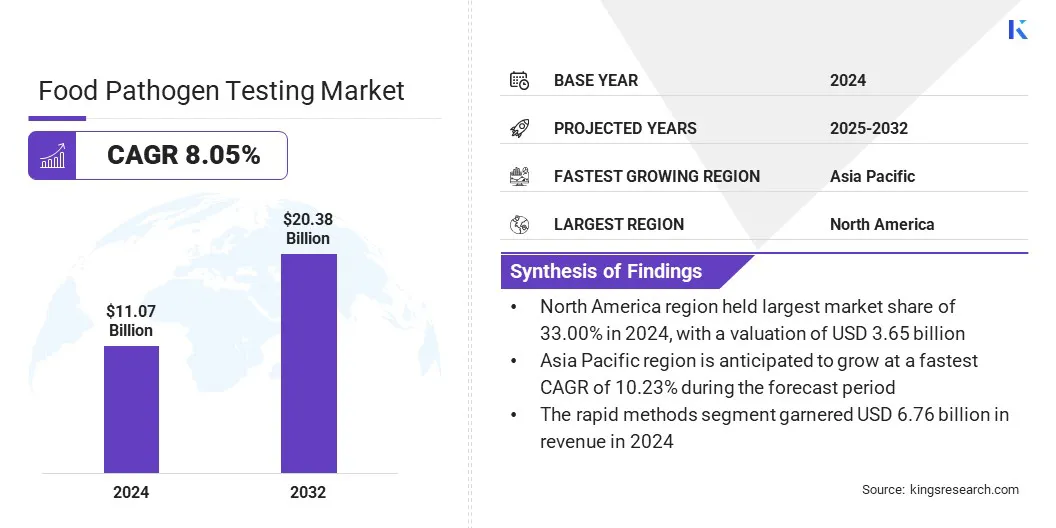

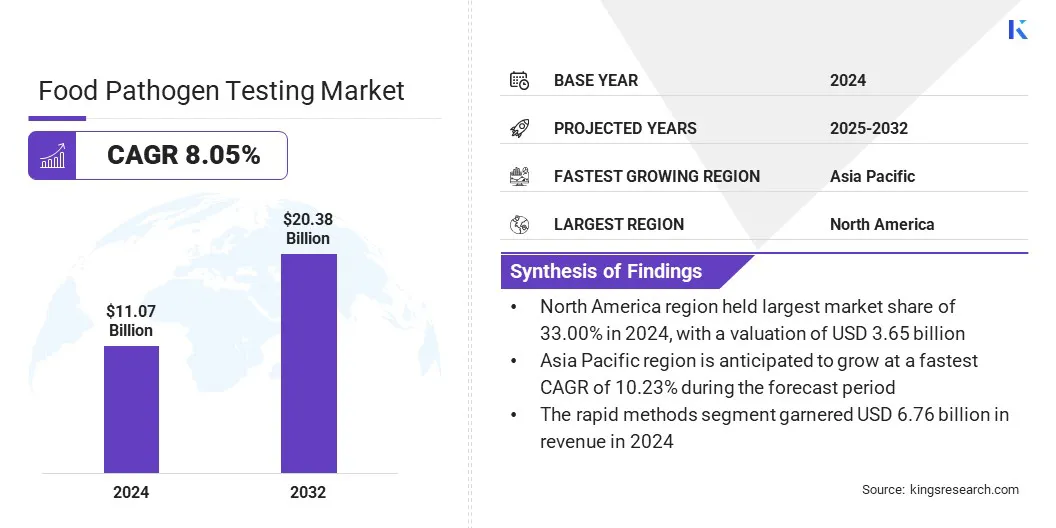

The global food pathogen testing market size was valued at USD 11.07 billion in 2024 and is projected to grow from USD 11.86 billion in 2025 to USD 20.38 billion by 2032, exhibiting a CAGR of 8.05% during the forecast period. This growth is fueled by the rising demand for pathogen testing solutions in the poultry industry, supported by the need to maintain food safety and comply with strict regulatory standards.

Rising use of real-time polymerase chain reaction solutions for rapid origin analysis is a key trend, enabling faster and more precise detection of pathogens. Companies are incorporating these technologies to improve operational efficiency and ensure prompt identification and management of contamination risks.

Key Highlights:

- The food pathogen testing industry was recorded at USD 11.07 billion in 2024.

- The market is projected to grow at a CAGR of 8.05% from 2025 to 2032.

- North America held a share of 33.00% in 2024, valued at USD 3.65 billion.

- The salmonella segment garnered USD 3.43 billion in revenue in 2024.

- The rapid methods segment is expected to reach USD 14.61 billion by 2032.

- The meat & poultry segment is projected to generate a revenue of USD 7.31 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 10.23% over the forecast period.

Major companies operating in the food pathogen testing market are Thermo Fisher Scientific Inc., Merck KGaA, Neogen Corporation, Bio-Rad Laboratories, Inc., BIOMÉRIEUX, QIAGEN, Agilent Technologies, Inc., Shimadzu Corporation, Bruker, dsm-firmenich, Hygiena LLC, 3M, PerkinElmer, Clear Labs, Inc., and Seegene Inc.

Market growth is propelled by the increasing adoption of PCR assays for the simultaneous detection of Salmonella and Cronobacter in food products. These assays enable rapid, accurate, and cost-effective identification of multiple pathogens in a single test, reducing analysis time and operational complexity.

Food producers are leveraging this technology to enhance safety monitoring across processing and packaging stages. The capability to detect multiple contaminants simultaneously supports more efficient quality control and strengthens compliance with regulatory standards.

- In May 2025, Hygiena launched the foodproof Salmonella plus Cronobacter Detection LyoKit, becoming the first to achieve ISO 16140-2 validation for a multiplex real-time PCR assay. The solution enables simultaneous detection of Salmonella spp. and Cronobacter spp. in a single test, improving testing efficiency and regulatory compliance.

Market Driver

Growing Demand for Pathogen Testing Solutions in Poultry Industry

The expansion of the food pathogen testing market is propelled by the rising demand in the poultry industry. Poultry products are highly susceptible to contamination from pathogens such as Salmonella and Campylobacter, which can lead to significant public health risks and costly recalls.

Stringent regulatory standards mandate regular testing across production and processing stages. This is prompting poultry producers to adopt advanced and high-frequency pathogen detection methods to ensure compliance, maintain product quality, and safeguard consumer trust.

- In January 2025, Neogen Corporation launched the Neogen Molecular Detection Assay 2 – Quantitative Salmonella (MDA2QSAL96), offering poultry producers a quantitative pathogen testing solution. The kit integrates qualitative testing with Quantitative Rapid Enrichment Dehydrated media to control growth rates and verify intervention effectiveness.

Market Challenge

High Complexity and Cost of Advanced Pathogen Testing

A significant challenge constraining the progress of the food pathogen testing market is the high complexity and cost associated with advanced technologies such as real-time Polymerase Chain Reaction and immunoassay-based methods. The substantial investment required for equipment, training, and maintenance limits adoption, particularly among small and medium-sized food producers, causing continued reliance on conventional, slower testing methods.

To address this challenge, industry participants are developing cost-effective, user-friendly testing kits and providing comprehensive technical training. They are also implementing scalable and automated solutions to reduce operational expenses and enhance accessibility across the supply chain.

Market Trend

Rising Use of Real-Time Polymerase Chain Reaction Solutions for Rapid Root Cause Analysis

The food pathogen testing market is witnessing a growing trend toward the use of real-time polymerase chain reaction solutions for rapid root cause analysis in the food industry. This technology enables highly accurate detection of specific pathogens within a short time frame, allowing food producers to quickly identify contamination sources.

The capability to perform precise and timely testing supports effective corrective actions, minimizes product recalls, and enhances overall food safety management. Its adoption is expanding across processing facilities, laboratories, and quality control departments to meet stringent safety requirements.

- In February 2025, bioMérieux launched GENE-UP TYPER, a real-time PCR solution for rapid strain characterization of Listeria monocytogenes in the food industry. The solution combines an assay with a web application to trace the source of contamination and speed up corrective actions.

Food Pathogen Testing Market Report Snapshot

|

Segmentation

|

Details

|

|

By Contaminant Type

|

Salmonella, E. coli, Listeria, Campylobacter, Others

|

|

By Technology

|

Rapid Methods (Convenience-Based Tests, Polymerase Chain Reaction (PCR), Immunoassay, Others), Conventional Methods (Quantitative Culture, Qualitative Culture)

|

|

By Application

|

Meat & Poultry, Dairy Products, Processed Foods, Fruits & Vegetables, Cereals & Grains, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Contaminant Type (Salmonella, E. coli, Listeria, Campylobacter, and Others): The salmonella segment earned USD 3.43 billion in 2024, mainly due to its high prevalence in foodborne outbreaks and the need for frequent screening.

- By Technology (Rapid Methods and Conventional Methods): The rapid methods segment held a share of 61.00% in 2024, boosted by the increasing demand for quick, accurate, and cost-efficient testing solutions.

- By Application (Meat & Poultry, Dairy Products, Processed Foods, Fruits & Vegetables, Cereals & Grains, and Others): The meat & poultry segment is projected to reach USD 7.31 billion by 2032, owing to safety regulations and consistent testing requirements in large-scale production.

Food Pathogen Testing Market Regional Analysis

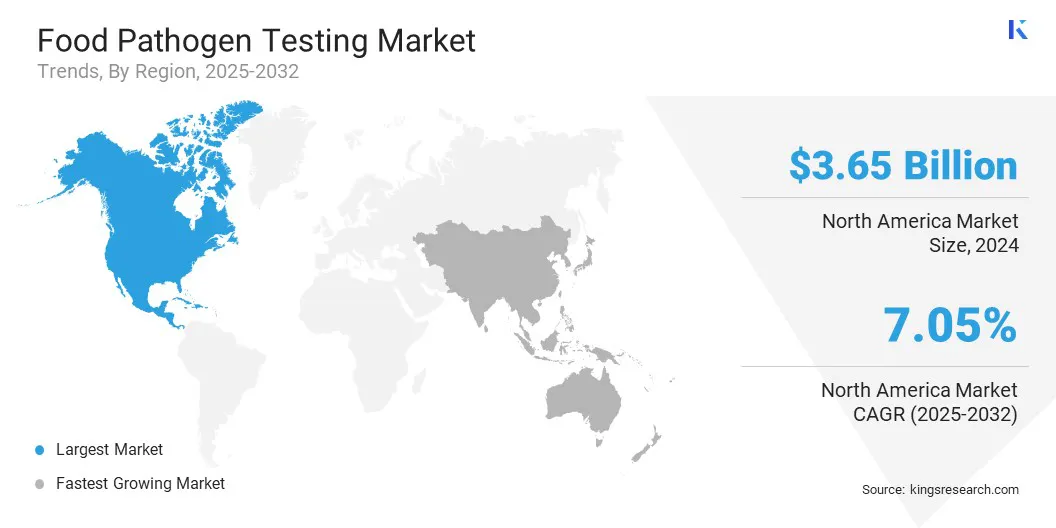

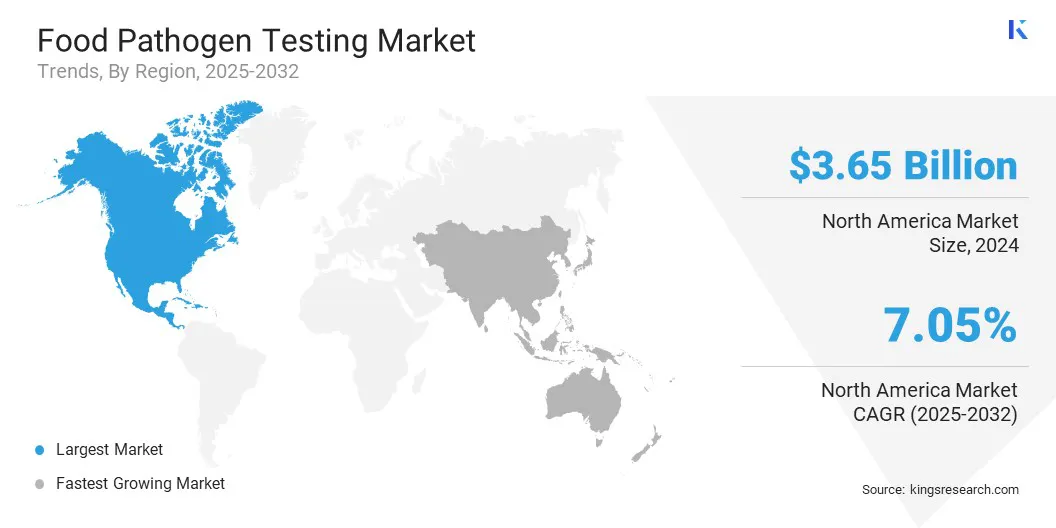

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America food pathogen testing market share stood at 33.00% in 2024, valued at USD 3.65 billion. This dominance is attributed to strong collaborations and initiatives between government agencies, research institutions, and industry players, which have enhanced testing capabilities and adoption of advanced technologies.

These partnerships have facilitated the development of standardized protocols, rapid detection methods, and large-scale implementation of pathogen testing across the food supply chain. Continuous investment in research and strategic alliances has reinforced North America’s position as the leading market for food pathogen testing.

- In February 2024, bioMérieux entered a strategic research collaboration with the US Food and Drug Administration, Center for Food Safety and Applied Nutrition, and associated offices to develop tools for combating food-borne pathogens. The inaugural projects focus on improving isolation of Shiga-toxin-producing E. coli, enhancing detection of Cyclospora cayetanensis, and simplifying microbial characterization for Salmonella and Listeria monocytogenes.

The Asia-Pacific food pathogen testing industry is poised to grow at a CAGR of 10.23% over the forecast period. The growth is bolstered by the rising demand for pathogen testing solutions in the poultry and meat industry, supported by increasing consumption, expanding production, and stricter food safety regulations.

Rapid industrialization and modernization of food processing facilities in the region are accelerating the adoption of advanced testing technologies, aiding regional market expansion.

Regulatory Frameworks

- In the U.S., food pathogen testing is regulated under the Food Safety Modernization Act, with oversight from the Food and Drug Administration and the United States Department of Agriculture. These agencies mandate preventive controls, routine inspections, and pathogen-specific testing protocols to reduce contamination risks in the food supply.

- In Europe, regulations are enforced through the General Food Law under the European Food Safety Authority, which establishes microbiological criteria and harmonized testing procedures across member states. These measures ensure consistent food safety standards and facilitate cross-border trade within the region.

- In India, the Food Safety and Standards Authority of India prescribes testing protocols, certification requirements, and compliance monitoring to safeguard public health. The framework covers testing across production, processing, storage, and distribution stages to ensure regulatory adherence throughout the supply chain.

Competitive Landscape

Key players in the global food pathogen testing industry are focusing on targeted acquisitions to strengthen technological expertise and diversify service portfolios. Industry participants are acquiring specialized laboratories, diagnostic technology developers, and testing service providers to enhance operational capabilities and expand geographic presence.

Such acquisitions enable the integration of advanced rapid detection platforms, automation systems, and molecular diagnostic solutions into existing workflows.

Companies are prioritizing acquisitions that add complementary capabilities in high-demand testing segments to improve turnaround times and broaden application coverage. These strategies aim to consolidate market position, enhance competitive advantage, and meet evolving client requirements across the global food supply chain.

- In July 2025, Mérieux NutriSciences acquired Bureau Veritas’ food testing activities in Ecuador. The move marks the company’s entry into the Ecuadorian market and strengthens its presence in Latin America. It enhances capabilities in microbiological and nutritional analysis, residue and pesticide testing, instrumental and heavy metal analysis, and molecular biology.

Key Companies in Food Pathogen Testing Market:

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Neogen Corporation

- Bio-Rad Laboratories, Inc.

- BIOMÉRIEUX

- QIAGEN

- Agilent Technologies, Inc.

- Shimadzu Corporation

- Bruker

- dsm-firmenich

- Hygiena LLC

- 3M

- PerkinElmer

- Clear Labs, Inc.

- Seegene Inc.

Recent Developments (Product Launch)

- In July 2025, Neogen Corporation launched the Molecular Detection Assay – Listeria Right Now, a rapid, enrichment-free solution for detecting Listeria species in environmental samples. The assay delivers results in approximately two hours, enabling food safety teams to make timely sanitation decisions without complex laboratory infrastructure.