Food Fortifying Agents Market Size

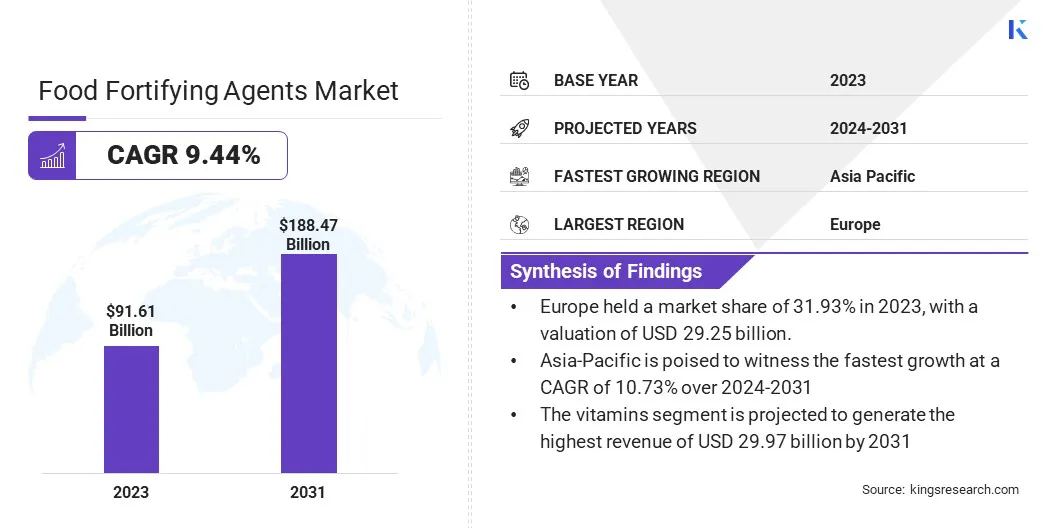

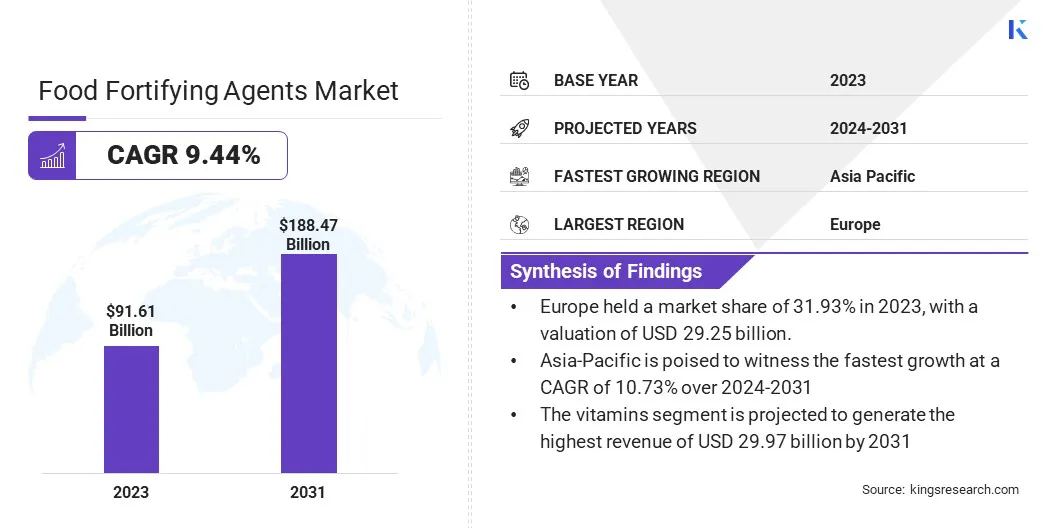

Global Food Fortifying Agents Market size was valued at USD 91.61 billion in 2023 and is projected to reach USD 188.47 billion by 2031, growing at a CAGR of 9.44% from 2024 to 2031. Growth is primarily driven by increasing health awareness and the rising prevalence of micronutrient deficiencies globally.

Government initiatives and interventions that mandate food fortification to prevent malnutrition significantly contribute to market expansion. Additionally, the growing consumer preference for fortified foods in diets and advancements in food technologies are ensuring the stability and efficacy of fortification agents, which are key factors driving product demand.

The global market for food fortifying agents encompasses a wide range of products, including vitamins, minerals, and other additives, designed to enhance the nutritional value of food. The surge in consumer demand for nutrient-rich food products across various regions is stimulating market growth. Key market players are focusing on innovation and geographic expansion to capitalize on emerging opportunities.

The food fortifying agents market refers to the industry involved in the production and distribution of substances such as micro and macronutrients added to foods to enhance their nutritional content. These agents include vitamins, minerals, amino acids, and other essential nutrients. The purpose of adding these agents is to prevent nutritional deficiencies and improve public health outcomes. This market serves a variety of sectors including dairy, bakery, beverages, and infant nutrition, among others.

Analyst’s Review

Food fortification is a pivotal strategy to address nutrient deficiencies and enhance public health. There is considerable public sector intervention regarding the reach of fortified foods. Public sector mandates regarding the implementation of these schemes enable manufacturers to produce and distribute products compliant with the guidelines.

Additionally, fortification is being employed across various formats with gradual expansion in product ranges including salt, flour, oil, milk, and staples such as rice and wheat, among others, which is likely to aid market growth in the forthcoming years.

Food Fortifying Agents Market Growth Factors

A significant factor driving food fortifying agents market growth is the increasing consumer awareness and demand for functional foods. Consumers are actively seeking products that offer added nutritional benefits, such as fortified cereals, beverages, and snacks. This trend is driven by the growing emphasis on health and wellness, with consumers looking for convenient ways to meet their dietary needs.

As a result, food manufacturers are innovating to develop new fortified products and marketing strategies to cater to evolving consumer demand. A key challenge in the market is the effectiveness of public sector schemes and interventions. While initiatives aim to promote food fortification to combat malnutrition, the impact and reach of these programs can vary significantly. To address this challenge, manufacturers are focusing on enhancing collaboration between the public and private sectors.

This includes fostering partnerships to improve distribution networks, implementing targeted awareness campaigns, and leveraging data-driven strategies to identify regions with the highest nutritional needs. Strengthening these efforts enables amplification of the positive outcomes arising due to food fortification programs and drives sustainable market growth.

Food Fortifying Agents Market Trends

An emerging trend in the market is the focus on clean label and natural fortification solutions. Consumers are seeking products with transparent ingredient lists and minimal processing, which is impelling the demand for fortification agents derived from natural sources.

This trend is driving innovation in the development of natural fortification techniques using plant-based extracts, marine ingredients, and fermentation processes. Market players are also investing in research to identify novel natural sources of vitamins, minerals, and other nutrients in keeping with surging consumer preferences for clean and sustainable food options, which is aiding market progress.

The adoption of personalized nutrition solutions is a significant factor impacting the food fortifying agents market. Advancements in technology and data analytics are enabling companies to leverage personalized nutrition to create tailored fortification options based on individual dietary needs and preferences.

This trend is supported by the growing availability of personalized health platforms and genetic testing services, allowing consumers to access individualized recommendations for fortified foods and supplements. The shift toward personalized nutrition reflects a broader consumer interest in optimizing health outcomes through targeted dietary interventions, which is driving the demand for customized fortification solutions among consumers globally.

Segmentation Analysis

The global market is segmented based on type, application, and geography.

By Type

Based on type, the market is segmented into vitamins, minerals, probiotics, prebiotics, amino acids & protein, and others. The vitamins segment led the food fortifying agents market in 2023, reaching a valuation of USD 29.97 billion.

The segment is experiencing robust growth within the market due to the increasing awareness of vitamin deficiencies and their impact on health, which is leading to a rise in fortified foods and supplements consumption.

Additionally, advancements in food processing technologies enable the incorporation of vitamins into a wide range of products without compromising taste or quality. Furthermore, proactive initiatives by governments and health organizations promoting vitamin fortification programs are projected to contribute to segment expansion.

By Application

Based on application, the food fortifying agents market is divided into infant formula, dairy products, cereals, fats & oils, beverages, dietary supplements, and others. The beverages segment secured the largest revenue share of 27.82% in 2023, due to the surge in consumer preferences for functional beverages with added nutritional benefits.

The convenience and wide availability of fortified beverages cater to busy lifestyles, thus making them a popular choice among consumers. Furthermore, innovative product formulations and marketing strategies by beverage manufacturers to promote health and wellness are contributing to segment growth.

Food Fortifying Agents Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Europe food fortifying agents market share stood around 31.93% in 2023 in the global market, with a valuation of USD 29.25 billion. Europe's dominance can be attributed to several factors such as stringent regulations and policies that promote food fortification to address nutritional deficiencies.

Furthermore, the region's strong food and beverage industry infrastructure enables the efficient production and distribution of fortified products. Additionally, consumer awareness and preference for healthy and functional foods have fueled demand for fortified items in European markets, which is strengthening the region's leading position in the market.

Asia-Pacific is poised to witness the fastest growth at a CAGR of 10.73% over 2024-2031 due to rapid urbanization and changing lifestyles in prominent countries viz., China, India, and Japan. This has increased the demand for fortified foods and beverages in the Asia-Pacific.

Additionally, rising disposable incomes and growing health consciousness among consumers are driving the adoption of fortified products in the region. Furthermore, government initiatives promoting food fortification to address malnutrition and improve public health outcomes are expected to fuel regional market growth over the forecast period.

Competitive Landscape

The global food fortifying agents market report will provide valuable insight with an emphasis on the moderately fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Food Fortifying Agents Market

- Adani Group

- Advanced Organic Materials, S.A.

- Archer Daniels Midland Company

- Artemis Salt

- BASF SE

- Cargill Incorporated

- DSM

- Morton Salt, Inc.

- Mead Johnson & Company, LLC

- Tata Consumer Products Limited

Key Industry Developments

- February 2024 (Launch): Arla Foods, announced the relaunch of JÖRĐ as Arla JÖRĐ. The relaunch included updating the packaging design to feature the Arla brand, aligning it with other Arla products like Arla Cravendale and Arla LactoFREE. Arla JÖRĐ offers products fortified with vitamins D and B9 that serve as a source of fiber, maintaining its focus on delivering products with optimal taste and nutrition.

- February 2023 (Launch): Société de Transformation Alimentaire (STA) launched Vitamil+, a fortified milk flour formulated to complement infant nutrition. The product was manufactured in Niger with support from Hystra and GRET as a part of the Meriem project, to combat malnutrition. The formulation utilizes local ingredients including millets, cowpea, groundnuts, and soybeans. The product is fortified with vitamins and minerals to complement the diets of infants.

The Global Food Fortifying Agents Market is segmented as:

By Type

- Vitamins

- Minerals

- Probiotics

- Prebiotics

- Amino Acids & Protein

- Others

By Application

- Infant Formula

- Dairy Products

- Cereals

- Fats & Oils

- Beverages

- Dietary Supplements

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America