Market Definition

The market covers a range of solutions and services designed to bring computation, storage, and networking closer to data sources. It involves infrastructure, platforms, and software that support distributed processing across various sectors such as manufacturing, healthcare, transportation, and smart cities.

The market also includes deployment frameworks, integration tools, and edge-to-cloud management systems. The report offers a thorough assessment of the key factors driving market expansion, along with detailed regional analysis and the competitive landscape influencing industry dynamics.

Fog Computing Market Overview

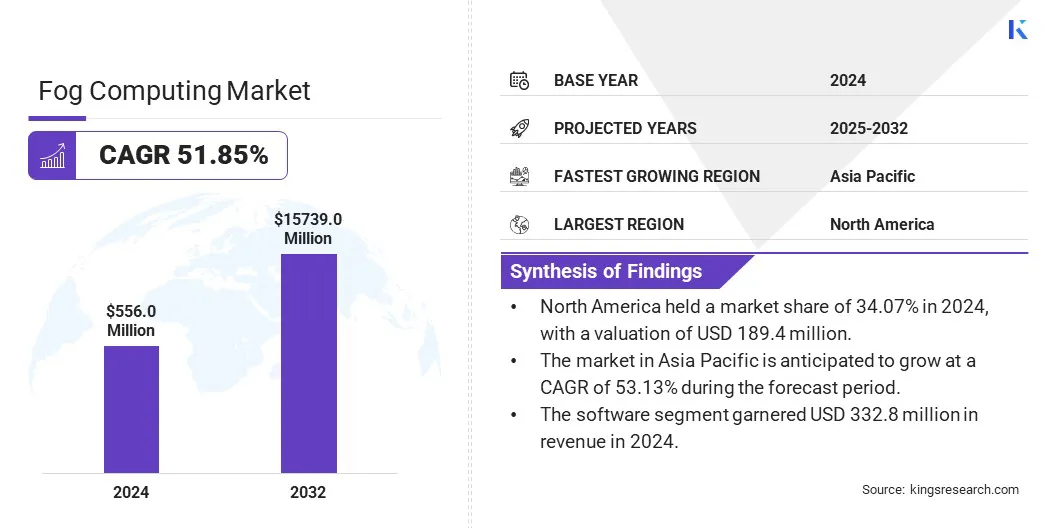

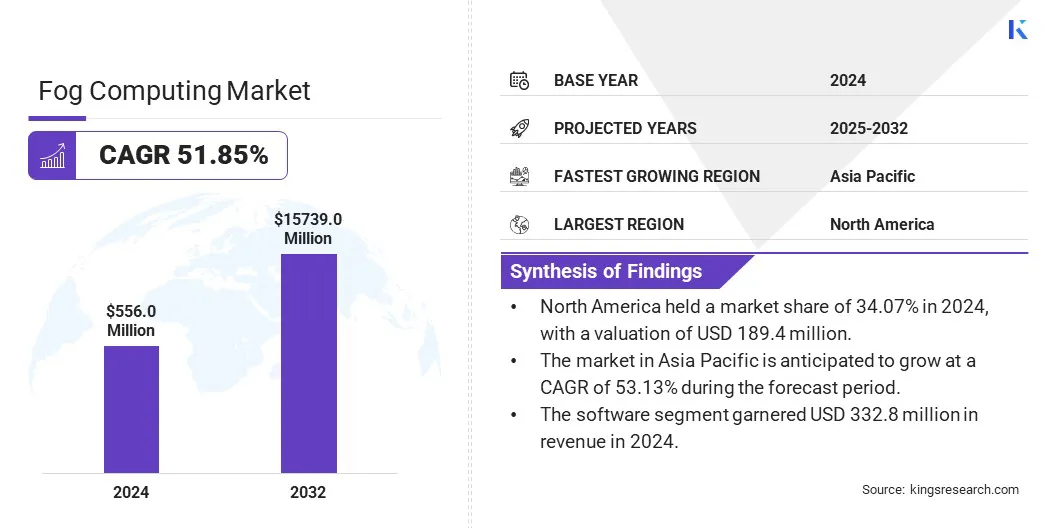

The global fog computing market size was valued at USD 556.0 million in 2024 and is projected to grow from USD 843.7 million in 2025 to USD 15,739.0 million by 2032, exhibiting a CAGR of 51.85% during the forecast period.

The market is experiencing strong growth driven by the rising demand for real-time data processing and low-latency applications across industrial and urban environments. As the number of connected devices continues to surge, organizations are turning to fog computing to reduce the burden on centralized cloud systems and improve response times.

Major companies operating in the fog computing industry are Cisco Systems, Inc., Intel Corporation, IBM, Microsoft, Amazon.com, Inc., NVIDIA Corporation, Qualcomm Technologies, Inc., Hewlett Packard Enterprise Development LP, Huawei Cloud Computing Technologies Co., Ltd., Dell Inc., Siemens AG, Advantech Co., Ltd., Palo Alto Networks, Telefonaktiebolaget LM Ericsson, and Oracle.

The growing adoption of Industrial IoT (IIoT), autonomous systems, and smart infrastructure further accelerates demand for decentralized computing architectures. Additionally, The rollout of 5G networks and rising data security needs at the network edge are driving investment in fog computing, thereby driving market growth.

Key Highlights

- The fog computing industry size was valued at USD 556.0 million in 2024.

- The market is projected to grow at a CAGR of 51.85% from 2025 to 2032.

- North America held a market share of 34.07% in 2024, with a valuation of USD 189.4 million.

- The software segment garnered USD 332.8 million in revenue in 2024.

- The connected vehicles segment is expected to reach USD 4,712.3 million by 2032.

- The market in Asia Pacific is anticipated to grow at a CAGR of 53.13% during the forecast period.

Market Driver

Rising Demand for Real-Time Data Processing

The fog computing market is growing rapidly due to the rising demand for real-time data processing across decentralized networks. As IoT devices and edge computing proliferate, industries are shifting toward processing data closer to the source to reduce latency and handle large data volumes more efficiently.

Fog computing addresses this need by enabling data processing at the network edge, lowering delays and easing bandwidth demands. This is particularly critical for applications like smart cities, industrial automation, and autonomous vehicles, where quick decision-making is essential. As a result, demand for efficient, real-time processing is accelerating the adoption of fog computing across multiple sectors.

Market Challenge

High Deployment Complexity Limiting Scalability in Fog Computing

A major challenge in the fog computing market is the high complexity involved in deployment and integration across heterogeneous systems. Fog architectures require coordination between diverse devices, platforms, and protocols, making setup and management technically demanding.

This complexity often results in increased implementation costs, longer deployment times, and the need for specialized expertise, which can limit adoption, especially among small and mid-sized enterprises.

To address this challenge, companies are focusing on developing standardized frameworks, interoperable platforms, and automated management tools that simplify integration and orchestration across edge and fog layers. These solutions aim to reduce technical barriers, improve scalability, and accelerate the adoption of fog computing in a broader range of industries.

Market Trend

Integration of AI Workloads Enhancing Efficiency in Fog Infrastructure

The fog computing market is witnessing a key trend in the integration of AI workloads into fog infrastructure to enable faster, localized data processing. As the volume of data generated at the edge continues to rise, organizations are deploying AI models within fog environments to analyze and act on data closer to the source.

This reduces reliance on cloud connectivity, lowers latency, and enhances responsiveness in time-sensitive applications. Integrating AI at the fog layer also improves data privacy and reduces the cost and energy demands associated with transmitting data to centralized cloud systems. This trend is strengthening the role of fog computing as a critical enabler of intelligent, distributed systems across multiple industries.

- In October 2024, Fujitsu Limited launched AI computing broker middleware to enhance GPU utilization and address the global shortage of high-performance GPUs. The middleware uses adaptive GPU allocator technology to dynamically allocate GPU resources and optimize memory management, enabling up to a 2.25x increase in computational efficiency during trials with AWL, Inc., Xtreme-D Inc., and Morgenrot Inc.

Fog Computing Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Hardware, Software

|

|

By Application

|

Connected vehicles, Smart Grids, Smart Cities, Connected Healthcare, Smart Manufacturing, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Hardware, Software): The software segment earned USD 332.8 million in 2024 due to the growing need for intelligent resource management and orchestration across decentralized computing environments.

- By Application (Connected vehicles, Smart Grids, Smart Cities, Connected Healthcare, Smart manufacturing, and Others): The connected vehicles segment held 29.90% of the market in 2024, due to the increasing demand for low-latency data processing to support real-time navigation, safety systems, and autonomous driving functions.

Fog Computing Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America fog computing market share stood at around 34.07% in 2024, with a valuation of USD 189.4 million. This dominance is largely driven by the presence of major technology companies, robust cloud and edge infrastructure, and early adoption of fog computing in the automotive, healthcare, and industrial sectors.

The U.S. automotive sector is a major adopter, leveraging fog computing for real-time data processing in autonomous and connected vehicles. Additionally, the country’s healthcare and manufacturing industries are utilizing fog-based architectures to support latency-sensitive applications such as remote diagnostics, robotic surgeries, and smart factory operations.

The presence of leading tech firms and startups actively investing in edge-to-cloud integration is further accelerating innovation in fog computing technologies, thereby driving market growth.

The fog computing industry in Asia Pacific is expected to register the fastest growth in the market, with a projected CAGR of 53.13% over the forecast period. This growth is fueled by the rapid expansion of smart city projects, increasing deployment of 5G networks, and a surge in connected devices across countries such as China, Japan, South Korea, and India.

Moreover, the presence of large-scale manufacturing hubs further drives market growth in this region by adopting fog computing for real-time equipment monitoring, predictive maintenance, and automation. Asia Pacific’s accelerating digital transformation in urban mobility and industrial applications is driving growth in the market in this region.

Regulatory Frameworks

- In the U.S., fog computing solutions must comply with various regulations depending on the application area. In healthcare, HIPAA ensures data privacy and security. For federal government systems, FISMA sets cybersecurity requirements. In industrial environments, standards from NIST and ISA/IEC 62443 provide guidelines for securing fog computing deployments in sectors such as manufacturing and energy. These frameworks collectively help ensure secure and compliant use of fog computing across critical domains.

- In Europe, fog computing solutions must align with the General Data Protection Regulation (GDPR), which imposes strict requirements on the collection, storage, and transfer of personal data, especially in decentralized architectures.

Competitive Landscape

The fog computing industry is evolving in response to increasing demand for real-time data processing and low-latency applications across industries such as manufacturing, healthcare, and transportation. Vendors are focusing on developing platforms that integrate with both IoT and cloud systems, with an emphasis on scalability and interoperability.

Industry initiatives have emphasized the need for standardized architectures to support broader adoption, and collaborative efforts are underway to define common frameworks. Partnerships between technology providers and telecommunications networks are being formed to improve edge infrastructure and accelerate deployment timelines.

According to published market research, there is also a growing trend of mergers and acquisitions involving firms specializing in edge analytics and network virtualization, aimed at enhancing product capabilities and reducing development cycles.

List of Key Companies in Fog Computing Market:

- Cisco Systems, Inc.

- Intel Corporation

- IBM

- Microsoft

- Amazon.com, Inc.

- NVIDIA Corporation

- Qualcomm Technologies, Inc.

- Hewlett Packard Enterprise Development LP

- Huawei Cloud Computing Technologies Co., Ltd.

- Dell Inc.

- Siemens AG

- Advantech Co., Ltd.

- Palo Alto Networks

- Telefonaktiebolaget LM Ericsson

- Oracle

in the global market