Market Definition

The market involves technologies and systems used to remove sulfur dioxide (SO₂) from industrial emissions, primarily in coal-fired power plants and heavy industries. These systems reduce air pollution, prevent acid rain, and support regulatory compliance and sustainable operations. The report outlines the primary drivers of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry's trajectory.

Flue Gas Desulfurization Market Overview

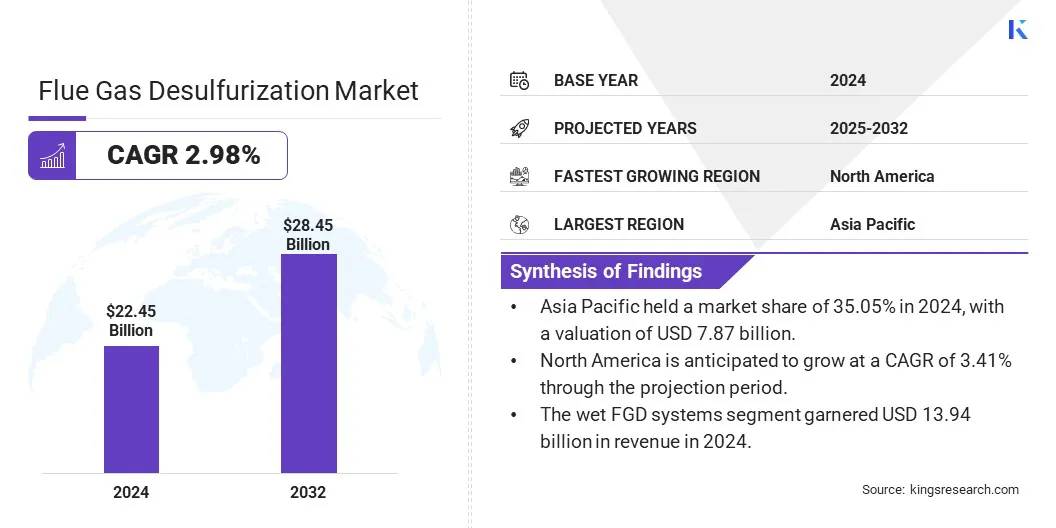

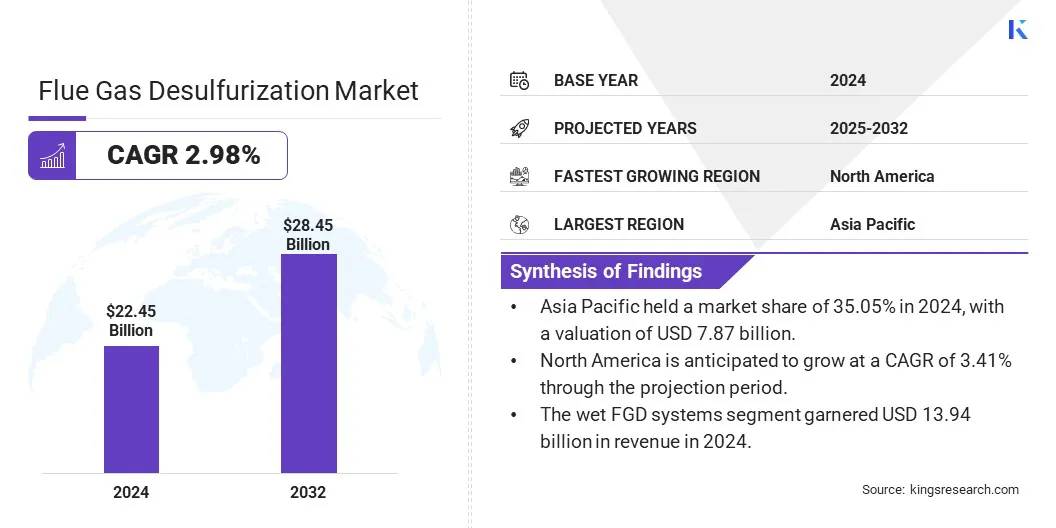

The global flue gas desulfurization market size was valued at USD 22.45 billion in 2024 and is projected to grow from USD 23.09 billion in 2025 to USD 28.45 billion by 2032, exhibiting a CAGR of 2.98% during the forecast period.

This growth is propelled by regulatory support, financial incentives, and stricter SO₂ norms, promoting adoption in thermal plants and cement industries. Wet limestone scrubbers enable these sectors to meet emission targets and sustainability goals while reducing import dependence.

Major companies operating in the flue gas desulfurization industry are MITSUBISHI HEAVY INDUSTRIES, LTD., GE Vernova, ANDRITZ, Babcock & Wilcox Enterprises, Inc., RAFAKO S.A., MET, Thermax Limited., DUCON, Chiyoda Corporation, Valmet, Kawasaki Heavy Industries, Ltd., Macrotek Inc., AECOM, Steinmüller Engineering GmbH, and Carmeuse Americas.

The market is witnessing strong growth due to the increasing reliance on coal-fired power generation in developing countries. As coal remains a primary energy source, particularly in rapidly industrializing nations, the associated rise in sulfur dioxide emissions has prompted the need for effective emission control technologies.

With low compliance rates and rising environmental concerns, governments are enforcing stricter regulations, boosting demand for FGD systems to mitigate air pollution and meet sustainability targets.

- In November 2024, the Centre for Research on Energy and Clean Air reported that full flue gas desulfurization (FGD) adoption in India’s coal plants could reduce SO₂ emissions by 64%, from 4,327 to 1,547 kilotons annually. With only 8% of plants compliant since 2015, the urgent need for wider implementation signals strong market potential amid increasing environmental concerns and regulatory pressure.

Key Highlights:

Key Highlights:

- The flue gas desulfurization industry size was recorded at USD 22.45 billion in 2024.

- The market is projected to grow at a CAGR of 2.98% from 2025 to 2032.

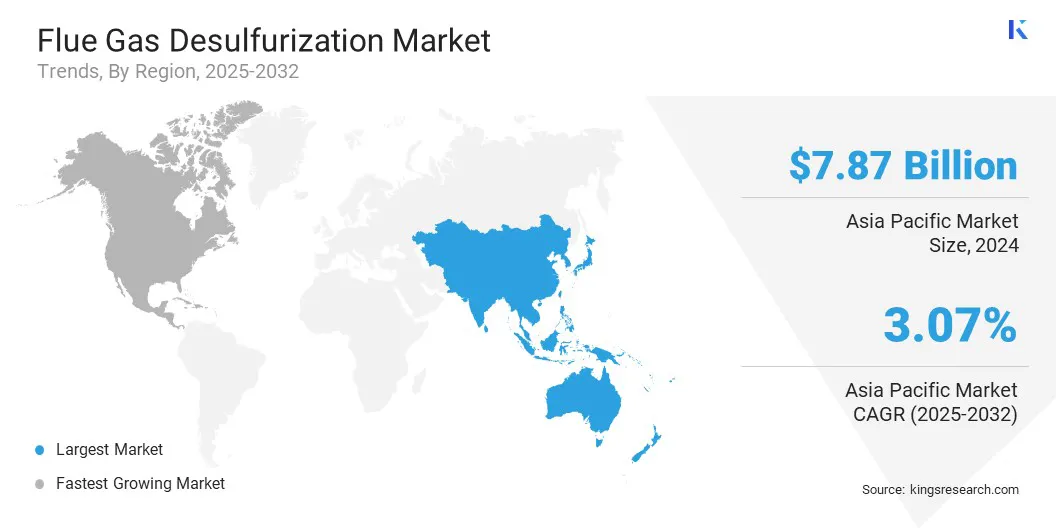

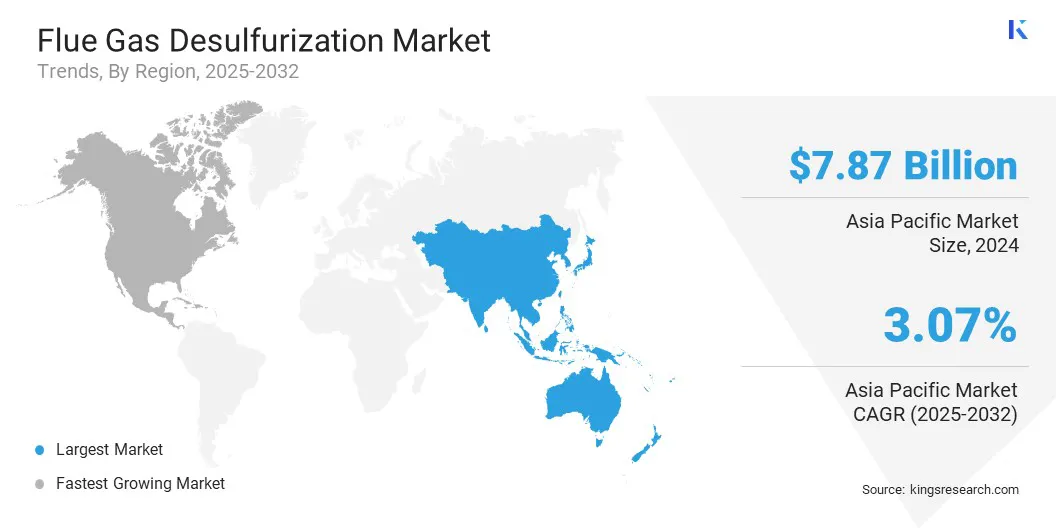

- Asia Pacific held a market share of 35.05% in 2024, with a valuation of USD 7.87 billion.

- The wet FGD systems segment garnered USD 13.94 billion in revenue in 2024.

- The components, repairs, & consumables segment is expected to reach USD 16.78 billion by 2032.

- The manufacturing segment is anticipated to witness the fastest CAGR of 3.25% over the forecast period.

- North America is anticipated to grow at a CAGR of 3.41% through the projection period.

Market Driver

Government Support and Incentives for Pollution Control Technologies

The expansion of the flue gas desulfurization market is fueled by strong government support and financial incentives for pollution control technologies. With mandatory SO₂ emission norms and penalties for non-compliance, authorities are promoting FGD adoption through regulatory deadlines and support for domestic manufacturing .

These policy measures are driving demand, reducing import dependence, and accelerating installation in thermal power plants, creating a favorable environment for market growth amid rising pressure to meet emission targets efficiently and promptly.

- In August 2024, the Union Minister for Power mandated that thermal power plants install flue gas desulfurization (FGD) systems by December 2024–2026, depending on their location. As of now, plants in eastern states are upgrading to meet SO₂ emmision standards. Non-compliance incurs penalties ranging from USD 0.0025 to USD 0.005 per unit. The Central Pollution Control Board (CPCB), State Pollution Control Board (SPCBs), and Central Electricity Authority (CEA) actively monitor FGD installation progress and emission compliance.

Market Challenge

High Energy Consumption of FGD System Operations in Power Plants

The high energy consumption of flue gas desulfurization (FGD) systems poses a major challenge, particularly in coal-fired power plants where operational efficiency is critical. FGD units require significant electricity to operate pumps, fans, and other components, increasing the overall auxiliary power load. This reduces net power output and raises operating costs, thereby impacting economic performance.

The added energy demand also strains older power infrastructure, complicating retrofitting efforts. To address this challenges, companies are developing low-energy FGD designs, optimizing system configurations, and integrating smart monitoring technologies to improve efficiency. Some are also exploring hybrid systems to reduce energy consumption.

Market Trend

Surging Adoption in Cement Industry

Flue gas desulfurization market is witnessing a notable trend toward the increasing adoption in the cement industry as emission regulations extend beyond power generation. Cement plants, which emit significant sulfur oxides during production, are integrating FGD systems to meet tightening environmental norms.

The use of wet limestone scrubbers with gypsum by-product aligns with industrial sustainability goals. This trend reflects broader cross-sectoral uptake of FGD technologies to reduce air pollution and comply with national emission standards, particularly in high-emission industries such as cement.

- In October 2023, Valmet was selected to supply its first wet limestone FGD system in India for a petroleum refinery’s four boilers, marking a significant advancement in emission control. The system, using limestone scrubbing and producing gypsum as a by-product, ensures compliance with MoEF&CC norms. This highlights the growing adoption of advanced FGD technologies across industries beyond power, including cement.

Flue Gas Desulfurization Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Wet FGD Systems, Dry/Semi-Dry FGD Systems

|

|

By Installation

|

New Systems, Components, Repairs, & Consumables

|

|

By Application

|

Power Plants, Chemicals, Cement, Metal Processing & Mining, Manufacturing, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product (Wet FGD Systems and Dry/Semi-Dry FGD Systems): The wet FGD systems segment earned USD 13.94 billion in 2024 due to its higher efficiency in sulfur dioxide removal and growing preference for gypsum by-product utilization across various industries.

- By Installation (New Systems and Components, Repairs, & Consumables): The components, repairs, & consumables segment held a share of 59.85% in 2024, mainly fueled by ongoing maintenance needs and the frequent replacement cycle required to ensure optimal FGD system performance and regulatory compliance.

- By Application (Power Plants, Chemicals, Cement, Metal Processing & Mining, Manufacturing, and Others): The power plants segment is projected to reach USD 8.52 billion by 2032, propelled by stringent emission regulations and increasing investments in pollution control infrastructure to meet environmental compliance standards.

Flue Gas Desulfurization Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia-Pacific flue gas desulfurization market share stood at around 35.05% in 2024, valued at USD 7.87 billion. This dominance is reinforced the region’s high reliance on coal-fired power generation and strict government regulations on air pollution.

Countries such as China and India have implemented stringent emission control mandates, accelerating FGD installations in thermal power plants. Additionally, rapid industrialization and urbanization have increased energy demand, highlighting the need for pollution control technologies. These factors position Asia Pacific as the leading region for FGD system deployment.

The North America flue gas desulfurization industry is estimated to grow at a CAGR of 3.41% over the forecast period. This rapid growth is fostered by rising investments in clean energy technologies and the modernization of aging coal-fired power infrastructure.

The region is witnessing increased adoption of advanced FGD systems to enhance operational efficiency and reduce maintenance costs. Additionally, growing public awareness of environmental health impacts is prompting utilities and industries to prioritize emissions control, fueling demand for efficient and reliable FGD solutions across the power and industrial sectors.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) enforces stringent regulations on flue gas desulfurization (FGD) systems through effluent limitations guidelines, including the 2015 Steam Electric Power Generating Sector ELGs, targeting pollutants such as mercury, selenium, arsenic, and nitrate in FGD wastewater.

- In India, FGD regulations for thermal power plants are governed by the Ministry of Environment, Forest and Climate Change (MoEFCC) and monitored by the Central Pollution Control Board (CPCB) to ensure compliance with emission standards.

- In Europe, FGD systems are regulated primarily by the European Union’s Industrial Emissions Directive (IED), enforced through national environmental agencies in member states. The IED sets strict emission limits for sulfur dioxide and other pollutants to control air pollution from industrial installations, including power plants and heavy industries.

Competitive Landscape

Key players in the flue gas desulfurization industry are actively implementing strategic initiatives to strengthen their market position. Companies are engaging in mergers and acquisitions to broaden their geographic presence and technological strengths.

They are also launching new products to diversify offerings and address varied customer needs. Additionally, partnerships and joint ventures are being formed to boost production capacity. These competitive moves highlight a dynamic market environment geared toward scaling operations and sustaining long-term growth in emissions control.

List of Key Companies in Flue Gas Desulfurization Market:

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- GE Vernova

- ANDRITZ

- Babcock & Wilcox Enterprises, Inc.

- RAFAKO S.A.

- MET

- Thermax Limited.

- DUCON

- Chiyoda Corporation

- Valmet

- Kawasaki Heavy Industries, Ltd.

- Macrotek Inc.

- AECOM

- Steinmüller Engineering GmbH

- Carmeuse Americas

Key Highlights:

Key Highlights: