Market Definition

Flexographic printing is a versatile rotary printing process that employs flexible relief plates made of rubber or photopolymer to transfer ink onto a wide range of substrates. Flexography is valued for its versatility, as it can print on materials such as paper, cardboard, plastic films, metallic foils, and laminates, making it essential for packaging, labels, and flexible packaging applications.

The process uses fast-drying inks, including water-based, solvent-based, and UV-curable variants, enabling high-speed production with consistent quality. Recent advancements in automation, hybrid integration, and sustainable inks have further enhanced its efficiency and adaptability to modern packaging needs.

Flexographic Printing Market Overview

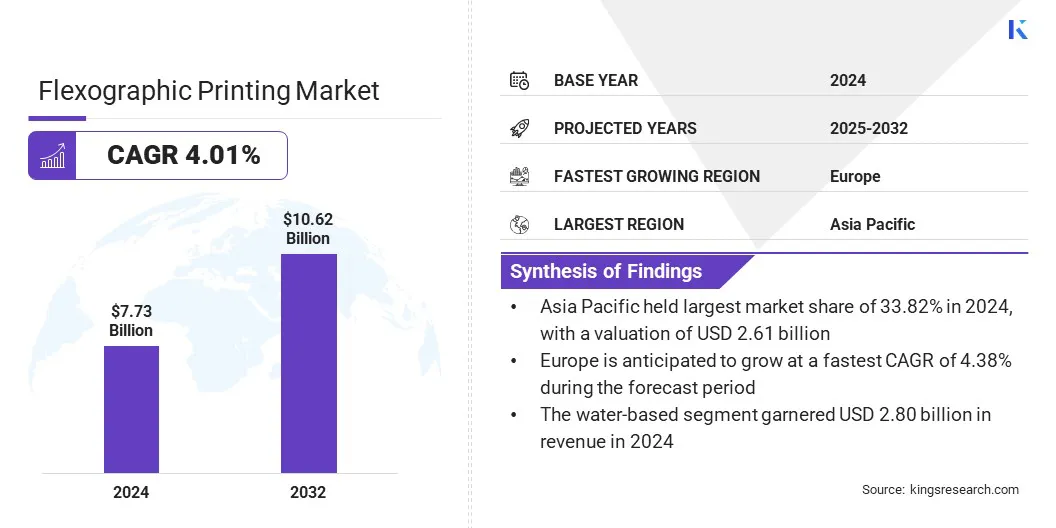

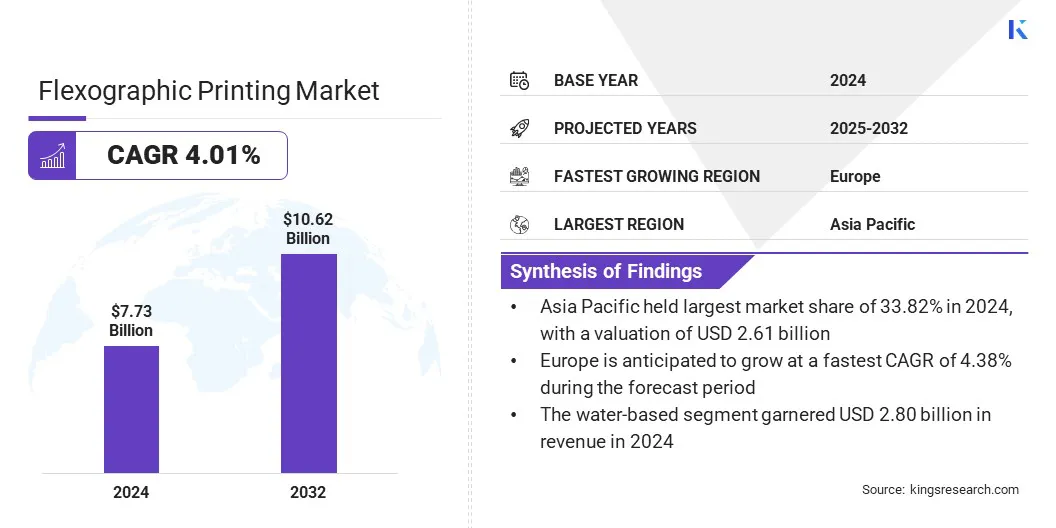

According to Kings Research, the global flexographic printing market size was valued at USD 7.73 billion in 2024 and is projected to grow from USD 8.03 billion in 2025 to USD 10.62 billion by 2032, exhibiting a CAGR of 4.01% during the forecast period.

Market growth is driven by the rising demand for sustainable inks and recyclable substrates, which reflects a notable shift toward eco-friendly packaging solutions. This trend is boosting the adoption of water-based and UV-curable inks, while recyclable substrates enhance compliance and appeal to environmentally conscious brands.

Key Highlights:

- The flexographic printing industry size was recorded at USD 7.73 billion in 2024.

- The market is projected to grow at a CAGR of 4.01% from 2025 to 2032.

- Asia Pacific held a share of 33.82% in 2024, valued at USD 2.61 billion.

- The in-line segment garnered USD 2.97 billion in revenue in 2024.

- The water-based segment is expected to reach USD 3.84 billion by 2032.

- The flexible plastic films segment is anticipated to witness the fastest CAGR of 4.30% over the forecast period.

- The print media segment is anticipated to grow at a CAGR of 4.30% over the forecast period.

- The healthcare & pharmaceuticals segment is set to grow at a CAGR of 4.52% through the forecast period.

- Europe is anticipated to grow at a CAGR of 4.38% through the projection period.

Major companies operating in the flexographic printing market are Bobst Group, Heidelberger Druckmaschinen AG, Mark Andy Inc., Nilpeter A/S, Windmöller & Hölscher KG, Uteco Converting S.p.A, Comexi Group Industries, S.A.U., Tresu Group, Edale Ltd, Koenig & Bauer AG, Gallus Ferd. Rüesch AG, MPS Systems B.V., Sandon Global, Allstein GmbH, and Focus Label Machinery Ltd.

Rising investments in high-definition (HD) flexo technologies are influencing the market by enabling sharper image reproduction, improved color accuracy, and premium packaging outcomes. HD flexo integrates advanced plate-making systems, precision registration, and digital workflow solutions, delivering gravure-like results at lower costs.

Brand owners and packaging converters are adopting these systems to meet the growing demand for high-quality graphics in food, cosmetics, and personal care packaging. This trend helps businesses differentiate products on crowded retail shelves and target premium and luxury segments, positioning HD flexo as a preferred solution for visually appealing, data-driven packaging.

- In November 2024, Italy-based Fiorini expanded its printing capabilities with a 10-color BOBST EXPERT CI Flexo press equipped with triLOCK technology. Operating at speeds up to 600 m/min, the press improves production efficiency through automated locking and streamlined operations.

Market Driver

Increasing Demand from Packaging Sector

The packaging sector continues to experience strong growth, boosting the adoption of flexographic printing technologies. Expansion in food, beverages, pharmaceuticals, and e-commerce logistics has increased demand for high-quality and versatile printing. Flexographic printing is favored for its ability to handle diverse substrates, ensure fast turnaround, and support cost-effective large-scale production.

This offers printing companies opportunities to expand service portfolios while meeting strict labeling and safety regulations. Growing consumer preference for attractive, sustainable, and functional packaging is further reinforcing flexographic printing’s role in enhancing innovation, customization, and large-scale production across industries.

- In May 2025, Invest India reported that the packaging sector became the fifth-largest in the Indian economy, expanding at an annual rate of 22–25%. Domestic consumption of packaging paper and paperboard grew 8.2% in 2023–24, reinforcing India’s global market leadership.

Market Challenge

High Initial Investment Costs for Advanced Flexographic Machinery

High initial investment costs for advanced flexographic machinery continue to hinder the progress of the flexographic printing market, particularly for small and mid-sized converters. Modern flexo presses with hybrid features, automation, and HD capabilities require substantial capital, limiting accessibility for smaller players. This financial barrier delays technology adoption, resulting in gaps in operational efficiency and print quality.

To overcome this challenge, companies are adopting leasing models, shared infrastructure, and strategic collaborations with equipment manufacturers. Additionally, incremental upgrades and flexible financing solutions enable smaller firms to access advanced flexo presses printing systems, reducing capital burdens while enhancing competitiveness and accelerating modernization.

Market Trend

Adoption of Hybrid Flexographic Printing Systems

The adoption of hybrid flexographic printing systems, which integrate digital and flexo technologies, is a key trend influencing the flexographic printing market, enhancing efficiency, flexibility, and customization. These systems combine the cost-effectiveness and scalability of flexography with the precision and personalization of digital printing, supporting short- and medium-run jobs with variable data.

They are particularly valuable for customized packaging, promotional campaigns, and on-demand label production. Converters are increasingly investing in hybrid presses to diversify offerings, reduce waste, accelerate changeovers, and maintain consistent quality, supporting market expansion.

- In September 2024, Mark Andy launched the 1200 dpi DSiQ-730 hybrid press, in partnership with Domino Printing Sciences. This single-pass hybrid system combines digital inkjet and flexo technology for high-quality, efficient label production with automation and variable data functionality.

Flexographic Printing Market Report Snapshot

|

Segmentation

|

Details

|

|

By Press

|

In-line, Stack, Central impression

|

|

By Ink

|

Water-based, Solvent-based, UV-Curable, Others

|

|

By Substrate

|

Paper & Paperboard, Flexible Plastic Films, Metallic Foil, Others

|

|

By Application

|

Corrugated Boxes, Folding Carton, Flexible Packaging, Labels & Tags, Print Media, Others

|

|

By End User

|

Food & Beverages, Healthcare & Pharmaceuticals, Personal Care, Industrial, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Press (In-line, Stack, and Central impression): The in-line segment captured the largest share of 38.45% in 2024, largely due to its high-speed integrated operations, reduced setup time, and ability to streamline multi-color printing efficiently.

- By Ink (Water-based, Solvent-based, UV-Curable, and Others): The UV-curable segment is poised to record a CAGR of 4.34% through the forecast period, owing to faster curing times, enhanced durability, and compliance with eco-friendly printing standards.

- By Substrate (Paper & Paperboard, Flexible Plastic Films, Metallic Foil, and Others): The paper & paperboard held a share of 33.24% in 2024, attributed to strong adoption in packaging, labeling, and corrugated applications amid growing demand for sustainable substrates.

- By Application (Corrugated Boxes, Folding Carton, Flexible Packaging, Labels & Tags, Print Media, and Others): The print media segment is anticipated to grow at a CAGR of 4.30% over the forecast period, boosted by increasing demand for customized labels, magazines, and short-run publications.

- By End User (Food & Beverages, Healthcare & Pharmaceuticals, Personal Care, Industrial, and Others): The healthcare & pharmaceuticals segment is set to grow at a CAGR of 4.52% through the forecast period, propelled by strict labeling regulations, traceability needs, and packaging compliance standards.

Flexographic Printing Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia-Pacific flexographic printing market accounted for a share of 33.82%, valued at USD 2.61 billion in 2024. This dominance is reinforced by rapid urbanization, expanding packaged food and personal-care sectors, and a dense network of contract packagers, leading to consistent capacity additions in Southeast and South Asia.

Local converters are investing in mid-web and wide-web flexo lines to serve domestic brands and export markets, while suppliers enhance regional service networks and plate-making capabilities. Improvements in logistics infrastructure and rising e-commerce volumes further boost demand for corrugated and flexible packaging formats.

Sustainability policies and shifting consumer preferences toward recyclable packaging are fueling the adoption of water-based and UV technologies, creating opportunities for retrofits and upgrades. For investors and vendors, the region offers balanced volume growth, diversification across substrate types, and long-term modernization potential, with notable opportunities in scalable automation and local service networks.

The Europe flexographic printing industry is projected to grow at a CAGR of 4.38% over the forthcoming years, bolstered by premiumization and regulatory changes. European brand owners increasingly demand high-definition printing, recyclable mono-materials, and on-pack traceability, prompting converters to adopt HD flexo, hybrid presses, and digital finishing systems.

Environmental regulations and circular-economy targets are accelerating the shift from solvent-based to water-based and UV-curable inks, creating both compliance challenges and opportunities for product differentiation.

Mature retail and e-commerce industries favor short runs, customization, and rapid SKU changeovers, supporting investments in automation and inline inspection. Supply-chain resilience and strategic supplier partnerships are crucial for smaller converters to access advanced capabilities.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) Clean Air Act regulates volatile organic compound (VOC) emissions from flexographic printing facilities. It ensures presses comply with air quality standards by limiting solvent-based ink emissions and mandating control technologies for compliance.

- In the European Union, the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) regulation governs substances used in flexographic inks and coatings. It ensures chemicals are tested, registered, and approved for safe use, reducing risks to health and the environment.

- In China, the Ministry of Ecology and Environment (MEE) VOC Emission Standards for Printing Industry monitor emissions from flexographic printing. It requires packaging and printing firms to install control equipment and shift to low-VOC or water-based inks.

Competitive Landscape

Key participants in the flexographic printing industry are focusing on technology leadership, service-led differentiation, and sustainable product portfolios. Major strategies include accelerating R&D to reduce plate and ink setup times, offering modular upgrade paths to protect customer investments, and building financing or leasing options to lower adoption barriers for smaller converters.

Companies are partnering with ink and substrate suppliers to deliver certified, recyclable solutions that meet regulatory requirements. Operational efficiency is enhanced through digital workflows, inline quality control, and predictive maintenance to reduce waste and improve overall equipment effectiveness (OEE).

Strategic M&A and localized service hubs complement organic growth, enabling faster response times and expanding market share across both developed and developing regions.

- In May 2025, South African label converter Label & Litho invested in the country’s first Nilpeter FB-14 press, underscoring its commitment to innovation and Nilpeter’s expanding presence in Africa. The compact, automation-rich FB-14 enhances productivity across diverse label applications.

Key Companies in Flexographic Printing Market:

- Bobst Group

- Heidelberger Druckmaschinen AG

- Mark Andy Inc.

- Nilpeter A/S

- Windmöller & Hölscher KG

- Uteco Converting S.p.A

- Comexi Group Industries, S.A.U.

- Tresu Group

- Edale Ltd

- Koenig & Bauer AG

- Gallus Ferd. Rüesch AG

- MPS Systems B.V.

- Sandon Global

- Allstein GmbH

- Focus Label Machinery Ltd

Recent Developments (New Product Launch)

- In August 2024, Nilpeter launched a new FB-Line press in 14″ and 17″ models to address rising automation and digitalization needs. The press integrates advanced automation from the FA-Line while maintaining full compatibility with the FB-Line, enhancing flexibility and operational efficiency.

- In June 2023, Gallus (Heidelberger) introduced the Gallus One with Converting, featuring inline digital printing, flexo, semi-rotary die-cutting, and vision inspection. They also support upgrading existing Gallus ECS 340 flexo presses into hybrid Gallus Labelfire 340 units with digital printing units, offering hybrid capability without requiring new machinery.