Flexible Batteries Market Size

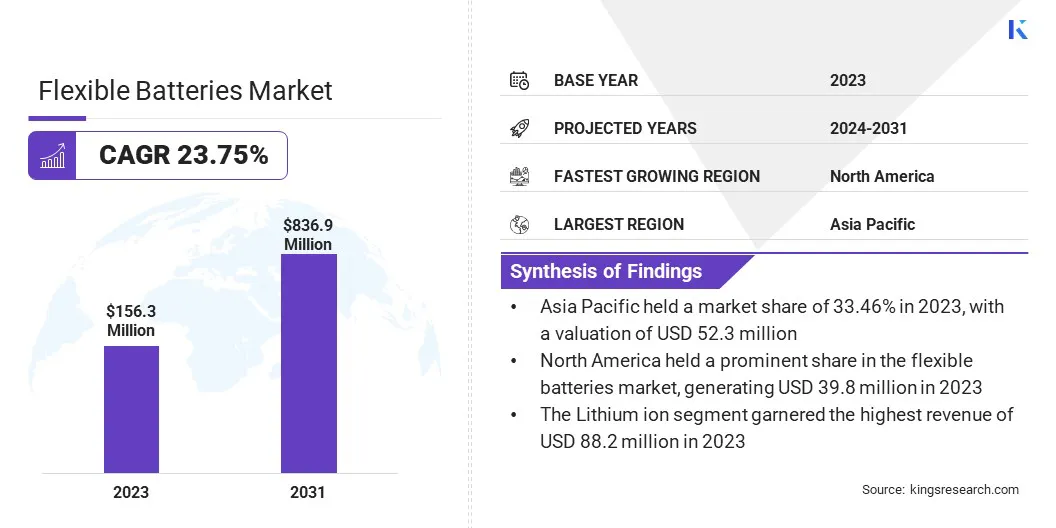

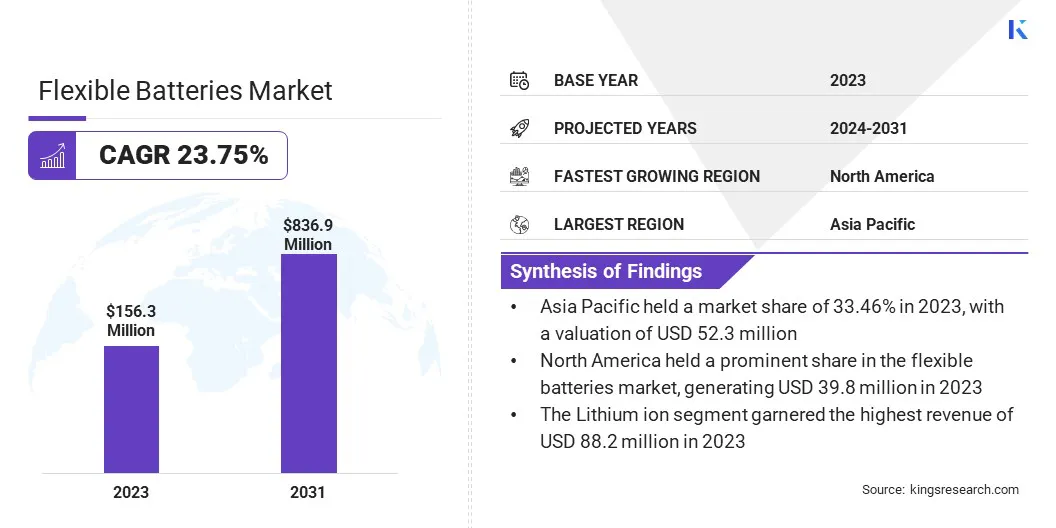

The global flexible batteries market size was valued at USD 156.3 million in 2023 and is projected to reach USD 836.9 million by 2031, expanding at a CAGR of 23.75% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as Samsung SDI, LG Chem, Enfucell, Brightvolt Inc., Blue Spark Technologies, Inc., Imprint Energy, Jenax Inc., ROCKET Poland Sp. z o.o., ProLogium Technology Co., Ltd., Ultralife Corporation, and others.

The market is experiencing substantial growth, mainly due to technological advancements in smart devices, evolving consumer demands, and increasing environmental awareness. The flexible batteries market is experiencing robust growth driven by the increasing demand for wearable electronics and IoT devices.

Advancements in material science and manufacturing techniques are driving the development of flexible batteries, which are becoming crucial for compact and lightweight electronic devices. These innovations address the growing demand for enhanced energy efficiency, durability, and adaptability in various applications, from wearable electronics to electric vehicles (EVs).

The market is highly competitive, with key players continuously striving to improve energy density, performance, and form factor flexibility to meet evolving consumer and industry needs.

- For instance, in March 2024, Panasonic unveiled a prototype of a flexible battery designed specifically for EVs. This innovation focuses on increasing energy density and improving battery longevity, showcasing Panasonic’s commitment to advancing battery technology and meeting the stringent demands of the EV industry.

Furthermore, the increasing popularity of wearable devices in healthcare and fitness applications is driving market growth due to the seamless integration of these batteries in fitness and healthcare wearables. The rise in the usage of IoT devices across various industries, including automotive, consumer electronics, and industrial automation, is fueling the demand for flexible batteries.

These batteries enable the development of compact and energy-efficient IoT sensors and actuators, driving innovation in smart infrastructure and connected devices. However, the flexible batteries market is facing several challenges such as scalability in production, ensuring consistent performance across flexible battery variants, and addressing concerns related to safety and environmental sustainability.

Flexible batteries are energy storage devices designed to be bendable, foldable, or stretchable without compromising performance. Unlike traditional rigid batteries, flexible batteries utilize innovative materials and manufacturing techniques to conform to various shapes and sizes, enabling integration into unconventional form factors such as wearable electronics, IoT devices, and medical implants.

These batteries typically employ flexible substrates and electrode materials, allowing them to withstand mechanical deformation while maintaining electrical functionality. Their versatility and adaptability make them ideal for applications where traditional batteries are impractical due to size, weight, or design constraints. Flexible batteries are crucial in the advancement of flexible and wearable technology, powering the next generation of portable and interconnected devices.

Analyst’s Review

Analyst’s Review

The global flexible batteries market is experiencing robust growth, driven by the increasing adoption of wearable consumer electronics, rising demand for miniaturized medical devices, and the expanding need for smart packaging solutions with integrated sensors. Flexible batteries are enabling innovation across industries by providing lightweight, durable, and adaptable power sources that cater to these rapidly growing applications.

As industries like healthcare, consumer electronics, and textiles continue to explore advanced technologies, flexible batteries are becoming a cornerstone for innovation and functionality.

- For instance, in February 2024, LG Chem announced the successful integration of its flexible batteries into smart clothing prototypes. This milestone highlights the transformative potential of flexible batteries in the textile industry, paving the way for widespread adoption in smart apparel and wearable technologies.

Moreover, technological innovations in materials, chemistries, and manufacturing processes are addressing key challenges, including energy density and flexibility. However, cost competitiveness and ensuring sustainable practices throughout the supply chain remain areas for ongoing development.

Flexible Batteries Market Growth Factors

The rise of continuous health monitoring practices is driving the need for long-lasting, flexible batteries in wearable medical devices. Additionally, the growing focus on preventative healthcare and the need for remote patient monitoring are boosting the demand for energy-efficient power sources in devices such as glucose monitors and smart patches that adapt to the body's movements.

- For instance, Abbott's FreeStyle Libre 3 sensor employs a flexible battery for continuous glucose monitoring, enhancing patient comfort and convenience while ensuring accurate data collection.

The adoption of smart packaging with integrated sensors is driving the demand for flexible batteries, thereby propelling market growth. Smart packaging solutions equipped with sensors for monitoring product integrity are gaining traction across various industries.

- For instance, TiLOGY utilizes printed thin-film batteries in its temperature-monitoring wine labels, enabling real-time monitoring and ensuring product quality throughout the supply chain.

As more companies embrace smart packaging technologies, the demand for flexible batteries to power these functionalities is expected to rise significantly.

However, cost competitiveness poses challenges for the flexible batteries market despite manufacturing advancements. To overcome this hurdle, key players are investing in research and development (R&D) to optimize production processes, thereby reducing manufacturing costs.

Ensuring safety in flexible batteries, especially for medical implants, demands continuous R&D efforts. Key players are focusing on enhancing the safety of the product by investing in advanced materials and electrolyte systems, conducting rigorous testing protocols, and adhering to stringent regulatory standards. Key players are collaborating with research institutions and regulatory bodies to facilitate the development of robust safety protocols and standards.

Flexible Batteries Market Trends

The shift toward miniaturization of electronics, particularly in wearable devices including smartwatches and fitness trackers, is fueling the demand for compact and flexible power sources. Consumers are increasingly seeking lightweight and portable devices that seamlessly integrate into their daily lives. This demand for miniaturized electronics necessitates advanced flexible batteries that can deliver reliable power in a space-efficient manner.

Furthermore, the increasing shift toward connected devices and smart infrastructure is emphasizing the need for energy-efficient and space-saving power solutions, positioning flexible batteries as a key component for the expanding IoT ecosystem. Additionally, the emergence of folding screens due to consumer demand for more immersive and interactive digital experiences is positively impacting the product outlook.

The integration of flexible battery solutions with these displays provides a seamless experience to consumers. This trend presents significant opportunities for flexible battery manufacturers to collaborate with display panel suppliers and device manufacturers to develop tailored solutions that meet the power requirements of next-generation flexible electronics.

Segmentation Analysis

The global market is segmented based on material, technology, product type, and geography.

By Material

Based on material, the flexible batteries market is categorized into lithium ion, lithium polymer, and zinc carbon. Lithium ion garnered the highest revenue of USD 88.2 million in 2023. The dominance of lithium-based batteries in the global market is largely due to their widespread adoption across various electronic devices, including smartphones, laptops, and wearable gadgets.

Renowned for their high energy density and extended cycle life, lithium batteries are integral to powering modern electronics, meeting the growing demand for efficient and long-lasting energy solutions. Their versatility and reliability make them a preferred choice across multiple industries, further bolstered by advancements in battery management technology.

- In March 2023, STMicroelectronics introduced its high-accuracy Battery Management System (BMS) controller, the L9961. This innovative device enhances the performance, lifetime, and safety of lithium-ion and lithium-polymer batteries by offering exceptional accuracy and flexibility.

Such developments underscore the continuous efforts to optimize lithium battery technologies, reinforcing their dominance in the energy storage landscape.

Additionally, recent advancements in lithium-ion battery technology, such as improvements in safety features and increased energy efficiency, are contributing to its growing market demand, which is further bolstering segment expansion. The lithium ion segment benefits from a well-established infrastructure for manufacturing, distribution, and recycling, which is contributing to its dominance in the overall market.

By Technology

Based on technology, the market is bifurcated into thin-film batteries and printed batteries. Thin-film batteries captured the largest market share of 65.78% in 2023. The flexible and lightweight nature of thin-film batteries, along with compatibility with various substrates, is propelling the growth of thin-film batteries. Furthermore, these batteries offer advantages in terms of scalability and manufacturing efficiency, which is driving their widespread adoption across diverse applications.

With ongoing advancements in thin-film battery technology, including improvements in energy density and production processes, this segment is poised to witness significant growth, offering lucrative opportunities for market players to capitalize on the rising demand for flexible energy storage solutions.

By Product Type

Based on product type, the market is divided into disposable batteries and rechargeable batteries. The rechargeable batteries segment is projected to register a robust CAGR of 25.20% over 2024-2031.

Rechargeable batteries offer advantages such as cost-effectiveness, environmental sustainability, and longer lifespan compared to disposable batteries, which is increasing their adoption across end-use industries. Moreover, advancements in rechargeable battery technology, including the development of high-performance electrode materials and fast-charging capabilities, are anticipated to further propel the growth of this segment over the forecast period.

Flexible Batteries Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The flexible batteries market in Asia Pacific accounted for 33.46% share of the global market in 2023, with a valuation of USD 52.3 million, due to the presence of battery manufacturing powerhouses such as China, Japan, and South Korea. These countries have a robust electronics manufacturing ecosystem, which is fostering innovation and the production of flexible batteries.

The flexible batteries market in Asia Pacific accounted for 33.46% share of the global market in 2023, with a valuation of USD 52.3 million, due to the presence of battery manufacturing powerhouses such as China, Japan, and South Korea. These countries have a robust electronics manufacturing ecosystem, which is fostering innovation and the production of flexible batteries.

Furthermore, key players such as Samsung, LG Chem, and BYD are leading investments in R&D and production, consolidating the region's dominance. Moreover, the rising purchasing power of consumers, along with notable technological development in the healthcare industry in India, China, and Japan, is fueling product demand.

- Government support is further propelling growth, with initiatives such as China's "Made in China 2025" fostering innovation in advanced battery technologies.

Additionally, the region exhibits a high adoption rate for consumer wearables, particularly fitness trackers and smartwatches, which is creating a lucrative market for flexible batteries.

North America held a prominent share of the flexible batteries market, generating USD 39.8 million in 2023, backed by the mounting focus on innovation and technological leadership.

North America hosts industry giants such as Apple, Google, and Tesla, which strongly emphasize technological advancement and invest heavily in R&D efforts focused on flexible battery technology for their state-of-the-art electronic devices. For instance, the Apple Watch showcases innovation, utilizing a pouch-type flexible lithium-ion battery.

Moreover, North America boasts early adoption of wearable electronics, which has resulted in the development of a mature market for flexible batteries powering these devices. Additionally, the high demand for advanced applications, including next-generation wearables and implantable medical devices, is impelling the need for high-performance flexible batteries in the region.

Stringent regulations in North America, focusing on safety and environmental sustainability, are further shaping the development and adoption of flexible battery technologies, ensuring their compliance with regulatory standards while fostering market growth and consumer trust.

Competitive Landscape

The flexible batteries market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are undertaking effective strategic initiatives involving expansions & investments, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, which could pose new opportunities for market growth.

Recent Developments:

- In March 2023 (Product Launch): Researchers at Nanyang Technological University in Singapore unveiled a groundbreaking flexible battery design that operates without the need for electrodes or wires.

- In March 2024 (Product Launch): LG Energy Solution revealed significant advancements in flexible battery technology, achieving a 20% increase in energy density through the utilization of cutting-edge materials.

List of Key Companies in Flexible Batteries Market

- Samsung SDI

- LG Chem

- Enfucell

- Brightvolt Inc.

- Blue Spark Technologies, Inc.

- Imprint Energy

- Jenax Inc.

- ROCKET Poland Sp. z o.o.

- ProLogium Technology Co., Ltd.

- Ultralife Corporation

The global Flexible Batteries Market is segmented as:

By Material

- Lithium Ion

- Lithium Polymer

- Zinc Carbon

By Technology

- Thin-Film Batteries

- Printed Batteries

By Capacity

- Less than 10 mAh

- 10 to 100 mAh

- More than 100 mAh

By Product Type

- Disposable Batteries

- Rechargeable Batteries

By End User

- Consumer Electronics

- Healthcare

- Smart Packaging

- Automotive & Transportation

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America