Flex Fuel Engine Market Size

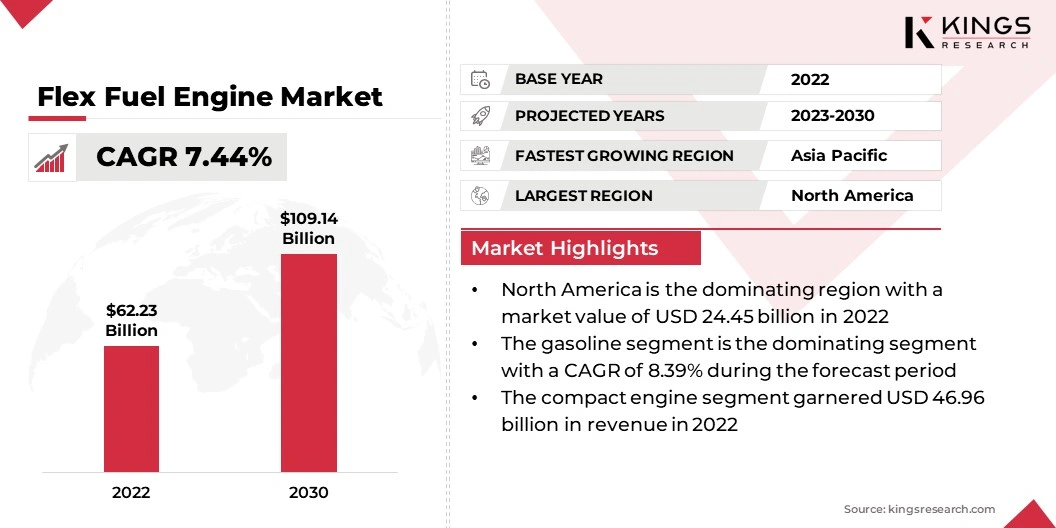

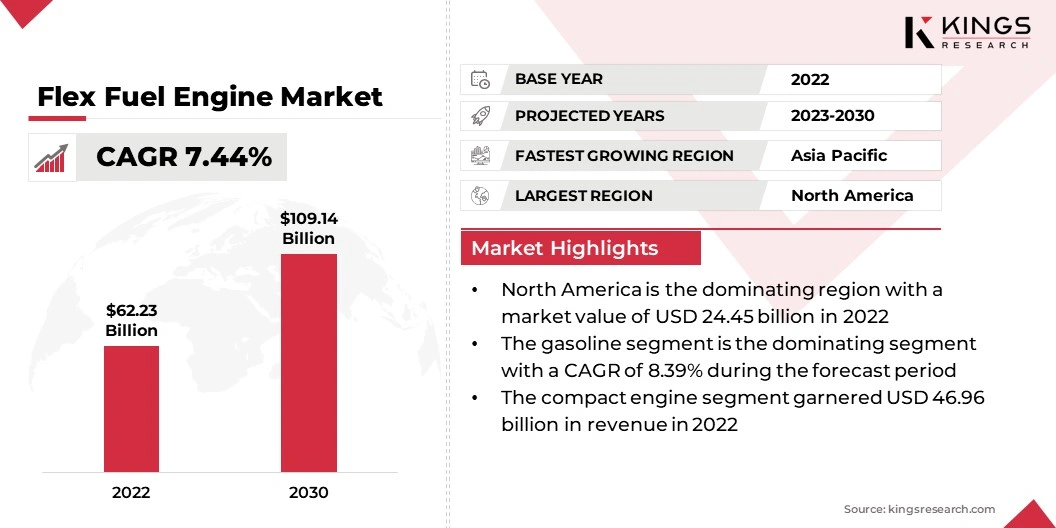

The global Flex Fuel Engine Market size was valued at USD 62.23 billion in 2022 and is projected to reach USD 109.14 billion by 2030, growing at a CAGR of 7.44% from 2023 to 2030.

The flex fuel engine market is growing rapidly owing to the adoption of sustainable automotive technologies and increased activity of the automotive industry in using higher ethanol blends across the globe are factors projected to boost the growth of the flex fuel engine market in the coming years.

Stringent environmental regulations, vehicle emission standards, and depletion of fossil fuel reserves are expected to influence the flex fuel engine market. Major automakers around the world are increasing their efforts to develop flex-fuel engines for both passenger and commercial vehicles, creating a significant opportunity for the flex fuel engine market.

New engine development continues to be a key area of focus for the industry as manufacturers strive to meet the changing demands of consumers and regulators.

However, engine damage, lack of flexible gas stations, and development of electric and hybrid electric vehicles are foreseen to limit the market growth during the forecast period. Concerns about fossil fuels depletion and engine damage is a major restraining factor for the market.

Flex fuel engines may experience reduced fuel efficiency when running on high ethanol blends. Ethanol has a lower energy content than gasoline, which can result in lower mileage or lower fuel consumption. Availability of flexible fuel blends such as E85 (85% ethanol and 15% gasoline) may be limited in some areas.

Additionally, burning ethanol-gasoline blends in flex-fuel engines can increase emissions of certain pollutants such as formaldehyde and acetaldehyde. As the demand for alternative fuels and hybrid vehicles increases, new innovations will be made to overcome these challenges and improve the overall efficiency and effectiveness of flex-fuel engines.

Analyst’s Review

Flex fuel engines have seen many innovations and advancements over the years to improve efficiency, effectiveness, and environmental impact. Flex fuel engines have adopted direct injection technology, which allows precise fuel delivery directly into the combustion chamber, resulting in better combustion and lower fuel consumption.

Engine management systems have become more advanced and sophisticated in flex-fuel engines. These systems use sensors and algorithms that continuously monitor and adjust engine parameters such as fuel injection timing, ignition timing, and air-fuel mixture to optimize performance based on the fuel mixture being used.

Some flex-fuel engines have dual-fuel injection systems that can deliver both gasoline and ethanol simultaneously or separately. This allows for better atomization and combustion of the fuel, resulting in better efficiency and effectiveness.

Flex fuel engines have benefited from advances in material and component design. Engine components such as fuel injectors, valves, and pistons are now made of materials that can withstand the corrosive properties of ethanol, providing greater durability and efficiency.

Ongoing research & development activities continue to drive innovation and progress in flex-fuel engines. Manufacturers and researchers are constantly researching new technologies and fuel blends to further improve the efficiency, effectiveness, and environmental impact of flex-fuel engines.

Market Definition

Flex-fuel engines can run on multiple types of fuel or a combination of two fuels, such as a blend of gasoline and ethanol or gasoline and methanol. Flex-fuel engines use different materials for the internals to prevent corrosion because of the various characteristics of ethanol. This is driven by the possibility that utilizing ethanol fuel in an authorized engine could increase corrosion and wear &tear over time.

Flex fuel engines use various emission control technologies such as catalytic converters and oxygen sensors to reduce harmful emissions, these technologies help meet strict emissions regulations and contribute to cleaner air quality. Flexible fuel engines may require fuel system modifications such as adding a fuel sensor and a flexible fuel sensor to accurately measure the ethanol content of the fuel mixture.

These changes ensure proper fuel delivery and combustion. Flex-fuel engines provide environmental benefits by reducing greenhouse gas emissions. They have sensors, electronic control, and fuel system modifications, which allow them to optimize efficiency based on the ethanol content of the fuel mixture.

Market Dynamics

The depleting natural resources of fuel oil and stringent automobile emission standards are driving the flex fuel engine market. The demand to minimize the use of natural non-renewable energy sources and strict emission regulations set by governments is driving the market growth.

Flex-fuel also produces less greenhouse gases, which makes them more environmentally friendly. As a renewable fuel, ethanol has a higher potential to reduce greenhouse gas emissions compared to gasoline. The higher the ethanol content in the mixture, the greater the opportunity to reduce emissions.

Ethanol has a higher oxygen content than gasoline, which can result in more complete combustion and lower emissions of carbon monoxide (CO) and hydrocarbons (HC). Engine tuning and optimization play a vital role in achieving optimal fuel economy and emissions control.

Manufacturers are constantly working to improve engine design and control systems to maximize the emissions reduction benefits of flex-fuel engines. The limited availability of mixed fuel blends may affect the widespread use of mixed fuel vehicles and their potential to reduce emissions.

The flex fuel engine market growth is restricted by the concerns related to the availability of ethanol gas stations. In many regions, the delivery and distribution infrastructure of ethanol fuel is limited, which makes it difficult for owners of flex-fuel vehicles to find suitable fueling options.

Ethanol stations are often concentrated in certain locations or areas where ethanol production is more common. This creates geographic disparities, where some areas have more ethanol gas stations while others have limited or no access to them. Ethanol gas stations can be expensive to build and maintain.

The infrastructure required to store and distribute ethanol may require additional investment compared to traditional gas stations. These higher costs may discourage gas station owners from installing ethanol infrastructure, resulting in limited availability. Regulatory barriers and regulations can also affect the availability of ethanol gas stations.

Permit and license requirements, zoning restrictions, and compliance with safety and environmental regulations can present challenges for gas station owners aiming to install ethanol infrastructure. These barriers could slow the expansion of ethanol fuel infrastructure, thereby restraining the market growth.

Segmentation Analysis

The global flex fuel engine market is segmented based on fuel type, engine capacity, blend type, vehicle type, and geography.

By Fuel Type

Based on fuel type, the flex fuel engine market is bifurcated into diesel and gasoline. The gasoline segment is the dominating segment with a CAGR of 8.39% over the forecast period owing to the rise in demand for low-cost sustainable automotive technologies across the globe. The main advantage of a flex-fuel gasoline engine is the widespread availability of this type of fuel.

Gasoline is readily available in most parts of the world, making it easy to find at gas stations. Gasoline also offers smoother and quieter operation than ethanol, which can be beneficial for drivers focusing on comfort and refinement.

By Engine Capacity

Based on engine capacity, the market is segmented into full-size engine and compact-size engine. The compact engine designs dominated the market with a market value of USD 46.96 billion in 2022 as these designs are evolving to integrate additional technologies aimed at improving performance while also reducing vehicle weight. They are used in light vehicles because they are cost-effective and use less fuel.

By Blend Type

Based on blend type, the flex fuel engine market described into E10 to E25, E25 to E85, above E85, and others. The above E85 segment is expected to dominate over the estimated timeframe with a market value of USD 52.78 billion owing to the augmenting use of these blends, which are typically utilized in specialized applications or in regions with high ethanol availability.

It can reduce greenhouse gas emissions, they may significantly impact fuel efficiency and require engine modifications to accommodate the higher ethanol content.

By Vehicle Type

By vehicle type, the flex fuel engine market is segmented into passenger vehicles and commercial vehicles. The passenger vehicles is the dominating segment as it offer the driver the flexibility to choose between gasoline and ethanol or a combination of the two.

In addition, the use of ethanol blends in passenger cars can lessen greenhouse gas emissions while also enhancing air quality. They provide fleet owners the opportunity to use ethanol blends, which can help businesses minimize their operations' carbon footprint.

Flex Fuel Engine Market Regional Analysis

Based on regional analysis, the global flex fuel engine market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

North America is the dominating region with a market value of USD 24.45 billion in 2022 owing to the increased popularity and use of a variety of fuel sources. The United States and Canada have been at the forefront of deploying flexible fuel technology in the region. This rise in sales is due to factors such as government incentives, increased availability of E85 fuel (a mixture of 85% ethanol and 15% gasoline), and growing awareness of the environmental benefits of ethanol.

The Canadian government has implemented policies and regulations to encourage the use of alternative fuels, including ethanol. As a result, the number of FFVs on Canadian roads has steadily increased due to their strong agricultural sectors and the presence of ethanol production facilities.

Gasoline vehicles dominate the market, but the introduction of flexible fuel technology is a positive step towards reducing greenhouse gas emissions and promoting sustainable transport. Government incentives, increased fuel choices, and growing environmental awareness have contributed to the rise in popularity of flex-fuel vehicles.

Latin America is growing significantly with a market value of USD 4.88 billion in 2022. Flex-fuel vehicles have gained considerable popularity in Latin America due to their ability to run on a mixture of gasoline and alternative fuels such as ethanol.

Latin America has initiated the adoption of flexible fuel technology as part of efforts to reduce dependence on traditional gasoline and promote the use of renewable fuels. Brazil has been a significant producer in the region with a strong focus on ethanol production and consumption.

Argentina and Colombia also showed a positive development in sales of flexible fuel engines. These countries have established policies and regulations to promote the use of alternative fuels, including ethanol.

Competitive Landscape

The global flex fuel engine industry report will provide valuable insight with an emphasis on the fragmented nature of the global market. Prominent players are focusing on several key business strategies such as partnerships, mergers & acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their respective market shares across different regions.

Expansion & investments involve a range of strategic initiatives including investments in R&D activities, new manufacturing facilities, and supply chain optimization.

Key Companies in Flex Fuel Engine Market

Key Developments

- August 2023 (Launch): Toyota Innova launched a flex-fuel engine that can run entirely on ethanol. This development has sparked new discussions about the potential of this environmentally friendly and efficient fuel and powertrain technology.