Market Definition

Fitness for service (FFS) is an engineering evaluation methodology used to evaluate whether industrial equipment containing flaws or damage can safely operate under specified conditions. It combines material properties, operating stresses, and defect characteristics to assess structural integrity and remaining service life.

The FFS market includes equipment such as pressure vessels, pipelines, storage tanks, and reactors across industries such as oil and gas, chemicals, and power generation. These evaluations facilitate safe operations, optimize maintenance schedules, and guide decisions on repair, replacement, or continued use.

Fitness for Service Market Overview

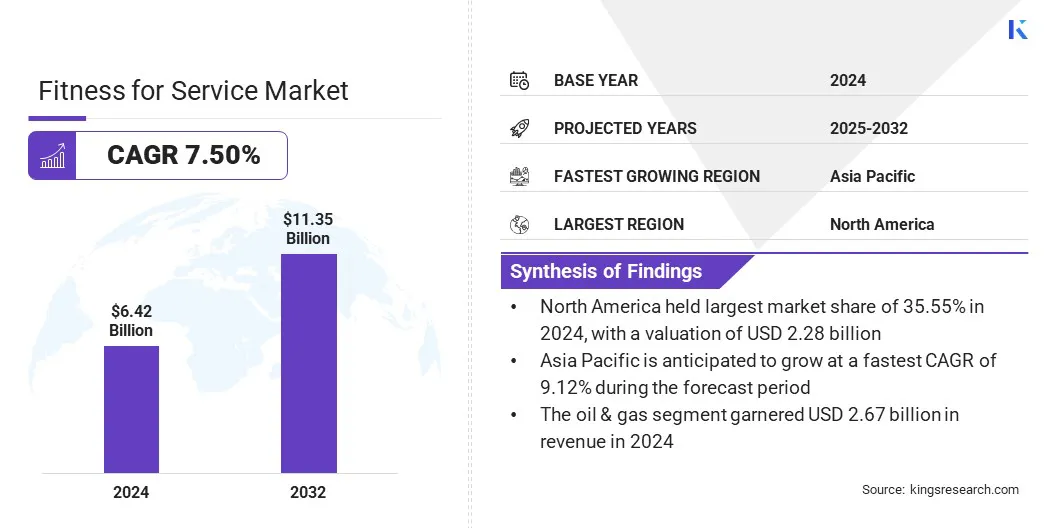

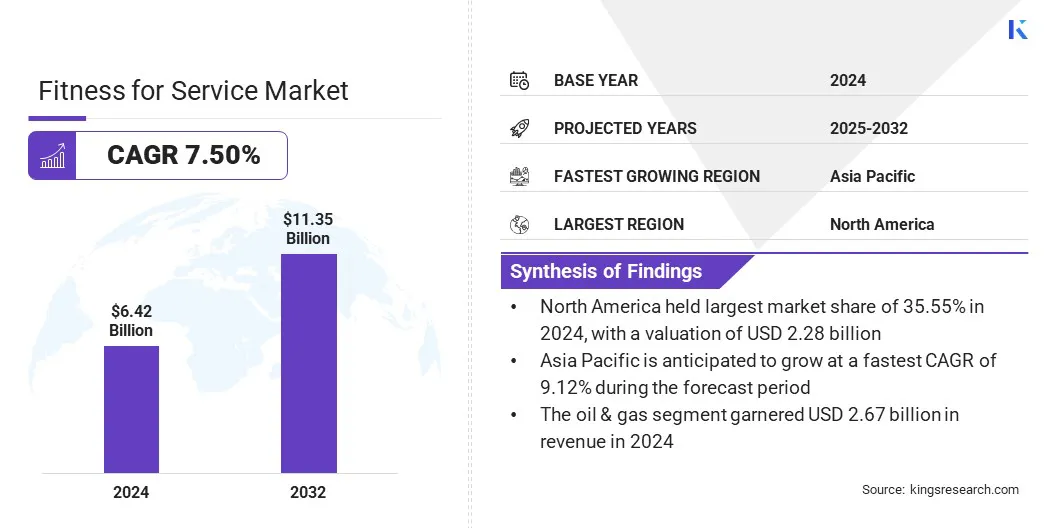

The global fitness for service market size was valued at USD 6.42 billion in 2024 and is projected to grow from USD 6.84 billion in 2025 to USD 11.35 billion by 2032, exhibiting a CAGR of 7.50% during the forecast period.

The growth of the market is driven by the rising demand for energy, which increases the need to extend the safe operating life of pressure systems and pipelines. Additionally, the integration of digital twin technology enhances defect analysis and predictive maintenance, boosting the adoption of FFS solutions.

Key Highlights

- The fitness for service industry size was valued at USD 6.42 billion in 2024.

- The market is projected to grow at a CAGR of 7.50% from 2025 to 2032.

- North America held a share of 35.55% in 2024, valued at USD 2.28 billion.

- The non-destructive testing (NDT) segment garnered USD 2.42 billion in revenue in 2024.

- The oil & gas segment is expected to reach USD 4.42 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 9.12% over the forecast period.

Major companies operating in the fitness for service market are TWI Ltd., MISTRAS Group, Equity Engineering Group, Inc., DNV, Bureau Veritas, TÜV SÜD, Intertek Group plc, John Wood Group PLC, SGS Société Générale de Surveillance SA, ABS Group of Companies, Inc., Danieli & C. S.p.A., Chevron Corporation, Shell Plc, Becht, and KBC.

The growing need to assess the structural integrity of aging oil and gas, petrochemical, and power assets is fueling demand for fitness for service evaluations. Several refineries, pipelines, and pressure vessels are operating beyond their original design life, necessitating systematic integrity assessments to ensure safe operation.

- In March 2024, the U.S. Pipeline and Hazardous Materials Safety Administration (PHMSA) reported that numerous U.S. operational pipelines are constructed of cast and wrought iron and bear steel materials that were installed over 60 years ago, classifying them as high-risk infrastructure requiring replacement.

Petrochemical facilities are relying on FFS methods to evaluate corrosion, cracking, and material degradation that develop over long operational periods. Power generation assets such as boilers, turbines, and pressure components are undergoing FFS evaluations to extend service life without compromising safety. Industries are increasingly investing in advanced non-destructive testing and engineering critical assessments to mitigate risks of unplanned shutdowns.

Market Driver

Rising Demand for Energy

The expansion of oil, gas, and chemical processing facilities is boosting the need for regular fitness assessments to ensure uninterrupted operations. Growing global energy consumption is placing continuous stress on critical equipment such as pressure vessels, storage tanks, and pipelines.

- According to the International Energy Agency, global energy demand grew by 2.2% in 2024, driven primarily by the power sector. Electricity consumption surged by 4.3%, representing nearly 1,100 terawatt-hours, nearly double the average annual increase over the past decade.

Operators are relying on fitness for service evaluations to identify flaws, degradation, or defects before they impact production. Chemical processing plants are implementing systematic assessments to reduce risks of leaks, breakdowns, and costly downtime.

Power plants are also investing in FFS evaluations to ensure the reliability of turbines, boilers, and related components under high operational loads. Rising energy demand is prompting industries to prioritize safety, efficiency, and asset longevity to meet production targets.

Market Challenge

High Cost of Assessments

A key challenge hampering the progress of the fitness for service market is the high cost associated with conducting comprehensive evaluations. These assessments require specialized tools, advanced inspection technologies, and skilled experts, which significantly increase expenditure. Smaller operators in sectors such as oil and gas, chemicals, and power generation are finding it difficult to justify such investments, particularly when operating under tight budgets.

To address this challenge, market players are developing cost-efficient service models, adopting remote monitoring technologies, and leveraging digital twins to reduce the dependency on frequent physical inspections. These approaches are helping operators manage expenses while maintaining the integrity and safety of critical assets.

Market Trend

Integration of Digital Twin Technology

The fitness for service market is witnessing a notable trend toward the adoption of digital twin technology to improve asset integrity management. Virtual replicas of industrial equipment, when linked with real-time inspection and operational data, enable continuous monitoring of structural health and performance. These models allow engineers to simulate potential damage scenarios, evaluate remaining life, and plan targeted maintenance.

By supporting predictive decision-making and reducing unplanned downtime, digital twins are becoming a crucial tool for enhancing the safety, reliability, and cost efficiency in industries such as oil and gas, petrochemicals, and power generation.

- In May 2025, ABS (American Bureau of Shipping) and Akselos jointly completed a technical assessment of a structural digital twin solution for FPSO (Floating Production, Storage, and Offloading) units. The assessment confirmed that the digital twin-based structural model can deliver more accurate and reliable integrity evaluations for offshore assets.

Fitness for Service Market Report Snapshot

|

Segmentation

|

Details

|

|

By Service Type

|

Non-destructive Testing (NDT), Engineering Critical Assessment (ECA), Remaining Life Assessment (RLA), Fitness For Purpose (FFP) Assessment

|

|

By End-use Industry

|

Oil & Gas, Chemicals and Petrochemicals, Power Generation, Refining and Midstream, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Service Type (Non-destructive Testing (NDT), Engineering Critical Assessment (ECA), Remaining Life Assessment (RLA), and Fitness for Purpose (FFP) Assessment): The non-destructive testing (NDT) segment earned USD 2.42 billion in 2024, largely due to its essential role in accurately detecting and assessing defects in pressure equipment and piping without interrupting operations.

- By End-use Industry (Oil & Gas, Chemicals and Petrochemicals, Power Generation, Refining and Midstream, and Others): The oil & gas segment held a share of 41.52% in 2024, fueled by extensive aging infrastructure, high-value pressure equipment, and strict regulatory and safety requirements.

Fitness for Service Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America fitness for service market share stood at 35.55% in 2024, valued at USD 2.28 billion. This dominance is reinforced by the region's extensive aging industrial infrastructure across the oil & gas, petrochemicals, and power generation sectors.

- In March 2025, L&T Technology Services reported that 60% of U.S. refineries are more than 40 years old, indicating a rising need for integrity assessments of aging industrial assets.

Regulatory authorities such as OSHA and regional environmental bodies have intensified their focus on safety, requiring companies to demonstrate whether older equipment can remain in service or must be repaired or replaced. These strict compliance requirements are significantly driving the demand for fitness-for-service assessments in North America.

The Asia-Pacific fitness for service industry is estimated to register a CAGR of 9.12% over the forecast period. This growth is bolstered by the rapid addition of new refining, petrochemical, and LNG facilities to meet rising energy demand. Each new project increases the number of critical pressure systems requiring integrity assessments, while commissioning and lifecycle planning require baseline FFS evaluations, generating both initial and recurring demand.

Moreover, significant investments in expanding pipeline and storage networks for oil, gas, and petrochemical feedstocks are underway. Larger networks and higher throughput raise the risk of metal loss, dents, and weld-related defects, further increasing reliance on FFS solutions.

Regulatory Frameworks

- In the EU, the Pressure Equipment Directive (2014/68/EU) governs market placement of pressure equipment, requiring demonstrable safety and conformity. Member states implement national inspection and in-service controls based on these rules, prompting owners to rely on formal engineering evaluations to meet both conformity and ongoing safety obligations.

- In China, pressure equipment is regulated by the State Administration for Market Regulation (SAMR) through the Special Equipment Licensing Office (SELO) and TSG (technical safety) rules. The SELO/TSG framework enforces conformity, licensing, and periodic inspection of stationary pressure vessels, with approvals or exemptions requiring technical justification akin to fitness-for-service assessments.

Competitive Landscape

Market players operating in the fitness for service industry are prioritizing continuous research and development to enhance the accuracy and usability of FFS software, while forming partnerships with inspection firms and engineering consultancies to expand service reach.

They are also investing in technological advancements, including advanced reporting tools, automation, and integration with digital inspection data platforms. These strategies enable improved compliance support, stronger customer trust, and sustained competitiveness in the market.

- In January 2025, Codeware introduced the latest version of its INSPECT API 579-1 FFS software. The update enhances fitness-for-service assessments for pressure vessels, piping, and aboveground storage tanks. The software generates professional, audit-ready reports tailored to API 579-1/ASME FFS-1 methodology, improving documentation of assessment outcomes.

Key Companies in Fitness for Service Market:

- TWI Ltd.

- MISTRAS Group

- Equity Engineering Group, Inc.

- DNV

- Bureau Veritas

- TÜV SÜD

- Intertek Group plc

- John Wood Group PLC

- SGS Société Générale de Surveillance SA

- ABS Group of Companies, Inc.

- Danieli & C. S.p.A.

- Chevron Corporation

- Shell Plc

- Becht

- KBC

Recent Developments (Product Launches)

- In October 2024, Creaform launched VXintegrity 3.0, an upgraded nondestructive testing (NDT) software platform for fitness-for-service evaluations in oil & gas infrastructure. The update includes advanced tools for evaluating the structural integrity of pressure vessels and pipelines under stress and degradation. It supports automated 3D inspection data processing and integrates industry-standard FFS methodologies to improve accuracy and efficiency.

- In June 2025, UK-based Eserv enhanced its cloud-based digital twin platform, AS-TEG, to assist in FFS-related workflows. The platform integrates remote virtual walkthroughs, clash detection, and inspection features for assets such as FPSOs, refineries, and power plants, facilitating scalable and continuous integrity monitoring.

- In May 2024, Akselos released a digital twin-based FFS platform that leverages a 3D structural model engine operating 1,000 times faster than traditional finite element analysis. The system utilizes live sensor data to deliver near real-time FFS assessments and generate API 579-compliant reports on demand.