Market Definition

The market includes the global trade, production, and consumption of fiber cement-based construction materials across various applications, product types, and end-use sectors. Key products include planks or lap siding, vertical siding or panels, flat sheets, shingles or slates, and other fiber cement formats.

These materials are used in a wide range of applications, including siding, cladding, molding and trimming, flooring. The report highlights key market drivers, major trends, regulatory frameworks, and the competitive landscape shaping the industry’s growth.

Fiber Cement Market Overview

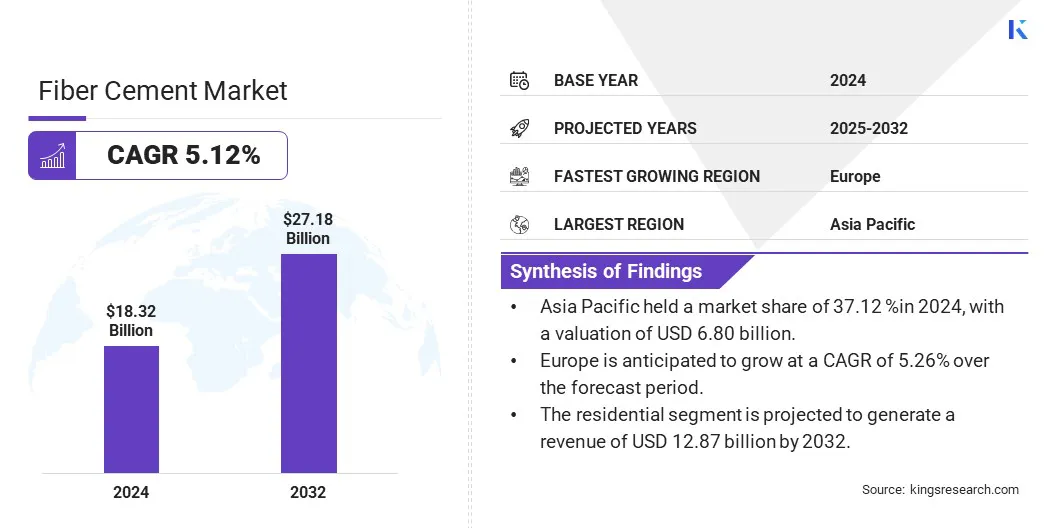

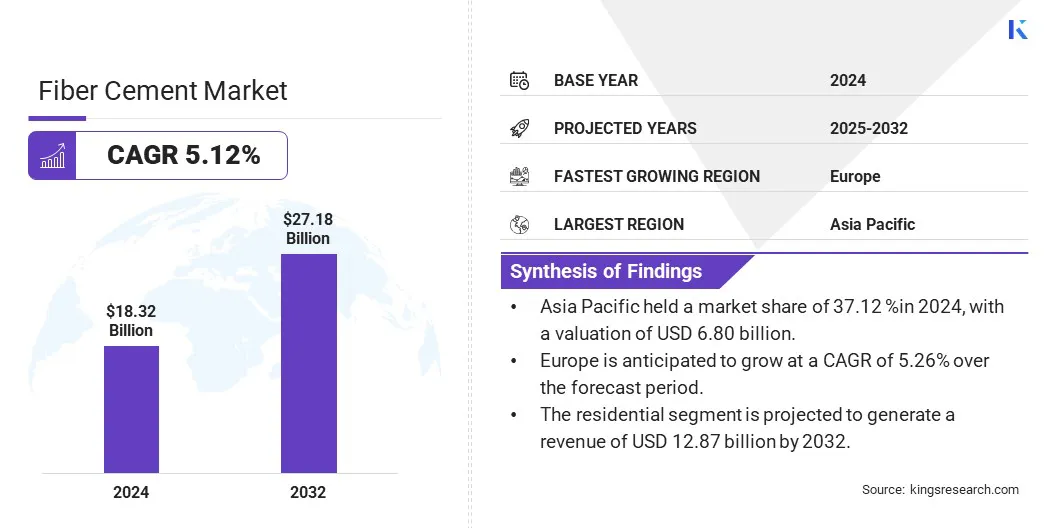

The global fiber cement market size was valued at USD 18.32 billion in 2024 and is projected to grow from USD 19.16 billion in 2025 to USD 27.18 billion by 2032, exhibiting a CAGR of 5.12% during the forecast period. This growth is propelled by the increasing demand for durable, low-maintenance, and fire-resistant building materials.

Rising construction activities across residential, commercial, and industrial sectors are fueling product adoption, particularly in emerging economies. This expansion is further supported by the shift toward sustainable construction, as fiber cement offers a low environmental footprint compared to traditional materials.

Major companies operating in the fiber cement industry are NICHIHA, CSR, Atermit, Cemex S.A.B DE C.V., LTM, James Hardie Building Products Inc., BASF, Knauf Digital GmbH, Tata Steel, Etex Group, Everest, Boral, LAFARGE, Saint-Gobain Group, and Siniat.

Additionally, AI-driven design tools are enhancing customer engagement by offering realistic visualizations of fiber cement applications. These technologies simplify the product selection process and expedite decision-making, fostering adoption in both new construction and renovation projects.

- In March 2024, Etex acquired BGC’s plasterboard and fiber cement businesses to expand its sustainable product portfolio in Australia and New Zealand. The acquisition strengthens Etex’s gypsum footprint and aligns with the company’s long-term growth and sustainability objectives in the region.

Key Highlights:

Key Highlights:

- The fiber cement industry size was recorded at USD 18.32 billion in 2024.

- The market is projected to grow at a CAGR of 5.12% from 2025 to 2032.

- Asia Pacific held a market share of 37.12 %in 2024, with a valuation of USD 6.80 billion.

- The planks/lap siding segment garnered USD 6.21 billion in revenue in 2024.

- The siding segment is expected to reach USD 8.90 billion by 2032.

- The residential segment is projected to generate a revenue of USD 12.87 billion by 2032.

- Europe is anticipated to grow at a CAGR of 5.26% over the forecast period.

Market Driver

"Rapid Urbanization and Infrastructure Development"

The fiber cement market is experiencing significant growth, primarily driven by rapid urbanization and infrastructure development in emerging economies. As cities expand and construction activities increase, there is a rising demand for cost-effective, durable, and low-maintenance materials such as fiber cement.

Additionally, there is a rising focus on building residential, commercial, and industrial structures to accommodate growing populations, creating a robust demand for materials that can withstand harsh environmental conditions. This is leading to the growing adoption of fiber cement in both new construction and renovation projects across emerging markets.

- In October 2024, James Hardie expanded into the Finnish market by introducing its fibre cement facade solutions at FinnBuild 2024 in Helsinki. The launch highlights the company’s focus on providing sustainable, fire-resistant, and easy-to-install facade solutions for new constructions and renovation projects.

Market Challenge

"High Cost of Installation and Demand for Skilled Labor"

A major challenge hampering the expansion of the fiber cement market is the high cost of installation and demand for skilled labor. Fiber cement products are heavier and more difficult to handle compared to alternatives such as vinyl or wood siding. This increases installation time and labor costs, limiting adoption in price-sensitive markets.

This challenge can be addressed through the development of lightweight fiber cement panels and the use of advanced fastening systems that simplify installation. Companies are also investing in installer training programs to improve efficiency and ensure product reliability on-site.

Market Trend

"Integration of AI and 3D Visualization"

A notable trend in the global fiber cement market is the integration of AI and 3D visualization tools in renovation planning. These technologies allow homeowners to upload images of their property and visualize fiber cement applications in realistic designs, enhancing engagement and simplifying product selection. As adoption increases, consumer engagement and adoption are expected to accelerate.

- In April 2025, James Hardie Building Products Inc. launched Hardie Designer, an AI-powered design tool developed in collaboration with Hover. The platform enables homeowners to visualize Hardie siding products on their actual homes using a single photo. Powered by Hover’s 3D property technology, the tool delivers real-time, photorealistic exterior designs and simplifies renovation planning.

Fiber Cement Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Planks/Lap Siding, Vertical Siding/Panels, Flat Sheets, Shingles/Slates, Others

|

|

By Application

|

Siding, Cladding, Molding & Trimming, Flooring, Others

|

|

By End Use

|

Residential, Commercial, Industrial

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Planks/Lap Siding, Vertical Siding/Panels, Flat Sheets, Shingles/Slates, and Others): The planks/lap siding segment earned USD 6.21 billion in 2024 due to its widespread use in residential exteriors and ease of installation.

- By Application (Siding, Cladding, Molding & Trimming, and Flooring): The siding segment held a share of 34.09% in 2024, fueled by the rising demand for durable, low-maintenance exterior finishes in housing projects.

- By End Use (Residential, Commercial, and Industrial): The residential segment is projected to reach USD 12.87 billion by 2032, propelled by rapid urbanization, housing developments, and renovation activities worldwide.

Fiber Cement Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific fiber cement market share stood at around 37.12% in 2024, valued at USD 6.80 billion. This dominance is reinforced by rapid urbanization, large-scale infrastructure projects, and high residential construction activity across countries such as China, India, and Southeast Asia.

Asia Pacific fiber cement market share stood at around 37.12% in 2024, valued at USD 6.80 billion. This dominance is reinforced by rapid urbanization, large-scale infrastructure projects, and high residential construction activity across countries such as China, India, and Southeast Asia.

Government initiatives to boost affordable housing, combined with growing demand for durable, fire-resistant building materials, are further fueling this expansion. Moreover, the presence of key manufacturers and increasing investments in sustainable construction are supporting regional market growth.

- In January 2025, Nuvoco Vistas Corp. Ltd. launched its patented Nuvoco Duraguard Microfiber Cement in Western Uttar Pradesh, India. This next-generation Portland Pozzolana Cement (PPC) incorporates microfibers that act as reinforcing agents, reducing micro-cracks and enhancing structural durability.

The Europe fiber cement industry is poised to grow at a significant CAGR of 5.26% over the forecast period. This growth is supported by rising demand for eco-friendly and energy-efficient construction materials.

Building regulations and emphasis on green building standards are leading to increased demand for fiber cement products. Additionally, renovation of aging infrastructure and increased focus on fire safety in buildings are contributing to market growth across major economies such as Germany, France, and the U.K.

Regulatory Frameworks

- In the Europe, fiber cement materials are regulated under the Construction Products Regulation (CPR) No. 305/2011, which mandates CE marking and compliance with harmonized standards such as EN 12467, covering fiber-cement flat sheets for internal and external use. Products must also meet fire safety and environmental standards under REACH and Ecodesign directives.

- In India, fiber cement products fall under the Bureau of Indian Standards (BIS) with relevant standards such as IS 14862:2000, which applies to fiber cement flat sheets. Compliance is required for safety, performance, and sustainability criteria, particularly for use in housing and industrial projects.

Competitive Landscape

Key players in fiber cement industry are focusing on developing high-performance, weather-resistant, and eco-friendly solutions that cater to both residential and commercial applications.

These products are being designed to meet stricter environmental standards, offer improved durability, and reduce lifecycle costs for end users. Manufacturers are increasingly incorporating recycled materials and low-emission components to align with sustainability goals and construction regulations.

Strategic partnerships and mergers are strengthening distribution networks, expanding customer bases, and enabling access to new geographic regions. Through these alliances, companies are able to share technical expertise, gain market insights, and leverage existing sales infrastructure to scale operations more efficiently.

- In July 2023, JOGANI Reinforcement received an Indian patent for its Blended Concrete Fibers, designed to enhance key performance parameters in concrete. The 20-year patent reinforces the company’s position in crack control concrete fibers, including brass-coated micro steel fibers, basalt fibers, carbon fibers, and alkali-resistant glass fibers.

List of Key Companies in Fiber Cement Market:

- NICHIHA

- CSR

- Atermit

- Cemex S.A.B DE C.V.

- LTM

- James Hardie Building Products Inc.

- BASF

- Knauf Digital GmbH

- Tata Steel

- Etex Group

- Everest

- Boral

- LAFARGE

- Saint-Gobain Group

- Siniat

Recent Developments (M&A)

- In March 2025, James Hardie Industries plc entered into a definitive agreement to acquire The AZEK Company Inc. for USD 8.75 billion, including net debt. The acquisition combines complementary exterior building product lines and significantly expands James Hardie’s total addressable market.

Key Highlights:

Key Highlights: Asia Pacific fiber cement market share stood at around 37.12% in 2024, valued at USD 6.80 billion. This dominance is reinforced by rapid urbanization, large-scale infrastructure projects, and high residential construction activity across countries such as China, India, and Southeast Asia.

Asia Pacific fiber cement market share stood at around 37.12% in 2024, valued at USD 6.80 billion. This dominance is reinforced by rapid urbanization, large-scale infrastructure projects, and high residential construction activity across countries such as China, India, and Southeast Asia.