Farm and Ranch Insurance Market Size

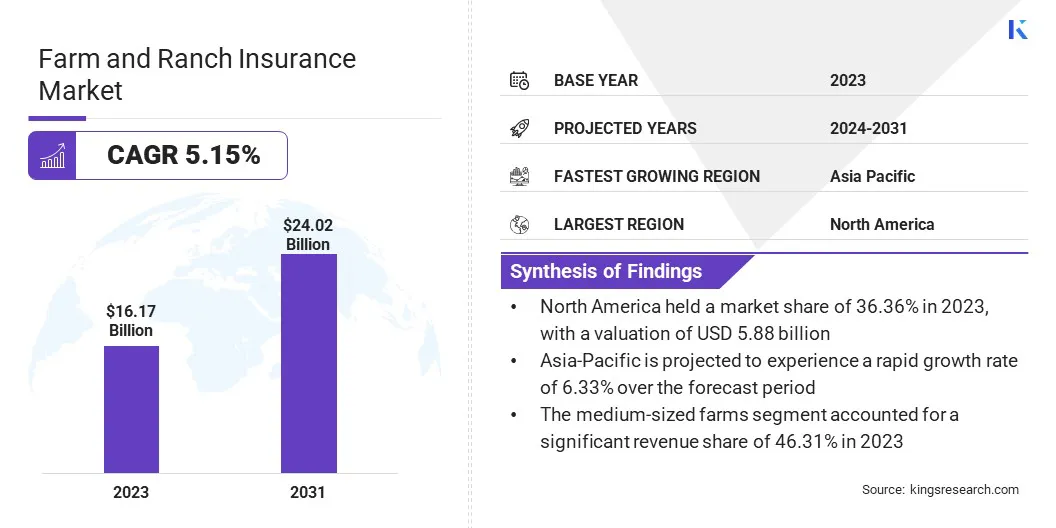

The global Farm and Ranch Insurance Market size was valued at USD 16.17 billion in 2023 and is projected to reach USD 24.02 billion by 2031, growing at a CAGR of 5.15% from 2024 to 2031.

In the scope of work, the report includes solutions offered by companies such as Nationwide Mutual Insurance Company, FBL Financial Group Inc., American Farmers & Ranchers Mutual Insurance Company, Oregon Mutual Insurance Company, Travelers , State Farm Mutual Automobile Insurance Company, Great American Insurance Company, Achmea Australia, Higginbotham, MetLife Services and Solutions LLC and Others.

The farm and ranch insurance industry serves as a vital component of the broader agricultural sector, providing essential coverage to protect against a variety of risks associated with farming and ranching operations. Farm and ranch insurance policies usually cover a range of potential risks, including property damage, liability claims, and loss of income due to unforeseen events such as natural disasters or accidents.

By offering this protection, insurance companies help farmers and ranchers mitigate financial losses and ensure a strong market standing in the face of challenges. Farm and ranch insurance play a crucial role in supporting the stability and sustainability of the agricultural industry.

Moreover, advancements in technology have increasingly influenced the farm and ranch insurance landscape. Insurers have integrated satellite imaging, drones, and other technologies to assess risks, monitor crops, and streamline claims processing, enhancing efficiency and accuracy in underwriting and risk management.

These technological tools allow insurers to have a more comprehensive understanding of the unique challenges faced by farmers and ranchers, leading to more tailored and cost-effective insurance solutions.

Additionally, these advancements help mitigate potential losses by identifying risks early on and providing proactive measures to address them. The integration of technology in farm and ranch insurance is revolutionizing the industry and improving the overall resilience of agricultural operations.

Analyst’s Review

The changing climate patterns and the rising occurrence of severe weather incidents have emphasized the significance of extensive insurance protection for individuals involved in farming and livestock management.

Tailored insurance options specifically designed to manage climate-related hazards, such as crop insurance covering droughts, floods, and storms, have become increasingly essential in safeguarding against financial setbacks caused by incalculable weather conditions.

Furthermore, in response to the ongoing effects of climate change on agricultural activities, insurance firms are innovating products and services to cater to the evolving requirements of farmers and ranchers.

These insurance solutions, which cover losses temperature fluctuations, erratic rainfall, and other weather-related risks, play a crucial role in ensuring the sustainability and adaptability of agricultural enterprises amidst an unpredictable environment.

Market Definition

Farm and ranch insurance is a specialized type of insurance designed to financially protect agricultural operations against various risks. It can be considered a hybrid as it combines coverage for both personal and commercial aspects related to farming and ranching.

This type of insurance usually covers property damage, liability risks, and loss of income due to unforeseen circumstances such as natural disasters, equipment breakdowns, or livestock injuries.

Farm and ranch insurance is essential for farmers and ranchers to ensure their operations remain financially stable in the face of unexpected events that could potentially devastate their livelihoods. Additionally, farm and ranch insurance can provide coverage for essential equipment and machinery, as well as protection for buildings and structures on the property.

This type of insurance can be tailored to meet the specific needs of each agricultural enterprise, ensuring that farmers and ranchers have the necessary protection to safeguard their investments. With the unpredictable nature of farming and ranching, having comprehensive insurance coverage is a crucial aspect of running a successful agricultural operation.

Farm and Ranch Insurance Market Dynamics

Shifts in consumer preferences are driving market growth as more people prioritize sustainable and ethically sourced products. This has led to an increase in demand for eco-friendly options, such as reusable products and organic foods. Companies are responding to these changes by offering more environmentally conscious products and investing in sustainable practices to meet the evolving needs of the market.

These shifts in consumer preferences are contributing significantly to market growth and promoting a more sustainable and responsible economy. Consumers are increasingly demanding transparency, sustainability, and ethical practices in food production.

This trend is boosting the adoption of organic farming, sustainable agriculture, and fair trade practices, leading to a rise in demand for insurance products that align with these initiatives.

Many farmers, especially those who are small-scale or marginalized, face a considerable hurdle in accessing cost-effective insurance and financial services. This lack of access to credit, insurance, and risk management tools can impede farmers' capacity to invest in their operations, integrate new technologies, and endure financial setbacks such as crop failures or natural calamities.

This financial services gap can maintain a cycle of poverty and fragility among farmers, hindering their full potential and obstructing the advancement and sustainability of the agricultural industry.

Furthermore, without access to financial services, farmers may struggle to expand their businesses, adopt sustainable practices, or even recover from unexpected losses. This can create a barrier to innovation and growth within the agricultural sector, thereby limiting the overall productivity and resilience of the industry.

Segmentation Analysis

The global market is segmented based on type, size of operations, distribution channel and geography.

By Type

By type, the market is bifurcated into crop insurance, livestock insurance and farm property & liability insurance. The crop insurance segment in farm and ranch insurance market is registered a significant revenue share of 42.58% in 2023. This dominance can be attributed to the increasing demand for protection against crop losses due to unpredictable weather conditions and natural disasters.

Additionally, advancements in technology have made crop insurance more accessible and affordable for farmers, thereby fueling the growth of the segment. As farmers continue to prioritize risk management strategies, the crop insurance segment is expected to maintain its dominant position in the market in the coming years.

By Size of Operation

By size of operation, the market is bifurcated into small farms and ranches, medium-sized farms and ranches and large commercial farms and ranches. The medium-sized farms segment in farm and ranch insurance market is accounted for a significant revenue share of 46.31% in 2023.

Medium-sized farms often require more coverage than smaller operations, however, they lack the resources available to large corporate farms. This segment is further characterized by a diverse range of crops and livestock, which necessitates comprehensive insurance policies to protect against various risks. As the agricultural industry continues to evolve, medium-sized farms are likely continue to play a crucial role in the market.

By Distribution Channel

By distribution channel, the market is bifurcated into independent agents & brokers and direct channels. The independent agents & brokers segment in farm and ranch insurance market is accrued the highest revenue share of 58.87% in 2023, mainly driven by the strong relationships established by independent agents and brokers with farmers and ranchers over the years.

Their personalized service, industry expertise, and ability to tailor insurance policies to meet the unique needs of each client have made them a preferred choice in the market.

Additionally, independent agents and brokers often have access to a wide range of insurance providers, allowing them to offer competitive rates and comprehensive coverage options to their customers. This has helped them maintain their leading position in the market.

Farm and Ranch Insurance Market Regional Analysis

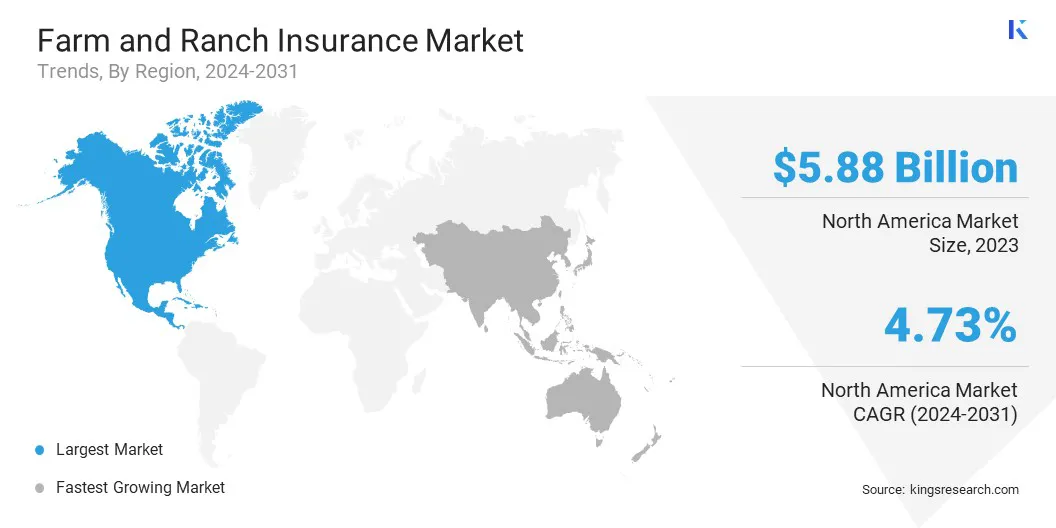

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America Farm and Ranch Insurance Market share stood around 36.36% in 2023 in the global market, with a valuation of USD 5.88 billion, due to the large number of agricultural operations in the United States and Canada, along with the high value of crops and livestock produced in these countries.

Additionally, the presence of well-established insurance companies in North America offering comprehensive coverage for farm and ranch operations has contributed to the region's dominance in the global marketplace.

With the increasing frequency of extreme weather events and other risks facing the agriculture industry, the demand for farm and ranch insurance is expected to continue growing in North America in the coming years.

The farm and ranch insurance industry in Asia-Pacific is projected to experience a rapid growth rate of 6.33% over the forecast period. This growth is primarily fostered by the expansion of agricultural sector in countries such as China and India, coupled with the increasing adoption of insurance products to mitigate risks in farming operations.

With the rising awareness of the importance of protecting agricultural assets, a growing number of farmers in the region are likely to invest in insurance coverage to safeguard their livelihoods. As a result, the market for farm and ranch insurance in Asia Pacific is poised to experience significant expansion in the near future.

Competitive Landscape

The farm and ranch insurance industry report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

List of Key Companies in Farm and Ranch Insurance Market

- Nationwide Mutual Insurance Company

- FBL Financial Group Inc.

- American Farmers & Ranchers Mutual Insurance Company

- Oregon Mutual Insurance Company

- Travelers

- State Farm Mutual Automobile Insurance Company

- Great American Insurance Company

- Achmea Australia

- Higginbotham

- MetLife Services and Solutions LLC

Key Industry Developments

- March 2021 (Collaboration) - American Farmers & Ranchers Mutual Insurance Company extended its collaboration with Oklahoma State University and the Ferguson College of Agriculture by contributing to the New Frontiers campaign, making a significant five-year pledge amounting to $100,000.

The Global Farm and Ranch Insurance Market is Segmented as:

By Type

- Crop Insurance

- Livestock Insurance

- Farm Property & Liability Insurance

By Size of Operation

- Small Farms and Ranches

- Medium-Sized Farms and Ranches

- Large Commercial Farms and Ranches

By Distribution Channel

- Independent Agents & Brokers

- Direct Channels

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America