Factoring Services Market Size

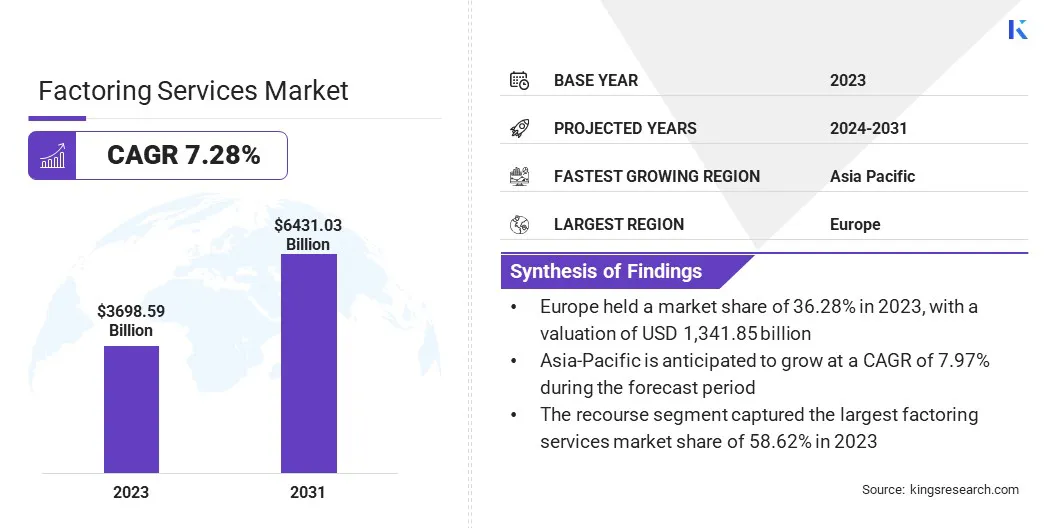

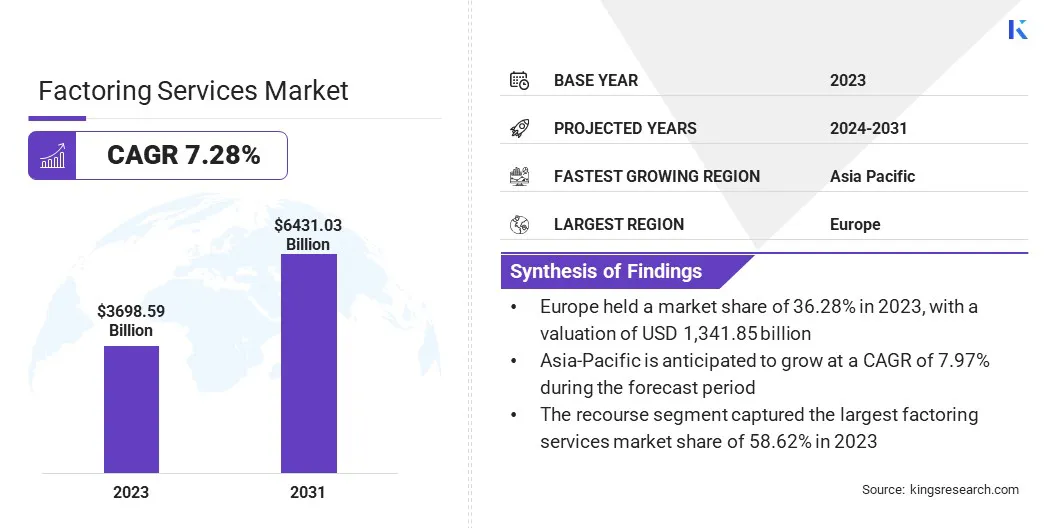

The global Factoring Services Market size was valued at USD 3,698.59 billion in 2023 and is projected to grow from USD 3,932.13 billion in 2024 to USD 6,431.03 billion by 2031, exhibiting a CAGR of 7.28% during the forecast period. The rising awareness of alternative financing solutions is boosting the growth of the market.

In the scope of work, the report includes services offered by companies such as altLINE, China Construction Bank, Deutsche Factoring Bank, Barclays Bank PLC, BNP Paribas Fortis, Factor Funding Co., Eurobank Direktna a.d., HSBC Group, RTS Financial Service, Inc., ICBC, and others.

The growing popularity of reverse factoring among large corporations presents a significant opportunity for the development of the factoring services market. Reverse factoring, also known as supply chain financing, allows suppliers to receive early payments on their invoices at a lower cost.

This process relies on the buyer's creditworthiness to determine the terms. This method has gained significant traction among large corporations looking to strengthen their supply chains and improve relationships with suppliers. By offering reverse factoring, companies are ensuring that their suppliers maintain healthy cash flow, thereby reducing the risk of disruptions in the supply chain.

- For instance, in August 2024, the International Finance Corporation (IFC) and Citi inaugurated a USD 500 million facility in Mexico. This facility marks the first project of their USD 2 billion sustainable supply chain finance program. This initiative aims to enhance local credit infrastructure and introduces innovative products such as reverse factoring, building on IFC’s advisory work.

This trend is particularly beneficial for industries with complex and extended supply chains, such as manufacturing, retail, and automotive. As more corporations recognize the strategic value of supporting their suppliers through reverse factoring, the demand for these services is expected to grow in the upcoming years.

This creates new opportunities for factoring companies to expand their offerings, develop specialized solutions for large enterprises, and capture a larger share of the market by catering to the specific needs of corporate clients seeking to optimize their supply chain operations.

Factoring services are financial transactions where a business sells its accounts receivable (invoices) to a third party, known as a factor, at a discounted rate. This process allows businesses to obtain immediate cash flow, which is especially beneficial for companies facing cash flow constraints or those looking to increase their working capital.

There are several types of factoring services, including recourse factoring, non-recourse factoring, and reverse factoring.

In recourse factoring, the business retains the risk associated with non-payment of the invoice by the customer, while in non-recourse factoring, the factor assumes the risk of non-payment. Reverse factoring, on the other hand, is initiated by the buyer rather than the seller, allowing suppliers to receive early payments at favorable rates due to the buyer’s stronger credit rating.

Factoring services are widely used across diverse industries such as manufacturing, construction, transportation, and retail, where managing cash flow is critical. Factoring offers benefits beyond merely enhancing cash flow. It also plays a role in reducing credit risk, outsourcing credit control, and enhancing the financial stability of businesses by converting receivables into immediate working capital.

Analyst’s Review

In the competitive global factoring services market, companies are increasingly focusing on innovative strategies to capture major market share and sustain growth. Key players are investing in digital transformation by leveraging technologies such as artificial intelligence and blockchain to enhance service efficiency and transparency.

The integration of these technologies into factoring processes improves operational efficiency and strengthens the security and accuracy of transactions. Moreover, companies are expanding their geographic presence to tap into emerging markets, where the demand for factoring services is rising due to the growth of small and medium enterprises (SMEs) and increased international trade.

- For instance, in April 2024, CaixaBank reported that it concluded 2023 with over USD 82.99 billion in factoring and reverse factoring transactions. This represents a 2% increase from the previous year and setting a new record for the company's collection and payment management volume. Factoring and reverse factoring remain the preferred tools for working capital financing among Spanish businesses.

Partnerships and collaborations with fintech companies are becoming a strategic imperative, enabling traditional factoring firms to offer more flexible and technologically advanced solutions. Additionally, companies are prioritizing customer-centric approaches, tailoring their services to meet the specific needs of different industries such as manufacturing, retail, and logistics.

The growth trajectory of the market suggests that these strategies are crucial for companies aiming to thrive in an increasingly dynamic and competitive environment.

Factoring Services Market Growth Factors

The rising awareness of alternative financing solutions is leading to the widespread adoption of factoring services across various industries. As traditional financing methods, such as bank loans, become increasingly stringent and time-consuming, businesses are turning to alternative financing options such as factoring to meet their immediate cash flow needs.

This shift is particularly evident among small and medium enterprises (SMEs), which often face challenges in accessing traditional credit due to limited credit histories or lack of collateral.

Factoring offers a viable alternative by converting outstanding invoices into immediate cash, enabling businesses to maintain liquidity and continue operations without the burden of long approval processes associated with traditional loans.

Furthermore, the flexibility and speed offered by factoring services make them an attractive option for businesses looking to manage working capital efficiently.

As awareness of these benefits grows, an increasing number of companies are recognizing factoring as a strategic tool for financial management, resulting in increased market penetration. Moreover, the expanding ecosystem of fintech solutions contributes to this trend, as digital platforms make factoring more accessible and transparent, thereby promoting its adoption.

The complexity of regulatory compliance across different countries presents a significant challenge for factoring companies, particularly those engaged in cross-border transactions. Each country has its own set of financial regulations, legal frameworks, and tax implications, making it difficult for factoring companies to operate seamlessly on a global scale.

Compliance with these varying regulations requires significant resources, including legal expertise, robust compliance programs, and continuous monitoring of regulatory changes. Failure to comply may result in hefty fines, legal disputes, and reputational damage, making it a critical concern for companies operating in the factoring industry.

The challenge is further compounded by the continual evolution of regulatory environments, which necessitate regular updates to compliance strategies. To mitigate this challenge, factoring companies are adopting a proactive approach by investing in comprehensive compliance management systems, collaborating with local legal and regulatory experts, and establishing strong governance frameworks that ensure adherence to international and local regulations.

Additionally, leveraging technology such as AI-driven compliance tools enhance the ability to navigate complex regulatory landscapes and reduce the risk of non-compliance.

Factoring Services Industry Trends

The rise of cross-border trade is boosting the popularity of international factoring, providing businesses with a reliable solution to manage cash flow and mitigate risks associated with global transactions. As companies increasingly engage in international trade, they face challenges such as extended payment terms, fluctuations in currency values, and the risk of non-payment by foreign buyers.

International factoring addresses these issues by allowing businesses to sell their foreign receivables to a factor, which then assumes the credit risk and provides immediate cash flow in the business’s local currency.

This service accelerates cash flow and reduces the uncertainty associated with dealing with foreign clients, making it a valuable tool for companies looking to expand their global operations. The trend is particularly pronounced in sectors such as manufacturing, wholesale trade, and logistics, where cross-border transactions are a regular occurrence.

Segmentation Analysis

The global market is segmented based on type, enterprise size, application, vertical, and geography.

By Type

Based on type, the market is categorized into recourse and non-recourse. The recourse segment captured the largest factoring services market share of 58.62% in 2023, primarily due to its lower cost and widespread acceptance among businesses. In recourse factoring, the seller retains the credit risk, which implies that if the buyer defaults on payment, the seller is responsible for reimbursing the factor.

This arrangement typically results in lower fees compared to non-recourse factoring, making it an attractive option for businesses looking to manage their cash flow while minimizing costs.

The popularity of recourse factoring is further reinforced by its flexibility, as it allows companies to access immediate working capital while retaining control over their customer relationships and collections. Additionally, recourse factoring is more commonly offered by factoring companies, particularly in markets where credit risk is a significant concern, thereby contributing to the expansion of the segment.

By Application

Based on application, the market is classified into domestic factoring and international factoring. The international factoring segment is poised to record a staggering CAGR of 7.90% through the forecast period, mainly due to the rapid expansion of global trade and the growing complexity of cross-border transactions.

As businesses increasingly engage in international commerce, they face challenges such as longer payment terms, currency risks, and the potential for non-payment by foreign buyers.

International factoring provides a robust solution to these challenges by offering immediate liquidity and credit protection, allowing businesses to focus on expanding their global footprint without the financial risks associated with international trade.

The growth of e-commerce and digital trade platforms has significantly contributed to the rise of international factoring, as a growing number of businesses seek to capitalize on global market opportunities.

Additionally, the increasing integration of emerging markets into the global economy is fueling the demand for international factoring services, as businesses actively look for reliable financial tools to manage their cross-border receivables.

By Vertical

Based on vertical, the factoring services market is divided into manufacturing, construction, transportation and logistics, healthcare, and others. The manufacturing sector garnered the highest revenue of USD 1,160.62 billion in 2023, mainly propelled by the industry’s major reliance on factoring services to manage working capital and sustain production cycles.

Manufacturing companies often operate on extended payment terms with their buyers, creating substantial gaps in cash flow that can hinder both day-to-day operations and growth.

Factoring services provide a vital solution by converting outstanding invoices into immediate cash, enabling manufacturers to maintain liquidity, purchase raw materials, pay employees, and meet other operational expenses without delay.

The expansion of the segment is further bolstered by its global supply chains, which often involve complex and long-term transactions that benefit from the risk mitigation offered by factoring.

Additionally, the rise in demand for manufactured goods, particularly in emerging markets, has led to an increase in the volume of receivables, highlighting the pressing need for factoring services.

Factoring Services Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Europe factoring services market accounted for a substantial share of 36.28% and was valued at USD 1,341.85 billion in 2023, making it the largest regional market globally. This dominant position is largely attributed to the region's mature financial infrastructure, strong economic ties between European countries, and the widespread adoption of factoring services among small and medium enterprises (SMEs).

Moreover, the European Union's well-established regulatory framework supports the growth of factoring by providing a stable and transparent environment for financial transactions.

Additionally, Europe’s export-oriented economies, particularly in countries such as Germany, France, and Italy, heavily rely on factoring to manage cash flow and mitigate credit risks associated with international trade. The high level of awareness and acceptance of factoring as a mainstream financial tool among businesses in Europe contributes to the expansion of the regional market.

The presence of major global factoring companies headquartered in Europe also strengthens the region’s position by fostering innovation and expanding the range of services offered.

Asia-Pacific is poised to grow at a robust CAGR of 7.97% in the forthcoming years, stimulated by rapid economic development, increasing international trade, and the expanding presence of small and medium enterprises (SMEs) across the region.

The rise of emerging economies such as China, India, and Southeast Asian nations is fueling the demand for factoring services, as businesses in these countries seek alternative financing solutions to manage cash flow and mitigate the risks associated with extended payment terms.

The region's robust manufacturing sector, coupled with its growing involvement in global supply chains, further boosts the need for factoring services to support production cycles and ensure timely payments.

Additionally, the digital transformation occurring across Asia-Pacific is enhancing the accessibility of factoring services to a broader range of businesses, particularly through fintech platforms that offer innovative and user-friendly solutions. The increasing awareness and acceptance of factoring as a reliable financial tool among Asian businesses are further contributing to the rapid expansion of the domestic market.

Competitive Landscape

The global factoring services market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Factoring Services Market

- altLINE

- China Construction Bank

- Deutsche Factoring Bank

- Barclays Bank PLC

- BNP Paribas Fortis

- Factor Funding Co.

- Eurobank Direktna a.d.

- HSBC Group

- RTS Financial Service, Inc.

- ICBC

Key Industry Development

- January 2023 (Partnership): GE and Poland's Export Credit Agency, KUKE, announced a USD 1.09 billion strategic export finance agreement to support global energy decarbonization and electrification. This partnership enables GE Poland to secure debt insurance, facilitating capital investment in renewable and gas power projects worldwide through Polish exports.

The global factoring services market is segmented as:

By Type

By Enterprise Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Application

- Domestic Factoring

- International Factoring

By Vertical

- Manufacturing

- Construction

- Transportation and Logistics

- Healthcare

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America