Exascale Computing Market Size

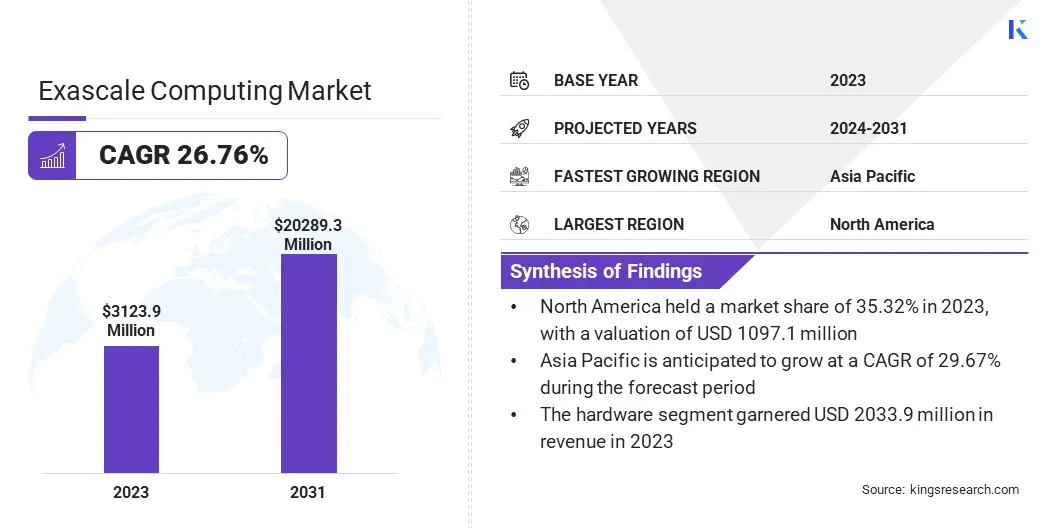

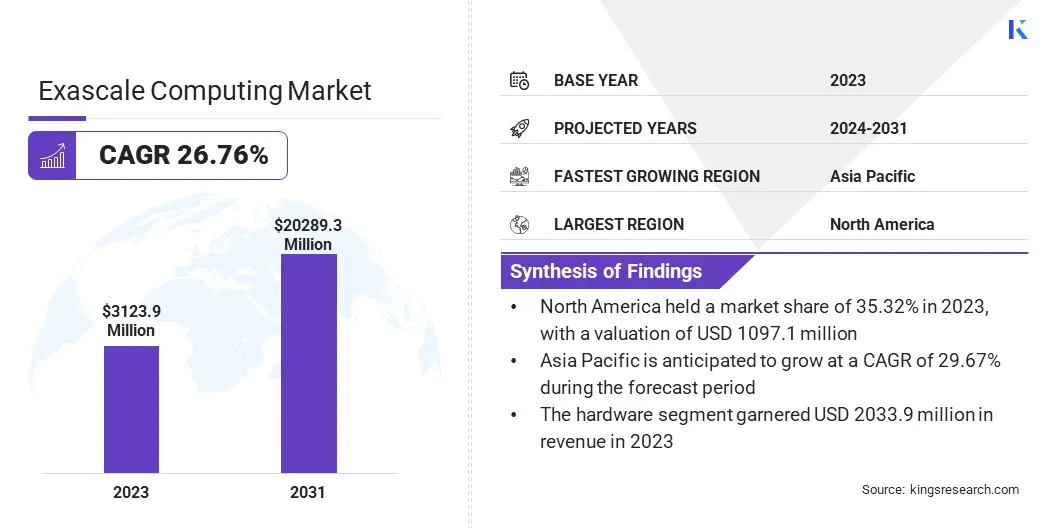

The global Exascale Computing Market size was valued at USD 3,123.9 million in 2023 and is projected to grow from USD 3,857.9 million in 2024 to USD 20,289.3 million by 2031, exhibiting a CAGR of 26.76% during the forecast period. The market is experiencing rapid growth, propelled by increasing demand for high-performance computing in scientific research, climate modeling, and artificial intelligence applications.

The progress of the market is further fueled by advancements in semiconductor technology, enhanced data storage solutions, and strategic collaborations between industry leaders and government agencies, fostering innovation and efficiency in processing vast datasets for complex problem-solving.

In the scope of work, the report includes solutions offered by companies such as Hewlett Packard Enterprise Development LP, IBM, Intel Corporation, NVIDIA Corporation, DDN, Fujitsu, Advanced Micro Devices, Inc., Lenovo, Atos SE, NEC Corporation, and others.

The exascale computing market is experiencing significant growth, mainly due to the increasing demand for high-performance computing (HPC) systems capable of handling complex data processing and large-scale simulations.

Advances in artificial intelligence (AI) and machine learning (ML) further propel this growth, as organizations seek faster and more efficient ways to analyze vast amounts of data. Additionally, public-private partnerships are fostering innovation and research capabilities in the sector.

- In May 2024, Intel Corporation joined forces with Hewlett Packard Enterprise to create the Aurora exascale supercomputer, which features 21,248 Intel Xeon CPU Max Series processors and 63,744 Intel Data Center GPU Max units. As the largest AI-capable system globally, Aurora attained 10.6 exaflops, highlighting a significant breakthrough in exascale computing technology.

The ongoing advancements in exascale computing, coupled with strategic collaborations, are expected to significantly enhance processing capabilities, thus stimulating market growth.

Exascale computing refers to systems capable of performing at least one exaflop, equivalent to one quintillion (10^18) calculations per second. This level of performance is essential for tackling highly complex problems across various domains, including climate modeling, genomic research, and large-scale simulations in physics and materials science.

Exascale systems combine advanced hardware, including powerful processors and vast memory capacities, with sophisticated software frameworks to efficiently manage and analyze massive datasets. The development of exascale computing aims to enhance scientific discovery, improve decision-making processes, and foster innovation by enabling researchers to tackle previously unattainable computational challenges.

Analyst’s Review

The exascale computing market is expanding due to investments in advanced computational capabilities, which enhance scientific research across various sectors such as healthcare, particularly in genomics and drug discovery. The growing demand for high-performance computing solutions fosters innovation and collaboration between government and private sectors, thereby propelling market expansion.

- For instance, Europe is set to launch its first exascale computer, Jupiter, in 2024 at the Jülich Supercomputing Centre in Germany. Jupiter is expected to achieve one exaflop, erforming one billion-billion calculations per second. The projected cost for its six-year construction and operation is USD 545 million.

Key players in the market are strategically leveraging this opportunity by investing in cutting-edge technologies, forming partnerships with research institutions, and developing innovative solutions that enhance computational capabilities.

Exascale Computing Market Growth Factors

The growth of the market is bolstered by the rising demand for advanced computational power across various industries. Its ability to process vast datasets and execute complex simulations at exceptional speeds plays a pivotal role in sectors such as climate research, genomics, and materials science.

The need for solving intricate challenges and optimizing data-driven decision-making is increasing the adoption of exascale systems. Industries aiming to improve predictive modeling, research, and real-time analytics are investing heavily in this technology, thereby contributing to the expansion of the exascale computing market.

The development of the market is hindered by the high costs associated with infrastructure development, maintenance, and energy consumption. Additionally, the complexity of integrating advanced hardware and software systems poses significant challenges for organizations seeking to implement exascale solutions.

Key players are mitigating these challenges through strategic partnerships and collaborations that leverage shared resources and expertise. Investments in energy-efficient technologies and innovative cooling solutions are reducing operational costs. Furthermore, companies are focusing on developing modular architectures, allowing for incremental upgrades rather than complete system overhauls.

Moreover, initiatives in workforce development and training are ensuring a skilled professionals to meet the complex requirements of exascale computing, supporting market growth and sustainability.

Exascale Computing Industry Trends

The growing reliance on artificial intelligence (AI) and machine learning (ML) models is reshaping the landscape of the exascale computing market. AI and ML models require immense computational power to process large datasets and perform complex calculations, making exascale systems highly valuable for these tasks.

This trend is advancing AI-driven research and development, fostering innovation in autonomous systems and predictive analytics.

- In November 2023, DDN partnered with Sandia National Laboratories to enhance its DDN Infinia ecosystem, optimizing it for high-performance computing (HPC) workloads and ensuring it meets the evolving demands of government labs.

The ability of exascale computing to meet increasing demands for faster processing and greater computational efficiency fuels market growth.

The integration of quantum computing capabilities into hybrid exascale computing models is propelling market growth by addressing the limitations of classical computing systems. Organizations are increasingly recognizing the advantages of combining quantum and exascale technologies to tackle complex challenges that require immense computational power, such as climate modeling and large-scale simulations.

This convergence allows for faster data processing and enhanced problem-solving capabilities, attracting investment and interest from various sectors, including pharmaceuticals, finance, and materials science. Leveraging quantum advantages within the exascale framework is facilirtating innovative applications, creating a robust demand for advanced computing solutions.

Segmentation Analysis

The global market has been segmented based on component, deployment, end user, and geography.

By Component

Based on component, the market has been categorized into hardware, software, and services. The hardware led the exascale computing market in 2023, reaching a valuation of USD 2,033.9 million. This growth is attributed to the increasing demand for advanced computational systems capable of processing vast amounts of data at unprecedented speeds.

Key components such as high-performance processors, GPUs, and memory systems are critical in supporting the high-speed operations needed for exascale systems. Companies are continually innovating to deliver energy-efficient and powerful hardware that can handle complex applications across scientific research, artificial intelligence, and national security.

The development of cutting-edge processors and specialized architectures is enhancing the performance of exascale systems, thereby aiding segmental growth.

By Deployment

Based on deployment, the market has been categorized into on-premises and cloud. The cloud segment captured the largest share of 68.79% in 2023. With the growing adoption of cloud-based infrastructure for scalable, high-performance computing needs, the segment is expected to experience substantial growth.

Cloud platforms offer flexibility, enabling users to access immense computational power without the need for on-premise hardware investments. This shift allows industries such as healthcare, finance, and scientific research to perform complex simulations and data-intensive tasks efficiently.

Cloud providers are continuously upgrading their infrastructure with advanced technologies such as quantum computing integrations and AI optimization, enhancing the capabilities of cloud-based exascale systems.

For instance, major players such as Amazon Web Services (AWS) and Microsoft Azure are expanding their high-performance computing offerings to accommodate the growing demand for cloud-based exascale solutions, contributing significantly to the expansion of the segment.

By End User

Based on end user, the market has been categorized into government & defense, healthcare & biosciences, financial services, research & academia, manufacturing & energy, and others. The government & defense segment is expected to garner the highest revenue of USD 8,113.0 million by 2031.

This growth is fostered by the rising need for advanced computational power to manage complex defense operations, national security, and scientific research projects. Governments worldwide are investing heavily in exascale systems to handle tasks such as cybersecurity, real-time data analytics, and large-scale simulations that support defense strategies and policy decisions.

This segment benefits from exascale computing's ability to process enormous amounts of data, enabling more precise modeling of military scenarios and disaster response strategies.

- For instance, in February 2024, the U.S. Department of Energy’s (DOE) Exascale Computing Project (ECP) developed a high-performance computing ecosystem over seven years, integrating applications, software, and hardware to optimize the world’s most powerful supercomputers.

These factors are expected to boost the expansion n of thesegment in the forthcoming years.

Exascale Computing Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America exascale computing market accounted for the largest revenue share of 35.12% in 2023, with a valuation of USD 1,097.1 million. This notable growth is propelled by substantial government investments and advancements in technology infrastructure.

The United States is at the forefront of this growth, characterized by initiatives such as the Department of Energy's (DOE) Exascale Computing Project (ECP), which aims to enhance national security, scientific research, and economic competitiveness.

The demand for advanced high-performance computing (HPC) systems is rising due to the surging need for complex data analysis in defense, healthcare, and energy sectors. Public-private partnerships are further accelerating technological innovations in the region.

- For instance, the ECP, conducted from 2016 to 2024, was the largest software research project managed by the DOE. This USD 1.8 billion initiative developed a robust exascale computing ecosystem to address future challenges in energy, security, and healthcare.

Asia-Pacific market is anticipated to grow rapidly, with a staggering CAGR of 29.67% over the forecast period. This expansion is augmented by increasing investments in advanced computing technologies and strong governmental support for scientific research.

Countries such as China and Japan are at the forefront, making significant advancements in high-performance computing infrastructure to enhance their capabilities in scientific discovery, healthcare, and industrial applications. The growing demand for energy-efficient systems and innovations in AI and quantum computing is further propelling the regional market growth.

- For instance, in June 2024, NEC Corporation, in collaboration with AIST, Yokohama National University, and Tohoku University, demonstrated a superconducting circuit capable of controlling many qubits at low temperatures, representing a major advancement toward large-scale quantum computing systems in Japan.

The region's ongoing investment in these cutting-edge technologies positions it as a key region in the global exascale computing landscape, promoting innovation and collaboration across industries.

Competitive Landscape

The global exascale computing market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Exascale Computing Market

- Hewlett Packard Enterprise Development LP

- IBM

- Intel Corporation

- NVIDIA Corporation

- DDN

- Fujitsu

- Advanced Micro Devices, Inc.

- Lenovo

- Atos SE

- NEC Corporation

Key Industry Developments

- September 2024 (Product Development): The EuroHPC Joint Undertaking upgraded Leonardo, the seventh fastest supercomputer, with a USD 219.4 million investment in new GPUs, CPUs, and high-bandwidth memory. This enhancement improved Leonardo's efficiency in AI workloads, reflecting the trend of supercomputers adapting to artificial intelligence demands. Such upgrades are vital for advancing research across sectors and are expected to stimulate the growth of the market.

- May 2023 (Product Launch): Nvidia launched its first commercial exascale supercomputer, the DGX GH200. This advanced system features 256 GH200 Grace Hopper hybrid processors connected via Nvidia's NVLink switch system, providing 144 terabytes of memory optimized for training AI frameworks.

The global exascale computing market is segmented as:

By Component

- Hardware

- Software

- Services

By Deployment

By End User

- Government & Defense

- Healthcare & Biosciences

- Financial Services

- Research & Academia

- Manufacturing & Energy

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America