Market Definition

ESG reporting software is a digital platform or set of tools that collects, analyzes, and manages environmental, social, and governance data across an organization. It enables automated data aggregation, standardized reporting, and improved transparency, helping companies ensure compliance with global sustainability frameworks.

Applications span regulatory reporting, performance benchmarking, risk management, and investor communications, supporting informed decision-making, operational efficiency, and accountability. Industries such as finance, energy, manufacturing, and retail leverage these tools to align corporate practices with sustainability goals and stakeholder expectations.

ESG Reporting Software Market Overview

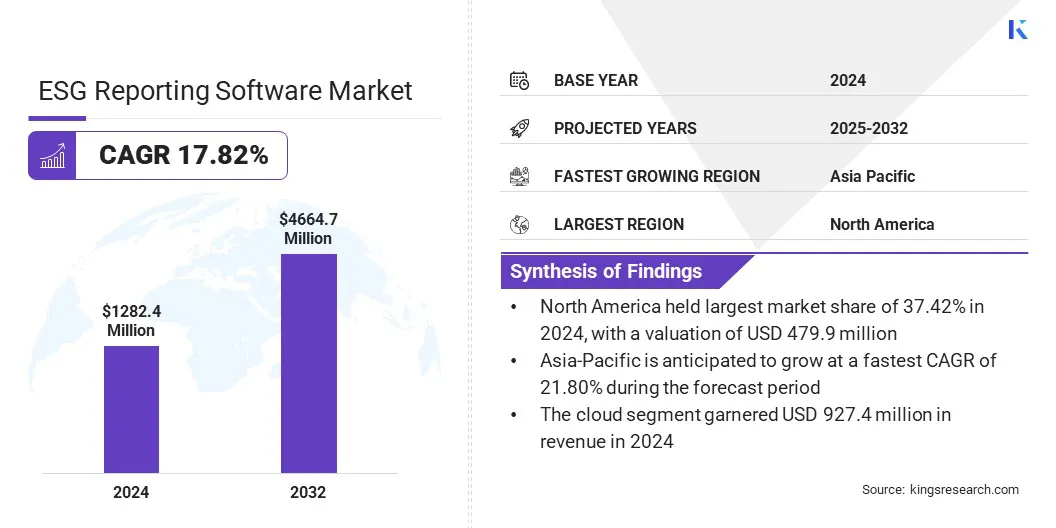

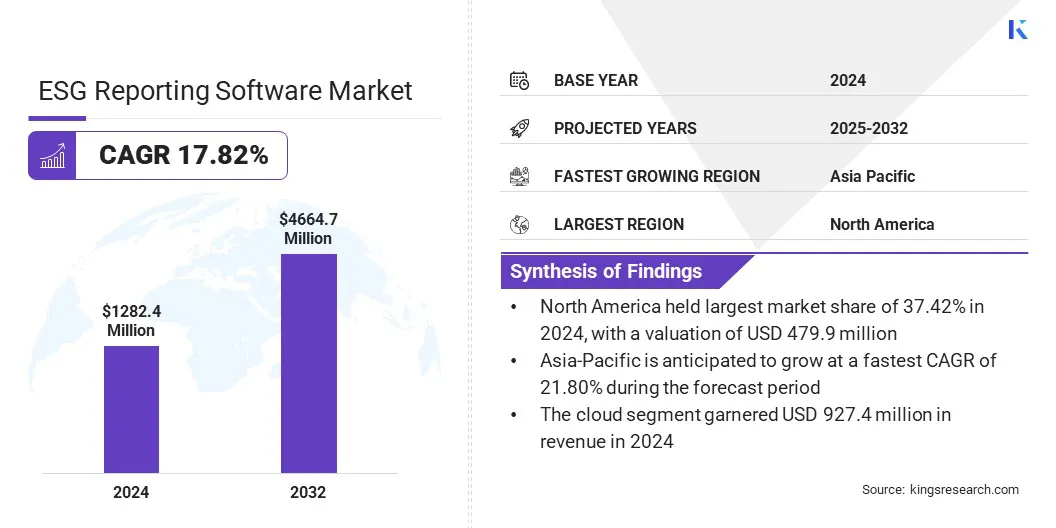

According to Kings Research, the global ESG reporting software market size was valued at USD 1,282.4 million in 2024 and is projected to grow from USD 1,480.0 million in 2025 to USD 4,664.7 million by 2032, exhibiting a CAGR of 17.82% over the forecast period.

This growth is attributed to the rising demand for advanced digital tools to streamline ESG data management, enhance reporting accuracy, and support informed decision-making across industries. Expanding adoption of automated data aggregation, analytics, and cloud-based reporting solutions is enabling greater transparency, compliance, and performance benchmarking, thereby driving market expansion.

Key Market Highlights:

- The ESG reporting software industry size was valued at USD 1,282.4 million in 2024.

- The market is projected to grow at a CAGR of 17.82% from 2025 to 2032.

- North America held a market share of 37.42% in 2024, valued at USD 479.9 million.

- The software segment garnered USD 889.3 million in revenue in 2024.

- The cloud segment is expected to reach USD 3,660.5 million by 2032.

- The small & medium enterprises segment is anticipated to witness the fastest CAGR of 20.52% over the forecast period.

- The BFSI segment garnered USD 261.2 million in revenue in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 21.80% through the projection period.

Major companies operating in the ESG reporting software market are Pulsora, Workiva, IBM, Novata, Inc., Novisto, SAP SE, Sphera, Watershed Technology, Inc., Wolters Kluwer N.V., Amplo Global, Brightest, Inc., Benchmark Digital Partners LLC, Cority, credibl ESG, and Diligent Corporation.

The growing focus from organizations, investors, and regulators on sustainability, governance, and risk management is driving integration of ESG reporting software into core business processes.

Additionally, ongoing technological advancements in ESG reporting software by solution providers, along with strategic partnerships and digital transformation initiatives by organizations, are accelerating market adoption and growth.

- In April 2025, OneStream Software launched its ESG Reporting & Planning solution to help CFOs manage sustainability reporting, integrating ESG metrics with financial data for analysis, forecasting, and compliance. The platform supports Scope 1, 2, and 3 emissions tracking and enhances transparency in ESG performance across organizations.

Growing Focus on Corporate Sustainability & ESG Strategy

The growth of ESG reporting software is fueled by organizations’ increasing focus on corporate sustainability and governance strategies. These platforms enable automated collection, analysis, and reporting of environmental, social, and governance data, ensuring accuracy and transparency.

Industries such as finance, energy, manufacturing, and retail are increasingly adopting these tools to monitor sustainability performance, manage risks, and meet regulatory standards.

Adoption is being reinforced by regulatory mandates, investor scrutiny, and the strategic focus on sustainable long-term value. This shift is strengthening organizations’ ability to align business practices with strategic sustainability objectives.

- In July 2025, UL LLC. expanded its ULTRUS software platform to support regulatory compliance and sustainability initiatives. The update includes tools for detecting per- and polyfluoroalkyl substances (PFAS) in products, tracking Scope 3 emissions, and supporting International Sustainability Standards Board (ISSB)-aligned ESG reporting.

Limited Compatibility with Existing Enterprise Systems

Limited Compatibility with Existing Enterprise Systems creates a significant barrier to the growth of the ESG reporting software market. Many organizations operate legacy IT, ERP, and operational systems that were not designed to handle ESG-specific data, reporting standards, or analytics.

Integrating ESG reporting software with these existing systems often requires custom interfaces, complex data migration, and ongoing maintenance, which increases implementation time and costs.

Smaller organizations with limited IT resources may find it especially difficult to adopt robust ESG solutions, creating a competitive disparity with larger, better-resourced enterprises.

Industries across financial services, manufacturing, and energy face additional hurdles, as ESG reporting demands accurate, real-time, and auditable data to meet regulatory and investor expectations. The lack of skilled personnel to manage both ESG data and software platforms further intensifies integration difficulties.

To overcome these constraints, companies are increasingly exploring modular software solutions, cloud-based platforms, and professional services for integration and deployment. These approaches aim to simplify system compatibility, reduce implementation complexity, and accelerate ESG adoption across enterprises of all sizes.

The ESG reporting software market is experiencing a significant shift toward platforms powered by advanced analytics, artificial intelligence, and cloud-based technologies.

This is fueled by the need for faster, more accurate, and transparent ESG reporting. These tools enable automated data collection, standardization, and real-time analysis, improving the reliability and comparability of ESG disclosures.

This capability is particularly valuable for multinational organizations, financial institutions, and energy companies, where large volumes of complex ESG data require precise management and reporting.

Organizations are increasingly adopting analytics-driven ESG platforms to streamline workflows, enhance compliance, and generate actionable insights. Advanced reporting tools help reduce manual effort, improve data accuracy, and enable more strategic decision-making.

The growing application of AI and digital tools is establishing them as essential enablers for efficient ESG management and sustainable business practices.

- In April 2025, ESG Book, in partnership with Boston Consulting Group, launched LEO, an AI-powered sustainability disclosure platform on Google Cloud. The platform streamlines ESG reporting with standardized data, smart pre-fill features, and secure sharing, supporting compliance and risk management for corporates and financial institutions.

ESG Reporting Software Market Report Snapshot

|

Segmentation

|

Details

|

|

By Offering

|

Software, and Services

|

|

By Deployment Mode

|

On-premises, and Cloud

|

|

By Organization Size

|

Large Enterprises, and Small & Medium Enterprises (SMEs)

|

|

By Vertical

|

BFSI, Government & Public Sector, Manufacturing, Retail and consumer goods, Energy and utilities, IT & Telecom, Healthcare & Life Sciences, and Other Verticals

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Offering (Software, and Services): The software segment earned USD 889.3 million in 2024, primarily due to strong demand for automated ESG data collection and reporting solutions.

- By Deployment Mode (On-premises, and Cloud): The cloud segment held a share of 72.32% in 2024, fueled by the scalability, flexibility, and remote accessibility it offers for ESG reporting.

- By Organization Size (Large Enterprises, and Small & Medium Enterprises (SMEs)): The large enterprises segment is projected to reach USD 2,548.7 million by 2032, owing to their greater regulatory compliance requirements and capacity to invest in advanced ESG reporting solutions.

- By Vertical (BFSI, Government & Public Sector, Manufacturing, Retail and consumer goods, Energy and utilities, IT & Telecom, Healthcare & Life Sciences, and Other Verticals): The IT & telecom segment anticipated to grow at a CAGR of 20.57% through the projection period, fueled by increasing regulatory expectations and the need for transparent ESG reporting in a data-intensive industry.

ESG Reporting Software Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America ESG reporting software market share stood at 37.42% in 2024, valued at USD 479.9 million. This dominance is attributed to the increasing investments from corporations and technology providers, rising demand for transparent and standardized ESG reporting, and the presence of large enterprises in this region that are prioritizing sustainability.

In 2024, the U.S. Securities and Exchange Commission adopted rules to standardize climate-related disclosures for public companies, providing investors with consistent and reliable information on climate risks and management.

Furthermore, the North American market benefits from the widespread use of cloud-based ESG reporting platforms with integrated analytics, where accuracy, compliance, and operational efficiency are critical. Supportive regulatory frameworks, advanced digital infrastructure, and skilled talent availability further enable effective ESG software deployment across this region.

- In April 2025, Zevero launched its AI-powered ESG reporting solution to streamline sustainability disclosures across frameworks like B Corp, CDP, and CSRD. The platform combines AI-driven data extraction with expert validation, reducing reporting time by over 40% while maintaining data accuracy above 90%.

Asia Pacific ESG reporting software industry is set to grow at a CAGR of 21.80% over the forecast period. This growth is fueled by increasing corporate focus on sustainability, rapid digital transformation, and rising adoption of ESG reporting software across industries such as manufacturing, finance, and energy.

Expanding enterprise operations in the region are leveraging cloud-based platforms and advanced analytics to enhance data accuracy, ensure regulatory compliance, and streamline ESG disclosures.

Additionally, government-led sustainability initiatives, along with collaborations between regional companies and global technology providers, are supporting software adoption and infrastructure development.

Furthermore, enterprises are prioritizing real-time analytics, automated reporting, and data-driven decision-making, supported by workforce upskilling and technological advancements, to drive long-term adoption. The growth of digital ecosystems and increasing stakeholder demand for transparency further propel regional market expansion.

- In November 2023, the Monetary Authority of Singapore (MAS) launched Gprnt, an integrated digital platform designed to streamline ESG data collection. Gprnt aims to simplify sustainability reporting processes, enhance data interoperability, and support informed decision-making by businesses, financial institutions, and regulators.

Regulatory Frameworks

- In the United Kingdom, Streamlined Energy and Carbon Reporting (SECR) regulates the disclosure of energy use and carbon emissions. It requires organizations to report on their energy consumption and greenhouse gas emissions, promoting environmental accountability.

- In Japan, the Corporate Governance Code regulates corporate governance and sustainability practices. It promotes transparency in ESG strategies, risk management, and stakeholder engagement, supporting the deployment of comprehensive reporting solutions.

Competitive Landscape

Companies operating in the ESG reporting software industry are maintaining competitiveness through investments in advanced analytics, cloud-based platforms, and strategic partnerships and acquisitions.

They are implementing ESG software for automated data aggregation, performance benchmarking, and regulatory compliance to support operations across finance, energy, manufacturing, and retail sectors.

Market players are expanding their offerings with integrated reporting solutions, AI-driven analytics, and workflow automation tools to address operational requirements and evolving ESG standards.

Moreover, they are establishing regional support centers and collaborating with technology providers and sustainability consultancies to facilitate adoption and improve the effectiveness of ESG initiatives. Additionally, companies are providing training programs, technical support, and real-time monitoring features to improve efficiency and sustain competitive positioning.

- In June 2024, ESG Book and Risk Software Labs announced a partnership to enhance ESG solutions in the Middle East and North Africa (MENA) region. The collaboration combines ESG Book’s global ESG data with Risk Labs’ regional expertise regional expertise in Treasury, Compliance, Risk, and Finance, enabling corporates and financial institutions in MENA to strengthen ESG reporting, ensure compliance, and support strategic decision-making..

Key Companies in ESG Reporting Software Market:

- Pulsora

- Workiva

- IBM

- Novata, Inc.

- Novisto

- SAP SE

- Sphera

- Watershed Technology, Inc.

- Wolters Kluwer N.V.

- Amplo Global

- Brightest, Inc.

- Benchmark Digital Partners LLC

- Cority

- credibl ESG

- Diligent Corporation

Recent Developments (Partnerships/Launch)

- In July 2024, IBM and JLL announced a global partnership to integrate IBM’s Envizi ESG Suite with JLL’s Sustainability Program Management, enhancing ESG reporting and data management for commercial real estate clients. The solution helps streamline the collection and analysis of ESG data across property portfolios, supporting decarbonization efforts and compliance with evolving sustainability standards.

- In April 2024, Infor launched Infor GenAI and ESG Reporting to enhance industry-specific productivity and environmental reporting. The platform uses generative AI and tailored data to streamline ESG reporting, improve accuracy, and track environmental footprints, while adhering to strict security and data privacy standards.