Market Definition

Enterprise governance, risk, and compliance (EGRC) refers to a structured framework that integrates corporate governance, risk management, and regulatory compliance to ensure ethical operations and strategic alignment.

The EGRC market includes software and services that help organizations identify risks, enforce policies, and meet regulatory requirements. It is widely adopted across sectors such as finance, healthcare, and manufacturing to improve transparency, reduce legal exposure, streamline audits, and support informed decision-making.

Enterprise Governance, Risk and Compliance Market Overview

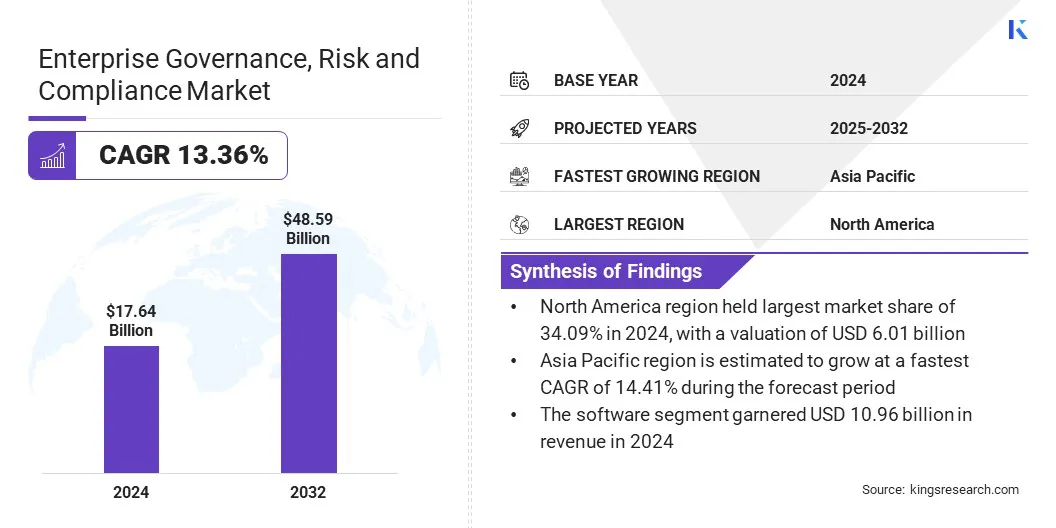

The global enterprise governance, risk and compliance market size was valued at USD 17.64 billion in 2024 and is projected to grow from USD 19.88 billion in 2025 to USD 48.59 billion by 2032, exhibiting a CAGR of 13.36% during the forecast period.

Market growth is driven by rising cybersecurity threats and regulatory pressures, prompting businesses to adopt integrated frameworks for risk management and compliance. Increasing AI integration is streamlining governance workflows and enabling real-time, data-driven risk assessment and oversight.

Major companies operating in the enterprise governance, risk and compliance industry are SAP, Oracle, IBM, ServiceNow, Thomson Reuters, Microsoft, Riskonnect, MEGA International, LexisNexis, Comensure, Onspring Technologies, LLC, FIS, ReadiNow Corporation, Mphasis, and VComply Technologies, Inc.

Market expansion is fueled by the growing demand for automation in compliance processes as organizations seek to eliminate manual, time-consuming tasks. Automation enables faster identification of control gaps, streamlines reporting, and improves accuracy across compliance workflows.

With increasing regulatory complexity, businesses require scalable solutions that adapt to evolving standards while reducing operational burdens. Automated capabilities enhance efficiency, support real-time monitoring, and allow teams to focus on strategic risk mitigation rather than repetitive administrative tasks.

- In April 2025, LogicGate introduced an Automated Control Gap Analysis feature to its Risk Cloud platform, enhancing its cyber, governance, risk, and compliance capabilities. This update replaces manual spreadsheets with automation, enabling organizations to identify control gaps, streamline remediation, and cross-map security measures across frameworks. The feature improves efficiency and strengthens compliance by optimizing risk and control management processes.

Key Highlights:

- The enterprise governance, risk and compliance industry size was recorded at USD 17.64 billion in 2024.

- The market is projected to grow at a CAGR of 13.36% from 2025 to 2032.

- North America held a share of 34.09% in 2024, valued at USD 6.01 billion.

- The software segment garnered USD 10.96 billion in revenue in 2024.

- The on-premises segment is expected to reach USD 28.46 billion by 2032.

- The small & medium enterprises segment is anticipated to witness the fastest CAGR of 14.14% over the forecast period.

- The BFSI segment garnered USD 4.08 billion in revenue in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 14.41% through the projection period.

Market Driver

Increasing Need for Cybersecurity Resilience

The growth of the enterprise governance, risk and compliance market is propelled by the increasing need for cybersecurity resilience as organizations face growing digital threats and regulatory pressures. Businesses are prioritizing robust frameworks to proactively manage cyber risks, ensure operational continuity, and meet compliance requirements.

The focus is on building systems that detect vulnerabilities early, respond effectively, and maintain trust. As threat landscapes evolve, enterprises are investing in integrated governance, risk, and compliance (GRC) solutions to strengthen overall defese mechanism.

- In March 2025, ZainTECH launched its Cybersecurity GRC Service Portfolio at LEAP 2025 in Riyadh, Saudi Arabia, offering organizations comprehensive solutions to meet regulatory demands, manage risks, and enhance cybersecurity resilience. The portfolio combines advisory, professional, and managed services to ensure end-to-end compliance, real-time risk visibility, and alignment with global standards, delivering measurable business value and long-term GRC effectiveness.

Market Challenge

Gap Between the Company's Culture and its EGRC framework

The enterprise governance, risk, and compliance (EGRC) market faces a significant challenge in aligning a company’s culture with its EGRC framework. Many organizations struggle to integrate risk awareness and compliance accountability into daily operations, which leads to ineffective implementation and resistance to EGRC policies.

To address this issue, companies are promoting transparency and responsibility through focused training, leadership involvement, and communication strategies. They are also integrating EGRC practices into daily operations, embedding compliance into the organizational culture.

Market Trend

Integration of AI to Enhance Risk and Compliance Functions

The enterprise governance, risk, and compliance (EGRC) market is witnessing a growing trend of integrating artificial intelligence to enhance risk and compliance functions. AI enables faster identification, assessment, and mitigation of risks by analyzing large volumes of regulatory and financial data.

It streamlines governance workflows, improves decision-making accuracy, and supports real-time monitoring. As organizations prioritize efficiency and strategic oversight, AI-powered tools are becoming essential in building proactive, adaptive EGRC systems that align with evolving regulatory requirements and board-level expectations.

- In April 2025, Diligent launched AI Risk Essentials, a new solution within its GRC platform to strengthen enterprise risk management. Utilizing SEC 10-K data, it enables rapid risk identification, assessment, and mitigation. Enhanced with AI-driven features, the solution streamlines governance workflows, ensures board-level preparedness, and reinforces the EGRC framework with secure and strategic oversight.

Enterprise Governance, Risk and Compliance Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Software (Risk Management, Audit Management, Compliance Management, Policy Management, Privacy Management), Services (Professional, Managed)

|

|

By Deployment

|

Cloud-based, On-premises

|

|

By Organization

|

Large Enterprises, Small & Medium Enterprises

|

|

By Vertical

|

BFSI, Healthcare, Government, Energy & Utilities, Manufacturing, Retail & Consumer Goods, IT & Telecommunications, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Software and Services): The software segment earned USD 10.96 billion in 2024, mainly due to rising demand for automated, scalable solutions that streamline risk management, compliance tracking, and governance processes.

- By Deployment (Cloud-based and On-premises): The on-premises segment held a share of 59.86% in 2024, fueled by greater control over data security, regulatory compliance, and customization requirements among large enterprises.

- By Organization (Large Enterprises and Small & Medium Enterprises): The large enterprises segment is projected to reach USD 25.38 billion by 2032, owing to their higher investment capacity, complex risk landscapes, and the need for comprehensive EGRC solutions to manage regulatory compliance and operational risks.

- By Vertical (BFSI, Healthcare, Government, Energy & Utilities, Manufacturing, Retail & Consumer Goods, IT & Telecommunications, and Others): The BFSI segment garnered USD 4.08 billion in revenue in 2024, propelled by strict regulatory requirements, high exposure to financial and cyber risks, and the critical need for robust EGRC frameworks to ensure compliance and risk mitigation.

Enterprise Governance, Risk and Compliance Market Regional Analysis

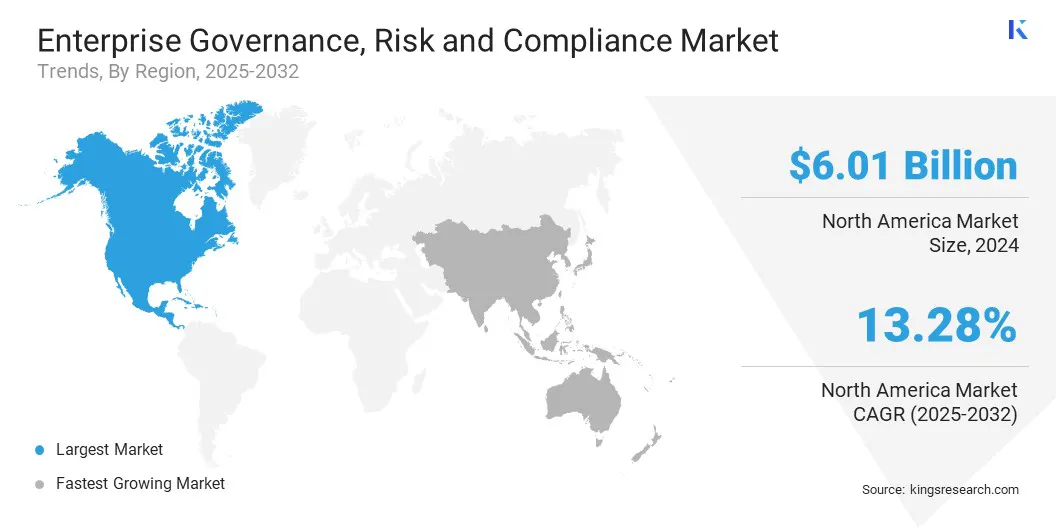

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America enterprise governance, risk and compliance market share stood at 34.09% in 2024, with a valuation of USD 6.01 billion. This dominance is reinforced by the region's strong focus on integrating operational resilience and business continuity within governance, risk, and compliance (GRC) frameworks.

Organizations across the region actively seek advanced, user-centric solutions that align with evolving regulatory requirements and enterprise risk strategies. Moreover, this emphasis on practical implementation, combined with the availability of specialized expertise and tailored advisory services, supports widespread adoption and fuels the demand for comprehensive EGRC platforms across North American enterprises.

- In December 2024, Swiss GRC partnered with OpResONE, Inc. to expand the implementation of advanced GRC solutions across North America. The collaboration leverages Swiss GRC’s Toolbox with OpResONE’s local expertise, offering practical, user-focused integration. The partnership also emphasizes aligning operational resilience and business continuity with GRC frameworks to enhance organizational preparedness and foster strategic growth.

The Asia-Pacific enterprise governance, risk and compliance industry is poised to grow at a robust CAGR of 14.41% over the forecast period. This growth is bolstered by increasing regulatory enforcement across the region.

Governments are implementing stringent compliance requirements in sectors such as finance, healthcare, and technology, compelling organizations to adopt structured EGRC frameworks. This regulatory pressure is prompting businesses to replace manual processes with automated, scalable solutions to ensure adherence to evolving laws, thereby stimulating demand for comprehensive EGRC platforms across emerging Asia Pacific markets.

Regulatory Frameworks

- In the U.S., enterprise governance, risk, and compliance is primarily regulated by the Securities and Exchange Commission (SEC) and the Federal Trade Commission (FTC), overseeing corporate disclosures, data protection, and compliance with financial and consumer protection laws.

- In India, the Securities and Exchange Board of India (SEBI) regulates enterprise governance, risk, and compliance by setting corporate governance norms, disclosure requirements, and risk management guidelines for listed companies and financial institutions.

Competitive Landscape

Companies in the enterprise governance, risk and compliance industry are prioritizing strategic partnerships, mergers and acquisitions, and the launch of advanced solutions.

Key players are expanding their portfolios by acquiring specialized firms, forming alliances to enhance regional presence, and introducing AI-powered platforms and integrated tools. These competitive actions are shaping the market landscape, allowing providers to strengthen their positions, diversify offerings, and respond effectively to evolving regulatory and risk management demands across industries.

- In February 2024, Archer acquired Compliance.ai to enhance its integrated risk management platform with advanced AI-driven regulatory change management capabilities. This strategic move enables Archer clients to automate the monitoring, tracking, reporting, and response to evolving regulations in real time, strengthening compliance initiatives and increasing efficiency across dynamic regulatory environments.

Key Companies in Enterprise Governance, Risk and Compliance Market:

- SAP

- Oracle

- IBM

- ServiceNow

- Thomson Reuters

- Microsoft

- Riskonnect

- MEGA International

- LexisNexis

- Comensure

- Onspring Technologies, LLC

- FIS

- ReadiNow Corporation

- Mphasis

- VComply Technologies, Inc.

Recent Developments (M&A/Partnerships/ Product Launch)

- In March 2025, SAI360 partnered with Signal AI to integrate real-time external risk intelligence into Risk Radar, a new module within its governance, risk, and compliance (GRC) platform. This integration empowers organizations to strengthen risk management by leveraging dynamic, AI-driven external data, enabling proactive identification and response to emerging threats.

- In February 2025, NAVEX and BDO partnered to enhance compliance reporting and risk mitigation. By integrating NAVEX One’s comprehensive GRC capabilities with BDO’s client-focused advisory services, the alliance aims to streamline processes, standardize compliance practices, and improve operational efficiency.

- In September 2024, Archer launched Archer Assurance AI and Archer AI Governance, enhancing its enterprise risk and compliance management solutions. The AI-powered platform automates regulatory mapping, gap analysis, and control generation, ensuring seamless compliance. User-centric interface updates deliver an advanced risk experience across organizational levels, optimizing efficiency and strengthening governance through intelligent, intuitive, and scalable risk management capabilities.

- In June 2024, Riskonnect acquired Camms to expand its governance, risk, and compliance (GRC) offerings and accelerate global expansion. The integration combines Camms’ expertise in aligning risk with business objectives and Riskonnect’s comprehensive risk platform, offering enhanced IT risk, strategy, and resilience features.

- In March 2024, Diligent launched an enterprise risk management (ERM) solution to deliver a unified, data-driven view of risk across key areas. Integrated within the Diligent One Platform, it streamlines cross-functional collaboration, enhances reporting, and leverages advanced analytics to automate tasks and improve operational efficiency.