Market Definition

Enterprise collaboration involves tools and strategies that enable effective communication, information sharing, and coordination across teams and locations. The market includes platforms, services, and solutions that support seamless interaction and content sharing.

It supports remote work, project management, and cross-departmental initiatives to boost productivity, enhance decision-making, streamline workflows, and foster innovation within organizations of all sizes and industries.

Enterprise Collaboration Market Overview

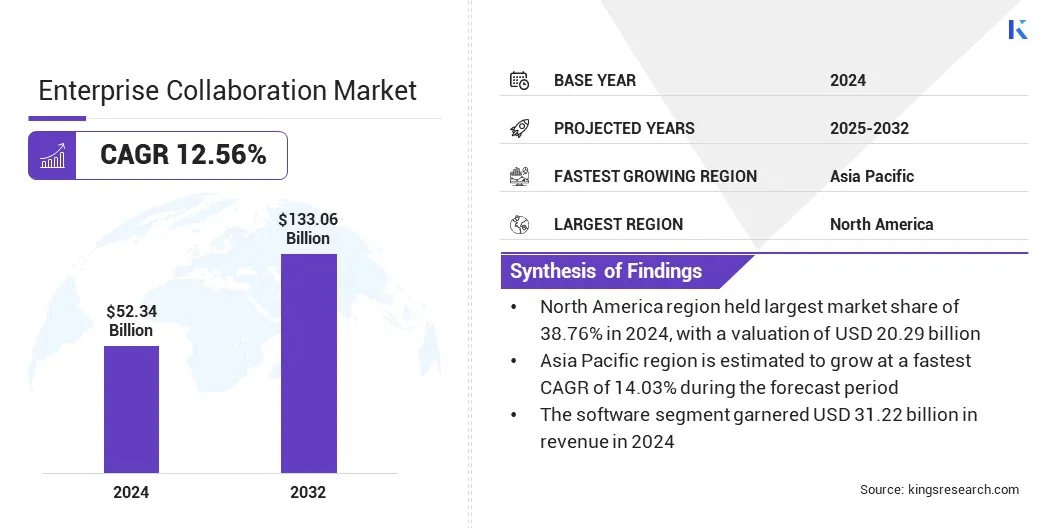

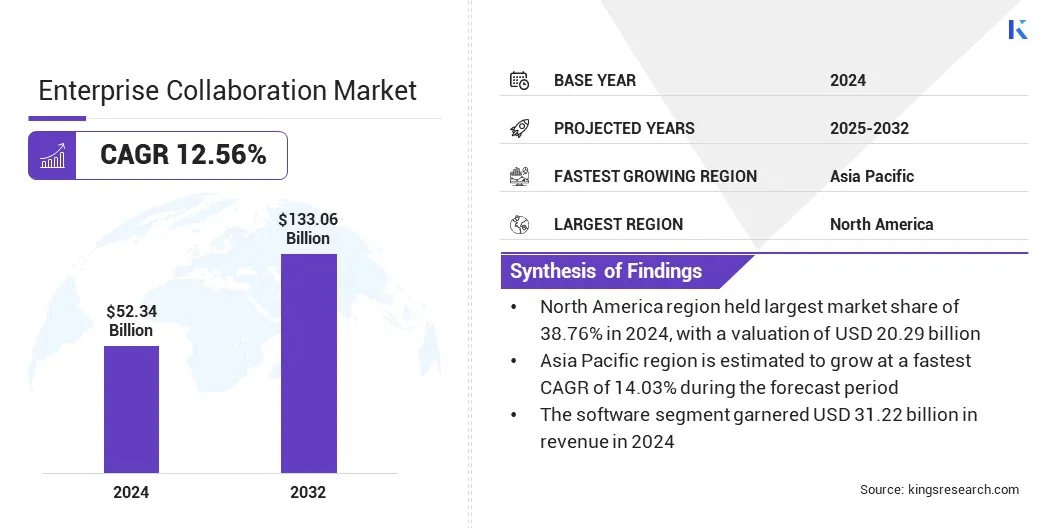

The global enterprise collaboration market size was valued at USD 52.34 billion in 2024 and is projected to grow from USD 58.13 billion in 2025 to USD 133.06 billion by 2032, exhibiting a CAGR of 12.56% during the forecast period.

Market growth is driven by the rising demand for remote work solutions and advanced tools that enable seamless, secure communication across locations. Additionally, AI-powered digital assistants enhance service quality and efficiency by streamlining onboarding processes, automating routine tasks, and providing precise, reliable responses.

Key Highlights:

- The enterprise collaboration industry size was recorded at USD 52.34 billion in 2024.

- The market is projected to grow at a CAGR of 12.56% from 2025 to 2032.

- North America held a share of 38.76% in 2024, valued at USD 20.29 billion.

- The software segment garnered USD 31.22 billion in revenue in 2024.

- The cloud-based segment is expected to reach USD 82.48 billion by 2032.

- The small and medium-sized enterprises (SMEs) segment is anticipated to witness the fastest CAGR of 14.15% over the forecast period.

- The IT & telecommunications segment garnered USD 18.09 billion in revenue in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 14.03% through the projection period.

Major companies operating in the market are Microsoft, Cisco Systems, Inc., Zoom Communications, Inc., Google, Salesforce, Inc., SAP SE, Atlassian, Igloo Software, Zoho Corporation Pvt. Ltd., Adobe, Cloud Software Group, Inc., Slack, Jive Software, LLC, Broadcom, and Asana, Inc.

Market expansion is fueled by the growing need for secure, seamless file collaboration across multiple devices and platforms. Businesses seek solutions that enable simultaneous coauthoring of complex documents without version conflicts, while maintaining robust security standards.

By supporting streamlined workflows and handling expanded file sizes, advanced collaboration tools improve productivity, protect data integrity, and ensure smooth, efficient communication in distributed and dynamic work environments.

- In May 2025, Progress announced an enhanced integration of ShareFile with Microsoft 365, enabling secure, real-time coauthoring and enhanced file collaboration across Office web, desktop, and mobile. This update streamlines workflows, reduces version conflicts, and supports larger file sizes for business documents and high-resolution presentations.

Market Driver

Rising Demand for Remote and Hybrid Work Solutions

The expansion of the enterprise collaboration market is propelled by rising demand for remote and hybrid work solutions that enable teams to operate seamlessly across locations.

Organizations are investing in advanced collaboration tools to address the gap between remote and on-site employees, ensuring effective communication and workflow integration. These solutions enable secure, efficient access to shared resources, supporting productivity and adaptability in line with evolving workforce needs.

- In January 2024, HP highlighted its suite of collaboration tools designed to unify remote and on-site teams, fostering effective communication and seamless cooperation. With 89% of Hong Kongers preferring remote work, HP enables secure, efficient work from anywhere. By selecting the right solutions, businesses can enhance productivity, support flexible work policies, and achieve stronger, more cohesive outcomes.

Market Challenge

Data Security and Privacy Concerns

The progress of the enterprise collaboration market is hindered by rising data security and privacy concerns, as sensitive business information is shared across various platforms and devices. Risks such as breaches, unauthorized access, and regulatory non-compliance risks create barriers to adoption, particularly in industries dealing with confidential data.

To overcome this challenge, companies are implementing robust encryption, multi-factor authentication, and strict access controls. They are investing in compliance certifications, conducting regular security audits, and adopting zero-trust security models. By integrating advanced threat detection and ensuring transparent data governance policies, businesses aim to protect critical information, foster trust, and enable secure collaboration across distributed teams.

Market Trend

Surging Adoption of AI-Powered Digital Assistants for Customer Support

The enterprise collaboration market is witnessing the widespread adoption of AI-powered digital assistants for customer support, enabling streamlined onboarding and enhanced service experiences. These advanced tools automate routine tasks, deliver precise responses using sophisticated language models, and integrate feedback from subject matter experts for continuous improvement.

By reducing manual workload and ensuring consistent, accurate communication, they improve efficiency, accelerate customer engagement, and support high service standards in complex, competitive environments.

- In October 2024, Mastercard expanded its AI solutions with new digital assistant capabilities to streamline customer onboarding. This advanced tool automates routine tasks, delivers accurate responses using Retrieval Augmented Generation, and incorporates expert feedback for continuous learning. By simplifying onboarding and enhancing operational efficiency, the solution supports faster, more efficient customer experiences while maintaining strong AI governance and data management standards.

Enterprise Collaboration Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Software (Communication & Messaging Tools, Conferencing Tools, Project Management & Workflow Automation Tools, Content & Document Collaboration, Others), Services (Consulting & Advisory, Implementation & Integration, Managed Services, Training & Support)

|

|

By Deployment Type

|

Cloud-Based, On-Premise

|

|

By Enterprise Size

|

Large Enterprises, Small and Medium-sized Enterprises (SMEs)

|

|

By End-Use Industry

|

IT & Telecommunications, BFSI, Manufacturing, Healthcare & Life Sciences, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Software and Services): The software segment earned USD 31.22 billion in 2024, mainly due to growing demand for advanced collaboration platforms that enable seamless communication, productivity, and integration across distributed teams.

- By Deployment Type (Cloud-Based and On-Premise): The cloud-based segment held a share of 57.66% in 2024, largely attributed to increasing preference for scalable, cost-effective solutions that support remote access and seamless collaboration across locations.

- By Enterprise Size (Large Enterprises and Small and Medium-sized Enterprises (SMEs)): The small and medium-sized enterprises (SMEs) segment is projected to reach USD 68.82 billion by 2032, owing to the rising adoption of affordable, flexible collaboration solutions that enhance productivity and competitiveness.

- By End-Use Industry (IT & Telecommunications, BFSI, Manufacturing, Healthcare & Life Sciences, and Others): The IT & telecommunications segment garnered USD 18.09 billion in revenue in 2024, propelled by high demand for robust collaboration tools that enable efficient communication, remote work, and seamless project management across global teams.

Enterprise Collaboration Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America enterprise collaboration market share stood at 38.76% in 2024, valued at USD 20.29 billion. This dominance is reinforced by the widespread adoption of integrated digital platforms that centralize communication, file sharing, and project management.

By supporting modern work styles and enabling seamless coordination across teams, these solutions enhance operational efficiency and agility. Strong technological infrastructure and a major focus on innovation further prompt businesses to adopt advanced collaboration tools.

The Asia-Pacific enterprise collaboration industry is poised to grow at a robust CAGR of 14.03% over the forecast period. This growth is stimulated by the expanding mobile workforce and high smartphone penetration, enabling seamless connectivity and productivity from any location. As companies prioritize flexible work policies to attract and retain talent, the demand for secure, user-friendly collaboration tools increases.

Additionally, strong economic growth and rising competitiveness across industries prompt businesses to adopt advanced solutions that support real-time communication, streamlined workflows, and effective team coordination across geographically dispersed operations.

Regulatory Frameworks

- In the U.S., enterprise collaboration is regulated by the Federal Trade Commission (FTC), which oversees consumer protection and data privacy, and the Federal Communications Commission (FCC), which governs communications infrastructure to ensure secure and reliable digital interactions.

- In India, enterprise collaboration is primarily governed by the Ministry of Electronics and Information Technology (MeitY), which monitors digital policies and data governance, and the Telecom Regulatory Authority of India (TRAI), which manages communication networks and services standards.

- In Europe, the European Data Protection Board (EDPB) regulates enterprise collaboration by ensuring compliance with data privacy laws such as the General Data Protection Regulation (GDPR) to protect personal information shared across collaboration platforms.

Competitive Landscape

Companies in the enterprise collaboration industry are actively adopting strategies such as mergers and acquisitions to expand capabilities and strengthen market positions. Key players are entering strategic partnerships to enhance technology integration and improve platform offerings.

Firms are also launching new products and solutions to address evolving collaboration needs. Additionally, investments in research and development support continuous innovation, enabling companies to maintain competitiveness in a rapidly evolving market.

- In April 2025, Atlassian launched Rovo, an enterprise AI solution designed to enhance enterprise collaboration by integrating advanced AI-powered search, chat, and agents into team workflows. Available with existing subscriptions, Rovo enables users of Jira, Confluence, and Jira Service Management to access knowledge, streamline communication, and support efficient human-AI collaboration across complex enterprise environments.

List of Key Companies in Enterprise Collaboration Market:

- Microsoft

- Cisco Systems, Inc.

- Zoom Communications, Inc.

- Google

- Salesforce, Inc.

- SAP SE

- Atlassian

- Igloo Software

- Zoho Corporation Pvt. Ltd.

- Adobe

- Cloud Software Group, Inc.

- Slack

- Jive Software, LLC

- Broadcom

- Asana, Inc.

Recent Developments (Partnerships/ Product Launches)

- In March 2025, Microsoft Teams unveiled a range of innovations at Enterprise Connect 2025, enhancing chat, meetings, events, Teams Phone, Rooms, and security. These updates aim to strengthen enterprise collaboration by enabling seamless communication and integrating advanced AI capabilities to support hybrid work.

- In March 2025, Citrix partnered with Google to integrate Chrome Enterprise Premium into the Citrix platform. This collaboration enhances Citrix’s ability to securely deliver enterprise applications, offering customers enhanced security and seamless access through a trusted enterprise browser.

- In April 2024, Cloud Software Group and Microsoft entered an eight-year partnership to advance enterprise collaboration through integrated cloud and AI solutions. This agreement strengthens Citrix’s position as an Enterprise Desktop as a Service partner, streamlines customer cloud adoption, and enhances access to Citrix solutions via Azure Marketplace.