Market Definition

Enteral feeding formulas are nutritionally balanced liquid diets administered directly into the gastrointestinal tract for patients unable to consume food orally. The market includes the production of these specialized nutritional solutions used in hospitals, home care, and long-term care settings.

These formulas are applied in treating individuals with chronic illnesses, neurological disorders, or post-surgical conditions to ensure adequate nutrient intake and support recovery & overall health management.

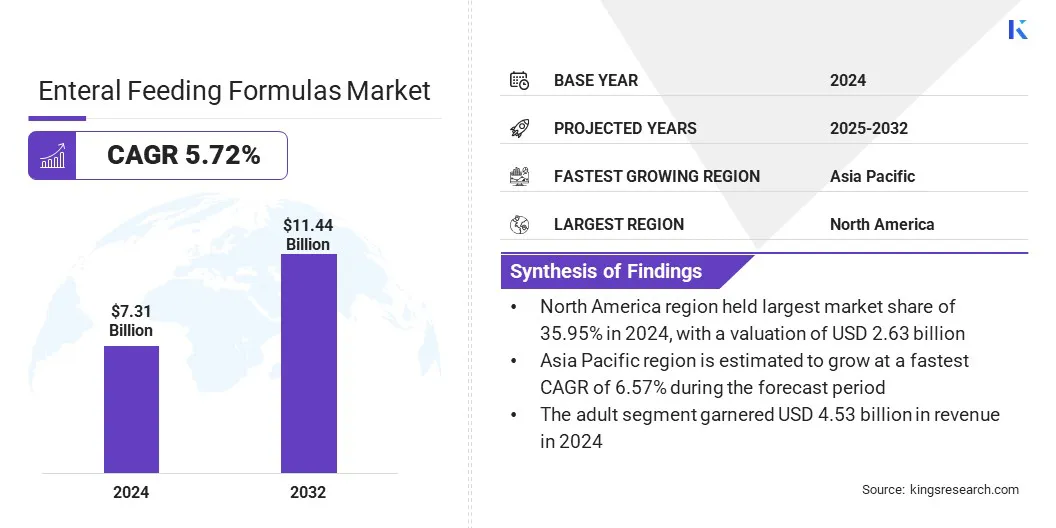

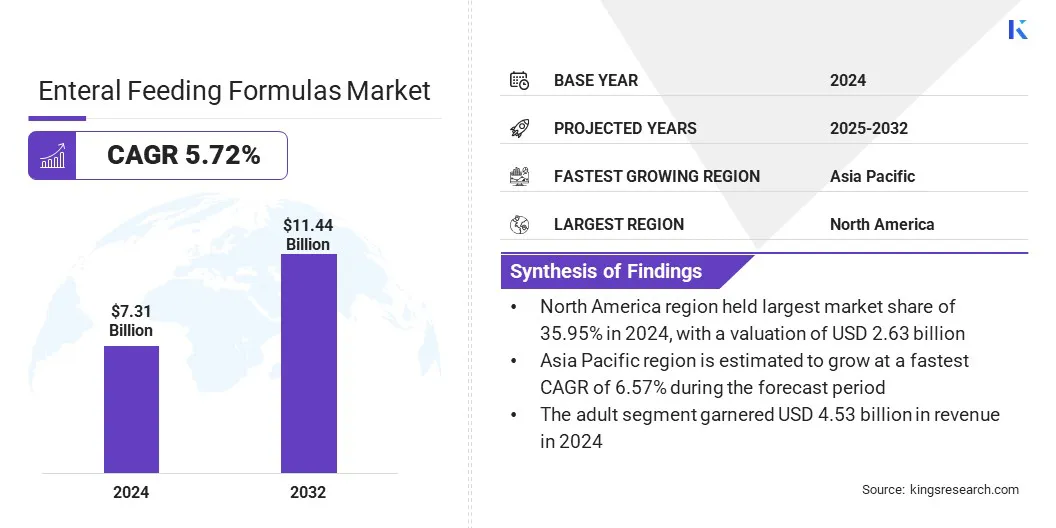

The global enteral feeding formulas market size was valued at USD 7.31 billion in 2024 and is projected to grow from USD 7.71 billion in 2025 to USD 11.44 billion by 2032, exhibiting a CAGR of 5.72% during the forecast period.

Increasing prevalence of the elderly population with swallowing difficulties is driving the demand for alternative nutritional support. Simultaneously, rising preference for plant-based, clean-label products is reshaping product development to meet evolving dietary and clinical expectations.

Major companies operating in the enteral feeding formulas industry are Nestlé S.A., Fresenius Kabi AG, Otsuka Holdings Co., Ltd., Abbott, Medtrition Inc., Danone, B. Braun SE, Kate Farms, Nutritional Medicinals, LLC, Meiji Holdings Co., Ltd., Global Health Products, Inc., Victus, Real Food Blends, Medline Industries, LP., and DermaRite Industries, LLC.

The market is driven by the rising prevalence of chronic diseases, which is leading to a larger patient population requiring consistent nutritional support. Conditions such as cancer, diabetes, and gastrointestinal disorders often impair normal eating, making enteral nutrition essential for maintaining health and recovery.

The growing number of individuals managing multiple chronic illnesses is increasing the reliance on clinically formulated nutrition, thereby boosting demand across healthcare settings, including hospitals, long-term care facilities, and home-based care environments.

- In February 2024, the Centers for Disease Control and Prevention reported that an estimated 129 million people in the US have at least one major chronic disease, with 42% managing two or more and 12% managing five or more. Chronic conditions account for approximately 90% of the annual USD 4.1 trillion healthcare expenditure, significantly impacting the nation's healthcare system.

Key Highlights:

- The enteral feeding formulas market size was valued at USD 7.31 billion in 2024.

- The market is projected to grow at a CAGR of 5.72% from 2025 to 2032.

- North America held a market share of 35.95% in 2024, with a valuation of USD 2.63 billion.

- The standard formulas segment garnered USD 2.19 billion in revenue in 2024.

- The adult segment is expected to reach USD 6.90 billion by 2032.

- The cancer segment is anticipated to register a CAGR of 5.82% during the forecast period.

- The hospital segment garnered USD 2.96 billion in revenue in 2024.

- The market in Asia Pacific is anticipated to grow at a CAGR of 6.57% during the forecast period.

Market Driver

Growing Prevalence of Elderly Population with Swallowing Difficulties

The market is expanding, due to the growing prevalence of elderly population with swallowing difficulties, which affects a significant percentage of older adults across various care settings. Aging individuals commonly face dysphagia resulting from age-related physiological changes or medical conditions, boosting the need for alternative nutritional delivery methods.

This demographic is driving consistent demand for enteral nutrition products that can support safe & efficient nutrient intake in populations unable to meet their dietary needs through conventional means.

- In April 2024, the National Institute of Health reported that the global prevalence of swallowing difficulties among adults was 43.8%, rising to 48.1% in older adults. Rates vary significantly based on setting, assessment tools, and geography, with hospital rates reaching up to 77% and nursing facilities up to 68%. Country-specific prevalence ranges from 2.6% in the U.S. to 25.1% in Japan.

Market Challenge

Risk of Infections and Tube-related Complications

The enteral feeding formulas market faces a significant challenge in the form of risk of infections and tube-related complications such as aspiration pneumonia, clogged feeding tubes, and gastrointestinal infections. These complications may result in serious clinical outcomes, including compromised nutritional delivery and increased patient morbidity.

Companies are focusing on developing formulas with improved sterility, enhancing packaging to reduce contamination risks, and designing user-friendly feeding systems that minimize handling. Additionally, manufacturers are investing in training programs for caregivers and healthcare professionals to ensure proper administration techniques and early detection of tube-related complications.

Market Trend

Rising Interest in Plant-based and Clean-label Enteral Formulas

Consumer interest in plant-based and clean-label products is growing, reflecting changing preferences toward organic, non-GMO, and allergen-free nutritional options. Consumers and healthcare providers are placing greater emphasis on ingredient transparency and the exclusion of artificial additives.

This trend is influencing product development strategies across age groups, particularly in pediatric and chronic care segments, where clean formulations are gaining traction. Companies are innovating to meet these expectations with high-quality, naturally sourced ingredients tailored to specific dietary needs.

- In March 2025, Kate Farms launched Kids Nutrition, a plant-based shake offering complete, balanced nutrition for children aged 1 to 13 years. Formulated with high-quality, allergen-free ingredients, it meets dietary needs while appealing to health-conscious parents. The product is USDA Organic, Non-GMO Project Verified, and free from artificial additives, reinforcing Kate Farms’ commitment to clean, pediatric-focused nutritional solutions.

|

Segmentation

|

Details

|

|

By Product

|

Standard Formulas, Disease-specific Formulas, Peptide Based, Immune modulating, Blenderized, Others

|

|

By Stage

|

Adult, Pediatric

|

|

By Application

|

Cancer, Neurological Disorders, Gastrointestinal Disorders, Malnutrition, Others

|

|

By End User

|

Hospital, Long-term Care Facilities, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product (Standard Formulas, Disease-specific Formulas, Peptide Based, Immune modulating, Blenderized, and Others): The standard formulas segment earned USD 2.19 billion in 2024, due to their widespread clinical acceptance, cost-effectiveness, and suitability for general nutritional support across diverse patient populations.

- By Stage (Adult, and Pediatric): The adult segment held 61.90% share of the market in 2024, due to the high prevalence of chronic diseases and age-related conditions requiring long-term nutritional support among the adult population.

- By Application (Cancer, Neurological Disorders, Gastrointestinal Disorders, and Malnutrition): The gastrointestinal disorders segment is projected to reach USD 3.42 billion by 2032, owing to the rising incidence of digestive conditions that impair natural nutrient absorption, driving sustained demand for enteral nutritional support.

- By End User (Hospital, Long-term Care Facilities, and Others): The hospital segment earned USD 2.96 billion in revenue in 2024, due to the high volume of critical care admissions and the routine use of enteral nutrition for inpatients requiring monitored nutritional support.

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for a market share of around 35.95% in 2024, with a valuation of USD 2.63 billion. The region dominates the enteral feeding formulas market, due to the strong presence of advanced medical nutrition infrastructure and growing integration of whole food-based enteral solutions.

Increasing focus on expanding clinical nutrition portfolios tailored to patient-specific needs has strengthened the regional supply chain and market access.

This emphasis on innovation, coupled with strategic efforts to enhance enteral feeding options across healthcare settings, reinforces North America’s leading position in delivering diverse and specialized nutritional support solutions across patient populations.

- In May 2024, Danone announced the successful acquisition of Functional Formularies, a leading U.S.-based whole foods tube feeding company, from Swander Pace Capital. This acquisition supports the Renew Danone strategy and enhances Danone’s Medical Nutrition portfolio by expanding its enteral tube feeding product offerings in the U.S. market.

The market in Asia Pacific is poised for significant growth at a robust CAGR of 6.57% over the forecast period. The region dominates the enteral feeding formulas industry, due to the increasing demand for adult medical nutrition amid a rapidly aging population and rising chronic disease incidence.

Emphasis on improving nutritional care after hospital discharge is accelerating the adoption of specialized formulas tailored to local patient needs. Regional production capabilities and targeted solutions for recovery support are strengthening the availability and relevance of enteral nutrition.

These factors collectively enhance the region’s position in addressing evolving clinical nutrition requirements across diverse healthcare settings.

- In November 2023, Danone launched its first adult Foods for Special Medical Purposes (aFSMP) products in China, marking its entry into the adult medical nutrition category. Designed to support recovery from surgery and chronic diseases, this development strengthens Danone’s enteral feeding formulas portfolio and aligns with growing nutritional care needs across China’s aging population.

Regulatory Frameworks

- In the U.S., enteral feeding formulas are regulated by the Food and Drug Administration (FDA) as medical foods. The FDA oversees labeling, manufacturing standards, and safety, ensuring that products meet specific nutritional requirements for medical conditions.

- In India, enteral feeding formulas are regulated by the Food Safety and Standards Authority of India (FSSAI), which oversees their safety, quality, labeling, and compliance under the Food Safety and Standards Act, 2006.

- In China, enteral feeding formulas are regulated by the National Medical Products Administration (NMPA), which oversees the safety, quality, and approval of medical foods and nutritional products used for clinical & therapeutic purposes.

Competitive Landscape

Companies operating in the enteral feeding formulas market are actively pursuing growth through strategic initiatives such as mergers and acquisitions, product launches, and geographic expansion. Key players are enhancing their portfolios by introducing condition-specific and plant-based formulas while expanding their global footprint through distribution partnerships.

These actions reflect a competitive landscape focused on innovation, market penetration, and strengthening brand presence across various healthcare settings to capture evolving demand and regulatory opportunities in both developed and emerging markets.

- In May 2025, Avanos Medical, Inc. announced direct sales and distribution of its MIC-KEY enteral feeding products in the UK. With over 25 years of global use, MIC-KEY’s low-profile feeding tube supports patient nutrition across 60 countries. This strategic move aims to enhance product accessibility and improve customer experience in the UK.

List of Key Companies in Enteral Feeding Formulas Market:

- Nestlé S.A.

- Fresenius Kabi AG

- Otsuka Holdings Co., Ltd.

- Abbott

- Medtrition Inc.

- Danone

- Braun SE

- Kate Farms

- Nutritional Medicinals, LLC

- Meiji Holdings Co., Ltd.

- Global Health Products, Inc.

- Victus

- Real Food Blends

- Medline Industries, LP.

- DermaRite Industries, LLC.

Recent Developments (M&A/ Product Launch)

- In May 2025, Danone announced a definitive agreement to acquire a majority stake in Kate Farms, enhancing its position in the market. Kate Farms’ plant-based, organic medical nutrition portfolio complements Danone’s specialized offerings. The partnership aims to expand access to high-quality, clinically trusted nutrition for patients with diverse health needs across the U.S. healthcare landscape.

- In September 2024, Nutricia, a Danone company, launched its reformulated Nutrison core range tube feeds at the 46th ESPEN Congress in Milan. As its top-selling adult medical nutrition brand, Nutrison delivers specialized tube feeds designed to address malnutrition in patients unable to eat or drink, particularly those undergoing treatment for critical illnesses or cancer.

- In September 2023, Cardinal Health launched the Kangaroo OMNI Enteral Feeding Pump in the U.S., offering a compact, attitude-independent system capable of delivering thick, homogenized, and blended formulas. Designed for use across care settings, it supports feeding, flushing, hydration, and records 30-day feeding history, enhancing personalized enteral nutrition management for patients and caregivers.

- In July 2023, Otsuka Pharmaceutical Factory launched two new 200 kcal/125 mL coffee and tea flavored variants of ENORAS Liquid for Enteral Use. Designed for feeding tubes and oral administration, these concentrated formulas support efficient nutrient intake in smaller volumes. The enhanced flavor variety and user-friendly packaging aim to improve patient adherence and accommodate personalized nutrition management.