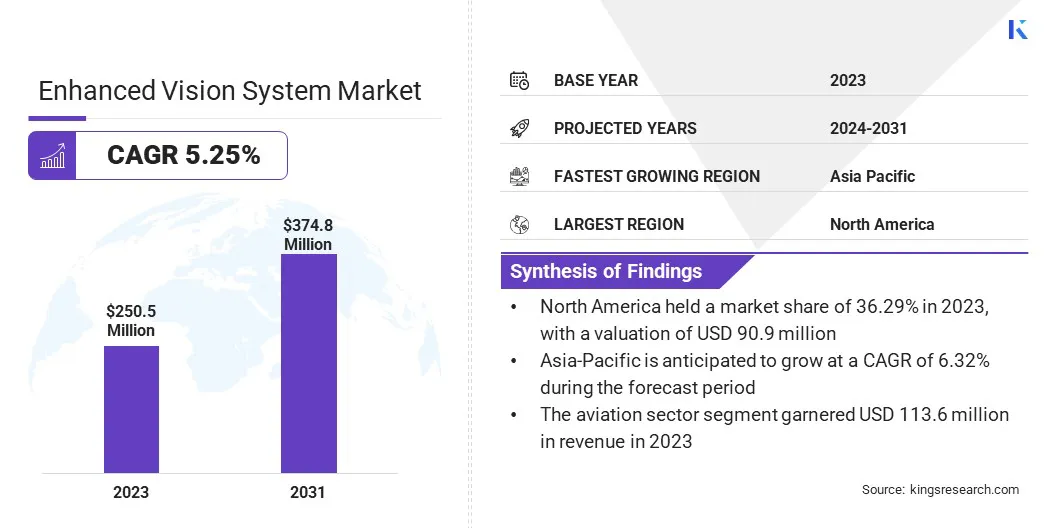

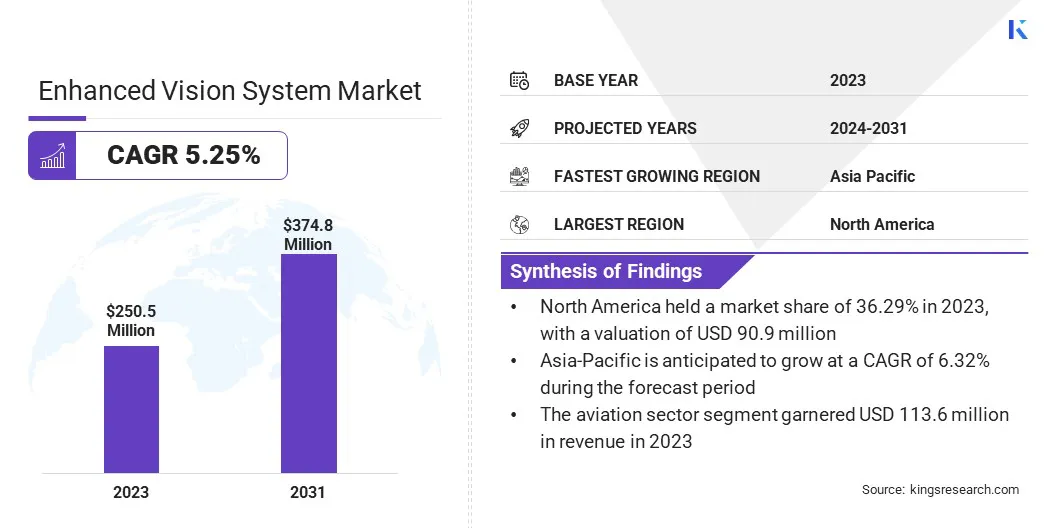

Enhanced Vision System Market Size

Global Enhanced Vision System Market size was recorded at USD 250.5 million in 2023, which is estimated to be at valued USD 261.9 million in 2024 and reach USD 374.8 million by 2031, growing at a CAGR of 5.25% from 2024 to 2031.

In the scope of work, the report includes solutions offered by companies such as ABB, Collins Aerospace, Honeywell International Inc., Astronics Corporation, Universal Avionics, Saab AB, L3Harris Technologies, Inc., Thales, Rosenbauer International AG, Mercury Systems, Inc., Bombardier Inc., and others. Head-up displays (HUD) and Augmented reality (AR) overlays are now key to enhanced vision systems, which is expected to boost the market..

HUDs let pilots see key flight data in their line of sight. This reduces the need to look down at cockpit instruments and helps maintain situational awareness. Integrating EVS with HUDs projects vital data onto the HUD. This includes terrain, runway markings, and obstacles from the enhanced vision systems. Therefore, this technology provides a complete real-time view, even in bad weather.

Augmented reality (AR) overlays enhance this by adding data to the live video feed from Enhanced Vision Systems. This integration eases the pilot's workload. It improves decision-making in critical flight phases, like takeoff, landing, and low-visibility conditions. The trend is further fueled by the increasing focus on aviation safety and efficiency. Regulatory bodies and aviation authorities are urging the use of new tech. The goal is to reduce human error and improve performance.

HUDs and AR overlays in EVS provide an enhanced view of the outside world, and merge this view with flight data. This is a major advance in avionics. It makes flights safer and more efficient. An enhanced vision system is a technology that comes under advanced avionics. It improves pilots' visibility and situational awareness in low-visibility conditions like fog, heavy rain, night, or snow. These systems use infrared cameras, radar, and various other sensors to display real-time visual information.

Enhanced vision systems are mainly used in aviation. They benefit commercial, business, and military aviation by improving safety and efficiency. The technologies driving enhanced vision systems include:

- Infrared sensors, which detect thermal emissions and provide clear images in darkness.

- Millimeter-wave radar, which penetrates fog and rain to reveal obstacles.

- Synthetic vision systems (SVS), which use a database to create a computer-generated image of the terrain.

These technologies often combine to form a Combined Vision Systems (CVS). CVS provides the benefits of both synthetic and real-time imagery.

EVS is extensively used in many applications. It is used to improve safety in commercial airline operations. It is also critical for business jets that need flexibility. In military aviation, mission success and safety depend on superior situational awareness provided by EVS. Thus, EVS is a key advance in aviation technology. It greatly reduces accidents and improves flight efficiency.

Analyst’s Review

The enhanced vision system market is growing fast. This is due to technology advancement and stricter rules to improve aviation safety. However, the landscape is competitive and key players are adopting various strategies to stay ahead. A key strategy is to continuously innovate. Manufacturers must integrate cutting-edge technologies, like AI, machine learning, and augmented reality, into their vision systems.

Also, companies are focusing on expanding their reach. This is especially true in emerging markets with rapidly growing aviation infrastructure.

The enhanced vision system market demands a complex strategy. It must include tech innovation, partnerships, market expansion, and regulatory compliance. These imperatives are crucial and will help key companies operating in the market to compete and meet the growing demand for advanced vision systems in aviation.

Enhanced Vision System Market Growth Factors

The rise in night flights in commercial and military aviation is boosting the adoption of low-visibility navigation systems. Night operations are challenging as low visibility makes it difficult to spot obstacles and terrain. For commercial airlines, daily operations create a need for reliable navigation vital for safe night flights.

In this context, enhanced vision systems are crucial. They give pilots clear, real-time visuals even in low-light conditions and bad weather. As military operations often require precision and stealth, they are often carried out in the night to avoid detection. In these cases, EVS improves awareness and allows safer maneuvers and accurate targeting.

Regulatory bodies and aviation organizations are focusing more on these systems to reduce the risks of night flights. The enhanced vision system market is growing fast driven by a critical need for better safety and efficiency in low-visibility conditions.

A major challenge for the enhanced vision system market is creating standardized data formats and ensuring different EVS systems can work together. As manufacturers develop their own technologies and data formats, compatibility and integration across systems and aircraft becomes difficult.

The lack of standardization causes fragmented information and inefficiencies. This is particularly challenging when different parts of an aviation system have to work together. Integrating EVS with other avionics systems, like SVS or HUDs, often requires custom solutions. This increases complexity and costs.

Resolving this challenge requires industry-wide collaboration. Companies must develop common standards and protocols to ensure interoperability. Regulatory bodies and industry associations play a crucial role in facilitating this process by setting and enforcing standard data formats. This improves efficiency, safety, and integration. These efforts contribute to the overall effectiveness of enhanced vision system technologies.

Enhanced Vision System Market Trends

A major trend is integrating artificial intelligence (AI) and machine learning (ML) into enhanced vision systems. AI integration and ML integration are revolutionizing image processing and object detection capabilities, and can significantly enhance the functionality of these systems. AI and ML algorithms analyze vast visual datasets in real-time.

They accurately identify and highlight critical features, like terrain, obstacles, and other aircraft. The advanced processing power boosts the vision system. It gives pilots clear, detailed visual information, even in poor visibility. Machine learning models are trained to find specific patterns and anomalies. This improves the system's ability to detect and respond to potential hazards.

Also, AI advancements enable predictive analytics. Systems can now analyze data trends to alert and ready pilots for possible future scenarios. Therefore, the rising need for advanced, reliable vision systems in aviation supports the trend of AI and ML integration.

Segmentation Analysis

The global enhanced vision system market has been segmented by platform type, technology, application, and geography.

By Platform Type

The market is categorized by platform type into fixed-wing, rotary-wing, and maritime vessels. The fixed-wing segment held the largest share of 43.38% in the 2023 enhanced vision system market. Fixed-wing aircraft, including commercial airliners and military jets, make up most of the global aviation fleet.

These aircraft are used for long-haul flights, cargo transport, and military missions, which requires advanced navigation and safety technology, like enhanced vision systems. There is a growing push to reduce accident rates, especially during takeoff and landing. Therefore, increasing stringency of safety regulations is dictating the adoption of EVS in fixed-wing aircraft.

Also, rising air travel demand and bigger airline fleets are boosting the segment's growth. Airlines and operators invest heavily in updating their avionics to improve efficiency and safety. Also, new and improved EVS technology and its integration with aircraft systems boost pilot awareness and safety. All these factors are expected to drive the uptake of EVS and support the segment growth.

By Technology

The enhanced vision system market, based on technology, has been divided into infrared, synthetic vision, and millimeter wave radar segments. The millimeter wave radar segment is estimated to grow at a CAGR of 6.40% through the forecast period. Its superior performance in bad weather and rising use in aviation are driving this growth.

Millimeter wave radar systems excel at detecting obstacles, terrain, and aircraft. They work well in low-visibility conditions caused by heavy fog, rain, or snow. Millimeter wave radar systems create high-res images and measure distances accurately for improving situational awareness and safety. A focus on flight safety and collision avoidance has raised demand for advanced radar systems in commercial and military aviation.

Further, advances in radar technology, like miniaturization and better signal processing, make millimeter wave radar systems efficient and accessible. Regulatory bodies are mandating the use of advanced safety systems. This is fueling the trend of integrating radar with other sensors in enhanced vision systems.

By Application

The market has been divided by application into aviation, maritime, ground vehicles, and others. In 2023, the aviation sector earned USD 113.6 million. This was due to the rising use of enhanced vision systems in aircraft to boost safety and efficiency. There is high demand for EVS in commercial aviation. Airlines look to improve safety and reduce accident risks, especially during takeoff and landing.

The integration of EVS with other avionics systems provides pilots with a comprehensive view of the surroundings, which helps improve pilots' decision making and ultimately enhance flight safety. Business aviation also drives this growth. Corporate jet operators equip their fleets with the latest safety technology to ensure passenger safety and reliable operations. Also, huge investments by the military aviation sector in advanced navigation and targeting systems boost the demand for EVS. This, in turn, drives the segment's growth.

Enhanced Vision System Market Regional Analysis

The global market has been classified by region into North America, Europe, Asia-Pacific, MEA, and Latin America.

In 2023, North America held a 36.29% share of the global Enhanced Vision System Market accounting for USD 90.9 million. The region's strong aviation industry and investments in advanced avionics drove this growth. The U.S. has major aircraft manufacturers and tech firms that boost the use of enhanced vision systems.

Also, the strict safety rules of the Federal Aviation Administration (FAA) and other regulators have increased the demand for advanced safety and navigation systems in both commercial and military aviation. North America has a strong R&D infrastructure. It drives innovation and integrates new technologies, like AI and AR, into vision systems. The high rate of air travel and a large fleet of planes boost the North America enhanced vision system market.

Also, the U.S. military's large budget for advanced avionics supports the use of EVS in defense applications. This solidifies North America's top spot in the global market.

Asia-Pacific's aviation sector is booming. It will grow at a 6.32% CAGR in the near future due to rising investments in aviation infrastructure. China, India, and Southeast Asian nations are seeing a surge in air travel demand. It is due to rising middle-class populations and economic growth. The rise in air traffic requires better safety and navigation systems. These include enhanced vision systems to ensure efficiency and passenger safety.

Also, governments in the region are investing heavily to modernize their aviation infrastructure. This includes upgrading airports and air traffic control systems. As a result, demand for EVS is increasing. The rise of low-cost carriers and new airlines boosts the regional market. More aircraft manufacturers and MRO facilities in Asia-Pacific support the integration of advanced avionics systems. The region's push to improve military capabilities drives the use of EVS due to a focus on advanced navigation and targeting systems.

Competitive Landscape

The enhanced vision system market report provides valuable insights which indicate the fragmented nature of the industry. Top players are pursuing key strategies to expand their products and market shares. These include partnerships, mergers, acquisitions, innovations, and joint ventures. In this regard, investments in R&D, new factories, and supply chain fixes are expected to create new growth opportunities.

List of Key Companies in Enhanced Vision System Market

- ABB

- Collins Aerospace

- Honeywell International Inc.

- Astronics Corporation

- Universal Avionics

- Saab AB

- L3Harris Technologies, Inc.

- Thales

- Rosenbauer International AG

- Mercury Systems, Inc.

- Bombardier Inc.

Key Industry Developments

- October 2023 (Achievement): AerSale Corporation announced a breakthrough in aviation safety and efficiency. The company improved visual clarity by 50% in low visibility. With its AerAware Enhanced Flight Vision System on the Boeing B737NG. This is a pioneering achievement in commercial aviation in licensing agreement with Boeing.

- July 2023 (Expansion): Mercury Systems won an USD 83 million, five-year contract from the U.S. Naval Air Systems Command to supply high-definition digital HUD systems for T-45 Goshawk training aircraft. Mercury will deliver nearly 300 HUD systems under this contract. The initial production order totaled USD 45 million.

- June 2023 (Acquisition): Honeywell acquired Saab's heads-up-display assets. It will integrate them into Honeywell avionics. As part of the deal, Saab collaborated with Honeywell to expand its HUD product line.

The Global Enhanced Vision System Market has been segmented:

By Platform Type

- Fixed-Wing

- Rotary-Wing

- Maritime Vessels

By Technology

- Infrared

- Synthetic Vision

- Millimeter Wave Radar

By Application

- Aviation

- Maritime Navigation

- Ground Vehicles

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America