Market Definition

The market involves delegating engineering tasks such as design, prototyping, and testing to external providers. This approach enhances access to specialized expertise, reduces costs, and accelerates product development.

ESO spans industries such as automotive, aerospace, healthcare, and IT, leveraging technologies such as AI, IoT, and digital twins.

Engineering Services Outsourcing Market Overview

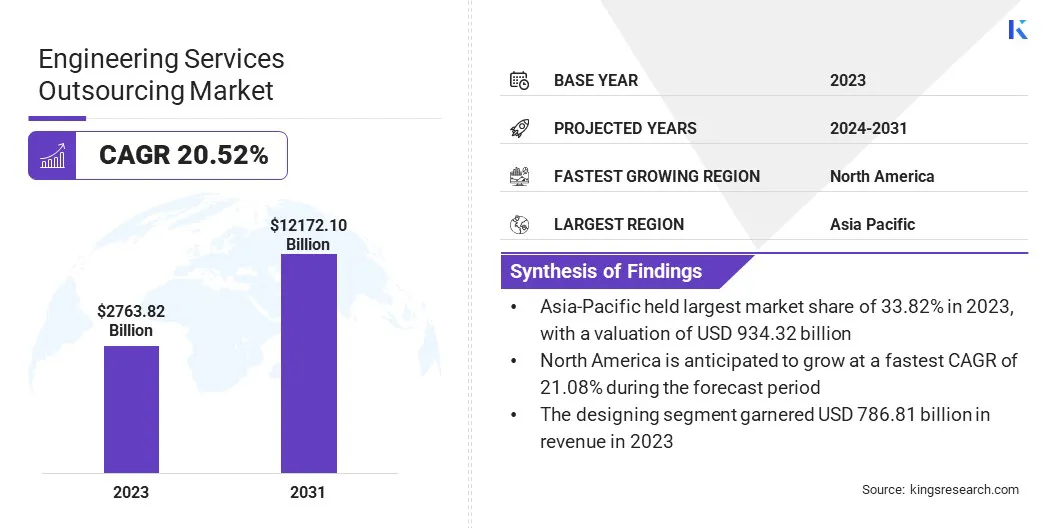

The global engineering services outsourcing market size was valued at USD 2763.82 billion in 2023 and is projected to grow from USD 3295.58 billion in 2024 to USD 12172.10 billion by 2031, exhibiting a CAGR of 20.52% during the forecast period.

This growth is driven by increasing demand for cost-effective engineering solutions, advancements in digital technologies such as AI, IoT, and cloud computing, and the rising complexity of product development across industries.

Major companies operating in the engineering services outsourcing industry are Accenture, ALTEN Group, Capgemini, Infosys Limited, HCL Technologies Limited, TATA Consultancy Services Limited, Tech Mahindra Limited, Wipro, IBM, AVL, Bertrandt AG, L&T Technology Services Limited, Quest Global, Cybage Software Pvt. Ltd., and Entelect.

Industries such as automotive, aerospace, healthcare, and IT are increasingly outsourcing engineering tasks to enhance efficiency, accelerate innovation, and reduce costs.

Additionally, globalization and demand for specialized expertise are fueling market expansion. The rising focus on R&D, digital transformation, and strategic collaborations is expected to sustain this growth.

- In June 2024, Cognizant and Gentherm signed an agreement to expand strategic product engineering services and establish a new delivery center. This collaboration aims to enhance innovation, accelerate product development, and integrate advanced technologies in engineering services.

Key Highlights

- The engineering services outsourcing industry size was recorded at USD 2763.82 billion in 2023.

- The market is projected to grow at a CAGR of 20.52% from 2024 to 2031.

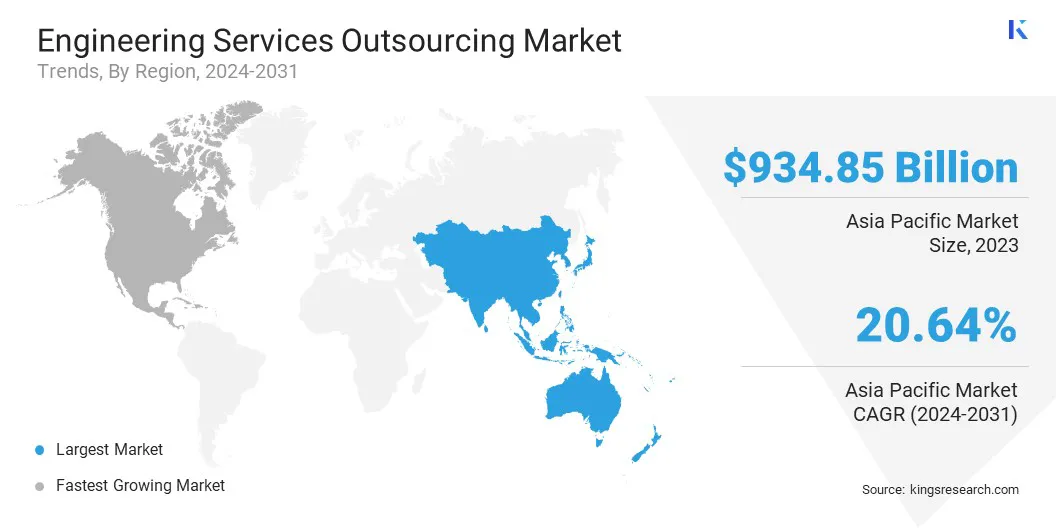

- Asia-Pacific held a share of 33.82% in 2023, valued at USD 934.85 billion.

- The designing segment garnered USD 786.81 billion in revenue in 2023.

- The manufacturing segment is expected to reach USD 3262.72 billion by 2031.

- North America is anticipated to grow at a CAGR of 21.08% over the forecast period.

Market Driver

"Cost Efficiency & Financial Flexibility"

The engineering services outsourcing market is growing rapidly due to cost efficiency and operational savings. Businesses reduce expenses on hiring, training, infrastructure, and technology by outsourcing to specialized providers in cost-effective regions.

This approach lowers labor costs, converts fixed expenses into variable ones, and enhances financial flexibility. Additionally, it grants access to advanced tools and expertise without continuous R&D investment, allowing companies to focus on core operations, improve efficiency, and enhance profitability.

- In August 2024, Cigniti Technologies, a Coforge company, was recognized as a Leader in the Quadrant Knowledge Solutions Spark Matrix: Digital Banking Services, Q3 2024, advancing from its previous Strong Contender position. This recognition reflects Cigniti’s strategic growth and expertise in digital banking and engineering services, reinforcing its commitment to innovation and excellence.

Market Challenge

"Intellectual Property and Data Security Risks"

Rising concerns regarding data security and IP protection are hindering the expansion of the engineering services outsourcing (ESO) market. Sharing sensitive designs, technical data, and confidential information with third-party providers increases the risk of cyber threats, data breaches, and IP theft.

Differences in international data protection laws add complexity to compliance, while weak cybersecurity in certain outsourcing hubs increases the risk of unauthorized access.

Companies can mitigate these challenges by enforcing non-disclosure agreements, intellectual property protection clauses, and compliance with data laws. Implementing encryption, access controls, and security audits strenghthens data security.

Partnering with certified providers enhances cybersecurity, while a hybrid outsourcing model balances in-house control with external expertise for optimal protection.

Market Trend

"Growth of Industry 4.0 and Smart Manufacturing"

The rise of Industry 4.0 and smart manufacturing is transforming the engineering services outsourcing market, creating a strong demand for advanced engineering solutions. Companies are integrating IoT, AI, automation, and data analytics into manufacturing processes to improve efficiency, reduce costs, and enhance product quality.

Smart factories leverage real-time data, predictive maintenance, and digital twin technology to optimize operations and minimize downtime. Engineering services outsourcing providers are essential in implementing these technologies, offering expertise in cyber-physical systems, AI-driven automation, and cloud-based engineering solutions.

Engineering Services Outsourcing Market Report Snapshot

|

Segmentation

|

Details

|

|

By Service

|

Designing, Testing, Prototyping, System Integration, Others

|

|

By End User

|

Manufacturing, Automotive, Consumer Electronics, Healthcare, Energy & Utilities, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Service (Designing, Testing, Prototyping, System Integration, and Others): The designing segment earned USD 786.81 billion in 2023 due to rising demand for innovative product development, advanced CAD (Computer-Aided Design) tools, and digital engineering solutions.

- By End User (Manufacturing, Automotive, Consumer Electronics, Healthcare, Energy & Utilities, and Others): The manufacturing segment held a share of 26.74% in 2023, attributed to the adoption of automation and Industry 4.0 for enhanced efficiency and cost reduction.

Engineering Services Outsourcing Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia-Pacific engineering services outsourcing market share stood at around 33.82% in 2023, valued at USD 934.85 billion. This dominance is attributed to the presence of major outsourcing hubs, including India, China, and Southeast Asia, which offer a skilled workforce at competitive costs.

Rapid industrialization, advancements in digital engineering, AI, and automation, and increasing investments in R&D and smart manufacturing further fuel this growth. Additionally, government initiatives and foreign investments strengthen the region's outsourcing capabilities.

North America engineering services outsourcing industry is expected to register the fastest CAGR of 21.08% over the forecast period. This growth is propelled by increasing demand for advanced engineering solutions, automation, and digital transformation across aerospace, automotive, healthcare, and IT sectors.

The regional market benefits from strong technological infrastructure, high R&D investments, and a focus on innovation. The adoption of cloud-based engineering, AI-driven design, and IoT integration is increasing outsourcing needs.

Companies are leveraging engineering services outsourcing to reduce costs, access specialized expertise, and accelerate product development, propelling regional market expansion.

- In January 2024, MGS established the Global Engineering Services Group, integrating global experts to accelerate healthcare innovation. Strengthened by strategic acquisitions, the group enhances product development, tooling, and automation, accelerating time-to-market for Pharma, Diagnostic, and MedTech companies.

Regulatory Frameworks

- The European Commission enforces the General Data Protection Regulation (GDPR) to uphold strict data protection and privacy standards across the EU and EEA. This regulation impacts the market by governing data transfers, requiring consent for data processing, and imposing penalties for non-compliance.

- The International Organization for Standardization (ISO) enforces ISO 27001, a global standard for information security management, ensureing engineering services outsourcing providers implement robust security controls to protect sensitive data, mitigate cyber threats, and comply with regulations.

- The Government of India enforces the Information Technology (IT) Act, 2000, governing electronic transactions, cybersecurity, and data protection. It ensures secure digital communication, prevents cyber threats, and regulates data handling in outsourced projects.

Competitive Landscape

The engineering services outsourcing industry is highly competitive, with numerous players striving to expand their service offerings, adopt advanced technologies, and strengthen their global presence. Companies focus on strategic partnerships, mergers & acquisitions, and R&D investments to enhance their capabilities.

The adoption of cloud-based engineering, cybersecurity challenges, and regulatory compliance requirements challenges are influencing competitive strategies. Market players are expanding into emerging economies to capitalize on growing outsourcing demand and skilled talent availability.

- In April 2023, Orion Systems Integrators, LLC was recognized as a global outsourcing leader by the International Association of Outsourcing Professionals (IAOP). The company was listed in the 2023 Global Outsourcing 100 list, marking its seventh consecutive and fourteenth overall inclusion.

List of Key Companies in Engineering Services Outsourcing Market:

- Accenture

- ALTEN Group

- Capgemini

- Infosys Limited

- HCL Technologies Limited

- TATA Consultancy Services Limited

- Tech Mahindra Limited

- Wipro

- IBM

- AVL

- Bertrandt AG

- L&T Technology Services Limited

- Quest Global

- Cybage Software Pvt. Ltd.

- Entelect

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In December 2024, ALTEN acquired Worldgrid from Atos SE, enhancing its engineering and IT services capabilities in the energy sector while ensuring service continuity.

- In May 2024, the Philippine Overseas Construction Board (POCB) and CIAP-DTI led a business mission to Sydney, Australia, debuting at the Sydney Build exhibition to promote Architecture and Engineering Services Outsourcing (AESO) and explored partnerships through business meetings and foster industry partnerships.

- In January 2024, L&T Technology Services Limited signed a multi-year framework agreement with Shell plc to provide Integrated Engineering and Procurement Services, Digital Engineering Solutions, Data Governance for Capital Projects, and Digital Project Management Consultancy across Shell’s global operations.

- In July 2023, NTT DATA Group Corporation launched an outsourcing service for security management (MDR service) to enhance security management, prevent incidents, and minimize damage from security breaches.