Market Definition

Energy harvesting is the process of capturing ambient energy from sources such as solar, thermal, mechanical, or electromagnetic energy and converting it into usable electrical energy. It encompasses technologies such as piezoelectric, photovoltaic, thermoelectric, and electromagnetic systems.

It includes applications in powering low-energy devices, wireless sensors, wearable electronics, remote monitoring systems, and internet of things (IoT) devices.

Energy Harvesting Market Overview

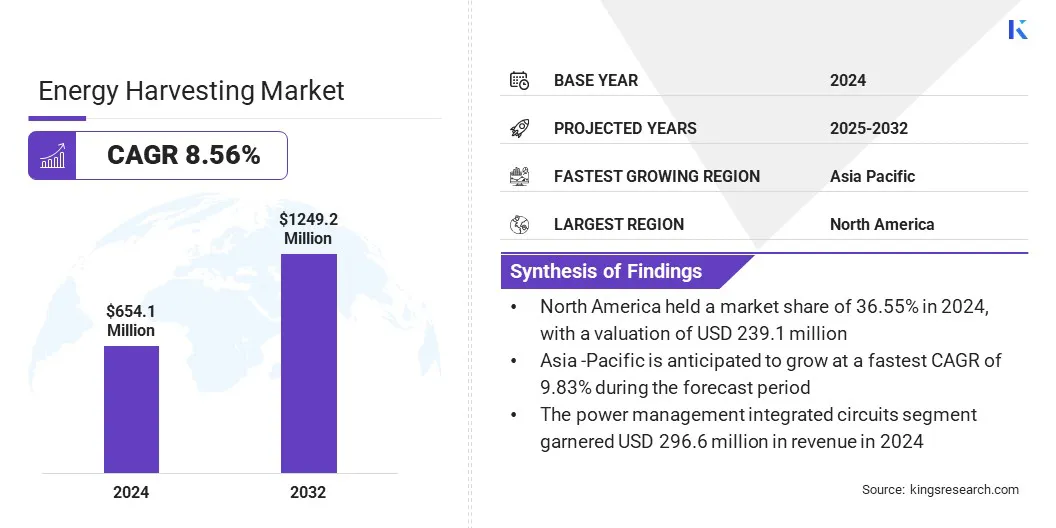

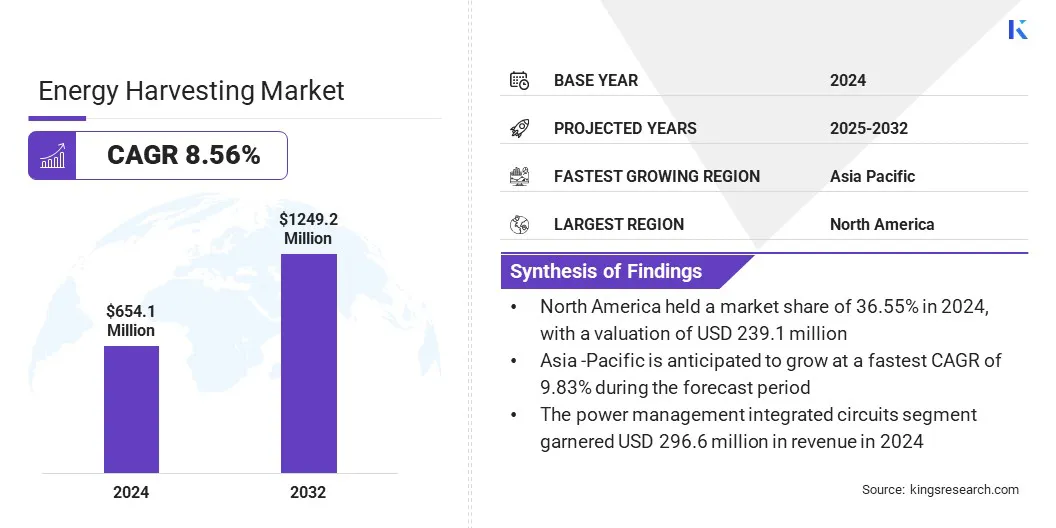

The global energy harvesting market size was valued at USD 654.1 million in 2024 and is projected to grow from USD 703.0 million in 2025 to USD 1,249.2 million by 2032, exhibiting a CAGR of 8.56% over the forecast period. The market is driven by the increasing demand for sustainable and renewable energy solutions that reduce reliance on conventional batteries and support long-term environmental goals.

The market is also expanding due to the advancements in energy conversion technologies, including the development of high-efficiency piezoelectric and thermoelectric materials that enable more effective harvesting of energy from ambient sources for diverse applications.

Key Market Highlights:

- The global energy harvesting industry was recorded at USD 654.1 million in 2024.

- The market is projected to grow at a CAGR of 8.56% from 2025 to 2032.

- North America held a market share of 36.55% in 2024, with a valuation of USD 239.1 million.

- The solar segment garnered USD 144.7 million in revenue in 2024.

- The power management integrated circuits segment is expected to reach USD 544.5 million by 2032.

- The industrial segment is anticipated to witness the fastest CAGR of 10.25% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 9.83% over the forecast period.

Major companies operating in the energy harvesting market are STMicroelectronics, Analog Devices, Inc, Texas Instruments Incorporated, EnOcean GmbH, Powercast, e-peas SA, Nexperia, Silicon Laboratories, Infineon Technologies AG, Qorvo, Inc, Advanced Linear Devices, Inc, ZF Friedrichshafen AG, Cedrat Technologies, Physik Instrumente (PI) GmbH & Co, and Kinergizer.

The expansion of enhanced geothermal systems is driving the energy harvesting market by increasing access to renewable thermal energy. This is boosting the development of technologies that convert geothermal and ambient heat into usable power, supporting self-powered sensors, IoT devices, and industrial monitoring applications across consumer electronics, and smart infrastructure sectors.

- The U.S. Department of Energy reported a goal to make enhanced geothermal systems a widespread renewable energy option by reducing costs by 90% to USD 45 per megawatt hour by 2035, supporting the adoption of sustainable and renewable energy solutions and encouraging development of low-cost ambient energy-harvesting technologies.

Market Driver

Increasing Demand for Sustainable and Renewable Energy Solutions

A major driver in the market is the increasing demand for sustainable and renewable energy solutions due to rising energy consumption and economic growth.

Organizations and consumers are adopting energy harvesting devices that capture ambient energy from light, vibrations, or thermal sources to power low-energy electronics. This growing focus on self-powered, energy-efficient technologies is prompting wider adoption of energy harvesting solutions.

- In March 2025, the Government of India reported that the total primary energy supply (TPES) grew by 7.8% in FY 2023-24, reaching 9,03,158 KToE, reflecting rising energy demand and driving the adoption of sustainable and renewable energy solutions.

Market Challenge

High Initial Costs of Energy Harvesting Systems

A key challenge in the energy harvesting market is the high initial costs associated with advanced energy harvesting systems. Developing these systems requires specialized materials, precise fabrication of flexible photovoltaic or piezoelectric modules, and integration with ultra-low-power electronics. These factors increase upfront expenses and can limit adoption for small and medium-sized enterprises.

To address this challenge, market players are focusing on developing more cost-effective materials and scalable fabrication techniques. They are designing modular, flexible, and compact energy harvesting devices that reduce manufacturing complexity.

Additionally, companies are investing in research to improve energy conversion efficiency, enabling the development of smaller, lower-cost systems that can deliver reliable performance comparable to larger and more expensive devices.

Market Trend

Miniaturization of Energy Harvesting for Microelectronics

A key trend in the market is the miniaturization of energy harvesting devices for integration into microelectronics applications. Developers are designing compact modules that capture ambient energy from light, vibrations, or thermal sources to power low-energy devices such as microcontrollers and sensors.

This enables self-powered operation in IoT devices, smart sensors, and wearable electronics. These innovations are driving wider adoption of energy harvesting in industrial, medical, consumer, and smart infrastructure applications, supporting more efficient and battery-free device designs.

- In March 2024, STMicroelectronics introduced a new generation of ultra-low-power microcontrollers that reduce energy consumption by up to 50%. These MCUs enable devices to operate solely from energy-harvesting systems, such as small photovoltaic cells, supporting applications in smart buildings, IoT devices, and smart sensors while reducing reliance on traditional batteries.

Energy Harvesting Market Report Snapshot

|

Segmentation

|

Details

|

|

By Energy Source

|

Solar, Thermal Energy, Vibration, Others

|

|

By Component

|

Transducers, Power Management Integrated Circuits, Energy Storage Systems, Sensors and Actuators

|

|

By Application

|

Consumer Electronics, Industrial, Automotive & Transportation, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Energy Source (Solar, Thermal Energy, Vibration, Others): The solar segment earned USD 144.7 million in 2024 due to rising adoption of solar-powered devices and increased focus on renewable energy solutions.

- By Component (Transducers, Power Management Integrated Circuits, Energy Storage Systems, and Sensors and Actuators): The power management integrated circuits segment held 45.34% of the market in 2024, owing to their critical role in optimizing energy conversion and storage efficiency.

- By Application (Consumer Electronics, Industrial, Automotive & Transportation, and Others): The automotive & transportation segment is projected to reach USD 449.5 million by 2032, supported by the growing deployment of energy harvesting technologies in electric and autonomous vehicles.

Energy Harvesting Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America energy harvesting market share stood at 36.55% in 2024 in the global market, with a valuation of USD 239.1 million. This dominance is attributed to the rising adoption of IoT-enabled devices such as smart wearables and industrial wireless sensors in region, which are fueling demand for self-powered technologies that reduce battery dependence and minimize maintenance costs.

Increasing government investment in renewable energy programs and smart city projects across the region further strengthens the adoption of energy harvesting solutions.

Moreover, the market is further growing due to the rising focus on integrating sustainable power technologies into everyday devices to improve energy efficiency. New product designs target the elimination of disposable batteries and extend device lifecycles.

This is driving the adoption of IoT-based solutions and low-power wireless devices across sectors, including healthcare, security, and industrial monitoring, thereby driving market expansion in the region.

- In November 2024, SMK Electronics Corporation U.S.A. launched the Self-Contained Power Supply Coin Battery Module, the first energy harvesting solution developed to replace the CR2032 coin cell batteries in consumer electronics. The module captures and stores ambient energy to power devices sustainably.

Asia Pacific is set to grow at a CAGR of 9.83% over the forecast period. This growth is attributed to the increasing deployment of energy harvesting devices across the region.

Ultra-low-current power management ICs are being introduced to efficiently charge small rechargeable batteries using ambient energy sources such as indoor light and body heat. Manufacturers are enabling IoT sensors, Bluetooth trackers, and remote controls to operate autonomously while reducing power consumption and enhancing device reliability.

Moreover, investments by market players in energy-efficient components are supporting widespread adoption of energy harvesting devices in consumer electronics, industrial monitoring, and smart infrastructure. These factors are driving demand for energy harvesting devices and contributing to the market growth in the Asia Pacific.

- In April 2025, Asahi Kasei Microdevices introduced the AP4413 series of ultra-low-current management ICs for energy harvesting. The PMICs enable efficient charging of small rechargeable batteries using ambient energy sources such as indoor light and body heat, supporting IoT sensors, Bluetooth trackers, and remote controls while minimizing power consumption and ensuring reliable autonomous operation.

Regulatory Frameworks

- In the U.S., the Federal Energy Regulatory Commission (FERC) regulates the market. FERC oversees licensing, environmental compliance, and grid stability, supporting sustainable energy initiatives and the adoption of energy harvesting technologies nationwide.

- In China, the National Energy Administration (NEA) formulates and implements national energy policies, focusing on renewable sources such as solar, wind, and biomass. It oversees planning, development, and regulation of energy infrastructure, ensuring energy harvesting projects align with economic and environmental goals.

- In India, the Ministry of New and Renewable Energy (MNRE) promotes renewable energy development across India, including solar, wind, and biomass projects. It provides policy frameworks, financial incentives, and regulatory oversight.

Competitive Landscape

Major players in the energy harvesting market are forming strategic partnerships and acquisitions to strengthen their technology portfolios and accelerate product development.

They are focusing on integrating ultra-low-power microcontrollers with advanced energy harvesting modules such as flexible photovoltaic and organic photovoltaic (OPV) solutions. Market players are developing flexible photovoltaic solutions that capture ambient light and store energy on compact films.

- In April 2024, Dracula Technologies partnered with STMicroelectronics to integrate its Organic Photovoltaic (OPV) modules with STM32U0 ultra-low-power microcontrollers. The OPV modules harvest ambient light and store energy on a single flexible film, enabling industrial, medical, smart-metering, and consumer devices to operate without traditional batteries.

Key Companies in Energy Harvesting Market:

- STMicroelectronics

- Analog Devices, Inc

- Texas Instruments Incorporated

- EnOcean GmbH

- Powercast

- e-peas SA

- Nexperia

- Silicon Laboratories

- Infineon Technologies AG

- Qorvo, Inc

- Advanced Linear Devices, Inc

- ZF Friedrichshafen AG

- Cedrat technologies

- Physik Instrumente (PI) GmbH & Co

- Kinergizer

Recent Developments (Product Launch)

- In March 2025, STMicroelectronics launched STM32U3 ultra-low-power microcontrollers for energy harvesting applications, enabling devices to operate on minimal ambient energy from solar or thermoelectric sources in utility meters, healthcare devices, industrial sensors, and wearables.

the