Energy Drinks Market Size

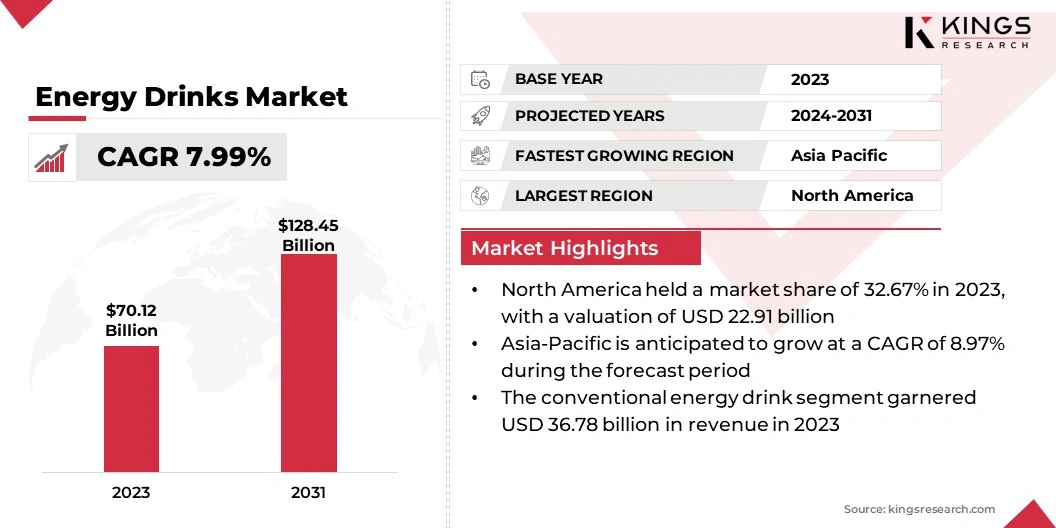

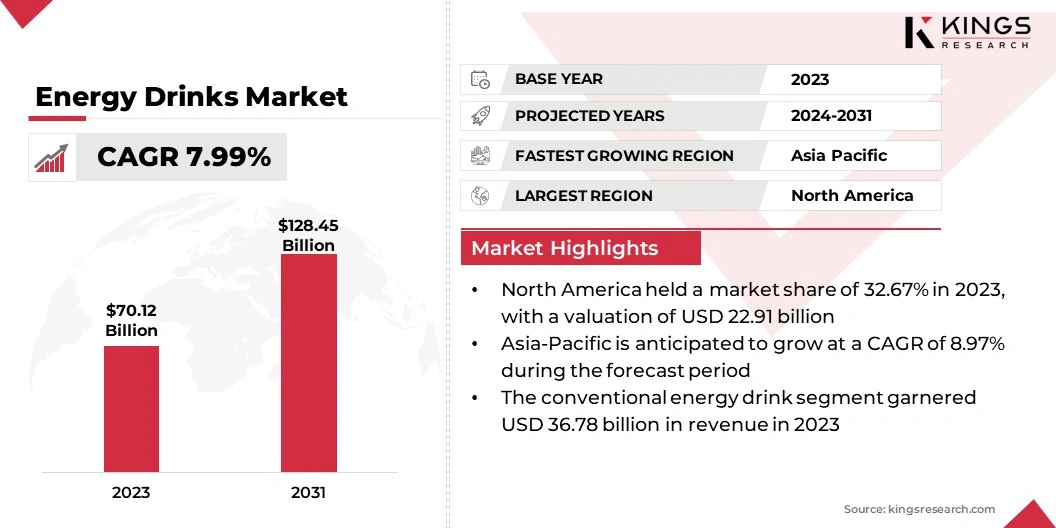

The global Energy Drinks Market size was valued at USD 70.12 billion in 2023 and is projected to grow from USD 75.00 billion in 2024 to USD 128.45 billion by 2031, exhibiting a CAGR of 7.99% during the forecast period. The growth of the market is primarily driven by increasing consumer demand for convenient energy-boosting solutions, coupled with rising disposable incomes, rapid urbanization, the rising popularity of fitness activities, and innovations in product formulations.

In the scope of work, the report includes solutions offered by companies such as AJE Group, Carabao Group Public Co., Ltd., Coca-Cola HBC., Congo Brands, PepsiCo, Inc., T.C. Pharmaceutical Industries Company Limited, Taisho Pharmaceutical Holdings Co., Ltd., HELL ENERGY, OSOTSPA PUBLIC COMPANY LIMITED, SUNTORY HOLDINGS LIMITED and others.

The market is influenced by increasing consumer demand for convenient energy-boosting solutions. Busy lifestyles and the growing need for enhanced physical and mental performance fuel this demand. Additionally, rising disposable incomes and rapid urbanization contribute to market growth. The surging popularity of fitness activities and sports has led to increased consumption of energy drinks, as they are marketed for their performance-enhancing benefits.

The expansion of organized retail channels and aggressive marketing strategies further support market growth. Moreover, innovations in product formulations that incorporate natural and organic ingredients, attract health-conscious consumers, thereby aiding market expansion.

The energy drinks market is characterized by robust growth, reflecting rising consumer preference for functional beverages. North America and Europe are mature markets with high consumption rates, while Asia-Pacific is emerging as a significantly growing region due to rapid urbanization and lifestyle changes. The market features a diverse range of products, including sugar-free, natural, and organic variants catering to various consumer preferences.

Major manufacturers in the industry are leveraging extensive distribution networks and strong brand recognition to maintain their presence in the market. Despite regulatory challenges regarding caffeine content and health concerns, the market is expected to maintain a positive growth trajectory.

Energy drinks are beverages formulated to boost energy levels, mental alertness, and physical performance. They typically contain caffeine, taurine, vitamins, and other stimulants and help combat fatigue and improve concentration. Unlike sports drinks, which are formulated to replenish electrolytes and hydration, energy drinks are designed to deliver quick energy boosts. They are available in various formulations and flavors, catering to a wide demographic, including athletes, professionals, students, and gamers.

Analyst’s Review

Manufacturers in the market are intensifying efforts to meet evolving consumer preferences. Key players are focusing on product innovation, by introducing new formulations with natural ingredients and lower sugar content, aiming to cater to health-conscious consumers.

Additionally, expanding distribution networks and strategic partnerships are enhancing market penetration. Increasing competition necessitates differentiation through unique branding and packaging, which are crucial for sustaining growth.

Continuous market research and consumer feedback are essential for maintaining a competitive edge by anticipating trends and adapting to changing consumer demands. Moreover, investing in sustainable practices, including eco-friendly packaging, helps companies improve their brand reputation and attract environmentally conscious consumers.

- In August 2023, Coca-Cola Europacific Partners (CCEP) introduced Monster Zero Sugar, a zero-calorie variant of the popular Monster Original. This new product offered the same iconic taste without sugar, responding to the rising demand for traditional energy drinks and zero-sugar options. Launched in the Euro-Pacific region in September 2023, Monster Zero Sugar complemented the existing lineup, aiming to engage core Monster fans and boost sales with its familiar can design.

Energy Drinks Market Growth Factors

The increasing demand for functional beverages designed to support active and busy lifestyles is propelling market growth. Consumers are increasingly seeking convenient ways to maintain energy levels and improve performance. This trend is particularly evident among young adults and working professionals who require quick, on-the-go solutions to combat fatigue and enhance productivity and concentration.

Additionally, the rising popularity of health and wellness among global consumers is fostering the consumption of energy drinks that offer added benefits such as vitamins and natural ingredients. Manufacturers are continuously innovating to meet these evolving consumer preferences, thus contributing to the energy drinks market growth.

However, the growing concern over the health impacts of high caffeine and sugar content presents a major challenge for manufacturers. Consumers and regulatory bodies are becoming increasingly concerned regarding the potential adverse effects, such as elevated heart rates and obesity. To address this challenge, manufacturers are focusing on reformulating products to include healthier alternatives.

Moreover, companies are introducing sugar-free and low-caffeine variants, as well as incorporating natural ingredients such as green tea extract and ginseng. Transparent labeling and educating consumers regarding moderate consumption further help mitigate health concerns, thereby fostering trust and ensuring sustained market growth despite these challenges.

- In January 2024, Poland enacted regulations banning the sale of energy drinks to individuals under 18. The law restricted sales within schools, educational units, and vending machines. Additionally, it required producers and importers to label drinks clearly as ‘energy drink.’ Violations included fines up to approximately USD 500 for selling to minors and up to USD 50,000 for improper labeling, with potential imprisonment for non-compliance.

Energy Drinks Market Trends

The growing shift toward health-conscious formulations is gaining prominence in the market since consumers are prioritizing their health, resulting in increased demand for products with natural and organic ingredients. Energy drink manufacturers are responding to this surging demand by developing beverages that contain fewer artificial additives, lower sugar levels, and added vitamins and minerals.

This trend is further propelled by the growing awareness regarding the negative health impacts associated with excessive sugar and synthetic ingredients. Due to this, brands are innovating to offer healthier options, exemplified by drinks containing natural caffeine sources such as green tea and yerba mate, thereby catering to the preferences of health-conscious consumers.

- Mateina offers its energy infusion drink that is available in different flavors infused with organic yerba mate. The product holds organic certification, aligning with the trend of the diversification of standard product portfolios to develop new solutions catered to the evolving consumer base.

The move toward sustainable packaging is a key factor transforming the energy drinks market dynamics. Environmental concerns play a key role in influencing consumer choices, prompting companies to adopt eco-friendly packaging solutions. Brands are increasingly using recyclable materials, biodegradable packaging, and reducing plastic usage to meet the rising demand for sustainability.

This shift is appealing to environmentally conscious consumers and supports global efforts to reduce waste and carbon footprints. Investments in sustainable packaging enable energy drink companies to enhance their brand image and address the growing environmental expectations of their customer base, thus stimulating market growth and differentiation.

Segmentation Analysis

The global market is segmented based on type, nature, distribution channel, and geography.

By Type

Based on type, the market is categorized into energy shots, conventional energy drink, sugar-free energy drink, and others. The conventional energy drink segment led the energy drinks market in 2023, reaching a valuation of USD 36.78 billion. The segment is leading the market due to its strong brand recognition and established consumer loyalty, which results in consistent sales.

Their widespread availability in various retail channels, including convenience stores, supermarkets, and online platforms, ensures easy access for consumers. Additionally, aggressive marketing campaigns and endorsements by popular athletes and celebrities enhance their appeal. The diverse range of flavors and formulations caters to a broad audience, from athletes to professionals seeking a quick energy boost, thus aiding segmental growth.

By Nature

Based on nature, the market is classified into organic and conventional. The organic segment is projected to showcase significant growth at a CAGR of 8.65% through the forecast period (2024-2031). The projected growth is largely attributed to increasing consumer awareness regarding health and wellness. With an increasing number of people seeking natural and healthier beverage options, the demand for organic products is rising.

These drinks are perceived as safer and beneficial since they are often free from artificial additives and preservatives. The shift toward sustainable and eco-friendly consumption further supports this trend, as organic farming practices are considered more environmentally friendly. Additionally, the availability of organic ingredients and improved production processes are making these drinks more accessible and appealing, contributing significantly to the expansion of the segment.

By Distribution Channel

Based on distribution channel, the market is segmented into off-trade and on-trade. The off-trade segment secured the largest energy drinks market share of 87.55% in 2023. The off-trade segment, encompasses retail outlets such as supermarkets, convenience stores, and online platforms. The segment dominated the market due to its extensive reach and convenience.

Consumers prefer off-trade channels for their accessibility and the ability to purchase products in bulk. The growth of e-commerce further boosts this growth, providing easy access to a wide range of products with the convenience of home delivery. Additionally, promotions, discounts, and a variety of packaging options offered through these channels attract a large consumer base, which is aiding segmental growth.

Energy Drinks Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America energy drinks market share stood around 32.67% in 2023 in the global market, with a valuation of USD 22.91 billion. The region’s dominance in the market is reinforced by a well-established culture of convenience and on-the-go consumption, which aligns with the appeal of energy drinks. Moreover, high disposable incomes and busy lifestyles contribute to the robust demand for quick energy-boosting solutions in the region.

Additionally, extensive marketing campaigns and product innovations by key players bolster consumer awareness and brand loyalty. The presence of major market players and a developed distribution infrastructure further solidify North America's leading position.

Asia-Pacific is poised to experience robust growth, depicting a CAGR of 8.97% through the estimated timeframe. Rapid urbanization and changing lifestyles in emerging economies such as China, India, and Southeast Asian countries are leading to increased consumption of functional beverages. Additionally, growing health consciousness and the influence of Western dietary trends are fueling demand for energy drinks in the region.

Furthermore, expanding middle-class populations with rising disposable incomes are contributing to domestic market growth. The availability of a wide range of product variants and aggressive marketing strategies by key players are further supporting regional market expansion.

Competitive Landscape

The energy drinks market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Energy Drinks Market

- AJE Group

- Carabao Group Public Co., Ltd.

- Coca-Cola HBC.

- Congo Brands

- PepsiCo, Inc.

- C. Pharmaceutical Industries Company Limited

- Taisho Pharmaceutical Holdings Co., Ltd.

- HELL ENERGY

- OSOTSPA PUBLIC COMPANY LIMITED

- SUNTORY HOLDINGS LIMITED

Key Industry Developments

- February 2024 (Partnership & Launch): FaZe Holdings, Inc. (FaZe Clan) and GHOST, announced their latest collaboration: FAZE UPTM. The drink was inspired by a nostalgic citrus soda and was available in GHOST ENERGY and GHOST GAMER flavors. This followed the success of their first collaboration, FAZE POPTM, which became 7-Eleven's top-selling energy product in 2023. FAZE UPTM was exclusively launched nationwide at 7-Eleven stores.

- August 2023 (Launch): AG Barr launched a new energy drink, PWR-BRU, exclusively for Scotland in four flavors, namely 'Origin' Original, 'Diablo' Cherry, 'Maverick' Berry and 'Dropkick' Tropical. The energy drink contains taurine, caffeine and B Vitamins to provide optimal benefits to the consumers.

The global energy drinks market is segmented as:

By Type

- Energy Shots

- Conventional Energy Drink

- Sugar-Free Energy Drink

- Others

By Nature

By Distribution Channel

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America