Market Definition

The market encompasses the production, distribution, and sales of endotracheal tubes (ETT), which are medical devices used to maintain the airway during ventilation, anesthesia, or emergency care used for airway management in surgeries, ventilation, and emergency care.

These tubes are inserted into the trachea through the mouth or nose to maintain airflow in critical care settings like hospitals and emergency units.

Endotracheal Tube Market Overview

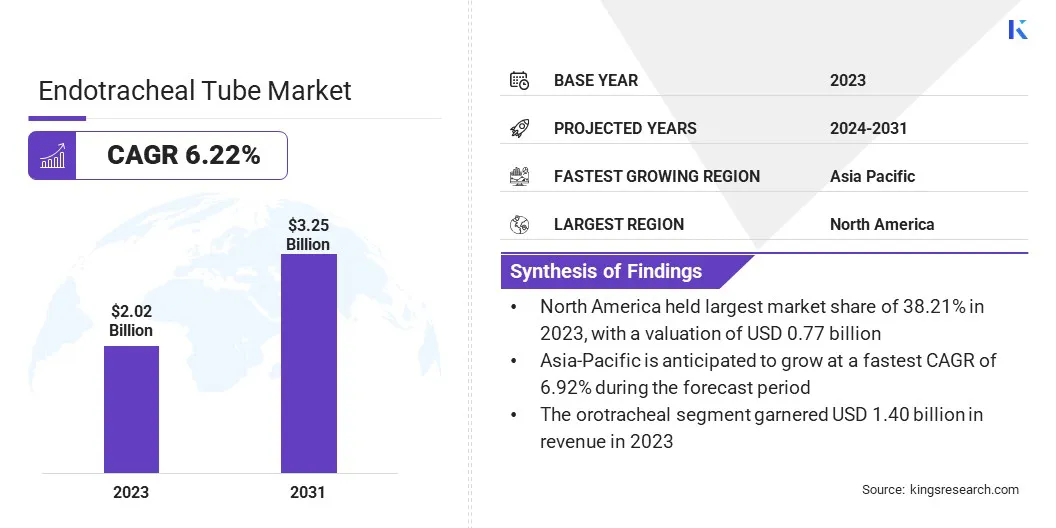

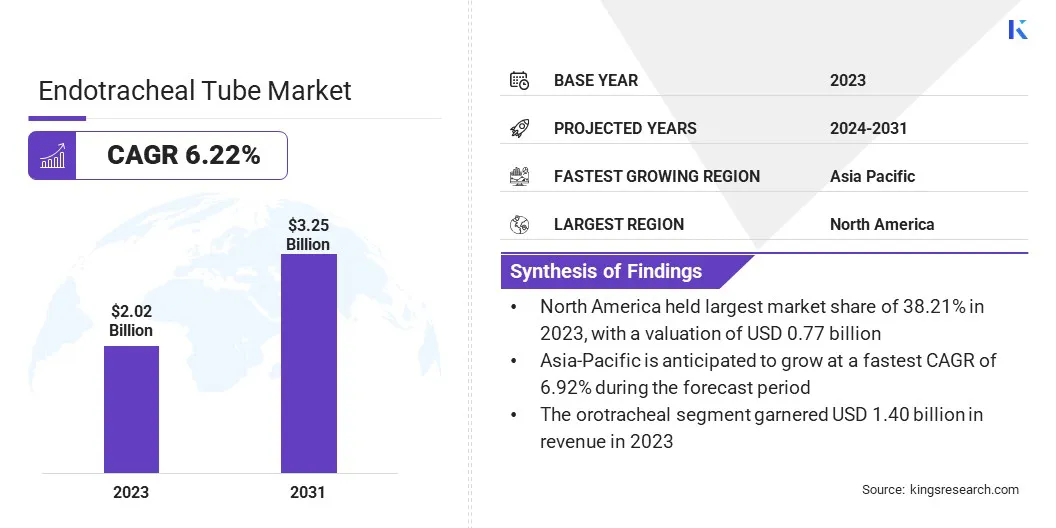

The global endotracheal tube market size was valued at USD 2.02 billion in 2023 and is projected to grow from USD 2.13 billion in 2024 to USD 3.25 billion by 2031, exhibiting a CAGR of 6.22% during the forecast period.

The market is growing, due to the rising demand for respiratory support in critical care, surgeries, and emergency medicine. Additionally, the rising cases of respiratory diseases like COPD, asthma, and infections, along with an increase in surgeries that demand mechanical ventilation, are driving the market.

Major companies operating in the endotracheal tube industry are Medline Industries, LP, Teleflex Incorporated, Venner Medical, Sterimed Group, SEWOON MEDICAL Co., Ltd., Medtronic, N8 Medical, Inc., Mercury Medical., Innovative Surface Technologies, Genesis Airway Innovations, Bactiguard AB, Sharklet Technologies, Fuji Systems. Well Lead Medical Co., Ltd., and Hollister Incorporated.

Technological advancements, such as antimicrobial-coated and reinforced tubes, improve safety and comfort, thereby boosting the market. The aging population and the need for long-term ventilation also contribute to market growth. The market is expected to continue growing as healthcare facilities adopt advanced airway management and infection control measures.

- In November 2023, the University of Nottingham announced the launch of human trials for the world’s first smart ETT that monitors and adjusts cuff pressure to prevent Ventilator-associated pneumonia (VAP) and tracheal injury.

Key Highlights

- The endotracheal tube industry size was valued at USD 2.02 billion in 2023.

- The market is projected to grow at a CAGR of 6.22% from 2024 to 2031.

- North America held a market share of 38.34% in 2023, with a valuation of USD 0.77 billion.

- The reinforced endotracheal tube segment garnered USD 0.84 billion in revenue in 2023.

- The orotracheal segment is expected to reach USD 2.22 billion by 2031.

- The therapy segment is anticipated to register the fastest CAGR of 6.65% during the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 6.92% during the forecast period.

Market Driver

Increasing Respiratory Diseases and Surge in Surgical Procedures

The market is growing, due to the increasing prevalence of respiratory diseases like COPD, asthma, and infections, along with the rising number of surgeries requiring ventilation and anesthesia. Technological advancements in tube design, such as antimicrobial coatings and reinforced materials, enhance safety and effectiveness.

These tubes are essential in managing patients who need ventilation support or anesthesia, driving their widespread use in hospitals, ambulatory surgical centers, and emergency care units. The overall expansion of healthcare services, along with rising healthcare expenditures globally, supports the growing demand for advanced medical devices like ETT.

Market Challenge

Risk of Ventilator-associated Infections

The risk of ventilator-associated infections such as VAP is a major challenge in the endotracheal tube market. VAP can occur when bacteria enter the lungs through the tube, often due to prolonged mechanical ventilation, improper tube insertion, or inadequate maintenance.

This leads to severe respiratory infections, longer recovery times, and higher healthcare costs. Despite innovations like antimicrobial-coated tubes, managing VAP remains a critical concern, influencing patient outcomes and driving demand for safer, more effective airway management solutions.

Healthcare providers can implement strict infection control protocols, such as regular tube maintenance, frequent suctioning, and ensuring proper hygiene during intubation & extubation procedures. Using ETT with antimicrobial coatings or advanced designs that reduce bacterial growth can also help minimize the risk of infection.

Timely extubation, along with minimizing the duration of mechanical ventilation, can further reduce the likelihood of VAP. Staff education on proper airway management techniques and regular monitoring of patients on ventilators are crucial steps in preventing infections.

- In February 2024, Medline Industries, LP issued a recall of its SubG Endotracheal Tube with Subglottic Suction in the U.S., due to issues with detachment and tearing of inflation tube, leading to moisture buildup and loss of pressure. This could result in severe health risks such as airway obstruction and respiratory distress.

Market Trend

Growing Focus on Infection Control

The growing focus on infection control in the market aims to reduce VAP. Manufacturers are developing antimicrobial-coated tubes and materials to prevent bacterial growth.

Additionally, healthcare providers are enhancing infection control protocols, including regular tube cleaning, proper intubation techniques, and staff training. Innovations such as self-sanitizing tubes and advanced drainage systems are also emerging, aiming to improve patient outcomes and reduce infection-related complications.

- In February 2024, Springer Nature Limited published a research article titled "Development of a Smart Endotracheal Tube for Real-time Monitoring of Airway Pressure". It discusses the advancements in ETT technology. Furthermore, it focuses on integrating sensors that monitor airway pressure to improve patient safety during mechanical ventilation. The study concludes that the type of ETT, with or without corticosteroids, and the duration of intubation affect the biomechanical properties of vocal folds.

Endotracheal Tube Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Regular Endotracheal Tube, Reinforced Endotracheal Tube, Preformed Endotracheal Tube, Double lumen Endotracheal Tube

|

|

By Route Type

|

Orotracheal, Nasotracheal

|

|

By Application

|

Emergency Treatment, Therapy, Others

|

|

By End use

|

Hospitals, Clinics, Ambulatory Surgical Centres, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Regular Endotracheal Tube, Reinforced Endotracheal Tube, Preformed Endotracheal Tube, Double lumen Endotracheal Tube): The reinforced endotracheal tube segment earned USD 0.84 billion in 2023, due to its enhanced durability and ability to withstand higher pressure, making it ideal for long-term ventilation and high-risk surgeries.

- By Route Type (Orotracheal, Nasotracheal): The orotracheal segment held 69.44% share of the market in 2023, due to its ease of insertion, lower risk of complications, and widespread use in emergency & surgical procedures.

- By Application (Emergency Treatment, Therapy, Others): The emergency treatment segment is projected to reach USD 1.82 billion by 2031, owing to the increasing number of critical care cases and the rising demand for rapid airway management in emergency situations.

- By End use (Hospitals, Clinics, Ambulatory Surgical Centres, Others): The ambulatory surgical centres segment is anticipated to grow at a CAGR of 6.98% during the forecast period, driven by the increasing number of outpatient surgeries and the demand for efficient airway management in non-hospital settings.

Endotracheal Tube Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for 38.34% share of the endotracheal tube market in 2023, with a valuation of USD 0.77 billion. This dominance is attributed to advanced healthcare infrastructure, a high volume of surgical procedures, and increasing cases of respiratory diseases. The region’s strong focus on innovation, coupled with rising demand for critical care and emergency respiratory support, further drives the market.

Additionally, the growing adoption of advanced airway management technologies and the presence of major medical device manufacturers in the region contribute to the leading market position of North America.

- In August 2023, SourceMark announced the release of the SuctionPlus Endotracheal Tube, a latex- and DEHP-free product designed with an evacuation lumen to reduce aspiration and the risk of VAP. The tube features a high-volume, low-pressure cuff and a removable 15mm connector, aiming to enhance patient safety and ease of use for clinicians.

The market in Asia-Pacific is poised for significant growth at a robust CAGR of 6.92% over the forecast period. Increasing prevalence of respiratory diseases, improving healthcare infrastructure, and rising surgical procedures are driving the endotracheal tube industry.

The expanding healthcare investments, particularly in countries like China and India, are boosting the demand for advanced medical devices such as ETT in the region. Furthermore, the growing awareness of critical care needs and the rising number of patients requiring ventilation support in hospitals and emergency units are expected to further accelerate the market expansion in Asia-Pacific.

Regulatory Frameworks

- The International Organization for Standardization (ISO) 77497 standard anaesthetic and respiratory equipment—endotracheal tubes, provides guidelines for the design and performance of endotracheal tubes, focusing on ensuring safety, effectiveness, and quality control.

- The Health Canada under the Medical Device Regulations (SOR/98-282) ensures that medical devices meet safety, effectiveness, and quality standards before being marketed in Canada. Manufacturers must provide evidence through premarket reviews, and devices must be licensed for sale.

- In Australia, the Therapeutic Goods Administration (TGA) provides resources and guidelines for the regulation of therapeutic goods. The TGA ensures compliance with standards through its guidelines, which cover aspects such as product safety, manufacturing, and marketing. The regulation ensures that devices meet safety and quality benchmarks before being approved for market distribution in Australia.

Competitive Landscape

The endotracheal tube industry is highly competitive, with companies focusing on product innovation and technological advancements to strengthen their market position. Key strategies include the development of antimicrobial coatings, reinforced tubes, and patient-specific designs to enhance safety and effectiveness.

Companies are also pursuing mergers, acquisitions, and product launches to meet the growing demand for advanced airway management solutions.

Companies are increasingly investing in research and development to introduce advanced features and improve the overall performance and safety of ETT as the market evolves, ensuring that they meet the rising demand for effective respiratory support across various healthcare settings.

- BioMed Central Ltd published a study titled "Double Lumen Endobronchial Tube Intubation: Lessons Learned from Anatomy", which investigates the impact of upper airway anatomy on the difficulty of double lumen tube (DLT) placement during thoracic surgeries. Using PET-CT scans and cadaver models, the research identifies key anatomical factors, such as the glottis and tracheal angles, that influence successful intubation. The study suggests that rotating the DLT 180 degrees improves ease of insertion, enhancing clinical outcomes in lung surgeries.

List of Key Companies in Endotracheal Tube Market

- Medline Industries, LP

- Teleflex Incorporated

- Venner Medical

- Sterimed Group

- SEWOON MEDICAL Co., Ltd.

- Medtronic

- N8 Medical, Inc.

- Mercury Medical.

- Innovative Surface Technologies

- Genesis Airway Innovations

- Bactiguard AB

- Sharklet Technologies

- Fuji Systems

- Well Lead Medical Co., Ltd.

- Hollister Incorporated

Recent Developments (New Product Launch)

- In November 2024, Asahi Kasei Medical announced "TrachFlush," an innovative ETT cuff inflator in Japan. This device enhances tracheal suctioning by reducing patient discomfort and minimizing the burden on healthcare providers.