Market Definition

The market encompasses the industry dedicated to technologies that monitor, measure, and analyze air pollutants released from sources such as industrial processes, power plants, and vehicles.

These systems are essential for regulatory compliance, air quality improvement, and Environmental Impact Assessments (EIA), and are widely adopted across sectors like energy, manufacturing, and transportation. The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Emission Monitoring Systems Market Overview

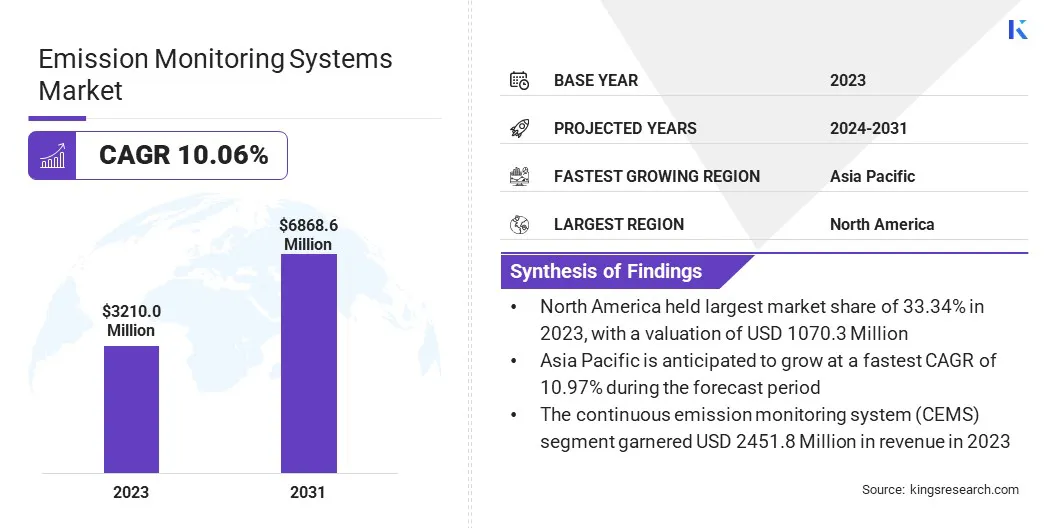

The global emission monitoring systems market size was valued at USD 3,210.0 million in 2023 and is projected to grow from USD 3,510.2 million in 2024 to USD 6,868.6 million by 2031, exhibiting a CAGR of 10.06% during the forecast period.

The growing emphasis on climate change mitigation is driving the market. With global initiatives aimed at reducing carbon footprints, industries are adopting advanced monitoring technologies to track emissions and comply with environmental regulations.

Major companies operating in the emission monitoring systems market are ABB Ltd., AMETEK Inc., Emerson Electric Co., Siemens, Thermo Fisher Scientific Inc., General Electric Company, HORIBA, Rockwell Automation, Teledyne Technologies Incorporated, Fuji Electric Corp., Chemtrols Industries Pvt. Ltd., Chemtrols Industries, M&C TechGroup Germany, DURAG GROUP, OPSIS AB, and ENVEA.

The market is registering significant growth, due to the increasing need for industries to track and manage their environmental impact. With rising environmental concerns and stringent regulations, businesses are investing in advanced Emission Monitoring Systems (EMS) solutions to monitor air quality and emissions in real time.

These systems are critical in helping industries achieve compliance with local and global emission standards while driving sustainability initiatives. Additionally, the integration of AI, IoT, and other cutting-edge technologies is improving the accuracy, reliability, and efficiency of EMS. The demand for innovative emissions monitoring solutions is expected to rise as industries focus on reducing their carbon footprints.

- In December 2024, ABB launched the CEM-DAS, the first data acquisition and handling system to pass the new international EN 17255 emissions monitoring standard. This innovative system enhances data integrity and ensures compliance with global environmental regulations, catering to industries like power, oil & gas, and chemicals seeking reliable and standardized emissions reporting solutions.

Key Highlights:

- The emission monitoring systems market size was valued at USD 3,210.0 million in 2023.

- The market is projected to grow at a CAGR of 10.06% from 2024 to 2031.

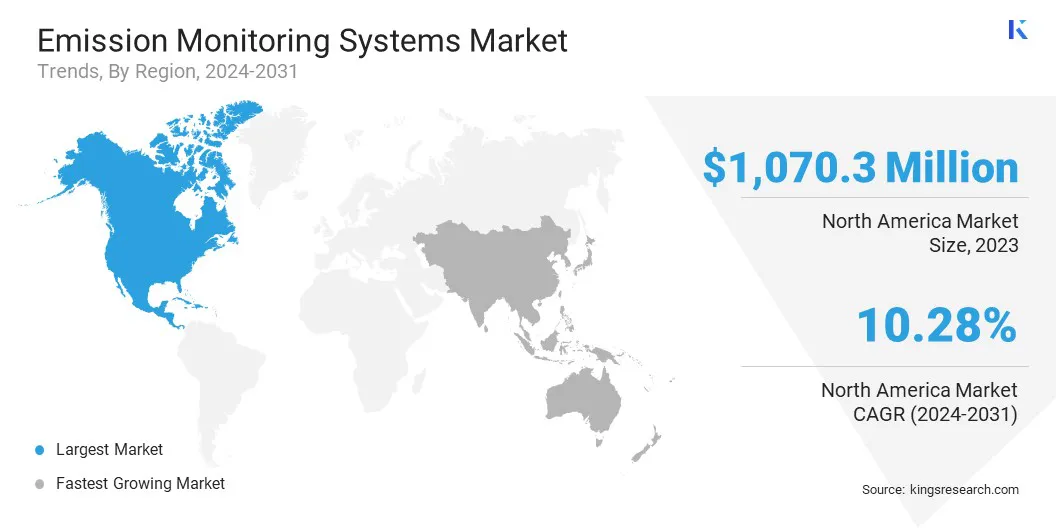

- North America held a market share of 33.34% in 2023, with a valuation of USD 1,070.3 million.

- The continuous emission monitoring system (CEMS) technology segment garnered USD 2,451.8 million in revenue in 2023.

- The hardware segment is expected to reach USD 3,709.7 million by 2031.

- The power generation segment is anticipated to register the fastest CAGR of 11.25% during the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 10.97% during the forecast period.

Market Driver

Rising Focus on Sustainability and Net-zero Commitments

The global shift toward sustainability and carbon neutrality is significantly accelerating the demand for EMS. With increasing pressure from stakeholders, investors, and consumers, companies across sectors are committing to long-term net-zero emission goals and integrating Environmental, Social, and Governance (ESG) criteria into their core strategies.

EMS technologies play a critical role in helping organizations accurately track, report, and reduce their Greenhouse Gas (GHG) emissions. This trend is especially evident in sectors like power, oil & gas, and manufacturing, where real-time emissions data is essential for achieving climate targets and maintaining regulatory compliance.

- In March 2023, Aspen Technology introduced a new emissions management solution to help industries reduce carbon emissions. The platform uses real-time data and decision-support tools to provide a clear view of emissions across operations, enabling faster, smarter actions toward sustainability and net-zero targets.

Market Challenge

Lack of Real-time Emissions Visibility and Actionable Insights

One of the major challenges facing asset-intensive industries is the limited visibility into real-time carbon emissions across their operations. Traditional systems often focus only on emissions reporting, which delays corrective actions and limits the ability to meet sustainability goals.

Companies struggle to integrate emissions data from various sources across the value chain, making it difficult to identify and prioritize areas with the highest impact on emission reduction. This lack of a unified, dynamic view obstructs informed decision-making and slows down progress toward achieving net-zero commitments.

Companies are increasingly adopting integrated, real-time emissions management systems to centralize data, track emissions continuously, and gain actionable insights for operational improvements.

Market Trend

Integration of AI and IoT in Emissions Monitoring

A significant trend in the market is the integration of Artificial Intelligence (AI) and Internet of Things (IoT) technologies. Combining smart sensors with AI-driven analytics helps companies automate emissions data collection, enhance anomaly detection, and predict equipment failures or emissions spikes before they occur.

As a result, monitoring systems become more accurate and reliable while reducing the need for manual intervention and lowering maintenance costs. The adoption of such advanced technologies is driving the development of intelligent, adaptive monitoring systems that support real-time decision-making and long-term environmental sustainability strategies.

- In July 2023, Hyundai Motor and Kia introduced the AI-enabled, blockchain-based supplier CO₂ emission monitoring system (SCEMS) to enhance transparency and accuracy in tracking carbon emissions across their supply chain. This innovative system helps suppliers reduce reporting burdens, enabling predictive emissions analysis.

Emission Monitoring Systems Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Continuous Emission Monitoring System (CEMS), Predictive Emission Monitoring System (PEMS)

|

|

By Component

|

Hardware, Software, Services

|

|

By End Use

|

Oil & Gas, Metals & Mining, Power Generation, Chemical & Fertilizer, Pulp & Paper, Pharmaceutical, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Continuous Emission Monitoring System (CEMS), Predictive Emission Monitoring System (PEMS)): The continuous emission monitoring system (CEMS) segment earned USD 2,451.8 million in 2023, due to its essential role in meeting environmental regulations across industries like power generation and manufacturing.

- By Component (Hardware, Software, Services): The hardware segment is projected to reach USD 3,709.7 million by 2031, owing to the increasing demand for advanced emission sensors and real-time monitoring devices in industrial applications across sectors like oil & gas, power generation, and chemical processing.

- By End Use (Oil & Gas, Metals & Mining, Power Generation, Chemical & Fertilizer, Pulp & Paper, Pharmaceutical, Others): The oil & gas segment held 26.44% share of the market in 2023, due to strict environmental regulations and the need for emissions monitoring in the oil & gas industry.

Emission Monitoring Systems Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for 33.34% share of the emission monitoring systems market in 2023, with a valuation of USD 1,070.3 million. This is attributed to strict environmental regulations like the Clean Air Act, and ambitious climate goals such as achieving net-zero emissions by 2050. Technological innovations, including real-time data analytics and IoT-powered sensors, are revolutionizing the way emissions are tracked.

At the same time, industries like power generation and transportation are increasingly adopting EMS to comply with regulations. Government incentives and rising public awareness around sustainability further accelerate EMS adoption, making North America a key player in the market.

The emission monitoring systems industry in Asia Pacific is poised for significant growth at a robust CAGR of 10.97% over the forecast period. This is attributed to stringent environmental regulations and ambitious climate goals such as carbon neutrality by 2060. Rapid industrialization and urbanization in countries like China and India are increasing emissions, fueling the demand for effective EMS.

Technological advancements in IoT, AI, and real-time data analytics are transforming emissions monitoring, while government policies and financial incentives promote clean energy adoption. Increased environmental awareness and the shift toward renewable energy further accelerate EMS adoption, positioning the region for significant market expansion.

- In July 2024, SICK AG and its partners launched the DIVMALDA project, addressing the growing need for transparent maritime emissions monitoring. This initiative aims to develop an automated, real-time system for accurately measuring and verifying ship emissions, helping operators meet regulatory and sustainability goals with reliable data.

Regulatory Frameworks

- The U.S. Environmental Protection Agency (EPA) has set regulations for CEMS, helping industries track real-time emissions and ensure compliance with air quality standards. This promotes transparency, supports carbon footprint reduction, and encourages the adoption of advanced monitoring technologies for environmental sustainability.

- The European Union (EU) has updated the EU ETS rules to expand emissions monitoring, particularly for aviation’s non-CO₂ effects and alternative fuels. These changes require more advanced emissions tracking, verification, and collaboration, ensuring compliance with sustainability criteria and supporting climate neutrality goals.

Competitive Landscape

Key players in the emission monitoring systems market are forming strategic partnerships to advance sustainable solutions by focusing on reducing environmental impact, optimizing emissions tracking, and enhancing regulatory compliance.

These collaborations integrate advanced technologies such as AI-driven analytics, real-time monitoring, and predictive maintenance to help industries reduce emissions, improve operational efficiency, and meet net-zero goals.

These companies are fostering innovations that improve environmental performance, enhance customer experience, and promote safer, more efficient emissions management globally by expanding hardware portfolios, offering comprehensive solutions, and entering new geographic and industrial markets.

- In May 2024, Honeywell and Weatherford announced a partnership to deliver an emissions management solution combining Honeywell's emissions management suite with Weatherford's Cygnet SCADA platform. The solution enables upstream oil and gas operators to monitor, report, and reduce greenhouse gas emissions, flammable hydrocarbons, and other gases.

List of Key Companies in Emission Monitoring Systems Market:

- ABB Ltd.

- AMETEK.Inc.

- Emerson Electric Co.

- Siemens

- Thermo Fisher Scientific Inc.

- General Electric Company

- HORIBA

- Rockwell Automation

- Teledyne Technologies Incorporated.

- Fuji Electric Corp.

- Chemtrols Industries Pvt. Ltd.

- Chemtrols Industries

- DURAG GROUP

- OPSIS AB

- ENVEA

Recent Developments (Product Launches)

- In March 2025, HORIBA launched the MEXAcube, an advanced emissions measurement system using Infrared Laser Absorption Modulation technology. The device accurately measures nine emission components, including ammonia and nitrous oxide, supporting both lab & real-world vehicle testing and ensuring compliance with Euro 7 standards for next-generation mobility.

- In December 2024, Hyundai Motor and Kia launched the Integrated Greenhouse Gas Information System (IGIS), a platform that tracks carbon emissions across the vehicle lifecycle. Using Life Cycle Assessment and blockchain technology, IGIS supports carbon neutrality goals by 2045 and strengthens regulatory compliance in the automotive industry.

- In August 2024, ABB announced the acquisition of Födisch Group to strengthen its position in CEMS. This enhances ABB’s ability to deliver advanced emissions-tracking solutions, enabling industries to meet stricter environmental regulations, improve operational efficiency, and support global sustainability goals.

- In June 2024, DURAG GROUP announced that its D-R 808 in-situ dust monitor received ATEX & IECEx certification, ensuring safe operation in hazardous industrial environments. The device ensures precise particulate measurement, minimal maintenance, and adherence to global environmental standards, providing an effective solution for emissions monitoring.