Market Definition

The market encompasses the industry involved in the development, manufacturing, and distribution of materials and products designed to protect electronic devices and systems from electromagnetic interference.

The market includes a wide range of shielding materials such as metal-based shields, conductive polymers, coatings, films, and composites, as well as shielding enclosures and gaskets. The report provides insights into the core drivers of market growth, supported by an in-depth evaluation of industry trends and regulatory frameworks.

EMI Shielding Market Overview

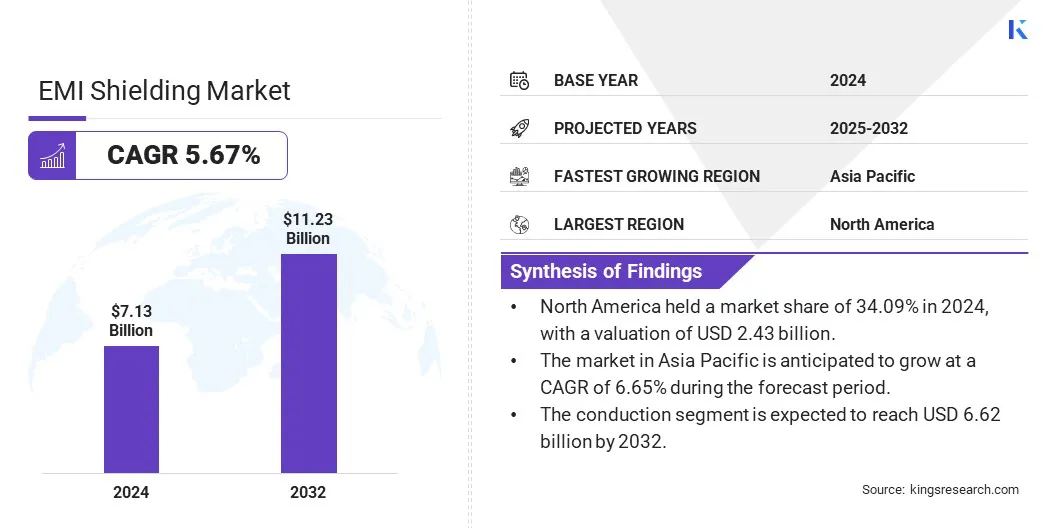

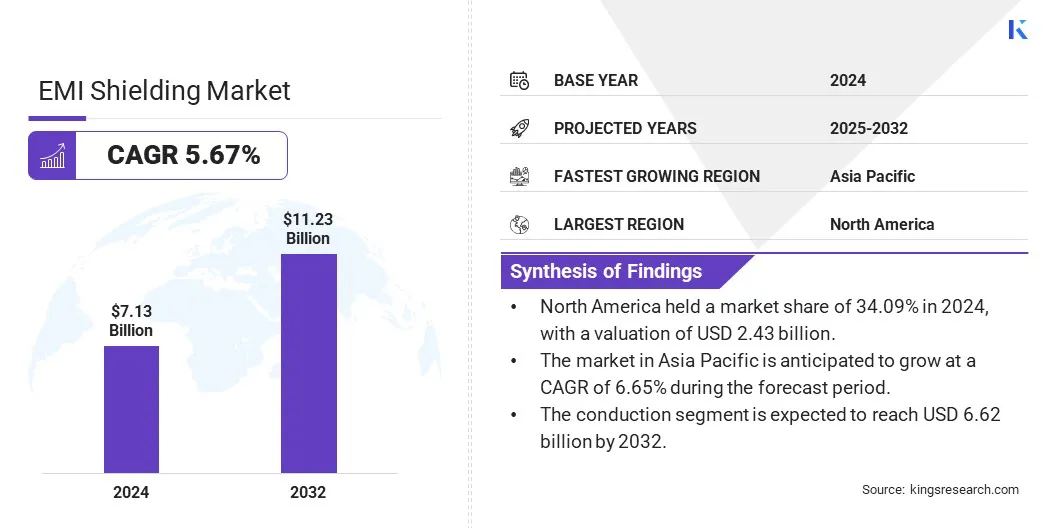

The global EMI shielding market size was valued at USD 7.13 billion in 2024 and is projected to grow from USD 7.48 billion in 2025 to USD 11.23 billion by 2032, exhibiting a CAGR of 5.67% during the forecast period.

This growth is attributed to the rising demand for advanced electronic devices across consumer electronics, automotive, aerospace, and telecommunications. This demand is further supported by rapid technological advancements and increasing electromagnetic interference challenges.

The need for enhanced electromagnetic compatibility to ensure device reliability and performance is further contributing to market expansion, particularly amid the widespread deployment of 5G networks and the growing proliferation of Internet of Things (IoT) devices.

Major companies operating in the EMI shielding industry are Henkel AG & Co, ETS-Lindgren, 3M, Parker Hannifin Corp, PPG Industries, Inc., Sealing Devices Inc., RTP Company, Laird Technologies, Inc., Parker Hannifin Corp, KITAGAWA Industries Co., LTD., Leader Tech Inc., MG Chemicals, Tech Etch, Inc., Omega Shielding Products, and Magnetic Shield Corporation.

Innovations in lightweight, flexible, and high-performance shielding materials, along with stringent regulatory standards on electromagnetic emissions, are further fueling market growth. The increasing adoption of electric vehicles, smart devices, and industrial automation systems is also contributing to the market growth over the forecast period.

Key Highlights

- The EMI shielding market size was valued at USD 7.13 billion in 2024.

- The market is projected to grow at a CAGR of 5.67% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, with a valuation of USD 2.43 billion.

- The conductive coatings & paints segment garnered USD 2.00 billion in revenue in 2024.

- The conduction segment is expected to reach USD 6.62 billion by 2032.

- The consumer electronics segment is anticipated to witness fastest CAGR of 5.97% during the forecast period

- The market in Asia Pacific is anticipated to grow at a CAGR of 6.65% during the forecast period.

Market Driver

Growing Integration of Electronic Devices

The market is expanding steadily, fueled by the continuous rise in the integration of electronic devices across various sectors, including consumer electronics, automotive, healthcare, and industrial applications.

As electronic devices become more embedded in everyday products, there is an increasing need to protect sensitive components from electromagnetic interference, which can compromise device performance and reliability. This growing complexity and density of electronic systems drive demand for effective EMI shielding solutions.

Moreover, miniaturization and multifunctionality in electronic devices, along with the proliferation of connected technologies like IoT and 5G, are expected to accelerate the adoption of advanced shielding materials and technologies in the coming years.

- In July 2024, NPG Asia Materials, published by Springer Nature Limited, featured research from Nanyang Technological University demonstrating a novel 3D printing technique that aligns graphite micro platelets to enhance EMI shielding in electronic packaging. This method achieved up to 90 dB shielding effectiveness, doubling performance by optimizing microstructures. The materials also offer excellent heat dissipation and mechanical strength, making them ideal for advanced electronic systems.

Market Challenge

Balancing Effective Shielding Performance with Material Compatibility and Design Constraints

Balancing effective EMI shielding performance with material compatibility and design constraints poses a key challenge for the EMI shielding market, as modern electronic devices demand solutions that provide robust interference protection while maintaining device functionality and aesthetics.

EMI shielding materials must be seamlessly integrated into compact, multifunctional devices while maintaining mechanical integrity, effective thermal management, and adherence to strict size and weight constraints.

To address this issue, manufacturers are focusing on the development of advanced materials such as lightweight conductive polymers, composites, and thin-film coatings that offer effective shielding without adding bulk. Key players are also developing modular and flexible shielding designs to enhance adaptability across different device form factors and applications.

Market Trend

Advancements in Lightweight and Sustainable Materials

Innovations in lightweight and environmentally sustainable shielding materials are significantly transforming the market by improving performance while reducing environmental impact.

Manufacturers are increasingly developing advanced materials such as conductive polymers, graphene-based composites, and biodegradable foams that provide effective electromagnetic interference protection without adding excessive weight to electronic devices.

These materials enhance device durability and flexibility, enabling seamless integration into compact and multifunctional electronics, which is essential for modern applications. Furthermore, ongoing research into these advanced materials supports the production of shielding components that meet stringent regulatory standards while reducing manufacturing costs and waste.

- In June 2023, researchers from Kocaeli University published a study in ACS Omega, hosted by the National Institutes of Health, on bio-based polyamide 11/poly (lactic acid) composites reinforced with carbon fibers for EMI shielding. The composites demonstrated improved thermal stability, conductivity, and shielding effectiveness up to 28 dB at 10 GHz, exceeding practical standards. This research offers a sustainable alternative to conventional metal-based EMI shielding materials.

EMI Shielding Market Report Snapshot

|

Segmentation

|

Details

|

|

By Material

|

Conductive Coatings & Paints, Conductive Polymers, Metal Shielding Product, EMC/EMI Filters, and Others

|

|

By Method

|

Radiation, and Conduction

|

|

By Application

|

Automotive, Defense & Aerospace, Healthcare, IT & Telecommunications, Consumer Electronics, and Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Material (Conductive Coatings & Paints, Conductive Polymers, Metal Shielding Product, EMC/EMI Filters, and Others): The conductive coatings & paints segment earned USD 2.00 billion in 2024 due to its widespread application in consumer electronics and automotive components, offering cost-effective and efficient EMI protection.

- By Method (Radiation, and Conduction): The conduction segment held 59.94% of the market in 2024, due to its superior effectiveness in transferring electromagnetic interference through physical contact, making it ideal for densely packed electronic assemblies.

- By Application (Automotive, Defense & Aerospace, Healthcare, IT & Telecommunications, Consumer Electronics, and Others): The automotive segment is projected to reach USD 3.36 billion by 2032, owing to the increasing integration of advanced electronic systems in electric and autonomous vehicles, which require robust EMI shielding to ensure safety and signal integrity.

EMI Shielding Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America EMI shielding market share stood at around 34.09% in 2024, with a valuation of USD 2.43 billion. This dominance is attributed to the region’s strong base of electronics and telecommunications industries, widespread adoption of high-performance electronic systems, and the presence of major EMI shielding material and component manufacturers.

Furthermore, increasing investments in electric vehicles, autonomous technologies, and 5G infrastructure are driving the adoption of advanced EMI shielding solutions across these sectors. Moreover, the region's rigorous electromagnetic compatibility regulations and emphasis on device reliability and safety support sustained demand for shielding technologies.

Additionally, the growing focus on R&D, coupled with rapid innovation in shielding materials and integration techniques is further fueling the market in North America.

The EMI shielding industry in Asia-Pacific is poised for significant growth at a robust CAGR of 6.65% over the forecast period. This growth is propelled by the rapid expansion of consumer electronics and automotive manufacturing across emerging economies in this region.

Additionally, the widespread deployment of advanced connectivity technologies, including 5G and IoT, is increasing the demand for high-performance EMI shielding to ensure system reliability and electromagnetic compatibility. Government-led initiatives aimed at enhancing domestic production capabilities and supporting technological innovation are further driving market expansion.

Moreover, rising investments in electric mobility, industrial automation, environmentally sustainable shielding materials and smart infrastructure are accelerating the integration of EMI shielding solutions across key application areas such as automotive, consumer electronics, telecommunications, and industrial equipment throughout the Asia-Pacific region.

- In May 2024, the Press Information Bureau reported that researchers from the Indian Institute of Technology (IIT), Mandi, developed an eco-friendly electromagnetic interference (EMI) shielding solution. This innovative development utilizes sustainable materials to provide effective EMI protection while reducing environmental impact, representing a major step forward in green technology for electronic devices.

Regulatory Frameworks

- Globally, electromagnetic interference (EMI) shielding products and systems are regulated under the International Electrotechnical Commission (IEC) standard IEC 61000-4-2, which specifies testing and measurement techniques for electromagnetic compatibility (EMC).

- In the European Union, electromagnetic interference (EMI) shielding is regulated under the Electromagnetic Compatibility (EMC) Directive 2014/30/EU, which sets requirements to ensure that electrical and electronic equipment operates without generating or being affected by electromagnetic disturbances.

Competitive Landscape

The EMI shielding market features a moderately fragmented competitive landscape, consisting of well-established multinational companies alongside specialized manufacturers of materials and components.

Key industry players are focusing on strategies such as advanced material development, product customization, and integration of EMI solutions within increasingly compact and multifunctional electronic systems to meet evolving industry demands.

Companies are actively investing in R&D to develop lightweight, high-performance, and environmentally sustainable shielding materials that align with stringent electromagnetic compatibility standards and application-specific requirements.

Furthermore, strategic collaborations with OEMs (Original Equipment Manufacturers), along with mergers and acquisitions, are being employed to strengthen market presence, expand global distribution networks, and broaden product portfolios across sectors such as automotive, aerospace, healthcare, and telecommunications.

List of Key Companies in EMI Shielding Market:

- Henkel AG & Co

- ETS-Lindgren

- 3M

- Parker Hannifin Corp

- PPG Industries, Inc.

- Sealing Devices Inc.

- RTP Company

- Laird Technologies, Inc.

- Parker Hannifin Corp

- KITAGAWA Industries Co., LTD.

- Leader Tech Inc

- MG Chemicals

- Tech Etch, Inc.

- Omega Shielding Products

- Magnetic Shield Corporation

Recent Developments (Product Launch)

- In February 2025, James Cropper Advanced Materials introduced EMITEC, a lightweight solution for electromagnetic interference shielding that is up to 19 times lighter than conventional metal materials. This breakthrough provides key benefits for sectors where minimizing weight and space is essential.

’s positive outlook