Electric Vehicle Charging Station Market Size

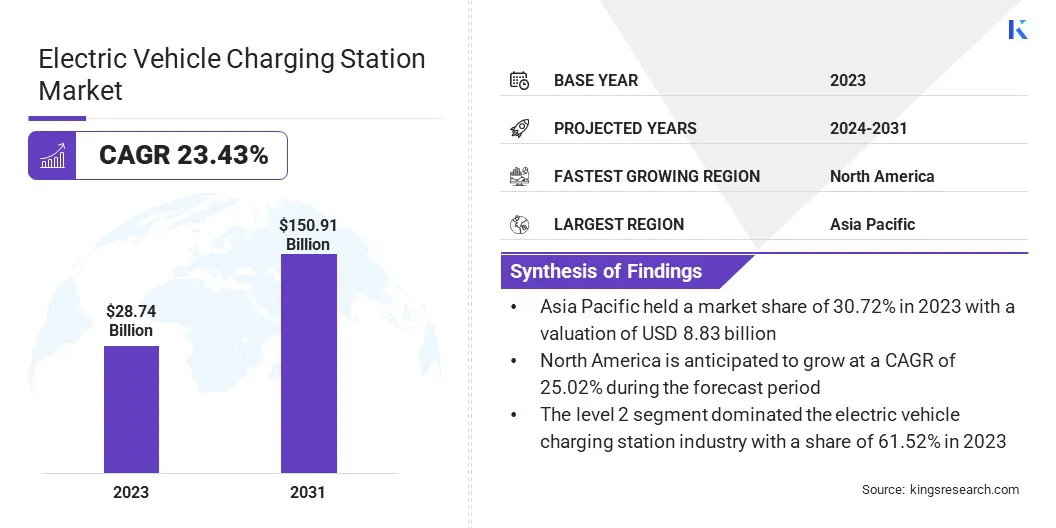

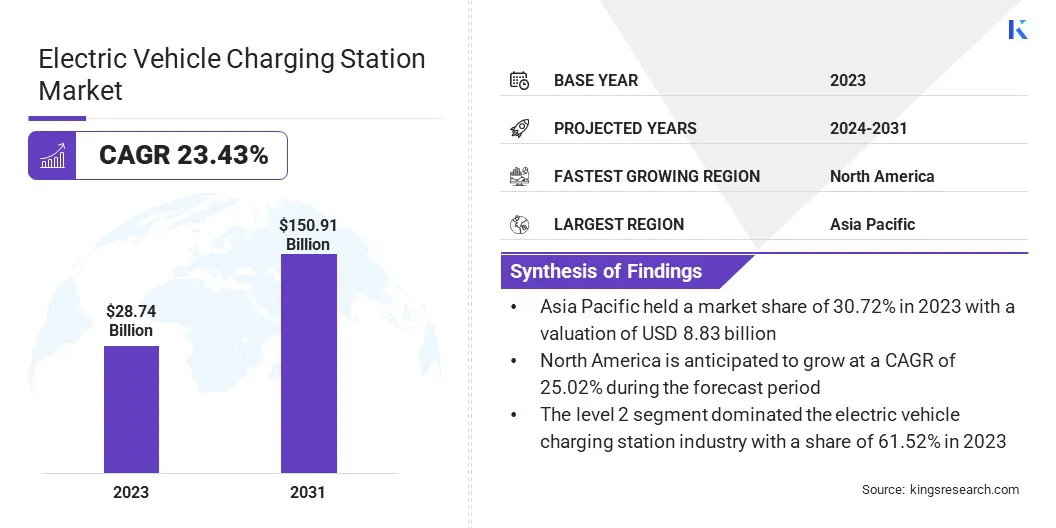

The global electric vehicle charging station market size was valued at USD 28.74 billion in 2023 and is projected to reach USD 150.91 billion by 2031, expanding at a CAGR of 23.43% from 2024 to 2031. Government incentives and policies play a crucial role in driving the adoption of electric vehicles (EVs) globally. Various governments have implemented tax incentives, rebates, subsidies, and grants to encourage consumers to switch to EVs.

Additionally, policies mandating stricter emissions standards and promoting the development of charging infrastructure have created a conducive environment for EV adoption, thereby fueling product uptake. In the scope of work, the report includes solutions offered by companies such as BYD Motors Inc., Tritium, Tesla, ChargePoint Holdings, Inc., Tata Power, BP p.l.c., Alfen N.V., Shell Group, Enel X Way USA, LLC, EVgo Services LLC (LS Power), Siemens, and others.

The increasing penetration of EVs in the automotive industry is significantly driving the growth of the EV charging station market. Rising vehicle sales, coupled with the growing awareness of the environmental impacts of gasoline-powered cars, have amplified the demand for EVs. Consumers are increasingly prioritizing sustainable alternatives as they shift away from traditional fuel-powered vehicles.

Rising fuel prices are further encouraging this transition, contributing to the robust expansion of the EV charging station market. This shift directly correlates with the growing need for reliable and efficient charging infrastructure to support the expanding EV ecosystem.

- According to the International Energy Agency (IEA), global EV sales surged by approximately 32.38% in 2023, exceeding 13 million for the first time, despite overall car sales experiencing a decline in 2022. This milestone underscores the accelerating adoption of EVs and highlights their transformative impact on the automotive industry.

The growing preference for EVs is reshaping the automotive landscape, creating lucrative opportunities for stakeholders in the EV charging station market. As vehicle sales continue to rise and more consumers embrace EVs, investments in advanced charging infrastructure are expected to increase, ensuring market growth remains strong in the coming years.

An EV charging station is a designated infrastructure that supplies electric energy for recharging the batteries of EVs. These stations vary in charging level, application, charging type, and compatible vehicles. Charging levels typically range from Level 1, which utilizes a standard household outlet, to Level 3 or DC fast charging, which provides rapid charging capabilities.

Charging stations support different charging types, such as plug-in charging, inductive charging, and wireless charging, catering to diverse user preferences and vehicle compatibility. These stations accommodate various types of EVs, including plug-in hybrids, battery electric vehicles, and hydrogen fuel cell vehicles, facilitating the widespread adoption of clean and sustainable transportation solutions.

Analyst’s Review

Analyst’s Review

The EV charging station market is experiencing rapid growth and evolution driven by the global shift toward sustainable transportation solutions. With increasing environmental awareness and government initiatives promoting EV adoption, the demand for charging infrastructure is surging. The market is characterized by a growing number of players offering a diverse range of charging solutions, including Level 2 chargers, DC fast chargers, and wireless charging technologies.

Moreover, technological advancements in EV charging technology are driving significant growth in the EV charging station market across Asia Pacific (APAC). Innovations such as fast-charging systems, wireless charging, and smart networks are enhancing convenience and efficiency, addressing key consumer concerns like charging speed and infrastructure accessibility.

The rising adoption of EVs, supported by models offering longer driving ranges, is further fueling the demand for advanced charging solutions. Additionally, collaborations between automakers, energy companies, and infrastructure providers are accelerating innovation and investment in the market.

- In November 2023, UK-based automaker Lotus introduced advanced charging solutions for the Indian market, including a 450 kW ultra-fast DC charger, a modular unit supporting up to four vehicles, and a power cabinet.

These cutting-edge technologies are meeting the growing need for faster and more efficient charging options, positioning the market for substantial growth and creating opportunities for stakeholders.

Electric Vehicle Charging Station Market Growth Factors

The escalating levels of carbon emissions and hazardous pollutants from transportation are driving the EV charging station market, subsequently boosting the demand for EV charging stations.

The transportation sector, a major contributor to air pollution and greenhouse gas (GHG) emissions primarily from internal combustion engine vehicles, is under scrutiny for its environmental impact. These emissions degrade air quality, accelerate climate change, and pose significant health risks.

The growing adoption of electric vehicles (EVs) is significantly boosting the EV charging station market as governments, automakers, and stakeholders push for sustainable transportation solutions. EVs, with zero-emission operations, are reducing reliance on fossil fuels and addressing environmental concerns.

- Automakers like BYD are driving this trend; in January 2023, BYD launched its Atto 3 electric SUV in India, featuring innovative Blade battery technology and aiming for a 40% market share by 2030. This global push is creating a surge in demand for reliable charging infrastructure.

Additionally, advancements in charging technology, including ultra-fast and wireless charging, and government incentives for installing public and residential charging stations, are accelerating the expansion of charging infrastructure, driving substantial market growth.

The limited availability of public charging stations in rural and remote areas poses a significant restraint to the widespread adoption of EVs in these areas. While urban centers typically have a dense network of charging infrastructure, rural and remote areas often lack adequate charging facilities, creating barriers to EV ownership and usage.

This constraint stems from various factors, including lower population density, limited infrastructure development, and logistical challenges in deploying charging stations. As a result, EV drivers in rural and remote areas may face range anxiety and inconvenience due to the scarcity of charging options, hindering the uptake of EVs in such areas.

Electric Vehicle Charging Station Market Trends

The increasing adoption of fast charging technology is a prominent trend shaping the EV charging landscape. Fast charging, also known as DC fast charging or rapid charging, enables EVs to replenish their battery capacities significantly faster than traditional charging methods. This technology is revolutionizing the EV charging experience by reducing charging times from hours to minutes, addressing one of the primary concerns of EV drivers: range anxiety.

As consumers demand greater convenience and flexibility in charging their EVs, fast charging solutions are becoming increasingly prevalent in public charging networks, especially in commercial locations.

Moreover, advancements in fast charging infrastructure, such as ultra-rapid chargers capable of delivering high power outputs, are facilitating long-distance travel and enabling EV drivers to recharge quickly during their journeys. The widespread application of fast charging technology is expected to accelerate the adoption of EVs by eliminating barriers associated with charging speed and accessibility, driving market growth, and enhancing the user experience for EV owners.

Segmentation Analysis

The global EV charging station market is segmented based on charging level, application, charging type, vehicle type, and geography.

By Charging Level

Based on charging level, the market is categorized into level 1, level 2, and level 3. The level 2 segment dominated the EV charging station market with a share of 61.52% in 2023, due to its widespread adoption in various applications and settings.

Level 2 charging stations are characterized by their compatibility with standard household electrical outlets (e.g., 240 volts) and relatively faster charging speeds compared to Level 1 chargers. These chargers are commonly installed in residential homes, workplaces, public parking facilities, and commercial buildings, catering to the charging needs of EV OEMs in diverse settings.

By Charger Type

Based on charger type, the market is classified into AC and DC. The AC segment is anticipated to witness the highest CAGR of 23.74% over the forecast period, due to the high adoption of alternating current (AC) charging solutions in the EV charging station market.

AC charging, commonly referred to as Level 1 and Level 2 charging, utilizes AC power sources to replenish EV batteries at varying speeds. The projected growth of the AC segment is attributed to the increasing demand for residential and commercial charging solutions, where AC chargers offer cost-effective and versatile charging options.

Additionally, the development of smart charging technologies and interoperable AC charging standards, such as the SAE J1772 connector, is facilitating the integration of AC charging infrastructure into public and private charging networks.

Furthermore, government incentives and initiatives aimed at expanding residential and workplace charging infrastructure are expected to drive the adoption of AC charging stations, contributing to the segment's robust growth trajectory over the forecast period.

By Vehicle Type

Based on vehicle type, the EV charging station market is segmented into passenger cars and commercial vehicles. The commercial vehicles segment is slated to exhibit the highest CAGR of 24.67% between 2024 and 2031.

Commercial vehicles, including buses, delivery vans, trucks, and taxis, are increasingly transitioning toward electric propulsion to reduce operating costs, lower emissions, and comply with stringent environmental regulations.

The total cost of ownership (TCO) benefits associated with electric commercial vehicles, such as lower fuel and maintenance costs over the vehicle's lifecycle, are compelling fleet operators to invest in electrification. Moreover, government incentives, subsidies, and regulatory mandates promoting the electrification of commercial fleets are incentivizing the adoption of EVs in this segment.

Additionally, advancements in battery technology, increased vehicle range, and the expanding charging infrastructure tailored for commercial applications are enhancing the feasibility and attractiveness of electric commercial vehicles. As a result, the commercial vehicles segment has emerged as a lucrative market opportunity, driving segment growth.

Electric Vehicle Charging Station Market Regional Analysis

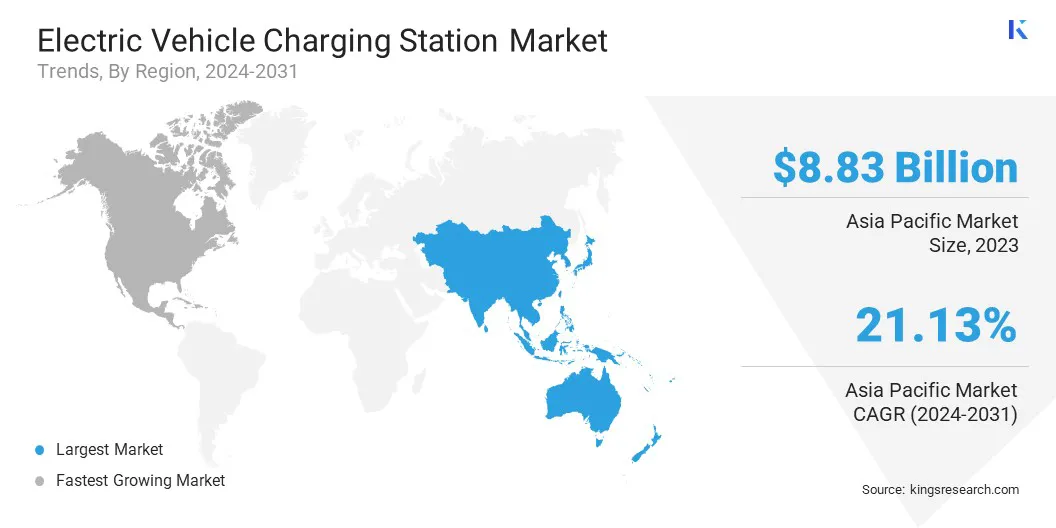

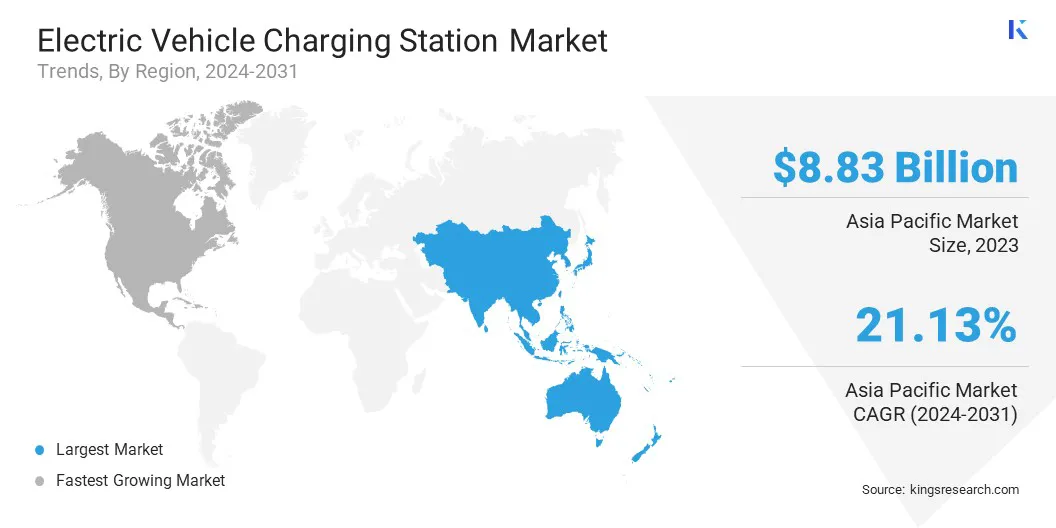

Based on region, the global EV charging station market is classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The EV charging station market in Asia Pacific accounted for 30.72% share of the global market in 2023, with a valuation of USD 8.83 billion, reflecting the region's pivotal role in the EV charging station market.

The dominance of Asia Pacific in the EV charging station market is driven by rapid urbanization, government initiatives promoting electric mobility, and significant investments in charging infrastructure.

Countries like China, Japan, and South Korea are leading electrification efforts with ambitious EV adoption targets and a strong focus on expanding charging networks. The region's robust manufacturing capabilities and technological advancements enable the development of cutting-edge charging solutions, such as fast charging and smart grid integration, further solidifying its position as a global leader in EV infrastructure.

Collaborations between automakers and energy providers are also propelling market growth.

- For instance, in May 2024, MG Motor India partnered with Hindustan Petroleum Corporation Ltd. (HPCL) to install 50kW/60kW DC fast chargers at key highways and urban centers across India.

- Similarly, in March 2024, Tata Motors’ electric division (TPEM) signed an MoU with HPCL to expand public EV charging stations using HPCL’s fuel station network. This initiative includes deploying chargers in high-traffic areas and leveraging usage data to improve customer experiences.

Such initiatives, coupled with technological innovation and strategic partnerships, are positioning Asia Pacific as a hub for EV charging infrastructure development, meeting the region's rising EV adoption and enhancing its sustainability goals.

Furthermore, supportive policies, incentives, and partnerships between public and private stakeholders are fostering a conducive environment for market growth in the region. With the increasing demand for clean transportation solutions and a burgeoning EV sector, Asia Pacific is poised to maintain its leadership position in the global EV charging station market in the coming years.

- In July 2023, according to the Confederation of Indian Industry (CII), India is projected to have over 1.3 million charging stations by 2030. This underscores the need for extensive infrastructure development to facilitate widespread usage of EVs.

The EV charging station market in North America is likely to experience significant growth, expanding at a CAGR of 25.02% between 2024 and 2031. The stringent emissions regulations and ambitious climate targets are accelerating the adoption of EVs, which is prompting investments in charging infrastructure to support EV proliferation.

Additionally, government incentives, tax credits, and grants aimed at promoting EV adoption and expanding charging networks are stimulating market growth. Moreover, collaborations between automakers, utilities, and technology providers are driving innovation and investment in EV charging solutions tailored to the needs and preferences of consumers in North America.

Furthermore, the region's robust technological infrastructure and consumer acceptance of EVs are supporting market expansion. With increasing consumer demand for sustainable transportation options and supportive regulatory frameworks, North America is poised to emerge as a key growth region in the global EV charging station market in the forecast period.

- For instance, in February 2023, the Biden-Harris Administration unveiled a series of initiatives to establish a convenient and domestically produced EV charging infrastructure to electrify the iconic American road trip. This included the construction of a national network comprising 500,000 EV chargers along highways and in communities, ensuring that EVS comprise at least 50% of new car sales by 2030.

Competitive Landscape

The global electric vehicle charging station market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Expansion & investments are the major strategic initiatives adopted by companies in this sector. Industry players are investing extensively in R&D activities, building new manufacturing facilities, and supply chain optimization.

List of Key Companies in Electric Vehicle Charging Station Market

- BYD Motors Inc.

- Tritium

- Tesla

- ChargePoint Holdings, Inc.

- Tata Power

- BP p.l.c.

- Alfen N.V.

- Shell Group

- Enel X Way USA, LLC

- EVgo Services LLC (LS Power)

- Siemens

Key Industry Developments

- March 2024 (Partnership): Osprey Charging partnered with East of England Co-op, a prominent independent retailer in the East of England. The collaboration commenced with the introduction of two ultra-rapid charge points at East of England Co-op Burnham-On-Crouch, followed by an additional 7 sites being rolled out in the subsequent months.

- February 2024 (Collaboration): Raizen and BYD collaborated to establish a network of 600 electric vehicle (EV) charging stations across eight Brazilian cities. The partnership aimed to address the anticipated demand for charging infrastructure in Brazil's burgeoning EV market.

- January 2024 (Launch): Tritium introduced the integration of Autocharge software capability into its RTM and PKM charger models. This strategic move enabled Tritium to enhance customer satisfaction by offering convenient and efficient solutions, ensuring a seamless end-to-end electric vehicle charging experience.

- November 2023 (Launch): ChargePoint announced the extensive deployment of the Express Plus Power Link 2000 DC fast charging platform. The Power Link system, equipped to deliver charging speeds of up to 500kW, served as both the hardware and software powering the swiftest public charging network in North America.

- August 2023 (Expansion): Tata Power and Zoomcar forged a Memorandum of Understanding (MoU) to encourage extensive electric vehicle adoption and provide a seamless, user-friendly charging experience for EV users in India.

The Global Electric Vehicle Charging Station Market is Segmented as:

By Charging Level

By Application

- Public

- Semi-Public

- Private

By Charging Type

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America