Market Definition

The dry ramming mass market encompasses the production of dry ramming mass materials, which are used as refractory linings in high-temperature industrial applications such as furnaces, kilns, and steel production.

These materials are tightly packed to protect equipment from heat damage. This market serves inductries such as steel, cement, glass, and non-ferrous metals, with a focus on durability and performance under extreme conditions.

Dry Ramming Mass Market Overview

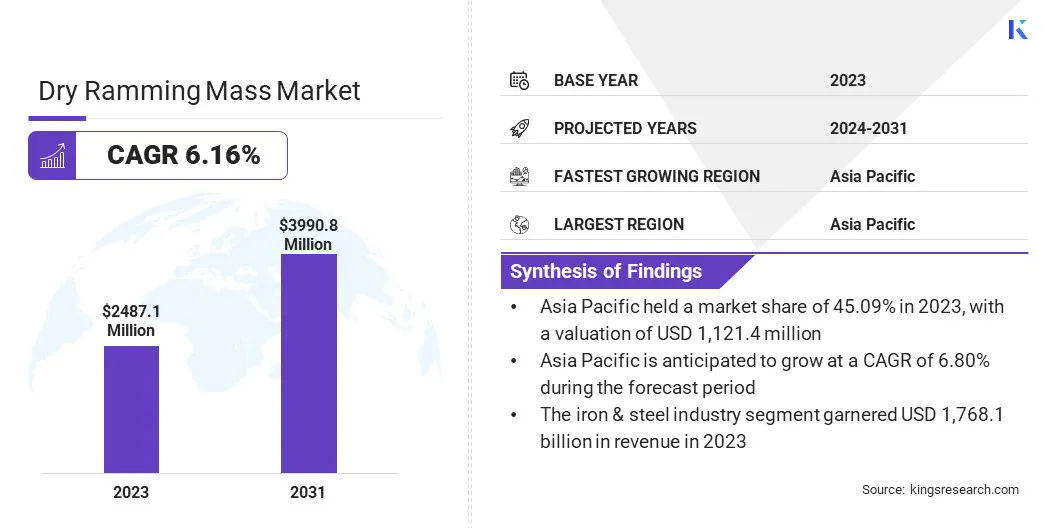

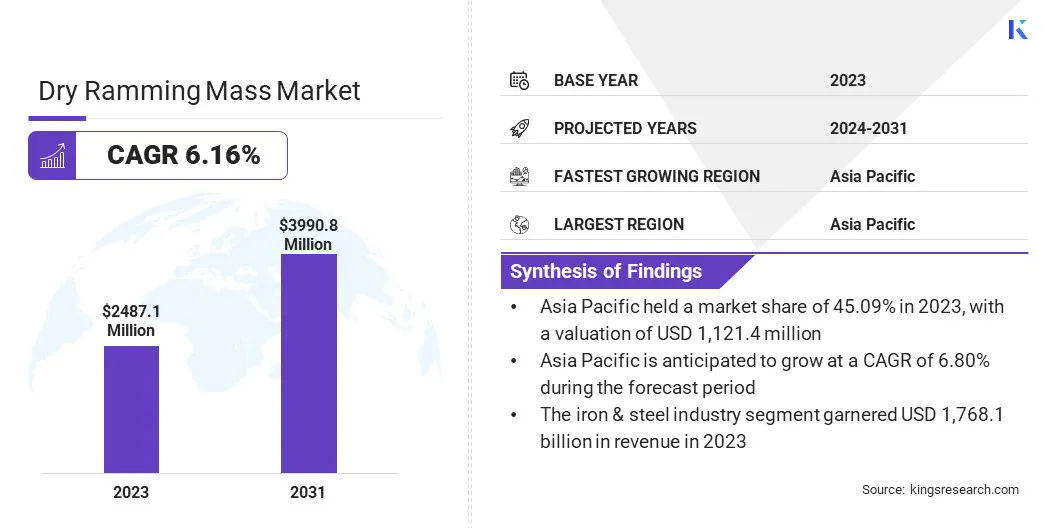

Global dry ramming mass market size was USD 2,487.1 million in 2023, which is estimated to be valued at USD 2,625.8 million in 2024 and reach USD 3,990.8 million by 2031, growing at a CAGR of 6.16% from 2024 to 2031.

Increasing industrial demand is a major factor driving this growth. Industries such as steel, cement, and glass, which rely on high-temperature processes, require durable and heat-resistant materials like dry ramming mass for furnace linings.

Major companies operating in the global dry ramming mass industry are Saint-Gobain, Vishva Vishal Refractory Limited, Zhengzhou Caihua Kiln Masonry Installation Co.,Ltd., Balaji Ceramics, REFCAST CORPORATION, Gita Refratories (P) Ltd, Imperial World Trade Pvt. Ltd., ShengHe Refractories, Arora Refractories, Galaxy Enterprise, Karma Associates, LMM GROUP, RGRM, RSP Corporation, Shree B. S. Mining Co., and others.

The market is a vital segment within the refractory industry, supplying heat-resistant materials for furnace linings in high-temperature industrial processes. With an emphasis on durability, cost-efficiency, and performance, dry ramming mass ensures longevity in extreme conditions.

The market is characterized by a strong demand for high-quality, innovative products that enhance operational efficiency and reduce maintenance costs in industries relying on heat-intensive production processes.

- In August 2024, Saint-Gobain Performance Ceramics & Refractories strengthened its position in the non-ferrous metals sector by acquiring Ceramco’s assets and technology. This acquisition enhances its refractory solutions, aligning with its strategy to deliver advanced, high-performance materials for high-temperature industries.

Key Highlights:

- The global dry ramming mass market size was recorded at USD 2,487.1 million in 2023.

- The market is projected to grow at a CAGR of 6.16% from 2024 to 2031.

- Asia-Pacific held a share of 45.09% in 2023, valued at USD 1,121.4 million.

- The silica-based ramming mass segment garnered USD 1,270.7 million in revenue in 2023.

- The induction furnaces segment is expected to reach USD 2,128.2 million by 2031.

- The non-ferrous metal industry segment is anticipated to witness the fastest CAGR of 6.81% over the forecast period.

- Europe is anticipated to grow at a CAGR of 6.65% through the projection period.

Market Driver

"Increasing Industrial Demand"

The growing industrial demand is fueling the progress of the dry ramming mass market. Industries such as steel, cement, and glass rely on high-temperature processing for production, requiring durable refractory materials for furnace linings.

As these industries expand, the need for effective, sustainable and long-lasting refractory solutions increases. Dry ramming mass ensures high performance under extreme conditions, making it ideal for maintaining efficient operations and reducing downtime in high-temperature manufacturing environments.

- In February 2024, Saint-Gobain Performance Ceramics & Refractories obtained EPD certification for Magmalox production at the SEPR Italia plant. This highlights the company’s commitment to sustainability while offering advanced refractory solutions for the glass and steel industries.

Market Challenge

"Supply Chain Disruptions"

Supply chain disruptions pose a significant challenge for the development of the dry ramming mass market. Global crises, including pandemics and geopolitical tensions, can delay raw material availability, impacting production timelines and increasing costs.

To mitigate hese risks, companies can diversify their supplier base, invest in local sourcing, and establish strategic partnerships to reduce dependency on single sources. Additionally, implementing advanced inventory management systems and strengthening logistics networks can help ensure smoother operations and timely deliveries during disruptions.

Market Trend

"Rising Emphasis on Sustainability"

Surging demand for eco-friendly and low-emission refractory materials is emerging as a notable trend in the dry ramming mass market, supported by stricter environmental regulations and the industry's commitment to sustainability.

Manufacturers are increasingly focused on reducing their carbon footprint, with a strong emphasis on using recycled materials and innovative, low-emission technologies. This shift aligns with global sustainability goals, ensures regulatory compliance, and offers a competitive edge in a market that prioritizes environmental responsibility and resource efficiency.

- In 2024, RHI Magnesita’s high-performance MgO-C bricks with 30% circular raw materials gained traction in steelmaking, influencing the market. This innovation reduces CO2 emissions while maintaining performance, supporting the industry’s sustainability goals.

Dry Ramming Mass Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Silica-Based Ramming Mass, Alumina-Based Ramming Mass, Magnesia-Based Ramming Mass, Others

|

|

By Application

|

Induction Furnaces, Ladle Lining, Tundish Lining, Foundries, Others

|

|

By End-Use Industry

|

Iron & Steel Industry, Non-Ferrous Metal Industry, Cement Industry, Glass Industry, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Silica-Based Ramming Mass, Alumina-Based Ramming Mass, Magnesia-Based Ramming Mass, and Others): The silica-based ramming mass segment earned USD 1,270.7 million in 2023, mainly due to its superior thermal stability and cost-effectiveness in industrial applications.

- By Application (Induction Furnaces, Ladle Lining, Tundish Lining, Foundries, and Others): The induction furnaces segment held a share of 58.12% of the market in 2023, largely attributed to its widespread use in efficient metal melting processes, boosting demand for high-performance ramming masses.

- By End-Use Industry (Iron & Steel Industry, Non-Ferrous Metal Industry, Cement Industry, Glass Industry, and Others): The iron & steel industry segment is projected to reach USD 2,849.4 million by 2031, owing to the increasing demand for ramming masses in steel production and the adoption of energy-efficient technologies.

Dry Ramming Mass Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific dry ramming mass market accounted for a share of around 45.09% in 2023, valued at USD 1,121.4 million. This dominance is reinforced by the region's extensive industrial base, particularly in steel, iron, and non-ferrous metal production.

The high demand for refractory materials, supported by rapid industrialization, infrastructure development, and strong manufacturing sectors in countries such as China and India, positions Asia Pacific as a leading market for dry ramming mass. Additionally, favorable government initiatives aimed at strenghtheing the industrial sector contribute to this growth.

Europe dry ramming mass industry is set to grow at a CAGR of 6.65% over the forecast period. This rapid growth is propelled by increasing investments in green technologies and sustainable manufacturing practices.

The shift toward low-emission and eco-friendly materials, coupled with advancements in the steel and non-ferrous metal industries, generates a robust demand for high-performance ramming masses.

Stricter environmental regulations in European countries are accelerating the transition to energy-efficient and environmentally friendly solutions, aiding regional market expansion.

- In October 2024, Shinagawa Refractories acquired Gouda Refractories Group, boosting its production of high-quality refractory solutions, including dry ramming mass. This acquisition strengthens Shinagawa’s presence in Europe, enhancing its capabilities to serve the steel and petrochemical sectors.

Regulatory Frameworks

- The Central Pollution Control Board (CPCB) sets emission norms that influence the production and use of dry ramming masses.

- The EU's Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) regulation is the main EU law to protect human health and the environment from the risks that can be posed by chemicals.

- In US, the Environmental Protection Agency (EPA) regulates and enforces policies to mitigate environmental and health risks while conducting research.

Competitive Landscape

Companies in the dry ramming mass market are increasingly focusing on expanding production capacity by building new manufacturing plants. This expansion strategy aims to meet the rising demand driven by growing industries such as steel, cement, and non-ferrous metals.

The development of new facilities allows for enhanced production efficiency, better supply chain management, and supports a diverse and sustainable product portfolio.

- In March 2024, INTOCAST announced a major investment in a new production plant in Tennessee, focused on manufacturing refractories, including dry ramming mass materials. This expansion underscores the company's commitment to innovation, sustainability, and enhancing supply chain efficiency to meet the growing demand in the U.S. steel industry.

List of Key Companies in Dry Ramming Mass Market:

- Saint-Gobain

- Vishva Vishal Refractory Limited

- Zhengzhou Caihua Kiln Masonry Installation Co.,Ltd.

- Balaji Ceramics

- REFCAST CORPORATION

- Gita Refratories (P) Ltd

- Imperial World Trade Pvt. Ltd.

- ShengHe Refractories

- Arora Refractories

- Galaxy Enterprise

- Karma Associates

- LMM GROUP

- RGRM

- RSP Corporation

- Shree B. S. Mining Co.

Recent Developments (Launch/Acquisition)

- In November 2024, RHI Magnesita launched the "4PRO" model, introducing innovative refractory solutions with a major focus on sustainability. This initiative aims to enhance dry ramming mass and other high-performance products, improving efficiency in high-temperature industries while reducing environmental impact through low-carbon initiatives and circular economy principles.

- In January 2025, RHI Magnesita expanded its North American footprint by acquiring Resco Group. This acquistion enhances local production capabilities, improves supply chain security for industries such as cement and steel, and supports sustainable solutions, fueling innovation and efficiency and innovation in dry ramming mass products.