Market Definition

The market focuses on the deployment of advanced technologies to enhance the efficiency, reliability, and performance of electrical distribution networks. It encompasses solutions such as smart grids, automated switches, sensors, communication systems, and advanced software for monitoring and control.

The report explores key drivers of market development, offering detailed regional analysis and a comprehensive overview of the competitive landscape shaping future opportunities.

Distribution Automation Market Overview

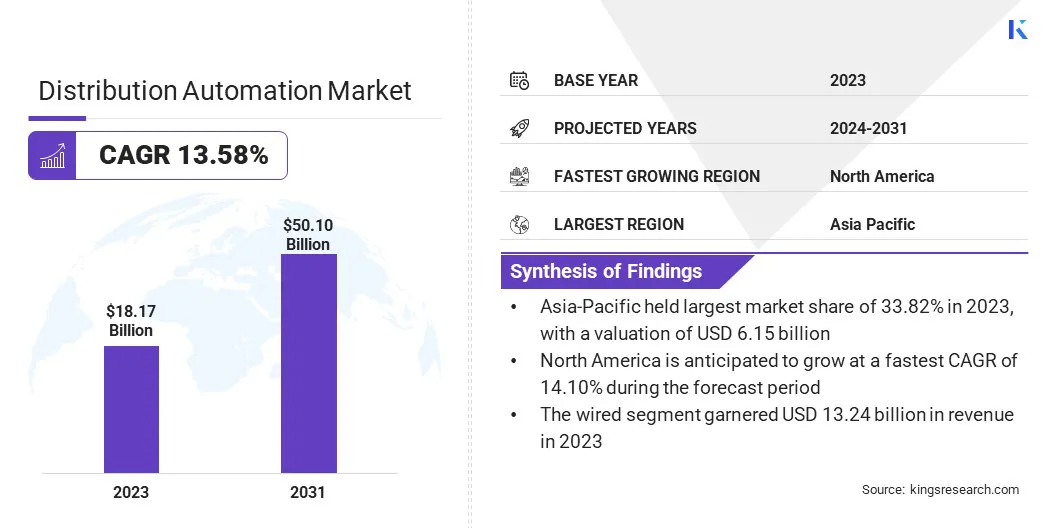

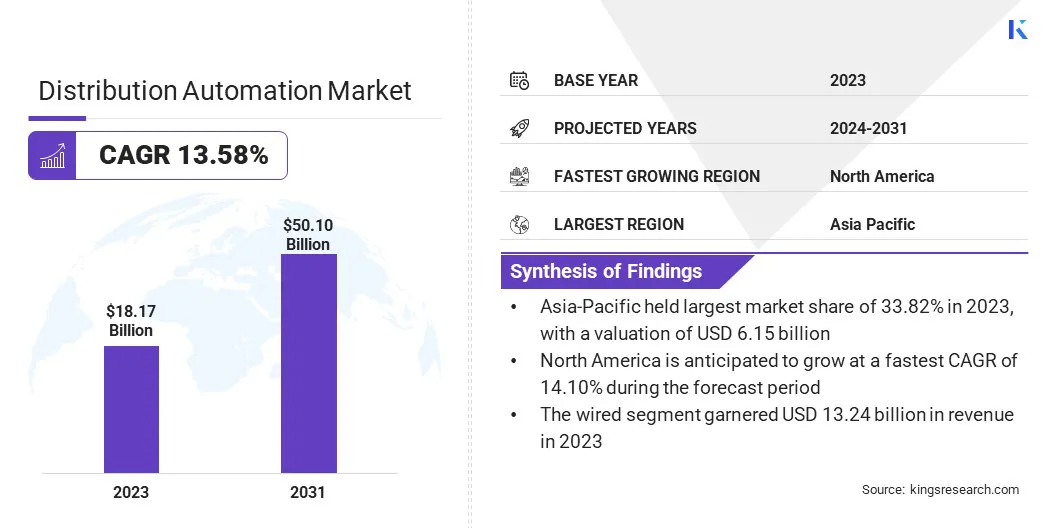

The global distribution automation market size was valued at USD 18.17 billion in 2023 and is projected to grow from USD 20.55 billion in 2024 to USD 50.10 billion by 2031, exhibiting a CAGR of 13.58% during the forecast period.

This growth is fueled by the increasing demand for enhanced grid reliability, operational efficiency, and real-time monitoring capabilities. The ongoing transition to smart grid infrastructure, coupled with rising investments in the modernization of aging distribution systems, is further boosting this expansion.

Major companies operating in the distribution automation industry are Siemens, Eaton, ABB, G&W Electric, Schneider Electric, Itron Inc, GE Grid Solutions, LLC, Hitachi Energy Ltd, Hubbell, Landis+Gyr, Schweitzer Engineering Laboratories, Inc., Minsait ACS, Inc., Trilliant Holdings Inc, Xylem, and Cisco Systems, Inc.

The growing integration of renewable energy sources, along with a strong emphasis on minimizing power outages and reducing energy losses, is fostering the global adoption of advanced distribution automation technologies. Regulatory initiatives promoting energy efficiency and grid resilience support market expansion.

- In August 2024, Hitachi Energy Ltd launched Relion REF650, specifically designed to provide advanced protection and control for power distribution applications. This new offering enhances grid reliability by enabling faster fault detection, improved operational efficiency, and optimized network performance for utilities.

Key Highlights

- The distribution automation market size was valued at USD 18.17 billion in 2023.

- The market is projected to grow at a CAGR of 13.58% from 2024 to 2031.

- Asia-Pacific held a share of 33.82% in 2023, valued at USD 6.15 billion.

- The field devices segment garnered USD 6.99 billion in revenue in 2023.

- The wired segment is expected to reach USD 36.44 billion by 2031.

- The public segment is anticipated to witness the fastest CAGR of 13.61% over the forecast period.

- The industrial segment garnered USD 7.66 billion in revenue in 2023.

- North America is anticipated to grow at a CAGR of 14.10% through the projection period.

Market Driver

Rising Demand for Reliable and Efficient Power Supply

The rising demand for reliable and efficient power supply is contributing to the expansion of the distribution automation market. As modern economies depend on uninterrupted electricity to support critical infrastructure, digital services, and industrial operations, power outages, voltage fluctuations, and service disruptions can result in substantial economic losses and diminished productivity.

Distribution automation addresses these challenges by enabling real-time monitoring, rapid fault detection, and automated system reconfiguration, enhancing grid reliability and performance. The growing adoption of energy-intensive technologies, such as electric vehicles, smart appliances, and data centers, further fuels demand for stable power delivery, boosting investment in advanced distribution automation solutions.

Market Challenge

High Initial Investment Costs

The deployment of advanced distribution automation systems involves significant capital investment in hardware, software, and communication infrastructure, hampering the expansion of the distribution automatiom market. These high upfront costs can be a barrier for utilities, particularly in developing regions where financial resources are limited.

The complex installation and integration with existing infrastructure add to the costs, making it difficult for utilities, particularly in emerging markets or with limited budgets, to secure necessary funding. This financial barrier often delays project implementation and limits the widespread deployment of distribution automation solutions among small and mid-sized utilities.

To mitigate this challenge, public-private partnerships (PPPs) can serve as a viable solution, enabling utilities to share financial risks while benefiting from private sector innovation and efficiency. Targeted government incentives, grants, and regulatory frameworks can significantly reduce capital barriers, particularly in emerging markets.

A phased implementation model allows utilities to distribute expenditures over time, making large-scale modernization more financially manageable. Furthermore, access to concessional financing through development banks, climate funds, or international lending institutions can provide essential capital for infrastructure upgrades.

Market Trend

Modernization of Aging Grid Infrastructure

A notable trend in the market is the modernization of aging grid infrastructure. Utilities worldwide are increasingly focusing on upgrading outdated electrical distribution systems to enhance operational efficiency, reliability, and resilience.

This trend is fueled by the growing demand for smart grid technologies, integration of renewable energy sources, and the need to reduce outage durations and maintenance costs. As part of this modernization, there is a rising deployment of intelligent electronic devices (IEDs), advanced sensors, automated switching systems, and robust communication networks, all of which are integral to distribution automation.

- In January 2025, AEP Ohio submitted a stipulation to the Public Utilities Commission of Ohio to enhance grid reliability and resiliency. The proposal includes expanding Distribution Automation Circuit Reconfiguration (DACR) technology across hundreds of circuits to reduce power outages and improve service continuity.

Distribution Automation Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Field Devices, Software, Services

|

|

By Technology

|

Wired, Wireless

|

|

By Utility

|

Private, Public

|

|

By End Use

|

Industrial, Commercial, Residential

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Field Devices, Software, and Services): The field devices segment earned USD 6.99 billion in 2023 due to their critical role in enabling real-time monitoring, control, and automation of power distribution networks.

- By Technology (Wired and Wireless): The wired segment held a share of 72.86% in 2023, attributed to its superior reliability, stable communication performance, and widespread adoption in established grid infrastructures.

- By Utility (Private and Public): The private segment is projected to reach USD 34.08 billion by 2031, fueled by increased investments in advanced grid technologies and the growing demand for optimized, cost-efficient energy distribution solutions in privately owned utility networks.

- By End Use (Industrial, Commercial, and Residential): The commercial segment is anticipated to grow at a CAGR of 13.70% over the forecast period, propelled by the increasing demand for reliable power supply, energy efficiency, and automation solutions in commercial buildings and facilities.

Distribution Automation Market Regional Analysis

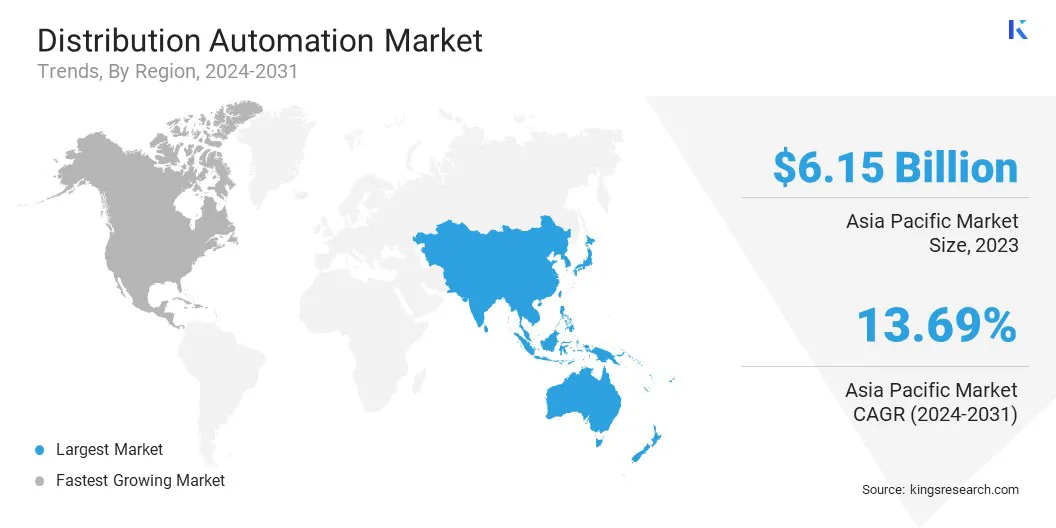

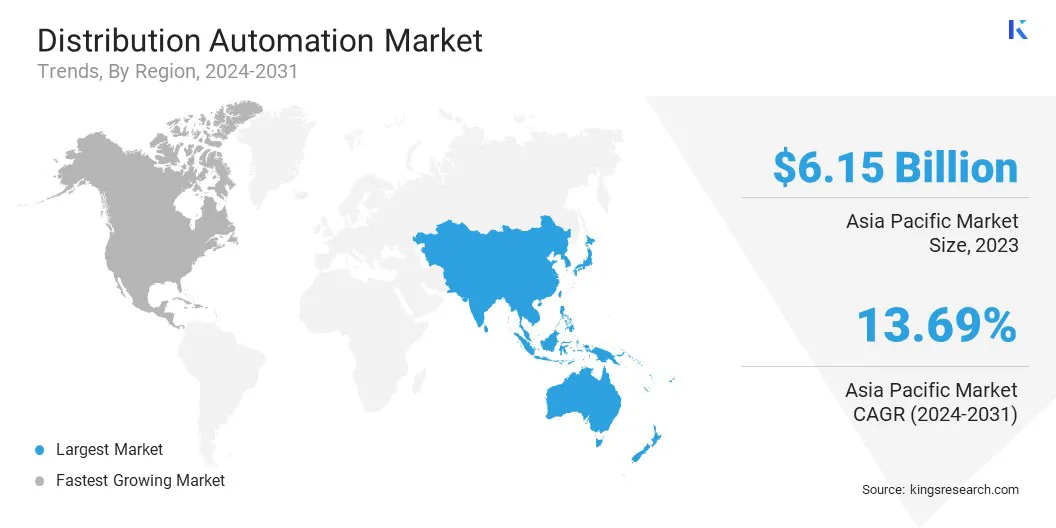

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific distribution automation market share stood at around 33.82% in 2023, valued at USD 6.15 billion. The dominance is reinforced by the region’s rapid industrialization, expanding urban populations, and growing investments in smart grid technologies.

Countries such as China, India, and Japan are at the forefront of grid modernization, supported by the need for improved grid reliability and the integration of renewable energy sources. This shift is further supported by government policies promoting energy efficiency, renewable energy integration, and the enhancement of grid resilience.

The rising demand for reliable and efficient power distribution across various sectors, including manufacturing, commercial, and residential, is fostering the widespread adoption of distribution automation solutions in the region.

North America distribution automation industry is likely to at a robust CAGR of 14.10% over the forecast period. This growth is fostered by efforts to upgrade aging infrastructure, improve grid resilience, and enhance power distribution efficiency. The integration of renewable energy sources, such as solar and wind, necessitates advanced automation solutions to manage their variability.

Moreover, regulatory support and incentives for smart grid development, along with substantial investments from both public and private sectors, are fueling regional market expansion.

- In March 2025, Southern States, LLC launched Distribution Fault Detection Isolation and Restoration (DFDIR) solution, featuring the Smart Automation Module (SAM) and Smart Automation Management System (SAMS). This decentralized system allows utilities to flexibly detect, isolate, and restore faults, while the user-configurable SAMS interface streamlines automation setup.

Regulatory Frameworks

- In the United States, the Energy Policy Act of 2005 (EPAct 2005) regulates the development of advanced grid technologies to enhance grid reliability, security, and efficiency, while supporting renewable energy integration and smart grid adoption.

- In the European Union, the Clean Energy for All Europeans Package (2019) regulates the modernization of the energy system, promoting the adoption of smart grids. It aims to increase energy efficiency, reduce carbon emissions, and integrate renewable energy sources, thereby enhancing grid flexibility .

- In Australia, the National Electricity Rules (NER) govern the operation of the national electricity market , economic oversight of monopoly transmission and distribution networks, and power system security management by the Australian Energy Market Operator (AEMO).

Competitive Landscape

Leading companies operating in the distribution automation market are focusing on expanding their product portfolios through technological advancements, strategic partnerships, and acquisitions to maintain a competitive edge. They are also investing in R&D to introduce new, more efficient solutions for grid management, fault detection, and integration with renewable energy sources.

Companies are increasingly adopting smart technologies such as artificial intelligence (AI), machine learning, and the Internet of Things (IoT) to enhance the capabilities of their distribution automation systems.

- In December 2024, ABB launched its Smart Buildings & Smart Power Technology Hub in London, showcasing advanced power distribution and building automation solutions. The hub offers a hands-on experience with cutting-edge energy management technologies, providing training and support for industries such as data centers and commercial buildings.

List of Key Companies in Distribution Automation Market:

- Siemens

- Eaton

- ABB

- G&W Electric

- Schneider Electric

- Itron Inc

- GE Grid Solutions, LLC

- Hitachi Energy Ltd

- Hubbell

- Landis+Gyr

- Schweitzer Engineering Laboratories, Inc.

- Minsait ACS, Inc.

- Trilliant Holdings Inc

- Xylem

- Cisco Systems, Inc.

Recent Developments (Collaboration)

- In February 2024, Itron, Inc. and Schneider Electric collaborated to modernize and streamline energy distribution. The partnership focuses on integrating their advanced grid and software technologies to accelerate the energy transition and enhance utility performance.