Market Definition

A digital isolator is a type of electronic component used to transmit digital signals between different sections of a system while electrically isolating them. This isolation helps protect sensitive circuits from high voltages, noise, and transients, which could otherwise cause damage or malfunction. The report highlights key market drivers, major trends, regulatory frameworks, and the competitive landscape shaping the market.

Digital Isolator Market Overview

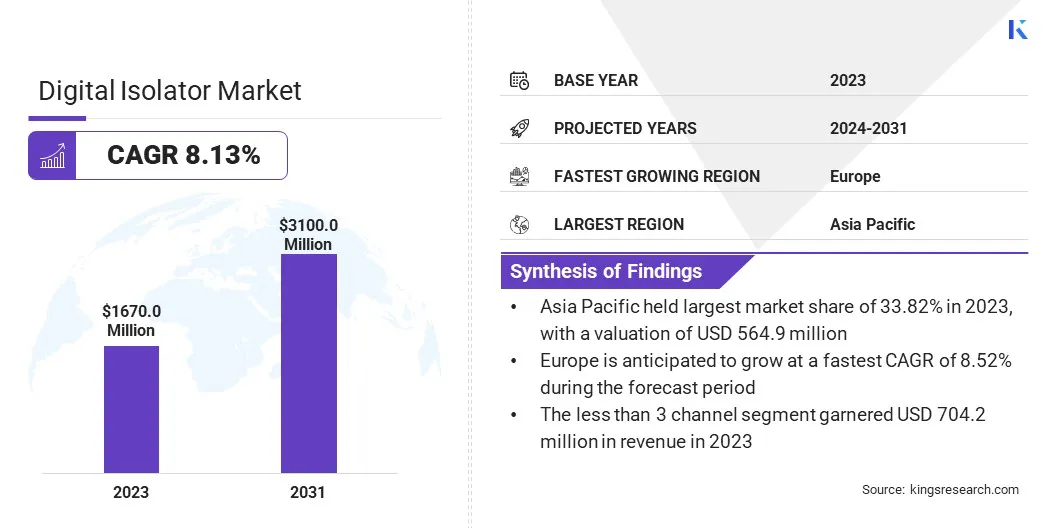

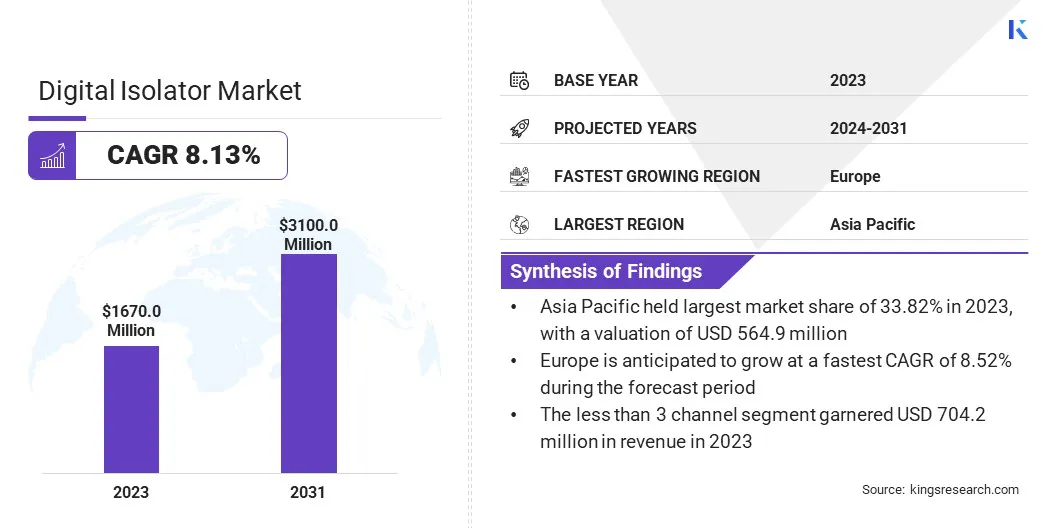

The global digital isolator market size was valued at USD 1670.0 million in 2023, which is estimated to be USD 1793.7 million in 2024 and reach USD 3100.0 million by 2031, growing at a CAGR of 8.13% from 2024 to 2031.

The rise of Electric Vehicles (EVs) and automotive automation is significantly driving the need for high-reliability digital isolators. These isolators are crucial for applications in electric drives, battery management systems, and automotive sensors, enhancing system safety and performance.

Major companies operating in the digital isolator industry are Texas Instruments Incorporated, Infineon Technologies AG, Broadcom, Renesas Electronics Corporation., Analog Devices, Inc., Vicor Corporation, Murata Manufacturing Co., Ltd., Monolithic Power Systems, Inc., STMicroelectronics, Semiconductor Components Industries, LLC, Advantech Co., Ltd., Skyworks Solutions, Inc., Toshiba Electronic Devices & Storage Corporation, ISOBAUD, Inc., and NOVOSENSE Microelectronics Co., Ltd.

The market is driven by the increasing demand for reliable and robust signal transmission in harsh industrial environments. High isolation voltage ratings are found in advanced isolators, making them crucial in sectors like automotive, energy, and telecommunications.

They offer enhanced protection, noise immunity, and long-term performance, making them indispensable in industrial automation, power management, and critical safety systems, thus fostering widespread adoption across diverse industries.

- In January 2023, STMicroelectronics expanded its range of dual-channel digital isolators with the introduction of the STISO620, offering enhanced flexibility for system designs. These isolators provide high-speed, reliable performance with robust 6kV thick-oxide technology, supporting industrial applications like smart grids, motor drives, and utility meters.

Key Highlights:

- The digital isolator market size was valued at USD 1670.0 million in 2023.

- The market is projected to grow at a CAGR of 8.13% from 2024 to 2031.

- Asia Pacific held a market share of 33.82% in 2023, with a valuation of USD 564.9 million.

- The capacitive coupling segment garnered USD 642.1 million in revenue in 2023.

- The 25 Mbps - 75 Mbps segment is expected to reach USD 1241.5 million by 2031.

- The less than 3 channel segment held a market share of 42.17% in 2023.

- The telecommunication segment is anticipated to grow at a CAGR of 8.24% during the forecast period.

- The market in Europe is anticipated to grow at a CAGR of 8.52% during the forecast period.

Market Driver

Increasing Demand in Automotive Applications

The increasing adoption of EVs and the rapid growth in automotive automation are boosting the demand for high-reliability digital isolators. These isolators ensure safe and efficient signal transmission in critical automotive applications, including electric drives, battery management systems, and automotive sensors.

The need for advanced isolators that provide robust isolation, noise immunity, and high-speed data transmission continues to expand as EVs become more mainstream and automotive systems become more sophisticated, driving the market.

- In January 2024, NOVOSENSE Microelectronics introduced quad-channel digital isolators for industrial and automotive applications. These high-reliability devices, offering up to 8kVrms insulation and advanced EMC protection, are ideal for applications like EVs, solar inverters, and industrial automation.

Market Challenge

Complex Design and Integration

A key challenge in the digital isolator market is the complex design and integration of these devices into sophisticated systems. Integrating isolators often requires specialized expertise to ensure compatibility with various components and maintain performance standards. The challenge lies in managing isolation voltage, noise immunity, and signal integrity across diverse applications.

Advancements like modular designs, evaluation boards, and simplified configuration tools are addressing this challenge. Manufacturers are offering flexible, user-friendly solutions, which help designers incorporate isolators into complex systems seamlessly.

Market Trend

Miniaturization and Compact Designs

A prominent trend in the market is the miniaturization and development of compact designs. Manufacturers are creating smaller, more efficient isolators, which offer enhanced performance while occupying less space. These compact designs allow for easier integration into space-constrained applications without sacrificing functionality.

This trend is particularly beneficial for industries like automotive and consumer electronics, where space, reliability, and performance are critical, driving the demand for smaller, high-performance isolators.

- In June 2024, Würth Elektronik expanded its digital isolator portfolio with a compact two-channel version in the SOIC 8WB package, offering a 5 kVRMS isolation voltage. These isolators are ideal for high-speed applications, providing superior noise immunity and reliable data transmission for sensitive circuits, especially in high-voltage environments.

Digital Isolator Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

Capacitive Coupling, Magnetic Coupling, Giant Magnetoresistive

|

|

By Data Rate

|

Below 25 Mbps, 25 Mbps - 75 Mbps, Above 75 Mbps

|

|

By Channel

|

Less than 3 Channel, 3 - 6 Channel, Above 6 Channel

|

|

By Vertical

|

Automotive, Healthcare, Telecommunication, Aerospace & Defense, Energy & Power, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America : Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Technology (Capacitive Coupling, Magnetic Coupling, Giant Magnetoresistive): The capacitive coupling segment earned USD 1 million in 2023, due to its ability to provide high-speed isolation with minimal power consumption and compact design, making it ideal for industrial and consumer applications.

- By Data Rate (Below 25 Mbps, 25 Mbps - 75 Mbps, Above 75 Mbps): The 25 Mbps - 75 Mbps segment held 40.47% share of the market in 2023, due to its balanced performance, supporting moderate-speed applications such as industrial automation, communications, and automotive systems.

- By Channel (Less than 3 Channel, 3 - 6 Channel, Above 6 Channel): The less than 3 channel segment is projected to reach USD 5 million by 2031, owing to the increasing demand for cost-effective isolators in smaller, less complex systems like home appliances, sensors, and low-cost industrial devices.

- By Vertical (Automotive, Healthcare, Telecommunication, Aerospace & Defense, Energy & Power, Others): The telecommunication segment is anticipated to register a CAGR of 8.24% during the forecast period, driven by the growing need for high-speed, reliable isolation in communication infrastructure and data centers.

Digital Isolator Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific accounted for 33.82% share of the digital isolator market in 2023, with a valuation of USD 564.9 million. This is attributed to the rapid industrialization, and growing demand in key sectors like automotive, telecommunications, and consumer electronics in the region.

Additionally, government investments in infrastructure and automation technologies enhance market opportunities. Countries such as China, Japan, and South Korea play a pivotal role in driving demand. Moreover, strong manufacturing capabilities and focus on energy-efficient solutions in the region contribute significantly to the market expansion.

The market in Europe is poised for significant growth at a robust CAGR of 8.52% over the forecast period. Europe is the fastest-growing region in the digital isolator industry, with an anticipated surge in demand due to the rising demand for EVs and advancements in industrial automation.

Stringent regulations in sectors like automotive, aerospace, and telecommunications, focusing on safety and reliability, push the adoption of high-performance isolators. According to the International Energy Agency (IEA), 3.4 million electric cars were sold in Europe in 2024, compared to 3.2 million electric cars in 2023.

Additionally, Europe’s commitment to sustainability and smart grid technologies propels the regional market. Countries such as Germany, France, and the UK are leading in the adoption of digital isolators, particularly in energy management and industrial control applications.

Regulatory Frameworks

- In the U.S., the Toxic Substances Control Act (TSCA) of 1976 empowers the Environmental Protection Agency (EPA) to enforce reporting, record-keeping, testing requirements, and restrictions on hazardous materials used in manufacturing digital isolators.

- In the European Union (EU), digital isolators must comply with CE marking requirements, ensuring adherence to health, safety, and environmental protection standards before being marketed or sold within the region.

Competitive Landscape:

Companies in the digital isolator market are advancing technologies to enhance performance, focusing on higher data transmission speeds and multi-channel solutions.

They are developing compact, low-power isolators to meet the needs of industries such as factory automation, motor control, and power systems. Additionally, companies are emphasizing cost-effective, energy-efficient designs that ensure safety and comply with global standards, supporting the growing demand for reliable, high-performance isolation in industrial applications.

- In May 2023, Toshiba launched the DCL54xx01 Series of high-speed quad-channel digital isolators, featuring 100kV/μs common mode transient immunity and a 150Mbps data rate, designed for stable high-speed isolated data transmissions in industrial applications such as factory automation and motor control.

List of Key Companies in Digital Isolator Market:

- Texas Instruments Incorporated

- Infineon Technologies AG

- Broadcom

- Renesas Electronics Corporation.

- Analog Devices, Inc.

- Vicor Corporation

- Murata Manufacturing Co., Ltd.

- Monolithic Power Systems, Inc.

- STMicroelectronics

- Semiconductor Components Industries, LLC

- Advantech Co., Ltd.

- Skyworks Solutions, Inc.

- Toshiba Electronic Devices & Storage Corporation

- ISOBAUD, Inc.

- NOVOSENSE Microelectronics Co., Ltd.

Recent Developments (Approval/Product Launch)

- In February 2025, Toshiba introduced its first 4-channel high-speed automotive digital isolators, compliant with AEC-Q100. Featuring 100kV/μs common-mode transient immunity and a 50Mbps data rate, these isolators ensure stable operation in the battery management systems of electric & hybrid vehicles and on-board chargers, enhancing safety and reliability.

- In November 2023, Infineon Technologies expanded its ISOFACE product portfolio with quad-channel digital isolators. Designed for automotive and industrial applications, these isolators offer high immunity against system noise, enhanced isolation, and precise timing, ensuring reliable data communication in demanding environments, including battery management systems and industrial automation.