Market Definition

The market encompasses technology-driven solutions that provide personalized health guidance and behavior modification through digital platforms. It includes AI-powered virtual coaches, mobile apps, wearable integrations, and telehealth services used by healthcare providers, insurers, and employers to enhance patient engagement and preventive care.

By leveraging, data analytics, machine learning, and remote monitoring, this market enables tailored health recommendations and promotes proactive health management.

Digital Health Coaching Market Overview

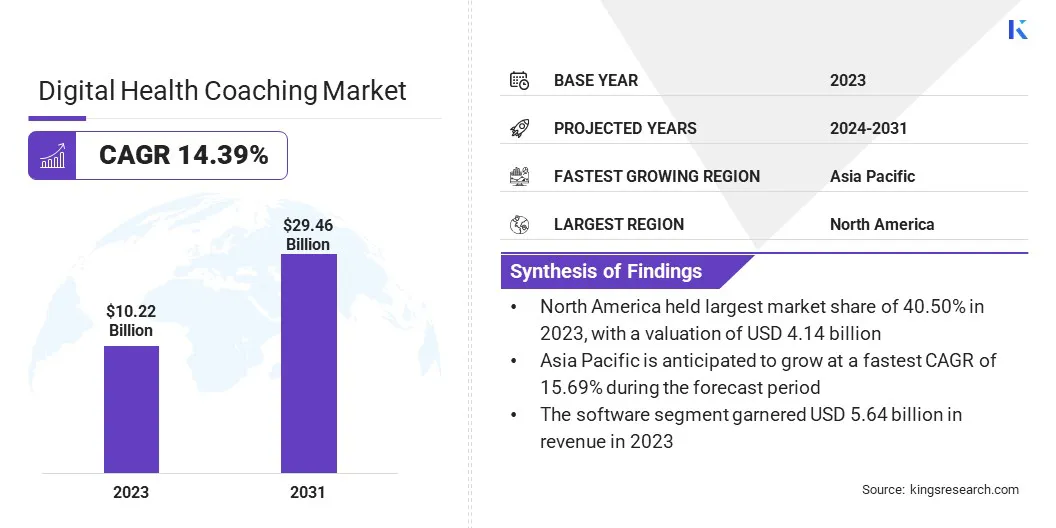

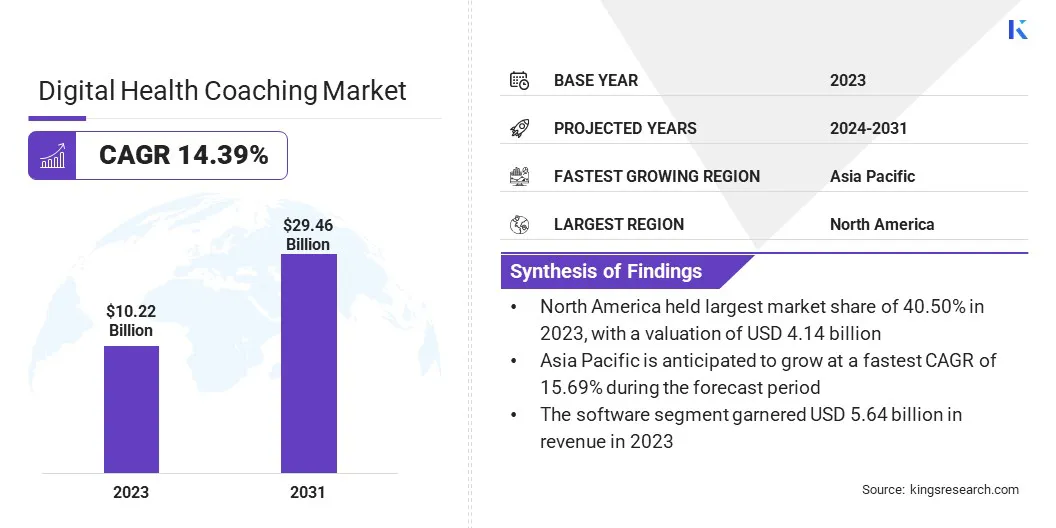

The global digital health coaching market size was valued at USD 10.22 billion in 2023 and is projected to grow from USD 11.50 billion in 2024 to USD 29.46 billion by 2031, exhibiting a CAGR of 14.39% during the forecast period. This growth is propelled by the increasing demand for personalized, technology-driven healthcare solutions.

The rising focus on preventive healthcare, coupled with the growing burden of chronic diseases, has led to the greater adoption of digital coaching tools that empower individuals to manage their health proactively. Innovations in artificial intelligence, wearable technology, and real-time data analytics are enhancing the effectiveness of these solutions.

Major companies operating in the digital health coaching industry are Lark Technologies, Inc., Omada Health Inc., Atlantis Health, Naluri, Avidon Health LLC, NeuroFlow, Lyra Health, Inc., Noom, Inc., Wellness Coach, Rally Health, Inc., Quest Diagnostics Incorporated, MOBE, LLC, YourCoach Health, Inc., Holly Health Ltd, and HealthifyMe Wellness Private Limited.

Additionally, the integration of digital health coaching into corporate wellness programs and insurance models is fostering market growth, as organizations seek to improve employee well-being and reduce healthcare costs. The market is further benefiting from regulatory support and increasing investments in digital health infrastructure.

- In March 2024, Headspace launched direct-to-consumer mental health coaching services, expanding beyond its employer and health plan partnerships. This initiative offers personalized support from mental health coaches to help individuals manage stress, improve emotional resilience, and achieve wellness goals.

Key Highlights

- The digital health coaching industry size was valued at USD 10.22 billion in 2023.

- The market is projected to grow at a CAGR of 14.30% from 2024 to 2031.

- North America held a market share of 40.50% in 2023, with a valuation of USD 4.14 billion.

- The software segment garnered USD 5.64 billion in revenue in 2023.

- The mobile applications segment is expected to reach USD 14.22 billion by 2031.

- The chronic disease management segment is anticipated to generate revenue of USD 11.71 billion by 2031.

- The individuals segment is likely to reach USD 12.52 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 15.69% over the forecast period.

Market Driver

"Rising Demand for Personalized and Preventive Healthcare"

The digital health coaching market is experiencing significant growth, fueled by the rising demand for personalized and preventive healthcare, along with the increasing adoption of AI-driven health coaching solutions.

Consumers are increasingly prioritizing proactive wellness over reactive treatments, seeking tailored health solutions to prevent chronic conditions and improve well-being. This demand is fueled by growing health awareness, escalating healthcare costs, and the need for more holistic, data-driven interventions.

Digital health coaching platforms address this need by offering personalized guidance based on individual health data, lifestyle habits, and wellness goals, focusing on areas such as nutrition, fitness, stress management, and sleep optimization.

Additionally, the rapid adoption of artificial intelligence, machine learning, and real-time analytics is revolutionizing the market by enhancing engagement and effectiveness.

AI-powered platforms process vast amounts of biometric and behavioral data to provide hyper-personalized recommendations, real-time feedback, and predictive insights that adapt to an individual’s changing health status.

This integration improves user adherence, supports long-term behavior change, and enables continuous monitoring and adaptive coaching for improved health outcomes.

- In June 2024, Welldoc partnered with Instacart to integrate AI-driven digital health coaching with grocery technology, offering personalized nutrition guidance and access to condition-specific foods for cardiometabolic health.

Market Challenge

"Data Privacy and Security Concerns"

Ensuring data privacy and security presents a major challenge to the development of the digital health coaching market, as platforms increasingly rely on real-time health tracking, behavioral insights, and connected devices to deliver personalized coaching.

These solutions collect vast amounts of sensitive personal data, including biometric readings, sleep patterns, activity levels, and mental health indicators. This growing data dependency raises concerns about unauthorized access, data breaches, and misuse of health information.

The rise in cyberattacks targeting healthcare data further amplifies privacy risks, posing a critical barrier to user adoption and trust in digital health coaching platforms.

To overcome this challenge, companies must implement robust cybersecurity infrastructure, encryption protocols, and decentralized data storage to protect user information. Additionally, focusing on transparent data practices, user consent mechanisms, and secure third-party integrations will enhance consumer trust.

Providing users with greater control over their personal health data, including managing permissions and opting in or out of data-sharing agreements, will further foster trust and promote adoption.

Market Trend

"Growth of Digital Family Wellness Coaching and Integration of Wearable Technology"

The digital health coaching market is evolving rapidly, fueled by the rise of digital family wellness coaching and the integration of wearable technology and IoT.

Modern family wellness platforms provide personalized wellness plans, interactive guidance, and expert recommendations to address the unique needs of each family member, including nutrition, mental well-being, fitness, and chronic disease prevention. These solutions enable families to adopt healthier lifestyles through proactive, accessible, and convenient coaching.

- In January 2025, Panasonic Well unveiled its vision for a comprehensive family wellness ecosystem at CES 2025. The ecosystem features Umi, an AI-powered digital family wellness coach that offers personalized plans, conversational AI, and expert-backed recommendations to support modern families. Panasonic Well also announced a strategic partnership with Anthropic to integrate responsible AI into its consumer solutions, enhancing AI-driven coaching and family well-being.

Additionally, the growing adoption of wearable technology and IoT devices is enhancing digital health coaching by enabling continuous health tracking, real-time feedback, and remote monitoring.

Devices such as smart watches, fitness trackers, and connected health sensors collect biometric and behavioral data, allowing digital health platforms to provide targeted recommendations and early interventions. This seamless integration improves user engagement, identifies potential health risks, and empowers individuals to make informed lifestyle decisions.

Digital Health Coaching Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Software, Services

|

|

By Mode of Delivery

|

Mobile Applications, Wearable Devices, Web-based Platforms

|

|

By Application

|

Chronic Disease Management, Mental Health & Wellness, Nutrition & Weight Management, Fitness & Lifestyle Coaching

|

|

By End User

|

Individuals, Employers & Corporate Wellness Programs, Health Plans & Insurance Providers, Healthcare Providers

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Software and Services): The software segment earned USD 5.64 billion in 2023 due to the increasing adoption of AI-driven coaching platforms, personalized health tracking, and seamless integration with digital health ecosystems.

- By Mode of Delivery (Mobile Applications, Wearable Devices, and Web-based Platforms): The mobile applications segment held a share of 49.50% in 2023, attributed to the rising smartphone penetration, user-friendly interfaces, and on-demand access to digital health coaching services.

- By Application (Chronic Disease Management, Mental Health & Wellness, Nutrition & Weight Management, and Fitness & Lifestyle Coaching): The chronic disease management segment is projected to reach USD 11.71 billion by 2031, propelled by the increasing prevalence of chronic conditions, growing demand for continuous monitoring, and personalized digital interventions.

- By End User (Individuals, Employers & Corporate Wellness Programs, Health Plans & Insurance Providers, and Healthcare Providers): The individuals segment is projected to reach USD 12.52 billion by 2031, on account of the growing consumer preference for self-management tools, remote health coaching, and proactive wellness strategies.

Digital Health Coaching Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America digital health coaching market accounted for a substantial share of 40.50% in 2023, valued at USD 4.14 billion. This dominance is reinforced by a well-developed digital health ecosystem, advanced AI and wearable technology adoption, and strong demand for personalized healthcare solutions.

Key growth factors include employer-sponsored wellness programs, insurance-backed digital coaching initiatives, and government policies supporting preventive healthcare.

The growing emphasis on chronic disease management and mental health solutions further boosts demand, as digital coaching platforms integrate with electronic health records (EHRs) and remote patient monitoring tools to enhance patient engagement and health outcomes.

Additionally, high consumer awareness, significant venture capital investments, and the presence of leading health tech companies continue to accelerate regional market expansion.

- In March 2025, HR Path partnered with Benefitfocus to enhance benefits solutions across the United States. This collaboration combines HR Path’s HR expertise with Benefitfocus’s cloud-based benefits technology to streamline administration, improve efficiency, and deliver personalized employee benefits.

Asia Pacific digital health coaching industry is expected to register the fastest CAGR of 15.69% over the forecast period. This growth is fueled by rising digitalization in healthcare, increasing smartphone penetration, and growing demand for cost-effective wellness solutions.

Governments in key markets such as China, India, and Japan are actively promoting telemedicine, AI-driven health interventions, and digital health infrastructure. Additionally, corporate wellness programs and the rise of digital-first healthcare startups are fostering adoption.

With an expanding middle-class population, increasing chronic disease burden, and a shift toward preventive healthcare, Asia Pacific is emerging as a key market for digital health coaching solutions.

The region is also attracting investments from global health tech firms, while local players focus on developing affordable and scalable digital coaching models to serve a diverse consumer base.

Regulatory Frameworks

- In the United States, the Food and Drug Administration (FDA) regulates digital health coaching solutions if they function as software as a medical device (SaMD) by providing diagnostic, treatment, or therapeutic recommendations. Additionally, the Health Insurance Portability and Accountability Act (HIPAA) ensure data privacy and security for platforms handling patient information. The Federal Trade Commission (FTC) monitors consumer protection and advertising claims.

- In the European Union, digital health coaching solutions must comply with the Medical Device Regulation (MDR) if they classified as medical devices. The General Data Protection Regulation (GDPR) enforces strict data privacy requirements for platforms handling personal health data.

- In China, the National Medical Products Administration (NMPA) digital health coaching solutions considered medical software. Additionally, the Cybersecurity Law and Personal Information Protection Law (PIPL) govern data security and patient privacy for digital health platforms.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) oversees digital health tools classified as medical devices, while the Act on the Protection of Personal Information (APPI) sets guidelines for handling personal health data.

Competitive Landscape

The digital health coaching industry is characterized by technological advancements and a strong focus on personalized, data-driven healthcare solutions. Market players are leveraging AI, machine learning, and advanced analytics to enhance user engagement, improve health outcomes, and differentiate their offerings.

They are also employing strategic partnerships, mergers and acquisitions, and continuous innovation to strengthen their market position. Integration with wearables, telehealth platforms, and electronic health records is leading to the delivery of seamless and holistic health coaching services.

Companies are focusing on subscription-based and employer-driven wellness programs to expand their customer base and enhance revenue streams. Numerous companies are investing heavily in AI-driven virtual coaching, real-time health monitoring, and behavioral science-based interventions to offer highly personalized coaching experiences.

- In May 2024, Accolade, Inc. partnered with Noom to integrate Noom’s weight loss and metabolic health solutions into Accolade’s Trusted Partner Ecosystem. This collaboration combines Noom Med’s clinical obesity management with Accolade’s physician-led primary care to offer personalized weight management support and anti-obesity medication guidance. The partnership aims to enhance employer healthcare benefits, reduce obesity-related costs, and improve long-term health outcomes.

Gamification, user-friendly mobile interfaces, and data-driven insights boost engagement and adherence to health programs. Additionally, market leaders are expanding geographically through localized content, multilingual support, and region-specific solutions. Companies are forming alliances with healthcare providers, insurers, and corporate wellness programs to drive adoption and scalability.

List of Key Companies in Digital Health Coaching Market:

- Lark Technologies, Inc.

- Omada Health Inc.

- Atlantis Health

- Naluri

- Avidon Health LLC

- NeuroFlow

- Lyra Health, Inc.

- Noom, Inc.

- Wellness Coach

- Rally Health, Inc.

- Quest Diagnostics Incorporated

- MOBE, LLC

- YourCoach Health, Inc.

- Holly Health Ltd

- HealthifyMe Wellness Private Limited

Recent Developments (Acquisition/Investment/New Product Launch)

- In February 2025, Owens & Minor launched ByramConnect, a digital health coaching platform powered by the Welldoc App. The platform offers AI-driven personalized coaching, real-time health tracking, and clinically relevant insights for individuals managing diabetes and related chronic conditions.

- In February 2025, ONVY HealthTech Group GmbH secured over USD 2 million in a seed extension financing round led by Voloridge Health, LLC. The investment will support ONVY’s strategic expansion, advancing its AI-powered health coaching platform and scaling AI-driven health recommendations, API integrations, and AI-as-a-Service solutions across 500+ health data sources.

- In March 2024, Numan introduced its AI Health Assistant, a digital tool providing personalized guidance on diet, exercise, and lifestyle. Using AI-driven insights and a Retrieval Augmented Generation (RAG) framework, it offers 24/7 support, promoting long-term healthy habits with clinical oversight and regulatory compliance.

- In March 2024, Vitality acquired WellSpark, a coaching provider, from EmblemHealth. The acquisition enhances Vitality’s integrated coaching capabilities, integrating WellSpark’s advanced coaching solutions to support employer and health plan clients.