Digital Finance Market Size

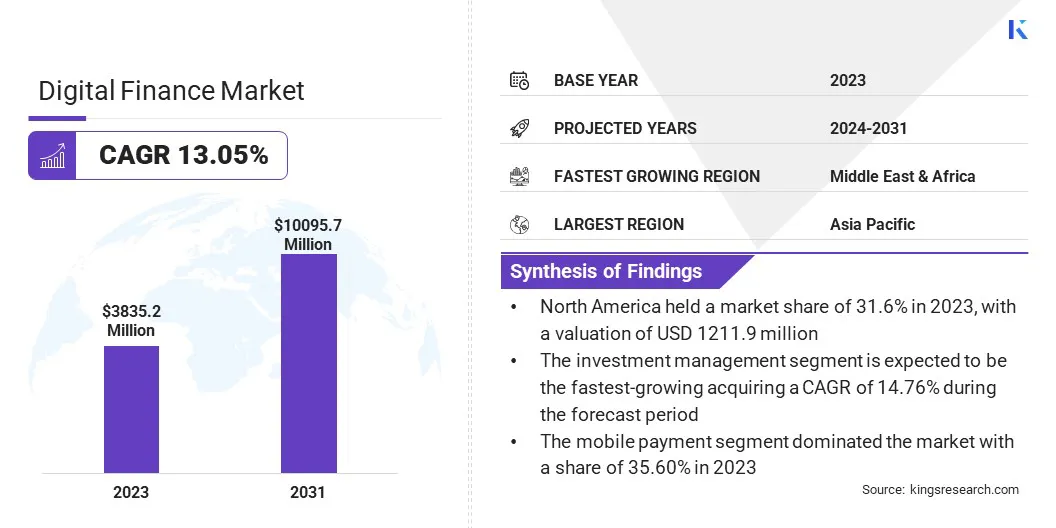

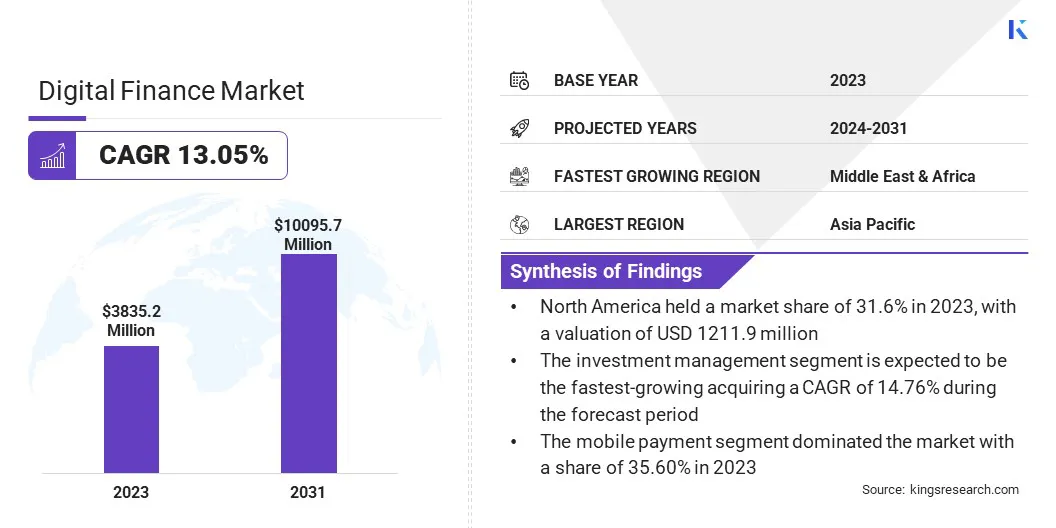

The global Digital Finance Market size was valued at USD 3,835.2 million in 2023 and is projected to reach USD 10,095.7 million by 2031, growing at a CAGR of 13.05% from 2024 to 2031. In the scope of work, the report includes solutions offered by companies such as PayPal Holdings, Inc., Square, Inc, Ant Group Co., Ltd., Stripe, Inc., Adyen N.V., Robinhood Markets, Inc., Revolut Ltd, TransferWise Ltd, Klarna Bank AB, SoFi Technologies, Inc and Others.

The digital finance market is experiencing a paradigm shift fueled by technological advancements and changing consumer behaviors. In the current market scenario, digital finance solutions have become widespread, providing users worldwide with convenience, accessibility, and security. The growth outlook for the market is highly optimistic, with forecasts indicating sustained expansion in the coming years. Factors driving this growth include the increasing adoption of smartphones, internet penetration, and the growing acceptance of cashless transactions.

Moreover, the COVID-19 pandemic has accelerated the shift toward digital finance, with consumers and businesses increasingly relying on online payment platforms and digital banking services. Emerging economies, in particular, are expected to drive substantial growth in the digital finance market, as they leapfrog traditional banking infrastructure in favor of digital solutions.

Furthermore, technological innovations such as blockchain, artificial intelligence, and biometric authentication are reshaping the digital finance landscape, offering new opportunities for efficiency gains and enhanced user experiences. Overall, the market is poised to experience continued expansion, with a plethora of opportunities for innovation and disruption.

Analyst’s Review

The rise of decentralized finance (DeFi) is an emerging financial technology that is reshaping the traditional financial landscape. DeFi refers to a decentralized financial system built on blockchain technology, offering various financial services without the need for traditional intermediaries such as banks. The market outlook for DeFi in the forecast years is highly promising, with continued innovation and adoption expected across various applications such as lending, borrowing, decentralized exchanges, and asset management.

However, challenges related to regulatory compliance, security, and scalability could impede the widespread adoption of DeFi. Nevertheless, as the technology matures and regulatory frameworks evolve, DeFi is expected to play a significant role in the finance sector, offering novel opportunities for financial inclusion and innovation.

Market Definition

Digital finance encompasses a broad range of financial services and transactions conducted electronically, typically through digital platforms and devices. This includes various types of digital payments such as mobile payments, online banking, digital wallets, and cryptocurrencies.

Furthermore, digital finance encompasses applications such as peer-to-peer lending, crowdfunding, robo-advisors, and blockchain-based financial services. Technologies such as artificial intelligence, blockchain, biometrics, and cloud computing play a crucial role in enabling and enhancing digital finance services by improving security, efficiency, and user experience. Overall, digital finance represents a transformative shift in the financial industry, offering greater convenience, accessibility, and innovation to consumers and businesses.

What are the major factors affecting this market?

The increasing adoption of mobile payment solutions is driving the growth of the digital finance market. As consumer's reliance on smartphones for everyday activities such as banking and shopping continues to grow, mobile payment solutions emerge as a convenient and secure for conducting transactions. Several factors driving this adoption include the proliferation of smartphones, improved mobile banking apps, and the acceptance of mobile payments by merchants. Moreover, the COVID-19 pandemic has accelerated the shift toward contactless payments, thereby boosting the adoption of mobile payment solutions.

As a result, financial institutions and technology companies are investing heavily in mobile payment technologies, thereby driving innovation and expanding the availability of mobile payment solutions to a wider audience. Overall, the increasing adoption of mobile payment solutions is a key factor supporting the growth of the digital finance market, offering new opportunities for convenience and financial inclusion.

Concerns pertaining to security and privacy breaches pose significant challenges to the market development. With the increasing digitization of financial services and the growing volume of sensitive personal and financial data being transmitted online, cybersecurity threats have become more sophisticated and prevalent. Security breaches, data leaks, and identity theft incidents can erode consumer trust and confidence in digital finance platforms, leading to reputational damage and financial losses for businesses.

Moreover, regulatory compliance requirements such as GDPR, CCPA, and PSD2 impose stringent data protection and privacy standards on financial institutions, leading to increased compliance costs and operational challenges. Additionally, the use of emerging technologies such as blockchain and artificial intelligence introduces new security risks and vulnerabilities that need to be addressed. Overall, addressing concerns pertaining to security and privacy breaches is essential to fostering trust and confidence in digital finance platforms and ensuring the long-term sustainability of the market.

Segmentation Analysis

The global market is segmented based on application, type, and geography.

What is the market share of the mobile payment segment?

Based on application, the market is segmented into internet payment, mobile payment, online banking service, outsourcing of financial services, and others. The mobile payment segment dominated the market with a share of 35.60% in 2023 owing to its convenience, accessibility, and widespread adoption among consumers.

With the increasing penetration of smartphones and improved mobile banking apps, consumers are increasingly relying on mobile payment solutions for everyday transactions such as bill payments, peer-to-peer transfers, and online shopping. Moreover, the COVID-19 pandemic has accelerated the shift towards contactless payments, thereby boosting the adoption of mobile payment solutions.

As a result, financial institutions and technology companies are investing heavily in mobile payment technologies, driving innovation and expanding the availability of mobile payment solutions to a wider audience. Overall, the mobile payment segment is expected to continue its dominance in the digital finance market, offering new opportunities for convenience and financial inclusion.

How fast will the investment management segment grow in this market?

Based on type, the market is classified into infrastructure, payment & settlement, financing, investment management, insurance, and others. The investment management segment is expected to be the fastest-growing acquiring a CAGR of 14.76%, primarily driven by the increasing adoption of digital investment platforms and robo-advisors. With the rise of fintech innovations and the growing acceptance of online investing, consumers are increasingly turning to digital investment platforms for convenient and cost-effective ways to manage their portfolios.

Moreover, the integration of artificial intelligence and machine learning in investment management processes is driving efficiency gains and personalized investment strategies. As a result, investment management firms are investing heavily in digital technologies, driving innovation and expanding the availability of digital investment platforms to a wider audience. Overall, the investment management segment is poised to experience rapid growth in the digital finance market, offering potential opportunities for investors to access diversified investment options and achieve their financial goals.

What is the market scenario in North America region?

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America Digital Finance Market share stood around 31.6% in 2023 in the global market, with a valuation of USD 1211.9 million, mainly fueled by its robust digital infrastructure, high smartphone penetration, and advanced fintech ecosystem. The region is home to several leading digital finance companies and tech giants, thereby driving innovation and adoption of digital finance solutions.

Moreover, a favorable regulatory environment and consumer preferences toward digital banking and payment solutions have propelled the growth of the market in North America. As a result, the region is expected to maintain its dominant position in the global market in the forecast years, offering vast opportunities for innovation and growth.

Competitive Landscape

The digital finance market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Expansion & investments are the major strategic initiatives adopted by companies in this sector. Industry players are investing extensively in R&D activities, building new manufacturing facilities, and supply chain optimization.

Key Companies in Digital Finance Market

- PayPal Holdings, Inc.

- Square, Inc

- Ant Group Co., Ltd.

- Stripe, Inc.

- Adyen N.V.

- Robinhood Markets, Inc.

- Revolut Ltd

- TransferWise Ltd

- Klarna Bank AB

- SoFi Technologies, Inc

The global Digital Finance Market is segmented as:

By Application

- Internet Payment

- Mobile Payment

- Online Banking Service

- Outsourcing of Financial Services

- Others

By Type

- Infrastructure

- Payment & Settlement

- Financing

- Investment Management

- Insurance

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America