Market Definition

The market encompasses the global landscape of equipment suppliers, service providers, and end-users involved in the separation of solids from liquids in industrial processes. This market includes applications across sectors such as wastewater treatment, oil and gas, food and beverage, chemical, and pharmaceutical industries, covering equipment sales and aftermarket services like maintenance, retrofitting, and spare parts.

The report offers a thorough assessment of the key factors driving market expansion, along with detailed regional analysis and the competitive landscape influencing industry dynamics.

Decanter Centrifuge Market Overview

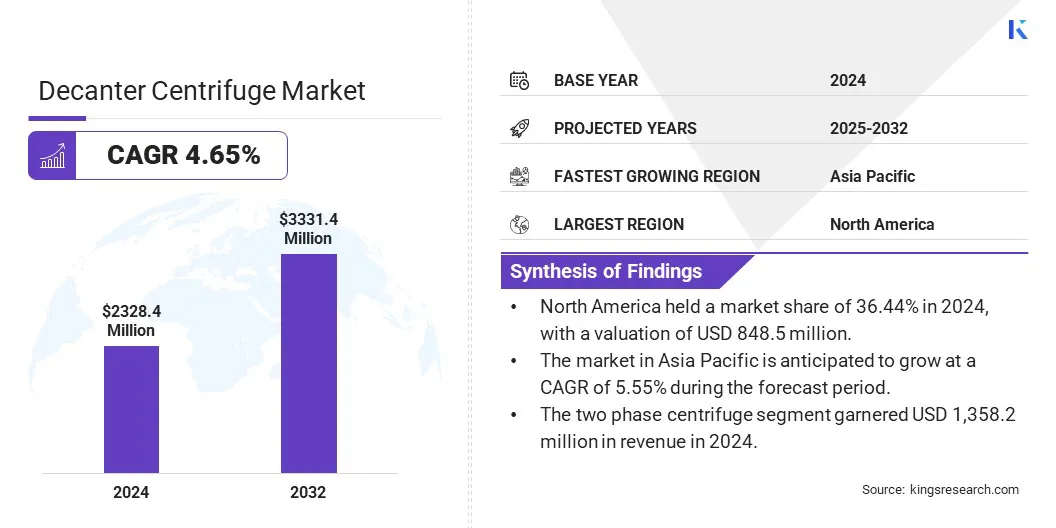

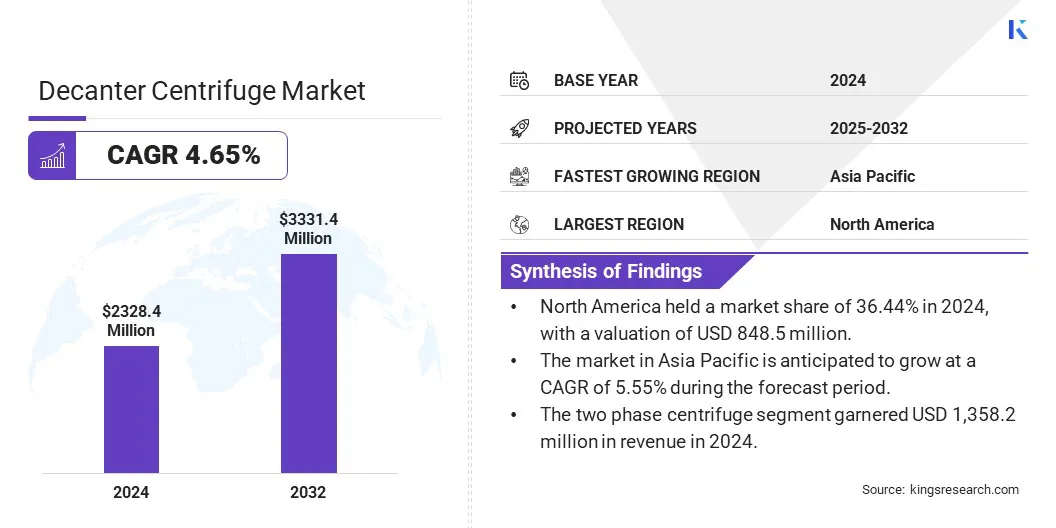

The global decanter centrifuge market size was valued at USD 2,328.4 million in 2024 and is projected to grow from USD 2,422.8 million in 2025 to USD 3,331.4 million by 2032, exhibiting a CAGR of 4.65% during the forecast period.

The market is witnessing steady growth due to the rising demand for efficient solid-liquid separation across multiple industries, including wastewater treatment, oil and gas, food and beverage, and pharmaceuticals. The increasing investment in wastewater treatment infrastructure, particularly in emerging economies is further fueling the market growth.

Governments and private sector entities are prioritizing the development of sustainable water management systems, which is increasing the demand for high-performance centrifuge equipment.

Major companies operating in the decanter centrifuge industry are ALFA LAVAL, GEA Group Aktiengesellschaft, Flottweg SE, ANDRITZ, PIERALISI MAIP SPA, SIEBTECHNIK GmbH, KES Separation Machinery, Mitsubishi Kakoki Kaisha, Ltd., FLSmidth A/S, TOMOE Engineering Co., Ltd., HAUS Centrifuge Technologies, SLB, A. Foeth BV, Centrimax, and Preqin.

Additionally, the food and beverage and pharmaceutical industries are leveraging decanter centrifuges to enhance production efficiency and meet regulatory standards. Technological advancements, such as energy-efficient and automated centrifuge systems, are also contributing to market growth by improving operational performance and reducing lifecycle costs for end users.

- In April 2025, GEA introduced Varipond C, an innovative technical solution for decanter centrifuges that allows fast and precise adjustment of the separation zone and pond depth. This enhancement improves separation consistency, product yield, and quality in both two-phase and three-phase processes. Additionally, Varipond C reduces energy consumption by approximately 30% compared to traditional decanter centrifuge operation without adjustable separation zones.

Key Highlights

- The decanter centrifuge market size was valued at USD 2,328.4 million in 2024.

- The market is projected to grow at a CAGR of 4.65% from 2025 to 2032.

- North America held a market share of 36.44% in 2024, with a valuation of USD 848.5 million.

- The two phase centrifuge segment garnered USD 1,358.2 million in revenue in 2024.

- The horizontal segment is expected to reach USD 1,671.8 million by 2032.

- The oil & gas segment is expected to reach USD 817.8 million by 2032.

- The market in Asia Pacific is anticipated to grow at a CAGR of 5.55% during the forecast period.

Market Driver

Growing Demand for Safe and Efficient Oil Recovery Solutions

The global market is experiencing robust growth, driven by increasing demand for efficient and safe oil recovery solutions in hazardous environments where flammable gases or vapors may be present.

In such conditions, safety is critical, prompting the adoption of explosion-proof decanter centrifuges equipped with advanced safety features designed to minimize ignition risks while maintaining high separation efficiency. These systems enable the recovery of high-purity oil from complex waste streams without compromising operator safety or compliance with environmental regulations.

As industries place greater emphasis on both operational efficiency and stringent safety standards, the demand for advanced decanter centrifuges tailored for safe and effective oil recovery in challenging environments continues to drive market expansion.

- In July 2023, ANDRITZ introduced upgraded three-phase decanter centrifuges for industrial oil recovery in ATEX Zone 1 and 2 environments. The systems recover high-purity oil from slop oil, crude oil, tank cleaning residues, and API separator sludge. Key features of ANDRITZ include TurboJet weir plates, GentleFeeder, ceramic or tungsten carbide wear parts, and gas-tight, explosion-proof housings.

Market Challenge

Maintenance and Operational Complexity in Decanter Centrifuges

A key challenge in the decanter centrifuge market is the operational complexity and maintenance requirements of these advanced systems. Decanter centrifuges require regular maintenance to ensure optimal performance and prevent downtime.

The complexity of the machinery, including components like the rotor, bowl, and conveyor system, demands skilled technicians for maintenance and troubleshooting. Additionally, issues such as wear and tear on parts, especially in high-throughput applications, increases maintenance costs and extend downtime.

To address this challenge, manufacturers are incorporating automated monitoring systems, predictive maintenance, and remote diagnostics for real-time performance tracking and early detection of potential issues. These technologies also support proactive maintenance scheduling, reducing the need for manual intervention and minimizing unplanned downtime.

Market Trend

Integration of Automation and Smart Control Systems in Decanter Centrifuge Technology

A key trend in the market is the integration of automation and smart control systems to optimize process efficiency and reduce the need for manual intervention.

These advanced technologies enable real-time monitoring and enhance operational performance. Features such as automated feed control, vibration monitoring, and predictive maintenance, powered by advanced sensors and analytics, are becoming increasingly prevalent.

These innovations help improve the reliability and efficiency of decanter centrifuges, allowing for more consistent performance, reduced downtime, and enhanced maintenance processes. The move toward automation and smart technologies is transforming the decanter centrifuge landscape, providing greater control over operations and driving operational savings.

Decanter Centrifuge Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Two Phase Centrifuge, Three Phase Centrifuge

|

|

By Design

|

Horizontal, Vertical

|

|

By End-use Industry

|

Oil & Gas, Chemical, Wastewater Treatment, Food & Beverage, Pharmaceutical, Mining & Minerals, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Two Phase Centrifuge, Three Phase Centrifuge): The two phase centrifuge segment earned USD 1,358.2 million in 2024 due to its widespread use in applications requiring solid-liquid separation with high throughput and lower complexity.

- By Design (Horizontal, Vertical): The horizontal segment held 52.65% of the market in 2024, due to its superior handling of high solid loads and suitability for continuous, high-capacity operations.

- By End-use Industry (Oil & Gas, Chemical, Wastewater Treatment, Food & Beverage, Pharmaceutical, Mining & Minerals, Others): The oil & gas segment is projected to reach USD 817.8 million by 2032, owing to increasing demand for efficient separation technologies in upstream and downstream operations, especially in hazardous environments.

Decanter Centrifuge Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for a substantial market share of 36.44% in 2024 in the global decanter centrifuge market, with a valuation of USD 848.5 million. The dominance of North America in the market is primarily driven by the extensive use of these systems in the oil & gas sector, especially in the United States, which remains one of the top global producers of crude oil and natural gas.

The demand is further supported by the critical role of decanter centrifuges in shale gas extraction and oil sands processing. Additionally, substantial investments in industrial wastewater treatment across several states—particularly those focusing on water reuse and zero-liquid discharge initiatives—have boosted the adoption of decanter centrifuges in environmental management applications.

The strong presence of major equipment manufacturers and service providers in North America also accelerates technological adoption by fostering innovation and enabling faster deployment of advanced solutions. Together, these factors contribute to sustained market growth in the region.

-

In March 2024, the U.S. Energy Information Administration reported that the United States achieved a historic milestone in crude oil production, averaging 12.9 million barrels per day in 2023. This output surpassed the previous record of 12.3 million barrels per day set in 2019, establishing the highest national crude oil production level ever recorded globally.

The decanter centrifuge industry in Asia Pacific is expected to register the fastest growth in the market, with a projected CAGR of 5.55% over the forecast period. This growth is primarily fueled by rising industrialization in countries such as China, India, and Indonesia, driving demand across diverse end-use sectors including food & beverage, pharmaceuticals, and mining.

In China, the rapid expansion of biopharmaceutical manufacturing is accelerating the use of decanter centrifuges for biomass separation and product clarification. Additionally, the increasing implementation of decentralized wastewater treatment systems in industrial zones, along with heightened demand for resource recovery technologies in densely populated manufacturing hubs, is further driving market growth.

- In March 2025, AstraZeneca invested USD 2.5 billion in Beijing to establish its sixth global strategic R&D center. The company also signed agreements with Harbour BioMed, Syneron Bio, and BioKangtai, and launched its first vaccine manufacturing facility in China.

Regulatory Frameworks

- In the U.S., the Occupational Safety and Health Administration (OSHA) enforces workplace safety standards that include regulations for the use of industrial machinery like centrifuges. The Environmental Protection Agency (EPA) regulates wastewater discharge, influencing the use of decanter centrifuges in treatment plants. The Food and Drug Administration (FDA) governs the use of centrifuges in the food and pharmaceutical sectors to ensure sanitary processing and compliance with safety standards.

- In Europe, the Machinery Directive ensures that industrial equipment, including centrifuges, adheres to stringent health and safety standards. Additionally, the ATEX Directive (Atmosphères Explosibles) governs equipment used in explosive environments, particularly in the oil, gas, and chemical industries.

Competitive Landscape

The decanter centrifuge market is characterized by companies focusing on differentiation through innovation, customization, and service integration. Leading manufacturers emphasize modular designs and system integration to address industry-specific requirements.

Market players are adopting vertical integration strategies to improve quality control and reduce production costs. Mergers, acquisitions, and strategic alliances are commonly used to broaden technology offerings and expand geographic presence. Additionally, companies are focusing on integrating smart technologies into their product offerings, enabling real-time performance tracking and system optimization.

- In September 2024, FLSmidth signed an agreement to acquire Decanter Machine, Inc., a U.S.-based manufacturer of centrifugal technology for the global minerals industries. The acquisition strengthens FLSmidth’s centrifuge offerings, particularly for coal and fertilizer industries, and enhances its service capabilities in rotor unit repairs, field service, and preventative maintenance.

List of Key Companies in Decanter Centrifuge Market:

- ALFA LAVAL

- GEA Group Aktiengesellschaft

- Flottweg SE

- ANDRITZ

- PIERALISI MAIP SPA

- SIEBTECHNIK GmbH

- KES Separation Machinery

- Mitsubishi Kakoki Kaisha, Ltd.

- FLSmidth A/S

- TOMOE Engineering Co., Ltd.

- HAUS Centrifuge Technologies

- SLB

- A. Foeth BV

- Centrimax

- Preqin

.