Market Definition

The market encompasses the global ecosystem of hardware and infrastructure supporting GPU (graphics processing units) deployement in data centers. This includes the integration and management of GPUs for high-performance computing, deep learning, data analytics, and virtualized workloads across enterprise, hyperscale, and cloud environments.

The report explores key factors of market development, offering detailed regional analysis and a comprehensive overview of the competitive landscape shaping future opportunities.

Data Center GPU Market Overview

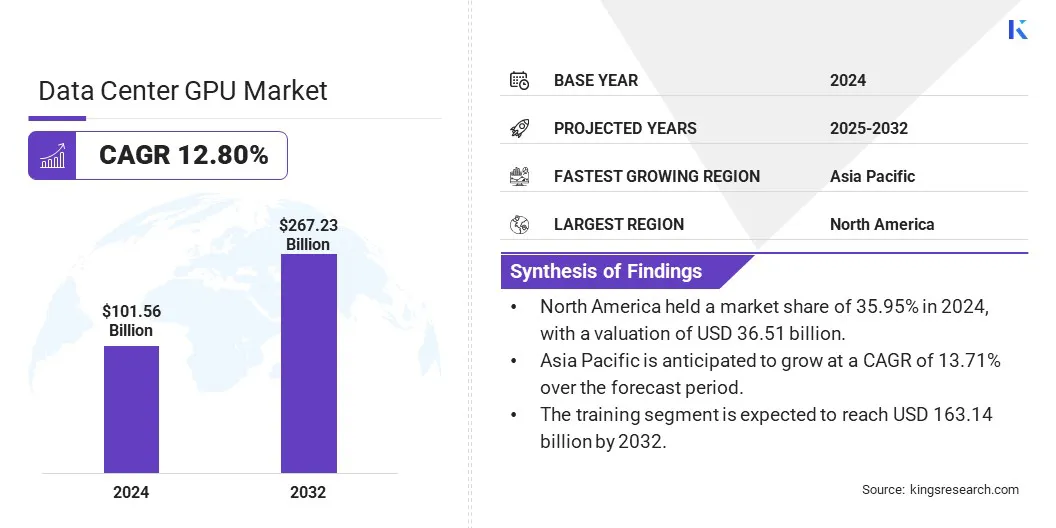

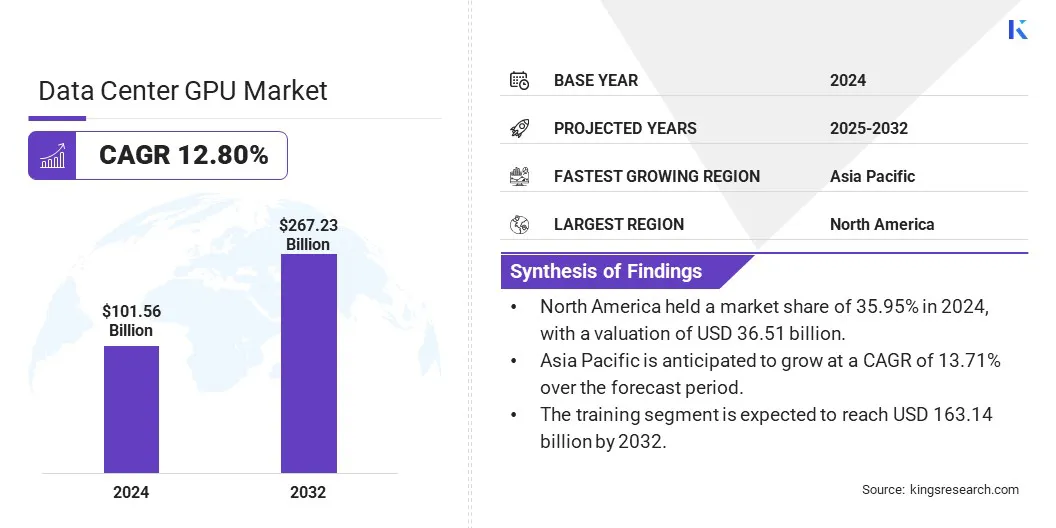

The global data center GPU market size was valued at USD 101.56 billion in 2024 and is projected to grow from USD 114.30 billion in 2025 to USD 267.23 billion by 2032, exhibiting a CAGR of 12.80% during the forecast period.

The market is experiencing rapid expansion fueled by rising demand for accelerated computing in artificial intelligence, machine learning, and high-performance computing applications. Enterprises and cloud providers are increasingly leveraging GPUs to handle complex data processing and support advanced analytics.

Key Market Highlights:

- The data center GPU market size was valued at USD 101.56 billion in 2024.

- The market is projected to grow at a CAGR of 12.80% from 2025 to 2032.

- North America held a market share of 35.95% in 2024, with a valuation of USD 36.51 billion.

- The on-premises segment garnered USD 54.93 billion in revenue in 2024.

- The training segment is expected to reach USD 163.14 billion by 2032.

- The generative AI segment is expected to reach USD 87.99 billion by 2032.

- The enterprises segment is expected to reach USD 99.78 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 13.71% over the forecast period.

Major companies operating in the data center GPU industry are NVIDIA Corporation, Intel Corporation, Amazon.com, Inc., Microsoft, Alibaba Cloud, Oracle, Tencent Cloud, Huawei Cloud Computing Technologies Co., Ltd., Meta, CoreWeave, Lambda, Inc., DigitalOcean, LLC., RiseUnion, Advanced Micro Devices, Inc., and Alphabet Inc.

Market growth is supported by the rise of AI-powered services such as natural language processing and image recognition. Expanding use cases in cloud gaming, scientific research, and 3D modeling are fostering adoption.

Additionally, the development of hyperscale data centers and the broader integration of GPU-accelerated workloads across finance, healthcare, and automotive sectors further bolster market progress.

- In April 2025, Jet.AI Inc. and Consensus Core Technologies Inc. formed a joint venture to develop two hyperscale data center campuses in Midwestern and Maritime Canada, targeting up to 1.5 gigawatts of power capacity. The projects aim to address growing AI compute demand with large-scale infrastructure, including access to natural gas and green energy resources, supporting rapid expansion and sustainable power solutions.

Market Driver

Rising Need for High-Performance GPU Acceleration in Data Centers

The growth of the market is fueled by the increasing demand for AI and machine learning workloads that require high-performance GPU acceleration. Enterprises adopting AI applications face growing computational complexity and large volumes of data, which necessitate advanced GPUs designed for large-scale parallel processing.

These GPUs improve the speed and efficiency of training and inference tasks, reducing latency and boosting overall system performance.

The expanding use of AI across various sectors highlights the need for scalable and efficient GPU infrastructure in data centers to handle resource-intensive workloads effectively. This demand fosters innovation and investment in GPU technologies tailored for data center use.

- In May 2025, NVIDIA launched its AI-first DGX Spark and DGX Station personal computing systems with Acer, ASUS, Dell Technologies, GIGABYTE, HP, Lenovo, and MSI. Built on the Grace Blackwell platform, DGX Spark offers up to 1 petaflop of compute, while DGX Station delivers up to 20 petaflops and supports multi-user AI workloads. Both systems run the NVIDIA AI software stack and will be available from July 2025.

Market Challenge

High Power Consumption and Heat Generation

A major challenge hampering the expansion of the data center GPU market is the high power consumption and heat generation from dense GPU deployments.

GPUs designed for high-performance computing and AI workloads require substantial energy, leading to increased operational costs and complex cooling requirements. Inefficient power usage can also impact data center sustainability goals and limit scalability.

To address this challenge, data centers are increasingly adopting advanced cooling technologies such as liquid cooling and immersive cooling systems, which offer more effective heat dissipation than traditional air cooling. Additionally, energy-efficient GPU architectures and improved power management software help optimize consumption.

Implementing these solutions reduces energy costs while also supporting sustainable operations and enabling data centers to expand GPU capacity while maintaining reliability and performance.

- In August 2024, Hewlett Packard Enterprise partnered with Khazna Data Centers to launch the UAE's first managed data center hosting service featuring direct liquid cooling (DLC) for AI and high-performance computing workloads. This energy-efficient infrastructure supports the UAE’s national AI strategy by improving performance, reducing space requirements, and addressing rising power demands.

Market Trend

Expansion of On-Demand GPU Access and Scalable Computing Solutions

The market is witnessing a notable trend toward the rising adoption of GPU-as-a-Service (GPUaaS) and on-demand GPU access models. These flexible delivery methods enable organizations to efficiently scale GPU resources based on fluctuating workloads without the need for large upfront investments in hardware.

On-demand access enhances resource utilization, reduces operational costs, and supports diverse high-performance computing and AI applications. This trend fosters operational agility and promotes innovation by making advanced GPU capabilities accessible to a broader range of enterprises, from startups to large corporations.

- In January 2025, SK Telecom launched its GPU-as-a-Service (GPUaaS) from its AI Data Center in Gasan, Seoul, providing scalable, on-demand access to NVIDIA H100 Tensor Core GPUs to support AI development. The service enables customized configurations for enterprise clients and integrates AI Cloud Manager for efficient resource management. The company also plans to deploy NVIDIA H200 GPUs to expand its GPUaaS customer base in South Korea.

Data Center GPU Market Report Snapshot

|

Segmentation

|

Details

|

|

By Deployment

|

On-premises, Cloud-based

|

|

By Function

|

Training, Inference

|

|

By Technology

|

Generative AI, Machine Learning, Natural Language Processing, Computer Vision

|

|

By End Use

|

Cloud Service Providers, Enterprises, Government

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Deployment (On-premises and Cloud-based): The on-premises segment earned USD 54.93 billion in 2024 due to enterprise demand for enhanced data control, security, and low-latency performance in mission-critical applications.

- By Function (Training and Inference): The training segment held a share of 62.05% in 2024, fueled by the high computational demands of large-scale AI model development.

- By Technology (Generative AI, Machine Learning, Natural Language Processing, and Computer Vision): The generative AI segment is projected to reach USD 87.99 billion by 2032, owing to its widespread use in content creation, coding, and enterprise automation tools.

- By End Use (Cloud Service Providers, Enterprises, and Government): The enterprises segment is projected to reach USD 99.78 billion by 2032, propelled by the increasing adoption of AI-driven solutions across sectors such as finance, healthcare, and manufacturing.

Data Center GPU Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America data center GPU market accounted for a substantial share of 35.95% in 2024, valued at USD 36.51 billion. This dominance is reinforced by the presence of major technology giants and large cloud service providers, which are heavily investing in GPU-powered infrastructure.

Additionally, North America's advanced research institutions and robust enterprise adoption of AI and high-performance computing in sectors such as healthcare, finance, and defense significantly contribute to the region’s leading position.

The established ecosystem of data centers, combined with early adoption of cutting-edge GPU technologies and strong partnerships between industry and academia, further supports this expansion.

The Asia Pacific data center GPU industry is expected to register the fastest CAGR of 13.71% over the forecast period. This rapid expansion is fueled by increasing digital transformation initiatives across emerging economies such as China, India, Japan, and South Korea.

The regional market benefits from growing investments in data center infrastructure by major cloud providers and a rising number of technology startups adopting GPU-accelerated solutions for AI, gaming, and automotive applications. Furthermore, the expanding manufacturing sector and rising demand for edge computing in Asia Pacific are accelerating GPU adoption in data centers.

- In May 2025, Sify Technologies launched a pay-per-use colocation pricing model at its NVIDIA-certified hyperscale data centers in Chennai, Noida, and Navi Mumbai. This hourly pricing covers hosting, power, and infrastructure, enabling faster, flexible deployment of NVIDIA GPU platforms to support growing AI workload demand in India.

Regulatory Frameworks

- In the U.S., the Federal Trade Commission (FTC) regulates data security and privacy within the data center industry. The FTC enforces laws against unfair and deceptive business practices, including those related to data breaches, privacy violations, and data handling. The National Institute of Standards and Technology (NIST) supports data center security by providing standards and guidance.

- In Europe, the European Data Protection Board (EDPB) regulates data center data protection. The EDPB, comprising national data protection authorities and the European Data Protection Supervisor (EDPS), works alongside the European Commission, which advises and legislates on data protection, notably under the General Data Protection Regulation (GDPR)..

Competitive Landscape

The data center GPU market is characterized by innovation and strategic partnerships. Key players focus on developing advanced GPU architectures that enhance performance and energy efficiency for AI and high-demand computing tasks. Collaborations with major cloud providers and system integrators help broaden adoption by enabling seamless integration into diverse workloads.

Companies expand their portfolios through acquisitions and internal development to provide comprehensive accelerated computing solutions. Emphasis on building robust software ecosystems and developer support increases customer retention. Additionally, geographic expansion into emerging markets, combined with competitive pricing and bundled offerings, strengthen regional market presence.

- In May 2025, Dell Technologies launched next-gen enterprise AI solutions via the Dell AI Factory with NVIDIA, featuring Blackwell GPU-powered servers, improved storage and networking, and full-stack integration to support scalable AI deployments.

Key Companies in Data Center GPU Market:

- NVIDIA Corporation

- Intel Corporation

- Amazon.com, Inc.

- Microsoft

- Alibaba Cloud

- Oracle

- Tencent Cloud

- Huawei Cloud Computing Technologies Co., Ltd.

- Meta

- CoreWeave

- Lambda, Inc.

- DigitalOcean, LLC.

- RiseUnion

- Advanced Micro Devices, Inc.

- Alphabet Inc.

Recent Developments (Product Launch)

- In May 2025, NVIDIA launched its RTX PRO Servers powered by RTX PRO 6000 Blackwell Server Edition GPUs, aimed at accelerating the global enterprise IT shift toward AI-driven infrastructure. The launch included the Enterprise AI Factory validated design, enabling partners to build advanced data center architectures for AI, design, and engineering workloads. This includes full-stack solutions with certified servers, networking, and software, supported by leading system manufacturers and consulting firms worldwide.