Market Definition

The market encompasses services that provide physical space, infrastructure, and support services businesses to house their IT equipment, such as servers, storage devices, and networking hardware, in third-party data center facilities.

Data Center Colocation Market Overview

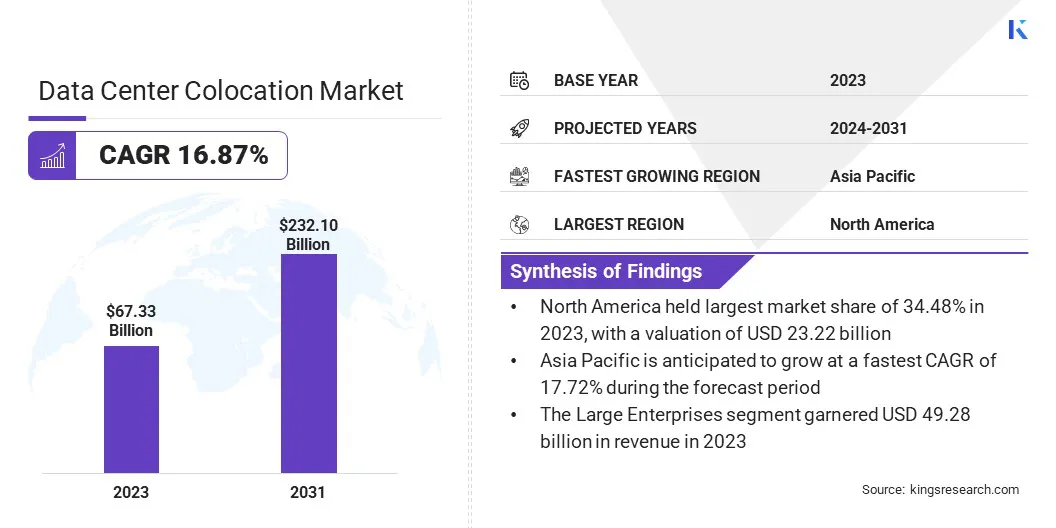

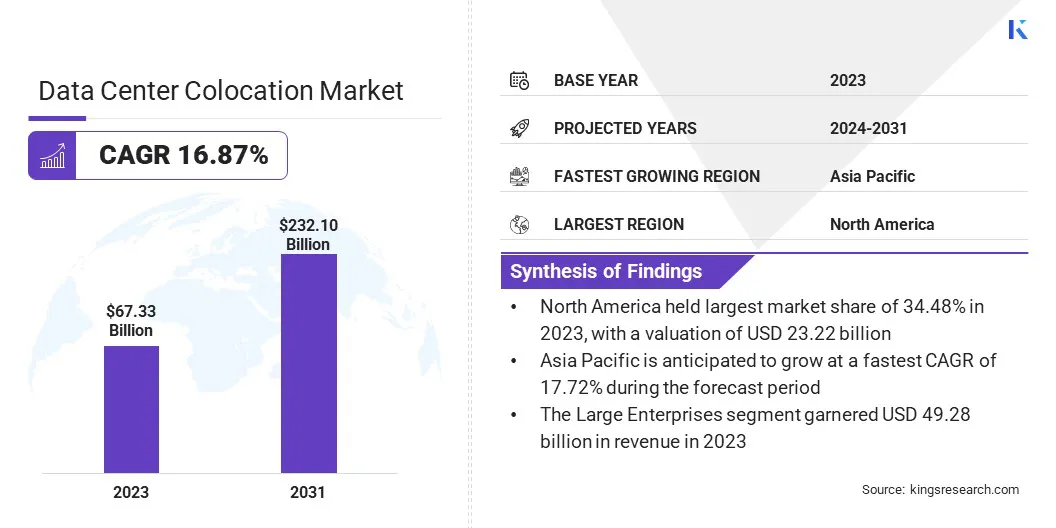

Global Data Center Colocation Market size was valued at USD 67.33 billion in 2023, which is estimated to be valued at USD 77.96 billion in 2024 and reach USD 232.10 billion by 2031, growing at a CAGR of 16.87% from 2024 to 2031.

The surge in data generation by businesses and consumers is creating a need for secure, scalable storage and management solutions, making colocation services a vital solution for handling the massive data influx.

Major companies operating in the data center colocation industry are China Telecommunications Corporation, Cologix, Colt Data Centre Services Holdings., Digital Connexion, CyrusOne, Centersquare, Digital Realty Trust, Equinix, Inc., Flexential, Iron Mountain, Inc., NTT Ltd., RACKSPACE TECHNOLOGY, Telehouse, CoreSite, Accenture, and others.

The market is expanding rapidly, fueled by rising dwmand in emerigin economies such as Asia-Pacific, Africa, and Latin America. Businesses in these areas are increasingly relying on third-party providers for secure, scalable, and cost-effective IT infrastructure.

This expansion is supported by the growing need for reliable data storage and processing solutions, propelled by digital transformation and cloud adoption. Providers are responding to this with state-of-the-art facilities to meet evolving enterprise requirements.

- In May 2023, Ascenty partnered with NUV to offer record-low latency connectivity between Brazil and Europe. This collaboration enhances global connectivity by addressing the growing demand for secure, scalable data solutions.

Key Highlights:

- The data center colocation industry size was recorded at USD 67.33 billion in 2023.

- The market is projected to grow at a CAGR of 16.87% from 2024 to 2031.

- North America held a share of 34.48% in 2023, valued at USD 23.22 billion.

- The retail colocation segment garnered USD 36.75 billion in revenue in 2023.

- The tier 3 segment is expected to reach USD 114.52 billion by 2031.

- The large enterprises held a share of 73.19% in 2023.

- The IT & telecom segment is anticipated to witness a CAGR of 64% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 17.72% through the projection period.

Market Driver

"Data Explosion"

The surge in data from digital interactions, IoT devices, and cloud-based services is fosterig the expansion of the data center colocation market. As b data volumes increase, businesses seek secure, reliable, and reliable infrastructure.

Colocation services offer businesses the ability to offload data storage, ensure uptime, and meet regulatory requirements, making them essential for efficient data management.

- In September 2024, MC Digital Realty was awarded Frost & Sullivan's 2024 Company of the Year Award for Japan's data center services industry. This recognition underscores the increasing demand for advanced colocation services to manage the massive surge in data generated globally.

Market Challenge

"Security and Privacy Concerns"

Security and privacy concerns pose a significant challenges to the development of the data center colocation market, as businesses increasingly store sensitive data off-premises. Ensuring robust physical and cybersecurity to prevent breaches and data theft is crucial. Providers face increasing threats, including cyberattacks and unauthorized access.

To address these challenges, colocation providers implement advanced security measures such as multi-layered access controls, encryption, continuous monitoring, and compliance with industry standards. Additionally, adopting AI-powered security systems and regular audits helps mitigate risks and enhance data privacy.

Market Trend

"5G and IoT Integration"

The rollout of 5G networks and the proliferation of IoT devices are highlighting the need for more decentralized data centers. As data generation shifts closer to the source, the demand for low-latency processing and real-time analytics grows.

Colocation supports this shift by providing businesses with distributed, secure, and scalable infrastructure to support 5G and IoT applications. This decentralization enhances data processing, connectivity, and high-performance computing to meet the evolving needs of modern technologies.

- In August 2024, U Mobile signed an MOU with ST Telemedia Global Data Centres to leverage 5G technology, enhancing colocation services in Malaysia. This collaboration aims to optimize edge computing, IoT, and disaster recovery, improving the efficiency of data centers.

Data Center Colocation Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Retail Colocation, Wholesale Colocation

|

|

By Tier

|

Tier 1, Tier 2, Tier 3, Tier 4

|

|

By Enterprise Size

|

Large Enterprises, SMEs

|

|

By End Use

|

Retail, BFSI, IT & Telecom, Healthcare, Media & Entertainment, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Retail Colocation and Wholesale Colocation): The retail colocation segment earned USD 36.75 billion in 2023 due to increasing demand for flexible, scalable, and cost-effective infrastructure solutions from small and medium businesses.

- By Tier (Tier 1, Tier 2, Tier 3, and Tier 4): The tier 3 segment held a share of 49.24% in 2023, largely attributed to its high reliability, uptime, and energy efficiency across various industries.

- By Enterprise Size (Large Enterprises and SMEs): The large enterprises segment is projected to reach USD 167.64 billion by 2031, fueled by the growing demand for secure, scalable, and global data center solutions to support digital transformation.

- By End Use (Retail, BFSI, IT & Telecom, Healthcare, Media & Entertainment, and Others): The IT & telecom segment is anticipated to grow at a CAGR of 17.64% over the forecast period, propelled by ongoing advancements in cloud computing, 5G, and IoT.

Data Center Colocation Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

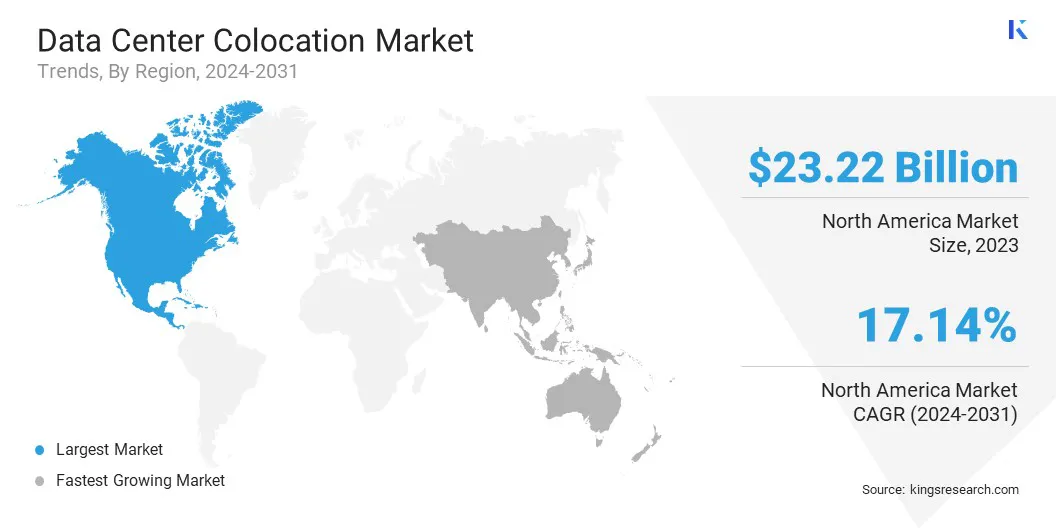

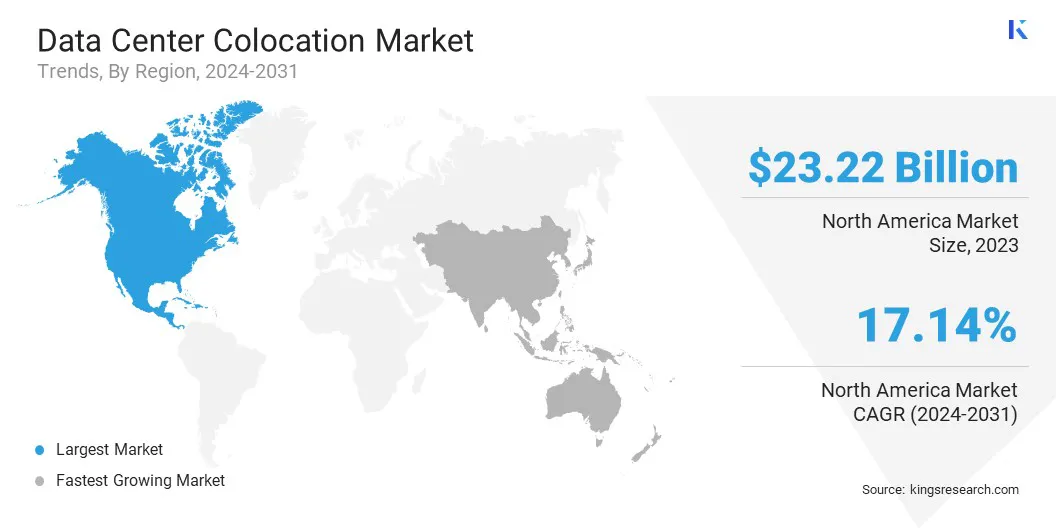

North America data center colocation market share stood at around 34.48% in 2023, valued at USD 23.22 billion. This dominance is reinforced by its well-established infrastructure, continual technological advancements, and strong demand from enterprises.

The regional market benefits from a high concentration of large data centers and major cloud providers, making it a prime hub for companies seeking reliable and scalable colocation services. Supported by a robust ecosystem of service providers and innovative offerings, North America remains a key region, particularly cloud computing and digital transformation.

Asia Pacific data center colocation industry is poised to grow at a robust CAGR of 17.72% over the forecast period. This rapid growth is facilitated by technological advancements, increased adoption of cloud services, and rising demand for digital infrastructure.

The region's growing economy and substantial investments in advanced technologies such as 5G and edge computing are aiding the expansion of data center services. With businesses increasingly seeking scalable, reliable, and secure solutions, Asia Pacific is witnessing a surge in demand for colocation services.

- In March 2025, Digital Realty formed a 50-50 joint venture with Bersama Digital Infrastructure Asia to develop and operate data centers in Indonesia. This partnership expands PlatformDIGITAL, providing scalable colocation solutions and enhanced connectivity to support the country's growing digital economy.

Regulatory Frameworks

- In the US, the California Consumer Privacy Act (CCPA) strengthens data privacy by granting consumers rights to access, delete, avoid discrimination related to their personal information.

- In the EU, the General Data Protection Regulation (GDPR) sets guidelines for collecting, storing, and processing personal information data to safeguard individual privacy.

Competitive Landscape

Companies in the data center colocation industry are increasingly securing high-profile colocation contracts with government agencies. These providers are focused on offering reliable power, seamless connectivity, and direct network access to support mission-critical operations.

By ensuring low-latency, high-performance environments, they are meeting the evolving needs of industries that rely on real-time data processing, enhanced security, and efficient cloud integration.

- In September 2024, the U.S. Department of Homeland Security awarded Equinix a colocation contract to support the Homeland Security Enterprise Network (HSEN). Equinix’s high-performance data centers will provide reliable power, connectivity, and operational support for DHS's mission-critical services.

List of Key Companies in Data Center Colocation Market:

- China Telecommunications Corporation

- Cologix

- Colt Data Centre Services Holdings.

- Digital Connexion

- CyrusOne

- Centersquare

- Digital Realty Trust

- Equinix, Inc.

- Flexential

- Iron Mountain, Inc.

- NTT Ltd.

- RACKSPACE TECHNOLOGY

- Telehouse

- CoreSite

- Accenture

Recent Developments (M&A/Expansion)

- In March 2025, Nebius Group announced the expansion of its AI infrastructure in North America with a 300 MW data center in New Jersey.

- In July 2024, Digital Realty acquired a data center campus in Slough, UK, for USD 200 million. This acquisition enhances its European colocation capabilities, offering increased capacity, seamless connectivity, and scalability while supporting sustainability with renewable energy-powered operations.