Market Definition

The market focuses on the production and sale of high-performance chips that power servers and storage systems supporting cloud computing, AI, big data, and online services. Applications span BFSI, healthcare, retail, telecommunications, media, and energy for data processing, storage, security, and real-time analytics.

The report outlines the primary drivers of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry's trajectory.

Data Center Chip Market Overview

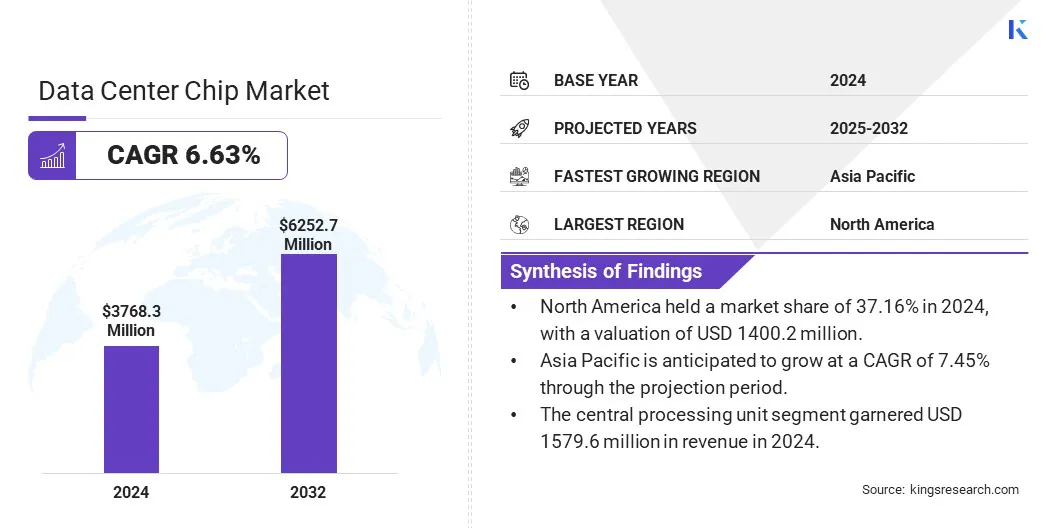

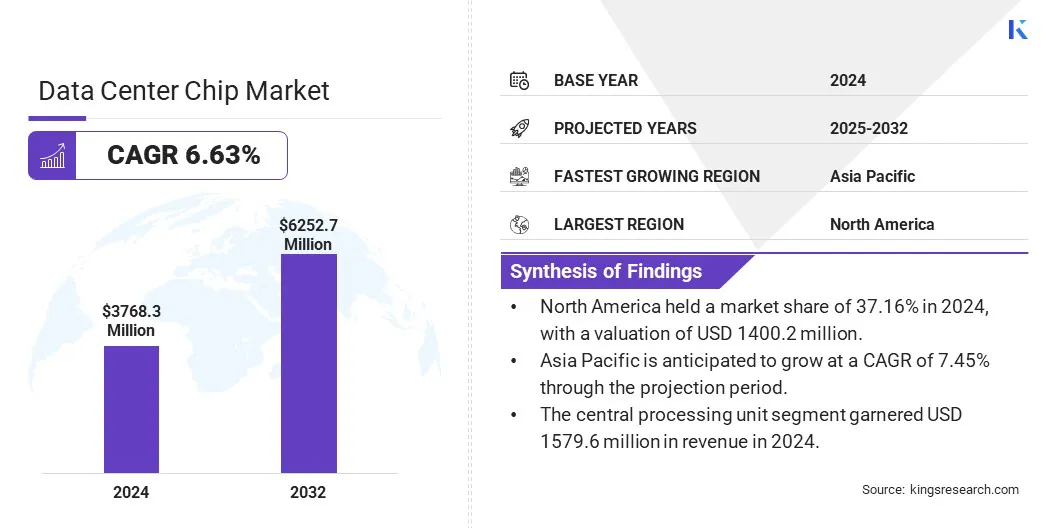

The global data center chip market size was valued at USD 3768.3 million in 2024 and is projected to grow from USD 3989.6 million in 2025 to USD 6252.7 million by 2032, exhibiting a CAGR of 6.63% during the forecast period.

Market expansion is driven by hyperscale data centers investing in high-performance, energy-efficient chips to support cloud, AI, and big data. AI-specific processors such as TPUs enhance efficiency, memory, and speed, accelerating innovation and scalability in AI workloads globally.

Major companies operating in the data center chip industry are NVIDIA Corporation, Advanced Micro Devices, Inc., Intel Corporation, Micron Technology, Inc, Google, SK hynix INC., Amazon Web Services, Inc., Samsung, Texas Instruments Incorporated, Analog Devices, Inc., Monolithic Power Systems, Inc., IBM, Infineon Technologies AG, Honeywell International Inc., and Graphcore.

Market progress is propelled by the exponential growth of artificial intelligence (AI) applications. Advances in AI require increasingly powerful and efficient processing capabilities, creating a strong demand for specialized chips that handle complex computations at high speeds.

This growth is fueled by deep learning and machine learning algorithms requiring substantial data processing and low latency. As AI adoption broadens across industries, the need to support massive data workloads and real-time analytics accelerates market progress.

- In November 2023, Microsoft introduced two custom chips, the Azure Maia AI Accelerator for AI and generative AI tasks, and the Azure Cobalt CPU, an Arm-based processor for general compute workloads. These chips complete Microsoft’s vertically integrated infrastructure, enhancing data center performance and efficiency.

Key Highlights:

- The data center chip industry size was recorded at USD 3768.3 million in 2024.

- The market is projected to grow at a CAGR of 6.63% from 2025 to 2032.

- North America held a market share of 37.16% in 2024, with a valuation of USD 1400.2 million.

- The central processing unit segment garnered USD 1579.6 million in revenue in 2024.

- The BFSI segment is expected to reach USD 1143.7 million by 2032.

- The small and medium data centers segment is anticipated to witness the fastest CAGR of 7.10% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 7.45% through the projection period.

Market Driver

Expansion of Hyperscale Data Centers

The growth of the data center chip market is propelled by the rapid expansion of hyperscale data centers led by major tech giants such as Amazon, Google, and Microsoft. These companies are investing heavily in large-scale infrastructure to support growing demand for cloud computing, AI, and big data services.

Hyperscale facilities require high-performance, energy-efficient chips to manage massive data volumes and complex workloads. This surge in deployment is fueling continuous innovation and increased demand for advanced processors, GPUs, and custom accelerators.

- In April 2025, du announced a AED 2 billion (USD 544.54 million) deal with Microsoft to build a hyperscale data center in the UAE. Operated by du, with Microsoft as the anchor tenant, the facility will expand in phases. This initiative strenghthens the UAE’s cloud infrastructure and supports its goal to become a global leader in AI and digital technologies.

Market Challenge

High Power Consumption and Heat Generation

The expansion of the data center chip market is hindered by high power consumption and heat generation. Large-scale data centers demand energy-intensive processors, leading to increased cooling costs and thermal management complexity. Inefficient heat dissipation reduces chip performance and reliability, resulting in higher operational expenses.

To address this challenge, companies are investing in energy-efficient chip designs, such as low-power architectures and advanced semiconductor materials. Innovative cooling solutions such as liquid cooling, immersion cooling, and AI-driven thermal management optimize heat removal.

Major players also integrate workload optimization to reduce power spikes. These strategies enhance performance, lower energy costs, and promote sustainable data center growth.

Market Trend

Increasing Use of AI-Specific Chips Like TPUs in Data Centers

The data center chip market is experincing a notable trend toward the adoption of AI-specific chips such as tensor processing unit (TPUs) to handle growing demands for compute-intensive AI workloads. These specialized processors deliver higher efficiency and performance for training and inference of large-scale models.

Enhanced memory capacity, bandwidth, and optimized architectures enable faster processing and lower latency, addressing power and thermal constraints. This shift accelerates innovation in AI applications, improving scalability and cost-effectiveness while supporting the expanding global need for advanced AI-driven services.

- In May 2024, Google launched Trillium, its sixth-generation TPU, advancing data center chip technology with a 4.7× boost in peak compute over TPU v5e. Trillium doubles memory and interconnect bandwidth and integrates third-gen SparseCore for large embeddings. It accelerates training and serving of AI models such as Gemini 1.5 with 67% greater energy efficiency, enhancing performance and sustainability in data centers.

Data Center Chip Market Report Snapshot

|

Segmentation

|

Details

|

|

By Chip Type

|

Central Processing Unit (CPU), Graphics Processing Unit (GPU), Application-Specific Integrated Circuit (ASIC), Application-Specific Integrated Circuit (ASIC), Field-Programmable Gate Array (FPGA)

|

|

By End-user

|

BFSI, Healthcare, Retail, Telecommunications, Media and Entertainment, Energy and Utilities, Others

|

|

By Data Center Type

|

Small and Medium Data Centers, Large Data Centers

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Chip Type (Central Processing Unit (CPU), Graphics Processing Unit (GPU), Application-Specific Integrated Circuit (ASIC), and Field-Programmable Gate Array (FPGA)): The central processing unit segment earned USD 1579.6 million in 2024 due to its essential role in handling general-purpose computing tasks across diverse data center applications.

- By End-user (BFSI, Healthcare, Retail, and Telecommunications): The BFSI segment held a share of 30.35% in 2024, fueled by its high demand for secure, real-time data processing and analytics to support digital banking, fraud detection, and financial transactions.

- By Data Center Type (Small and Medium Data Centers and Large Data Centers): The large data centers segment is projected to reach USD 6252.7million by 2032, largely attributed to the growing need for scalable infrastructure to support cloud computing, AI workloads, and massive data storage requirements.

Data Center Chip Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America data center chip market share stood at around 37.16% in 2024 , valued at USD 1400.2 million. This dominance is reionforced by the region's significant investments in large-scale AI inference infrastructure. The region hosts a majority of advanced data centers equipped with cutting-edge chip technologies designed for high-speed, compute-intensive tasks.

These facilities enable rapid processing of massive AI workloads, supporting the region’s leadership in AI innovation. With a strong focus on domestic chip deployment and infrastructure expansion, the regional market experiences enhanced capacity to meet growing global demand for efficient, high-performance data processing.

- In March 2025, Cerebras Systems launched six AI inference datacenters powered by its Wafer-Scale Engines, boosting capacity 20x to serve over 40 million Llama 70B tokens per second. Equipped with thousands of CS-3 systems primarily located in the U.S., these data centers strengthen AI infrastructure by delivering the world’s fastest high-speed inference cloud, highlighting significant advancements in data center chip technology.

The Asia Pacific data center chip industry is estimated to grow at CAGR of 7.45% over the forecast period. This growth is fostered by rapid digital transformation across industries and increasing government initiatives to build robust technology infrastructure.

Rising investments in edge computing and 5G networks create a strong demand for specialized chips that deliver low latency and high efficiency. Additionally, expanding manufacturing capabilities and local semiconductor innovation enhance the region’s ability to produce advanced processors, positioning Asia Pacific as a key region for data center chip.

Regulatory Frameworks

- In Europe, data center operations and chip usage are governed by the General Data Protection Regulation (GDPR) and the Digital Operational Resilience Act (DORA), both emphasizing strong data protection, cybersecurity, and operational resilience across digital infrastructure and services.

- In India, the data center chip and industry is overseen by the Ministry of Electronics and Information Technology (MeitY), guided by the draft Data Centre Policy and the Digital Personal Data Protection Act, 2023, which governs data processing obligations.

- In Japan, data center chips and asscoiated data are mainly regulated by the Act on the Protection of Personal Information (APPI), with oversight by the Personal Information Protection Commission (PPC) to ensure data privacy and compliance standards.

Competitive Landscape

Key players in the data center chip industry are implementing several strategic initiatives such as mergers and acquisitions and new product launches. These companies are consolidating technologies and expanding their portfolios to strengthen market positioning.

They are accelerating the introduction of advanced chip architectures and customized solutions to address evolving industry demands. These efforts reflect a competitive landscape focused on enhancing capabilities and scaling operations to capture increased market share in a rapidly evolving environment.

- In September 2024, Intel and Amazon Web Services announced a multi-year, multi-billion-dollar co-investment in custom chip designs, expanding their strategic collaboration. Intel will produce an AI fabric chip for AWS using its advanced 18A process node and develop a custom Xeon 6 chip on Intel 3, enhancing AWS’s ability to power diverse workloads and accelerate AI application performance.

List of Key Companies in Data Center Chip Market:

- NVIDIA Corporation

- Advanced Micro Devices, Inc.

- Intel Corporation

- Micron Technology, Inc

- Google

- SK hynix INC.

- Amazon Web Services, Inc.

- Samsung

- Texas Instruments Incorporated

- Analog Devices, Inc.

- Monolithic Power Systems, Inc.

- IBM

- Infineon Technologies AG

- Honeywell International Inc.

- Graphcore

Recent Developments (Partnerships/New Product Launch)

- In March 2025, Texas Instruments launched new power-management chips to meet rising power demands in modern data centers. The TPS1685 is the industry's first 48V integrated hot-swap eFuse with power-path protection, while the LMG3650R series features integrated GaN power stages in standard TOLL packaging, enhancing efficiency and simplifying hardware design.

- In February 2024, Intel Foundry Services and Cadence Design Systems expanded their partnership through a multiyear agreement to co-develop custom IP and optimized design flows for Intel 18A and future nodes. The collaboration focuses on advanced system-on-chip development for AI and HPC.