Market Definition

Customer journey analytics encompasses the process of collecting, integrating, and analyzing data from every customer interaction across various channels and touchpoints to gain actionable insights.

It enables applications such as personalized engagement, improved customer retention, campaign optimization, and enhanced customer experience by identifying behavior patterns, preferences, and friction points throughout the journey.

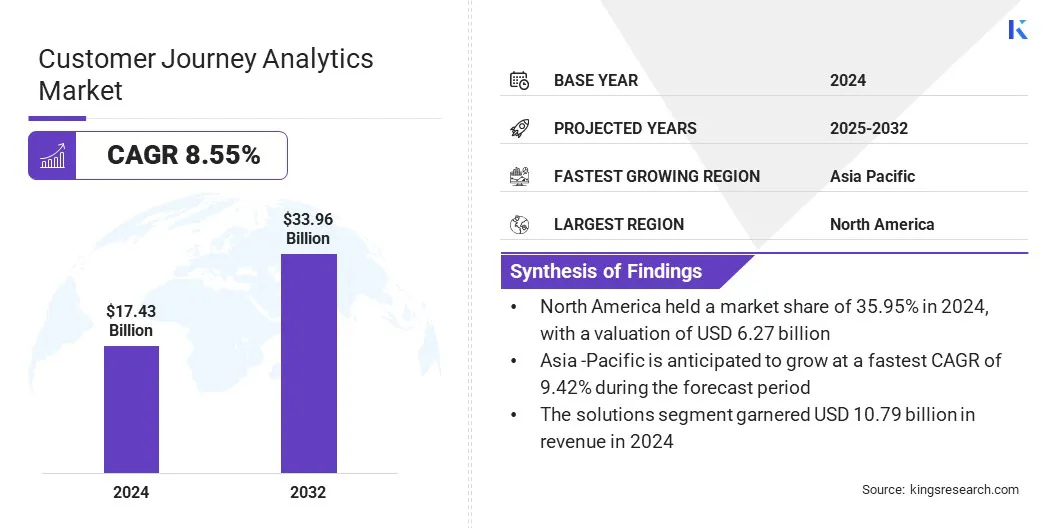

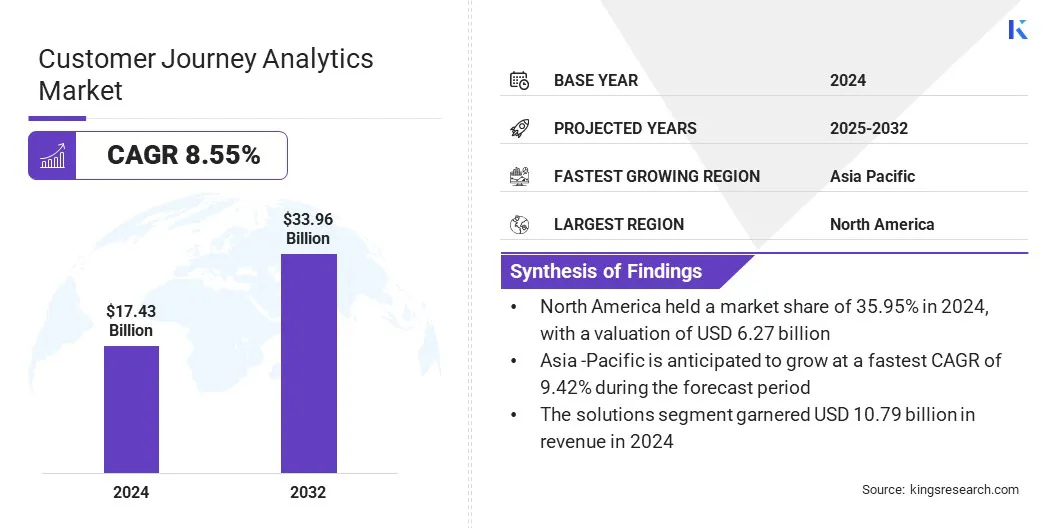

The global customer journey analytics market size was valued at USD 17.43 billion in 2024 and is projected to grow from USD 18.81 billion in 2025 to USD 33.96 billion by 2032, exhibiting a CAGR of 8.55% during the forecast period.

This market growth is attributed to the rising demand for personalized customer experiences that align engagement with individual preferences and behaviors across interaction channels.

The market is also progressing, due to the increasing use of predictive and prescriptive analytics as businesses use AI to forecast actions and facilitate proactive customer engagement throughout the journey.

Key Market Highlights:

- The global market size was valued at USD 17.43 billion in 2024.

- The market is projected to grow at a CAGR of 8.55% from 2025 to 2032.

- North America held a market share of 35.95% in 2024, with a valuation of USD 6.27 billion.

- The solutions segment garnered USD 10.79 billion in revenue in 2024.

- The website segment is expected to reach USD 9.55 billion by 2032.

- The cloud-based segment is anticipated to register the fastest CAGR of 8.83% during the forecast period.

- The brand management segment garnered USD 5.21 billion in revenue in 2024

- The BFSI segment held a market share of 24.88% in 2024

- The market in Asia Pacific is anticipated to grow at a CAGR of 9.42% over the forecast period.

Major companies operating in the customer journey analytics industry are Oracle, Adobe, Salesforce, Inc., NiCE, Google LLC, Cisco, Teradata, inQuba, Verint Systems Inc., CallMiner, Servion Global Solutions, ALTERIAN, FirstHive, Genesys, and Acoustic, L.P.

Customer Journey Analytics Market Report Snapshot

Customer Journey Analytics Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Solutions, Services

|

|

By Source

|

Website, Social Media, Email, Mobile, Others

|

|

By Deployment

|

On-premises, Cloud-based

|

|

By Application

|

Brand Management, Campaign Management, Churn Management, Customer Behavioral Analysis, Product Management, Others

|

|

By Vertical

|

BFSI, Healthcare, Retail and E-commerce, IT & Telecommunications, Travel & Hospitality, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Customer Journey Analytics Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America accounted for 35.95% share of the customer journey analytics market in 2024, with a valuation of USD 6.27 billion. This dominance is attributed to the increasing adoption of integrated customer journey analytics platforms that unify marketing and sales data across enterprise systems in the region.

The market is progressing as players in the region focus on enhancing coordination between departments such as marketing, sales, and customer service while ensuring consistent engagement across all customer interaction points. Businesses are implementing solutions that support synchronized workflows and generate insights from various communication channels.

The market in North America is growing, due to the regional focus on real-time decision-making and performance monitoring to improve customer interaction outcomes.

Enterprises are using analytics platforms that provide end-to-end visibility across customer journeys and support strategic execution by linking data to measurable outcomes, thereby supporting the expansion of the regional market.

- In June 2024, Fullcast acquired Datajoin to strengthen its Go-to-Market platform with integrated customer journey analytics. The acquisition enables seamless connection of marketing and sales data across tools like Google Analytics and Salesforce, enhancing collaboration and real-time decision-making. This move aims to deliver unified insights and optimize revenue team performance.

The customer journey analytics industry in Asia Pacific is set to grow at a robust CAGR of 9.42% over the forecast period. This growth is attributed to the increasing integration of AI-driven analytics and e-commerce data management solutions across the region.

Key players are unifying customer data to enhance journey visibility and improve decision-making across pricing, inventory, and marketing. The market is further benefiting from rising digital commerce activity and the growing need to build more responsive and informed engagement strategies within the consumer packaged goods sector.

The market in the region is growing as enterprises adopt predictive analytics to manage customer interactions more effectively and scale e-commerce operations by anticipating demand and optimizing engagement efforts.

Businesses in the region are focusing on centralizing insights across platforms to support consistent customer experiences and enhance operational efficiency throughout the digital commerce landscape, thereby fueling the regional market.

- In December 2024, ADA acquired Customore to launch an advanced Intelligent Commerce solution tailored for the CPG industry. The integration combines Customore’s ecommerce data unification capabilities with ADA’s AI-driven predictive analytics and digital operations expertise. This move enhances customer journey visibility and supports real-time optimization of pricing, inventory, and marketing decisions across e-commerce platforms in Asia Pacific.

Customer Journey Analytics Market Overview

The integration of AI agents into customer experience platforms for real-time customer engagement is driving the customer journey analytics market. Businesses are deploying purpose-built AI agents to automate audience targeting, content personalization, and journey orchestration across digital channels.

These AI agents are enabling organizations to enhance customer experiences, increase retention, and deliver measurable outcomes throughout the customer lifecycle.

- In March 2025, Adobe launched the Adobe Experience Platform Agent Orchestrator to help businesses build, manage, and deploy AI agents for enhancing customer experiences and marketing workflows. The platform integrates real-time data, first-party insights, and purpose-built AI agents to support dynamic personalization and optimize customer journeys.

Market Driver

Growing Demand for Personalized Customer Experiences

The market is expanding, due to the growing demand for personalized customer experiences that align with individual preferences, behaviors, and real-time expectations.

Organizations are leveraging advanced analytics to gain a comprehensive understanding of customer journeys, enabling the delivery of tailored content, recommendations, and offers. This shift toward hyper-personalization is enhancing customer satisfaction, fostering loyalty, and driving competitive differentiation across industries seeking to elevate their engagement strategies.

- In June 2024, NetSpring launched its Product and Customer Journey Analytics application powered by the Snowflake AI Data Cloud. The solution enables product-led companies to unify product and customer data within Snowflake, driving cost-effective insights to enhance product development and customer experiences.

Market Challenge

High Implementation and Integration Complexity

High implementation and integration complexity is posing a significant challenge in the customer journey analytics market. Organizations are facing difficulties in aligning analytics platforms with existing IT infrastructure, which often involves multiple data sources, legacy systems, and varying data formats.

This complexity is also impacting the scalability and limiting the ability of enterprises to fully utilize analytics capabilities for real-time customer engagement and decision-making.

Market players are developing modular and interoperable analytics solutions that simplify integration with existing systems. They are offering pre-built connectors and APIs to enable faster data unification across platforms and reduce deployment time.

Additionally, vendors are investing in cloud-native architectures and low-code tools to streamline implementation and minimize the need for extensive technical resources.

By providing dedicated onboarding support and customizable configurations, companies are helping enterprises overcome complexity and accelerate the adoption of customer journey analytics solutions.

Market Trend

Use of Predictive and Prescriptive Analytics

The use of predictive and prescriptive analytics is transforming the market by enabling businesses to move from reactive analysis to proactive engagement. Organizations are embedding AI and ML models into analytics platforms to forecast customer behavior, identify churn risks, and recommend next-best actions in real time.

These capabilities support decision-making, helping businesses personalize experiences at scale, optimize campaign performance, and improve customer retention by anticipating needs and automating strategic responses across the customer lifecycle.

- In September 2024, Amazon launched enhanced customer analytics and audience segmentation tools to support sellers in optimizing data-driven growth strategies. These tools provide deeper insights into customer behavior across the entire shopping journey, from awareness to post-purchase engagement.

Market Segmentation:

- By Component (Solutions and Services): The solutions segment earned USD 10.79 billion in 2024, due to the rising adoption of integrated analytics platforms for personalized engagement.

- By Source (Website, Social Media, Email, Mobile and Others): The website segment held 28.08% share of the market in 2024, due to the growing reliance on web-based customer interactions and data collection.

- By Deployment (On-premises and Cloud-based): The on-premises segment is projected to reach USD 17.99 billion by 2032, propelled by the increasing demand for greater data control and security compliance.

- By Application (Brand Management, Campaign Management, Churn Management, Customer Behavioral Analysis, Product Management and Others): The brand management segment earned USD 5.21 billion in 2024, owing to the increasing focus on improving brand perception and customer loyalty.

- By Vertical (BFSI, Healthcare, Retail and E-commerce, IT & Telecommunications, Travel & Hospitality, and Others): The IT & telecommunications segment is anticipated to register the fastest CAGR of 8.83% during the forecast period, due to the growing adoption of digital services and need for customer journey optimization.

Regulatory Frameworks

- In the U.S., the Federal Trade Commission (FTC) oversees the use of personal data in customer analytics, ensuring compliance with privacy, consent, and data protection regulations. The FTC regulates the collection, sharing, and application of customer journey data in marketing and enforces transparency in consumer profiling and behavioral tracking while taking action against deceptive practices.

- In China, the Cyberspace Administration of China (CAC) regulates data collection and analytics practices under the Personal Information Protection Law (PIPL). The agency monitors the use of analytics platforms for processing personal behavior data, enforces consent requirements, imposes cross-border data transfer restrictions, and mandates security assessments for platforms handling large-scale consumer analytics in digital environments.

- In India, the Data Protection Board of India (DPBI), established under the Digital Personal Data Protection Act, governs the use of personal data in customer analytics. The DPBI enforces lawful processing principles such as purpose limitation and informed consent, and ensures that organizations managing behavioral data through journey analytics tools uphold user rights including data access, correction, and grievance resolution.

Competitive Landscape

Major players in the customer journey analytics market are expanding their capabilities by acquiring specialized analytics providers to strengthen their expertise in predictive modeling and customer experience management.

They are focusing on integrating AI-powered tools that deliver real-time insights and enhance the effectiveness of engagement strategies. Additionally, these players are increasing their talent base and incorporating proprietary technologies to provide deeper analytics and improve customer understanding.

These strategies are enabling organizations to manage complex customer journeys more effectively and achieve improved long-term outcomes.

- In March 2024, Accenture acquired GemSeek, a customer experience analytics provider specializing in AI-powered predictive models and customer insights. This acquisition strengthens Accenture Song’s data and analytics capabilities, adding over 170 professionals and proprietary technologies to support global businesses in enhancing customer understanding and experience strategy.

Key Companies in Customer Journey Analytics Market:

- Oracle

- Adobe

- Salesforce, Inc

- NiCE

- Google LLC

- Cisco

- Teradata

- inQuba

- Verint Systems Inc.

- CallMiner

- Servion Global Solutions

- ALTERIAN

- FirstHive

- Genesys

- Acoustic, L.P.

Recent Developments (Product Launches)

- In June 2025, RingCentral launched new Customer Journey Analytics. The solution provides a complete view of the customer call journey, eliminating data silos and enhancing experience visibility.

- In May 2024, Genesys launched native journey management capabilities for the Genesys Cloud platform to enhance visibility and control over customer interactions. The new features allow organizations to build, monitor, and analyze complete customer journeys and optimize them using AI-driven automation and prediction.