Market Definition

A crystalline solar PV backsheet is a protective layer found at the rear end of photovoltaic modules. It provides mechanical strength, electrical insulation, and environmental protection to solar cells. The backsheet provides protection against moisture ingress and UV degradation, ensuring the long-term performance and reliability of crystalline silicon modules in residential, commercial, and utility-scale solar power installations.

Crystalline Solar PV Backsheet Market Overview

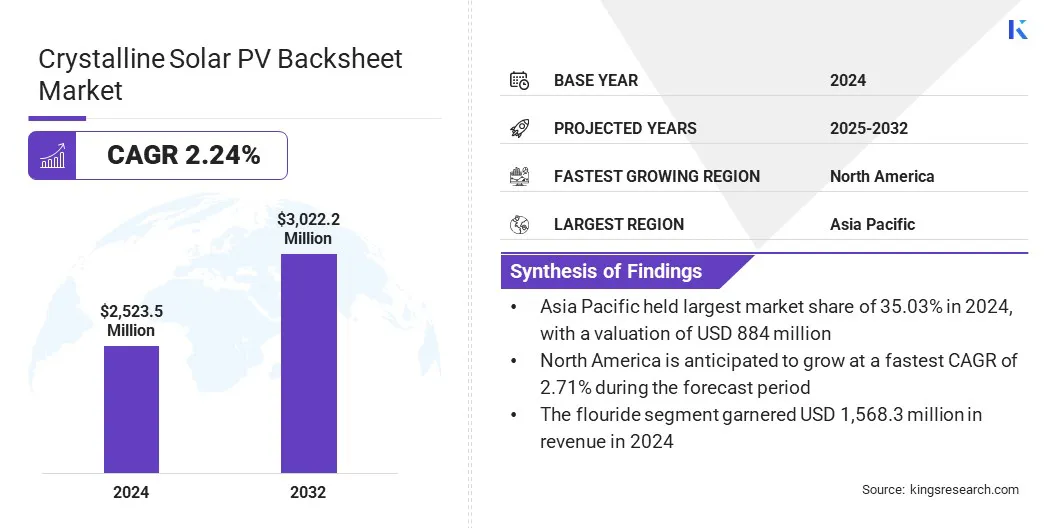

The global crystalline solar PV backsheet market size was valued at USD 2,523.5 million in 2024 and is projected to grow from USD 2,575.7 million in 2025 to USD 3,022.2 million by 2032, exhibiting a CAGR of 2.24% over the forecast period. This growth is driven by advancements in multi-layer backsheet structures enhancing UV resistance, insulation, and durability. These designs, often combining polymer films and coatings, improve thermal stability and module longevity.

Key Highlights:

- The crystalline solar PV backsheet industry was recorded at USD 2,523.5 million in 2024.

- The market is projected to grow at a CAGR of 2.24% from 2025 to 2032.

- Asia Pacific held a share of 35.03% in 2024, valued at USD 884.0 million.

- The fluoride segment generated USD 1,568.3 million in revenue in 2024.

- The 100 to 500 micrometer segment is expected to reach USD 1,154.7 million by 2032.

- The PEN segment is anticipated to witness the fastest CAGR of 2.53% over the forecast period.

- The commercial segment held a share of 42.17% in 2024.

- North America is anticipated to grow at a CAGR of 2.71% over the forecast period.

Major companies operating in the crystalline solar PV backsheet market are DuPont, Targray, Krempel GmbH, 3M, Arkema, COVEME s.p.a., Cybrid Technologies Inc., DUNMORE, Endurans Solar, RenewSys India Pvt. Ltd., Navitas-Alpha Renewables Private Limited, Goldi Solar, Inc., Silfab Solar Inc., VIKRAM SOLAR LTD., and TOYO ALUMINIUM K.K.

The rising adoption of bifacial and half-cut cell modules is fueling market expansion. These advanced module architectures require backsheets with enhanced reflectivity, superior thermal management, and high dielectric strength. Manufacturers are developing specialized materials that maintain stability under variable irradiance and temperature conditions, enabling consistent power output.

Consequently, demand for high-performance multilayer backsheets compatible with next-generation crystalline modules is growing across large-scale and rooftop solar installations globally.

How is growing demand for investments in solar power generation driving the market?

Governments and private entities are funding large-scale photovoltaic infrastructure to meet renewable energy targets boosting demand for durable and efficient backsheet materials that improve module longevity and performance. Increasing capacity across Asia-Pacific, Europe, and North America is strengthening backsheet production, supporting the supply of high-quality materials for crystalline module manufacturing.

- India’s solar power sector drove the expansion of renewable energy, with installed capacity rising from 15 GW in FY24 to about 21 GW in FY25, marking a significant 38% growth.

What are the negative implications of volatility in raw materials?

Volatility in raw material prices and supply chain constraints are primarily hindering the expansion of the crystalline solar PV backsheet market. Frequent fluctuations in polymer and resin costs disrupt manufacturing operations and impact profit margins. Limited supplier availability and logistical disruptions further constrain production efficiency across the industry.

To address this, manufacturers are focusing on local sourcing networks, optimizing inventory management, and adopting long-term supplier partnerships to stabilize procurement and ensure a consistent supply of backsheet materials.

How is the circular economy trend influencing the crystalline solar PV backsheet market?

The rising focus on circular economy initiatives is reshaping the market by creating demand for eco-friendly, recyclable materials and innovative manufacturing processes. Manufacturers are developing backsheets with recyclable polymers and sustainable coatings that facilitate end-of-life recycling, reducing waste and environmental impact.

This trend is promoting R&D investments, collaboration with recycling firms, and adoption of sustainable production practices, particularly in regions with stringent environmental regulations. As a result, companies that embrace circular economy principles are gaining a competitive advantage by appealing to environmentally conscious buyers and aligning with evolving global sustainability standards.

- In March 2024, Council on Energy, Environment and Water (CEEW) reported that India aims to achieve approximately 292 GW of solar capacity by 2030, underscoring the importance of effective solar PV waste management. The proper handling and recycling of end-of-life panels are essential in mitigating environmental impact, optimizing resource utilization, and gaining sustainable economic and social outcomes in the solar energy sector.

Crystalline Solar PV Backsheet Market Report Snapshot

|

Segmentation

|

Details

|

|

By Material

|

Fluoride, Non-Fluoride

|

|

By Thickness

|

Less than 100 Micrometer, 100 to 500 Micrometer, Above 500 Micrometer

|

|

By Product

|

TPT-Primed, TPE, PET, PVDF, PEN, Others

|

|

By Application

|

Residential, Commercial, Utility

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Material (Fluoride and Non-Fluoride): The fluoride segment generated USD 1,568.3 million in revenue in 2024, mainly due to strong demand for PVF and PVDF-based backsheets offering superior UV stability, weather resistance, and extended operational lifespan.

- By Thickness (Less than 100 Micrometer, 100 to 500 Micrometer, and Above 500 Micrometer): The less than 100 micrometer segment is poised to record a CAGR of 2.35% over the forecast period, propelled by increasing use of lightweight, flexible backsheets in high-efficiency crystalline solar modules.

- By Product (TPT-Primed, TPE, PET, PVDF, PEN, and Others): The TPT-primed segment is estimated to hold a share of 29.94% by 2032, fueled by its high mechanical strength, strong adhesion properties, and proven long-term reliability in outdoor photovoltaic applications.

- By Application (Residential, Commercial, and Utility): The commercial segment is projected to reach USD 1,261.0 million by 2032, owing to rising installation of mid-scale solar systems requiring durable backsheets that ensure consistent performance and extended lifecycle efficiency.

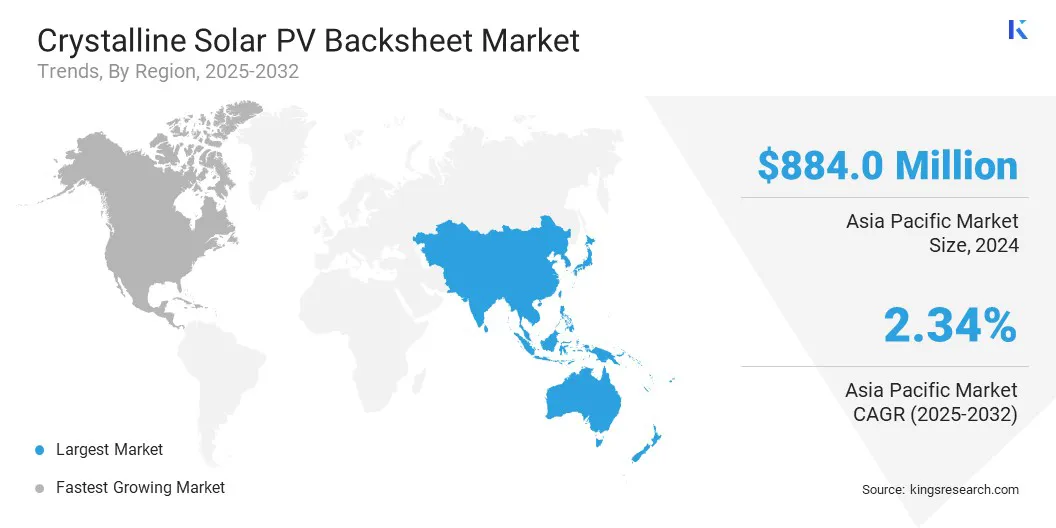

What is the market scenario in Asia-Pacific and North America region?

The global crystalline solar PV backsheet market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America, on the basis of region.

The Asia Pacific crystalline solar PV backsheet Market stood at 35.03% in 2024, valued at USD 884.0 million. This dominance is attributed to the large-scale solar capacity additions and rapid module manufacturing expansion. Strong demand from residential and utility-scale projects has boosted the supply base for backsheet materials.

Increasing production of high-efficiency crystalline modules has accelerated the use of advanced multilayer and non-fluorinated backsheets. Growing partnerships among material suppliers and module producers are also reinforcing regional manufacturing competitiveness.

- In 2024, International Energy Agency (IEA) reported that China is projected to maintain its leadership in the global solar PV market, contributing to nearly 60% of global capacity expansion by 2030. The nation surpassed its 1,200 GW solar PV target six years early, driven by declining costs, policy incentives, and strong support for both large-scale and distributed solar installations.

The North America crystalline solar PV backsheet market is set to grow at a CAGR of 2.71% over the forecast period. This growth is due to the expanding commercial and utility-scale solar deployments and a rising focus on product durability and energy yield optimization.

Demand for high-performance backsheet materials offering long-term reliability is increasing, pushing manufacturers to develop weather-resistant and recyclable backsheets that align with industry standards. Ongoing investment in R&D and product standardization continues to shape market advancement across the region.

Regulatory Frameworks

- In the U.S., the Underwriters Laboratories Standard UL 1703 regulates photovoltaic module safety requirements. It ensures that backsheets used in crystalline solar modules meet fire resistance, electrical insulation, and weatherability standards, enhancing module reliability and safety performance.

- In the EU, the Restriction of Hazardous Substances (RoHS) Directive governs material composition in electrical and electronic equipment. It limits the use of hazardous chemicals in backsheet manufacturing, promoting environmentally compliant and recyclable products.

- In China, the GB/T 31897 standard supervises quality and performance testing for photovoltaic module materials. It specifies testing protocols for thermal resistance, adhesion, and insulation of backsheets, ensuring material durability under varying climatic conditions.

- In Japan, the Japan Electrical Safety & Environment Technology Laboratories (JET) certification enforces performance and reliability criteria for photovoltaic modules. It validates that crystalline module backsheets meet mechanical strength and UV stability requirements for long-term operation.

- In India, the Bureau of Indian Standards (BIS) IS/IEC 61730 standard mandates safety qualification for PV modules. It defines electrical and mechanical protection parameters for backsheets, ensuring compliance with national quality and operational safety benchmarks.

Competitive Landscape

Key players operating in the crystalline solar PV backsheet industry are focusing on capacity expansion, vertical integration, and material innovation to strengthen their market presence. Companies are investing in advanced coating technologies and multilayer film development to improve product quality. Strategic partnerships with module manufacturers help ensure consistent supply and product compatibility.

Firms are prioritizing automation, process optimization, and regional manufacturing to improve cost efficiency. Continuous R&D efforts are directed toward non-fluorinated formulations and sustainable material sourcing to align with evolving industry standards and regulatory frameworks.

Top Key Companies in Crystalline Solar PV Backsheet Market:

- DuPont

- Targray

- Krempel GmbH

- 3M

- Arkema

- COVEME s.p.a.

- Cybrid Technologies Inc.

- DUNMORE

- Endurans Solar

- RenewSys India Pvt. Ltd.

- Navitas-Alpha Renewables Private Limited

- Goldi Solar, Inc.

- Silfab Solar Inc.

- VIKRAM SOLAR LTD.

- TOYO ALUMINIUM K.K.

Recent Developments (M&A)

- In May 2025, Silfab Solar acquired EnPV’s technology patent portfolio, expanding its intellectual property holdings. The acquisition strengthens Silfab’s patent assets, develops its pipeline of advanced technologies, and supports the growth of the next generation of U.S. -manufactured solar panels. The portfolio includes multiple solar technology patents and a related trademark.