Market Definition

The market involves the production and distribution of devices that use quartz crystals to generate precise frequency signals for timing and control in electronic systems.

These oscillators are essential in applications such as telecommunications, consumer electronics, automotive, and industrial equipment. The report provides insights into the core drivers of the market, supported by an in-depth evaluation of industry trends and regulatory frameworks.

Crystal Oscillator Market Overview

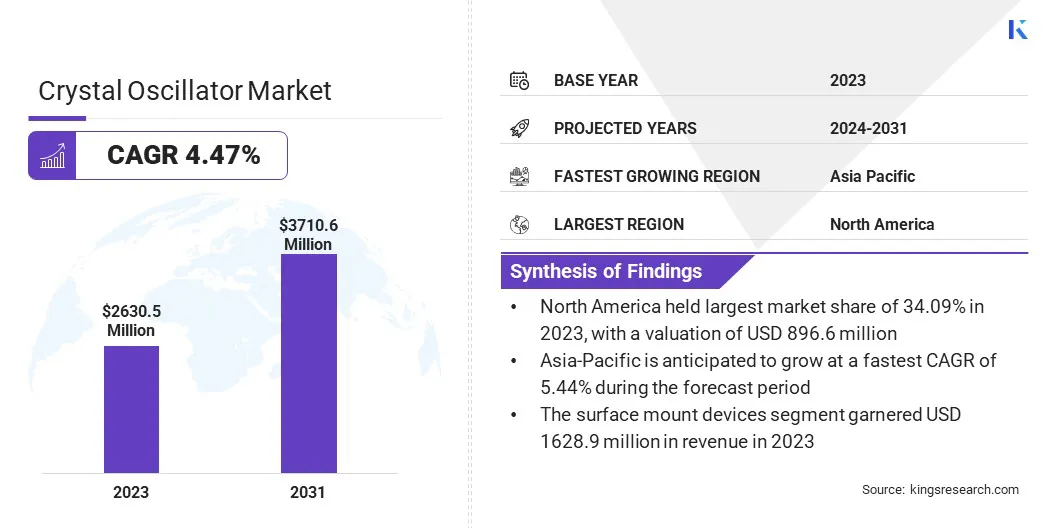

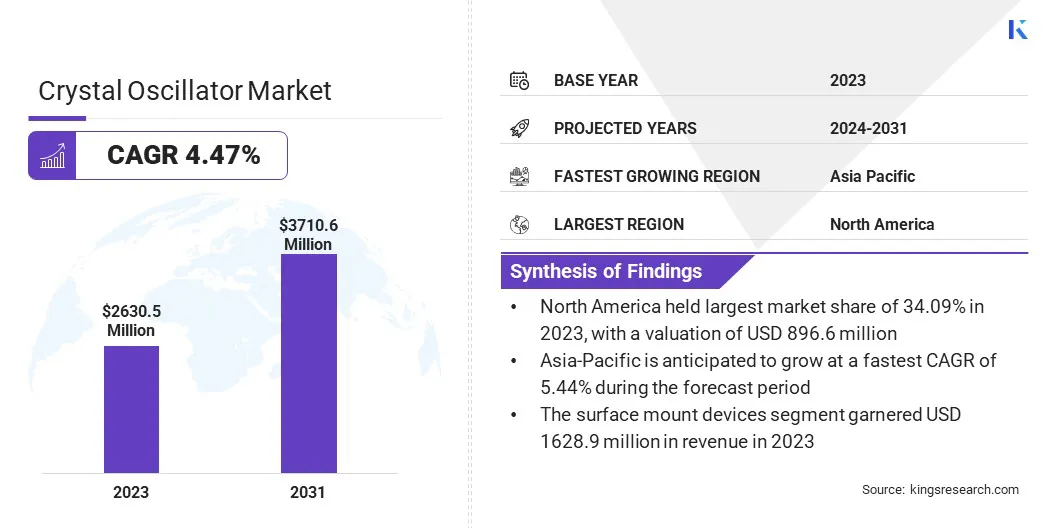

The global crystal oscillator market size was valued at USD 2630.5 million in 2023 and is projected to grow from USD 2732.3 million in 2024 to USD 3710.6 million by 2031, exhibiting a CAGR of 4.47% during the forecast period.

This market is primarily driven by the growing demand for accurate frequency control in advanced electronic systems. The rising adoption of 5G technology, IoT devices, and connected infrastructure has significantly increased the need for precise timing components such as crystal oscillators.

Key Market Highlights

- The crystal oscillator industry size was valued at USD 2630.5 million in 2023.

- The market is projected to grow at a CAGR of 4.47% from 2024 to 2031.

- North America held a market share of 34.09% in 2023, with a valuation of USD 896.6 million.

- The surface mount devices segment garnered USD 1628.9 million in revenue in 2023.

- The temperature compensated crystal oscillator (TCXO) segment is expected to reach USD 925.5 million by 2031.

- The telecom & networking segment is anticipated to register the fastest CAGR of 4.61% during the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 5.44% during the forecast period.

Major companies operating in the crystal oscillator industry are KYOCERA Corporation, TXC, SiTime Corp, NIHON DEMPA KOGYO CO., LTD., Daishinku Corp, Seiko Epson Corporation, Murata Manufacturing Co., Ltd., Bliley, Mtron, Microchip Technology Inc., Diodes Incorporated, Rakon Limited, CTS Corporation, Vishay Intertechnology, Inc., and Skyworks Solutions, Inc.

Advancements in miniaturization and the development of high-performance variants like TCXOs and OCXOs are shaping the current market landscape. These oscillators are preferred for their stability, reliability, and suitability for applications in telecommunications, automotive electronics, industrial automation, and aerospace systems.

- In March 2024, Mixed-Signal Devices Inc. revealed plans to present its crystal oscillators powered by Virtual Crystal technology at the Optical Networking and Communications Conference (OFC) 2024. These highly programmable, ultra-low jitter oscillators ranging from 100 MHz to 2 GHz are optimized for high-speed applications such as SerDes, Fibre Channel, and advanced optical communication systems.

Rising Demand for High-precision Timing in Electronics

The rising demand for high-precision timing in electronics is boosting the crystal oscillator market. The need for accurate and stable frequency control is critical for ensuring seamless operation across functions such as data transfer, signal processing, and communication as electronic devices become more sophisticated.

The market is further fueled by the proliferation of smart devices, high-speed computing, and complex digital systems that require dependable timing solutions. The integration of crystal oscillators in applications ranging from consumer electronics to network infrastructure is fostering expansion and technological advancement in the market.

- In January 2024, INTERCHIP CORPORATION revealed a major improvement in verifying its next-generation clocking oscillators, achieving a threefold boost in verification speed through Siemens' cutting-edge analog and mixed-signal EDA tools. The company efficiently validated its latest IPV VCXO and IPS SPXO ICs by utilizing Siemens' Analog FastSPICE (AFS) and Symphony mixed-signal verification solutions, significantly speeding up product development.

Short Product Lifecycles and Rapid Technological Change

A significant challenge hindering the growth of the crystal oscillator market is the short product lifecycles and rapid technological change in the electronics industry. Manufacturers of oscillators face pressure to continuously innovate and adapt their products as devices become more advanced and consumer demands evolve quickly, leading to increased development costs, inventory risks, and reduced profitability.

Moreover, maintaining a broad portfolio of oscillator variants to meet diverse customer demands can strain operational and inventory management, particularly when demand patterns shift unpredictably.

Manufacturers can invest in modular design platforms and flexible architectures that allow for faster product iterations without a complete redesign. Building strong partnerships with OEMs during the early design phase enables better anticipation of future technology trends and specification needs.

Furthermore, implementing agile R&D frameworks and leveraging advanced simulation and prototyping tools can significantly reduce development time and costs. Adopting flexible, scalable manufacturing processes and using data-driven analytics for demand forecasting and inventory optimization can also help minimize waste and improve responsiveness to shifting market needs.

The crystal oscillator market is shifting toward miniaturization and performance enhancement. Consumer electronics and IoT devices are becoming more compact, boosting the demand for oscillators that are smaller, more energy-efficient, and capable of maintaining high levels of accuracy and stability.

This shift reflects a rising focus on improving device functionality while reducing power consumption and space requirements. This is expected to drive the development of advanced crystal oscillators that cater to the needs of next-generation technologies, aligning with the growing demand for high-performance, compact components in applications like wearables, mobile devices, and automotive systems.

- In January 2025, Jauch Quartz GmbH launched the JT11GL, JT11S, and JT11LE series of miniature TCXOs, designed for high frequency stability and low power consumption in applications like GNSS, mobile devices, and wireless communication. These compact oscillators offer a temperature stability of ±0.5 ppm and supply voltages from 1.2V to 3.3V, ideal for space-constrained and energy-sensitive designs.

Crystal Oscillator Market Report Snapshot

|

Segmentation

|

Details

|

|

By Mounting

|

Surface Mount Devices, Through Hole Devices

|

|

By Type

|

Temperature Compensated Crystal Oscillator (TCXO), Simple Packaged Crystal Oscillator (SPXO), Voltage Controlled Crystal Oscillator (VCXO), Frequency Controlled Crystal Oscillator (FCXO), Oven Controlled Crystal Oscillator (OCXO), and Others

|

|

By End-user Industry

|

Consumer Electronics, Automotive, Telecom & Networking, Aerospace & Defense, Research & Measurement, Industrial, and Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Mounting (Surface Mount Devices, Through Hole Devices): The surface mount devices segment earned USD 1628.9 million in 2023, due to their widespread use in compact and high-performance electronic devices.

- By Type (Temperature Compensated Crystal Oscillator (TCXO), Simple Packaged Crystal Oscillator (SPXO), Voltage Controlled Crystal Oscillator (VCXO), Frequency Controlled Crystal Oscillator (FCXO), Oven Controlled Crystal Oscillator (OCXO), and Others): The temperature compensated crystal oscillator (TCXO) segment held 24.88% share of the market in 2023, due to its ability to provide high stability and accuracy across varying temperature conditions.

- By End-user Industry (Consumer Electronics, Automotive, Telecom & Networking, Aerospace & Defense, Research & Measurement, Industrial, and Others): The consumer electronics segment is projected to reach USD 901.4 million by 2031, owing to the increasing demand for precise timing and frequency control in devices such as smartphones, wearables, and smart home systems.

Crystal Oscillator Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America crystal oscillator market share stood at around 34.09% in 2023, with a valuation of USD 896.6 million. This market dominance is reinforced by the strong telecommunications, aerospace, and defense sectors in the region. The growing demand for high-precision, reliable timing components in these industries supports the widespread adoption of crystal oscillators.

North America crystal oscillator market share stood at around 34.09% in 2023, with a valuation of USD 896.6 million. This market dominance is reinforced by the strong telecommunications, aerospace, and defense sectors in the region. The growing demand for high-precision, reliable timing components in these industries supports the widespread adoption of crystal oscillators.

Additionally, advancements in crystal oscillator manufacturing technologies and the rising adoption of next-generation technologies like 5G and IoT aid the regional market growth. With substantial investments in R&D and a robust industrial base, North America is poised to maintain its leading market position.

- In December 2024, Q-Tech Corporation announced the U.S. market launch of its AXTAL GHz Series, offering ultra-low noise crystal-controlled sources and custom modules. These high-frequency oscillators, developed by Q-Tech's European affiliate AXTAL, are designed for radar, communications, and RF measurement systems, with customizable solutions and multiple outputs.

The crystal oscillator industry in Asia-Pacific is poised for significant growth at a robust CAGR of 5.44% over the forecast period. This growth is attributed to the rising demand for advanced electronic devices, the expansion of 5G infrastructure, and the increasing adoption of IoT technologies, all of which rely on high-performance crystal oscillators for precise timing and frequency control.

The region's strong emphasis on technological innovation, coupled with substantial investments in Research and Development (R&D), is driving the adoption of more efficient and reliable oscillator solutions.

Moreover, the growing demand for miniaturized components in mobile devices, wearables, and automotive applications is contributing to the rapid growth of the market in Asia-Pacific. Ongoing advancements in manufacturing processes and the increasing focus on high-precision components are further strengthening the market's potential in the region.

Regulatory Frameworks

- In the U.S., the Toxic Substances Control Act (TSCA) governs the use of chemicals in consumer and industrial products. It requires manufacturers to report the use of certain substances and adhere to restrictions aimed at protecting human health and the environment.

- In the EU, the Directive 2012/19/EU on Waste Electrical and Electronic Equipment (WEEE) regulates the collection, recycling, and recovery of electronic waste. It enforces extended producer responsibility and sets targets to minimize environmental impact and improve resource efficiency.

Competitive Landscape

The crystal oscillator industry is characterized by a mix of established multinational corporations and emerging regional players, each striving to expand their market presence and enhance product offerings. Market leaders are actively pursuing strategic collaborations, acquisitions, and investments in advanced oscillator technologies to gain a competitive advantage.

Emphasis is being placed on the development of high-performance oscillators that meet the growing demand for miniaturization, energy efficiency, and high-frequency stability, particularly in emerging applications like 5G, IoT, and automotive electronics.

Additionally, several companies are focusing on enhancing manufacturing processes and improving product reliability to stay ahead of the competition. Innovation, precision, and compliance with international standards remain key factors shaping the competitive dynamics of the market as the demand for high-quality timing solutions continues to rise.

- In July 2023, KYOCERA AVX launched its first oven-controlled crystal oscillator (OCXO) products, the KOV and KLN Series, expanding its frequency control portfolio. These high-performance oscillators offer low phase noise and high stability, targeting applications like 5G, aerospace, and defense.

Key Companies in Crystal Oscillator Market:

- KYOCERA Corporation

- TXC

- SiTime Corp

- NIHON DEMPA KOGYO CO., LTD.

- Daishinku Corp

- Seiko Epson Corporation

- Murata Manufacturing Co., Ltd.

- Bliley

- Mtron

- Microchip Technology Inc.

- Diodes Incorporated

- Rakon Limited

- CTS Corporation

- Vishay Intertechnology, Inc.

- Skyworks Solutions, Inc.

Recent Developments (M&A/Partnerships/Agreements/Product Launches)

- In November 2024, IQD Frequency Products Ltd launched the IQOV-116 miniature OCXO, offering ±20 ppb stability and low phase noise in a compact 7.5 x 5.5 mm package. With a temperature range of -40 to 95°C and standard frequencies of 10.0 MHz, 19.2 MHz, and 20.0 MHz, it is ideal for wireless communication and small cell networks.

- In June 2024, CTS Corporation introduced its CC Series clock oscillators (XO) and CV Series voltage-controlled oscillators (VCXO), both featuring advanced PLL-based quartz crystal technology. These high-performance oscillators offer a broad frequency range up to 2.1 GHz, ultra-low phase jitter, and are available in compact, hermetically sealed ceramic SMD packages.

- In October 2023, Q-Tech Corporation launched its QT2021 Series Microcomputer Compensated Crystal Oscillators (MCXOs), offering OCXO-level stability with reduced size, weight, and power consumption. These MCXOs provide exceptional stability (±20ppb over -40°C to +85°C) while consuming only 90mW, making them ideal for space applications with strict size and power limitations.

- In June 2023, Mixed-Signal Devices Inc. launched its MS11xx series crystal oscillators, offering 25 femtoseconds of jitter and frequencies up to 2 GHz. Designed for applications like 5G infrastructure and high-speed SerDes, these oscillators provide ±20 ppm stability and are manufactured using TSMC's RF CMOS process for high reliability.

North America crystal oscillator market share stood at around 34.09% in 2023, with a valuation of USD 896.6 million. This market dominance is reinforced by the strong telecommunications, aerospace, and defense sectors in the region.

North America crystal oscillator market share stood at around 34.09% in 2023, with a valuation of USD 896.6 million. This market dominance is reinforced by the strong telecommunications, aerospace, and defense sectors in the region.