Market Definition

Conversational commerce refers to digital purchasing experiences delivered through messaging applications, voice-based assistants, and artificial intelligence-powered chatbots that enable real-time communication between businesses and consumers.

The market includes platforms, software solutions, and application programming interfaces that support transactions, customer interaction, and personalized recommendations across industries such as retail, e-commerce, banking, travel, and healthcare.

It covers both business-to-consumer and business-to-business use cases, with applications in sales automation, customer support, and marketing through integrated artificial intelligence and natural language processing technologies.

Conversational Commerce Market Overview

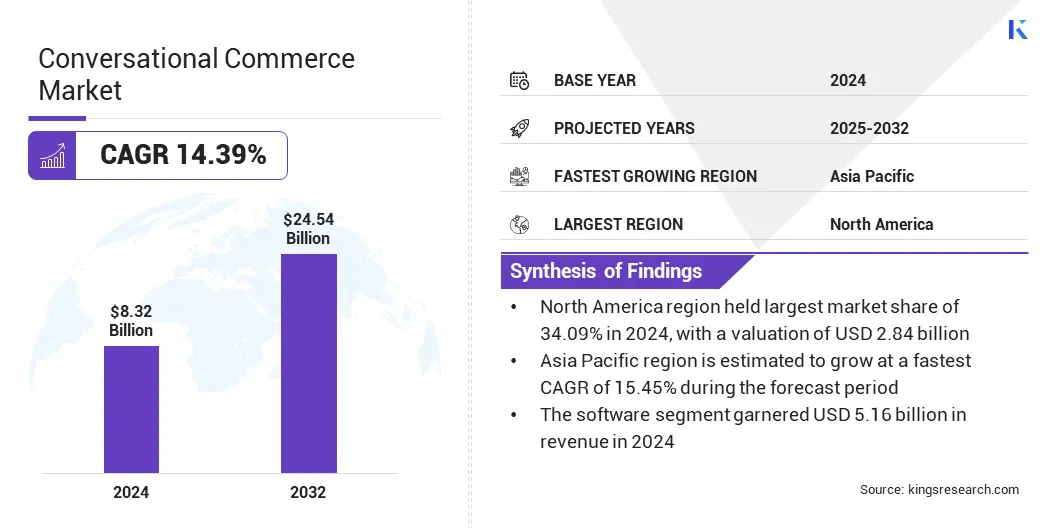

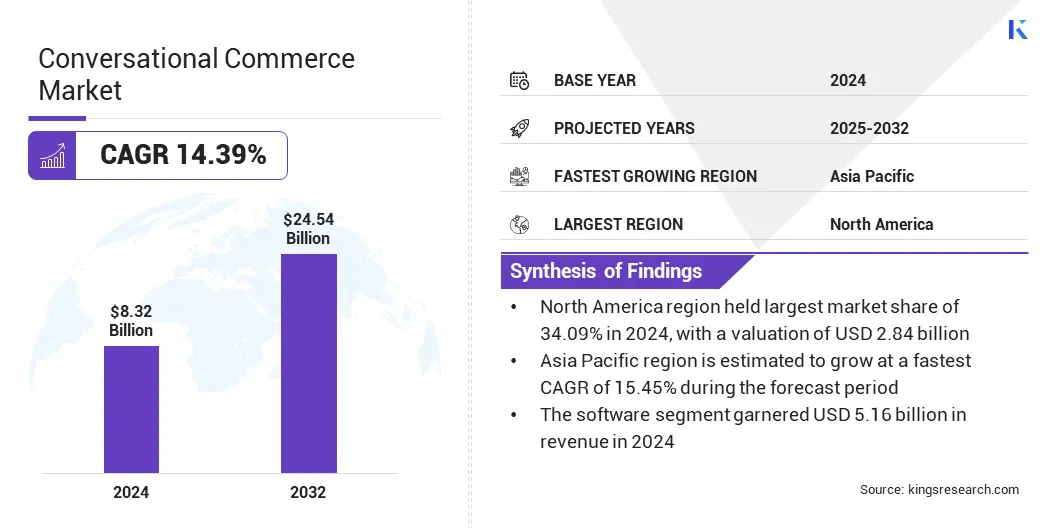

The global conversational commerce market size was valued at USD 8.32 billion in 2024 and is projected to grow from USD 9.48 billion in 2025 to USD 24.54 billion by 2032, exhibiting a CAGR of 14.39% during the forecast period.

The market growth is driven by rising smartphone penetration, which is enabling real-time brand engagement through instant messaging, mobile apps, and mobile-first commerce strategies. The growing use of voice assistants is also transforming digital shopping by streamlining user experiences and enabling hands-free transactions.

Key Highlights:

- The conversational commerce industry size was recorded at USD 8.32 billion in 2024.

- The market is projected to grow at a CAGR of 14.39% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, with a valuation of USD 2.84 billion.

- The chatbots & AI segment garnered USD 3.51 billion in revenue in 2024.

- The software segment is expected to reach USD 15.00 billion by 2032.

- The on-premises segment secured the largest revenue share of 59.94% in 2024.

- The small & medium enterprises segment is poised for a robust CAGR of 14.65% through the forecast period.

- The BFSI segment garnered USD 2.01 billion in revenue in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 15.45% during the forecast period.

Major companies operating in the conversational commerce industry are Glia Technologies, Inc., Nurix, Genesys, Kapture CX, Meta, Google, Microsoft, Apple Inc., Twilio Inc., Vonage Holdings Corp., Jio Haptik Technologies Limited, LivePerson, Sinch, Connectly Inc., and Charles GmbH.

Growing consumer expectations for round-the-clock interaction are accelerating the expansion of the market. Consumers are increasingly seeking instant support, tailored responses, and uninterrupted communication, which requires brands to maintain continuous availability across digital platforms. This demand is prompting businesses to implement automated conversational agents that handle real-time queries and transactions without interruption.

Market Driver

Rising Smartphone Penetration is Enabling Real-Time Brand Engagement

Rising smartphone penetration is driving the growth of the conversational commerce market by enabling continuous access to messaging platforms and voice assistants.

Consumers are increasingly using smartphones to engage with brands in real time, access product recommendations, and complete transactions efficiently. In response, businesses are adopting conversational commerce solutions to meet growing expectations for immediate, personalized service and mobile-first engagement.

- In April 2024, the U.S. Census Bureau reported that 90% of U.S. households owned a smartphone, compared to 81% with a desktop or laptop computer. This high penetration rate reflects the dominant role smartphones play in enabling real-time digital engagement.

Market Challenge

Data Privacy and Security Concerns

Data privacy and security concerns are limiting the growth of the conversational commerce market. Many consumers are hesitant to share personal information through messaging apps and voice assistants. This reluctance is more pronounced in sectors such as finance and healthcare that handle sensitive data.

To address this issue, providers are deploying end-to-end encryption, secure authentication, and regulatory compliance features. These efforts aim to build user trust, reduce perceived risks, and enable safer engagement for consumers and enterprises operating within the conversational commerce ecosystem.

Market Trend

Integration of Voice Assistants Enhancing Digital Shopping Experiences

The integration of voice assistants into consumer purchasing experiences marks a key development in the conversational commerce market, driven by the widespread adoption of Alexa, Google Assistant, and Siri.

These platforms enable users to search for products, make selections, and complete transactions through voice commands, offering a seamless and hands-free experience. This shift toward voice-enabled engagement enhances convenience and operational efficiency, positioning voice commerce as a growing facet of digital retail and service interaction.

- In February 2025, Amazon launched Alexa+, an AI-enhanced voice assistant enabling users to complete shopping tasks such as booking tickets, ordering groceries, and making reservations through voice commands without requiring any screen-based interaction.

Conversational Commerce Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Chatbots & AI, Voice Assistants, Messaging Apps

|

|

By Component

|

Software, Services

|

|

By Deployment

|

Cloud-based, On-premises

|

|

By Organization Size

|

Large Enterprises, Small & Medium Enterprises

|

|

By Vertical

|

BFSI, Retail, Government, Healthcare, IT & Telecommunications

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Chatbots & AI, Voice Assistants, and Messaging Apps): The chatbots & AI segment earned USD 3.51 billion in 2024 due to their ability to automate real-time customer interactions, improve response accuracy, and increase conversion rates while reducing operational costs.

- By Component (Software and Services): The software segment held 62.06% of the market in 2024, due to increasing demand for integrated platforms that enable seamless chatbot deployment, real-time analytics, and personalized customer engagement across multiple digital channels.

- By Deployment (Cloud-based and On-premises): The on-premises segment companies are projected to reach USD 14.47 billion by 2032, owing to rising concerns over data privacy and security, which drive organizations to maintain direct control over their conversational data and infrastructure.

- By Organization Size (Large Enterprises and Small & Medium Enterprises): The large enterprises segment earned USD 4.80 billion in 2024 due to their greater financial capacity to invest in advanced AI-driven solutions and their need to manage high volumes of customer interactions across global operations.

- By Vertical (BFSI, Retail, Government, Healthcare, and IT & Telecommunications): The BFSI segment held 24.12% of the market in 2024, due to the increasing adoption of AI-powered chat interfaces that enhance customer service, streamline banking operations, and ensure secure, real-time financial transactions.

Conversational Commerce Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America conversational commerce market share stood at 34.09% in 2024 in the global market, with a valuation of USD 2.84 billion. The dominance is driven by advanced digital infrastructure that supports the effective deployment of intelligent communication technologies.

High-speed internet access, widespread 5G coverage, and strong cloud computing adoption enable real-time, consistent user engagement across multiple platforms. These conditions facilitate the integration of voice assistants, chatbots, and AI-driven interfaces within commercial channels. This digital foundation enables the efficient and scalable implementation of conversational commerce across the region.

Asia Pacific conversational commerce industry is poised for significant growth at a CAGR of 15.45% over the forecast period. The growth is driven by the fast-paced expansion of e-commerce across leading economies. Increasing internet access and a shift toward mobile-centric consumer behavior are significantly boosting online retail transactions and engagement.

Moreover, businesses in this region are actively investing in conversational interfaces to manage high transaction volumes and improve customer engagement. Increased digital retail adoption across urban and semi-urban regions is driving the demand for AI-enabled communication tools, positioning Asia Pacific as the fastest growing region in the market.

Regulatory Frameworks

- In the U.S., the Federal Trade Commission (FTC) regulates data collection and marketing in conversational commerce under the Federal Trade Commission Act and the Children’s Online Privacy Protection Act, ensuring ethical use of AI-driven interfaces.

- In China, the Cyberspace Administration of China (CAC) regulates the market through the Personal Information Protection Law, Cybersecurity Law, and Generative AI Measures, ensuring responsible data handling and AI deployment.

Competitive Landscape

The conversational commerce industry is highly competitive, with companies frequently launching products that enhance AI-driven customer engagement. Leading players are developing advanced chatbots, voice assistants, and multimodal interfaces to support seamless interaction across messaging apps, websites, and voice platforms.

These solutions increasingly feature generative AI, real-time analytics, and multilingual capabilities to improve personalization and drive conversions. Vendors are also tailoring offerings to sector-specific needs, particularly in retail, banking, and travel. This is helping companies to strengthen their market presence and differentiate through advanced functionality and user experience.

- In November 2024, Gupshup launched Conversation Cloud, a Software-as-a-Service (SaaS) platform that enables Artificial Intelligence (AI)-driven customer engagement, advancing beyond web and app interfaces toward real-time interactions in conversational commerce.

Key Companies in Conversational Commerce Market:

- Glia Technologies, Inc.

- Nurix

- Genesys

- Kapture CX

- Meta

- Google

- Microsoft

- Apple Inc.

- Twilio Inc.

- Vonage Holdings Corp.

- Jio Haptik Technologies Limited

- LivePerson

- Sinch

- Connectly Inc.

- Charles GmbH

Recent Developments (Expansion/Launch)

- In November 2024, Bitly Inc. expanded its app marketplace with text-to-pay and text-to-buy integrations, enabling seamless conversational commerce through messaging, while enhancing SMS engagement using custom short links, QR codes, and customer behavior insights.

- In October 2024, Gubagoo launched ChatSmartGuba IQ, an AI-powered solution designed to enhance automotive dealer chats. It uses industry-specific knowledge to answer feature and comparison questions, creating a showroom-like sales experience through sustained customer engagement.