Market Definition

Controlled release fertilizers are nutrient formulations coated with materials such as polymers or sulfur that enable a gradual and controlled release of essential elements into the soil. They align nutrient supply with plant growth stages, reduce losses from leaching or volatilization, and improve efficiency compared to traditional fertilizers.

Key applications include agriculture, horticulture, turf management, and ornamental crop cultivation, where reliable nutrient delivery is critical. These fertilizers enhance crop yields, lower application frequency, reduce environmental impact, and support sustainable farming practices through improved resource utilization.

Controlled Release Fertilizers Market Overview

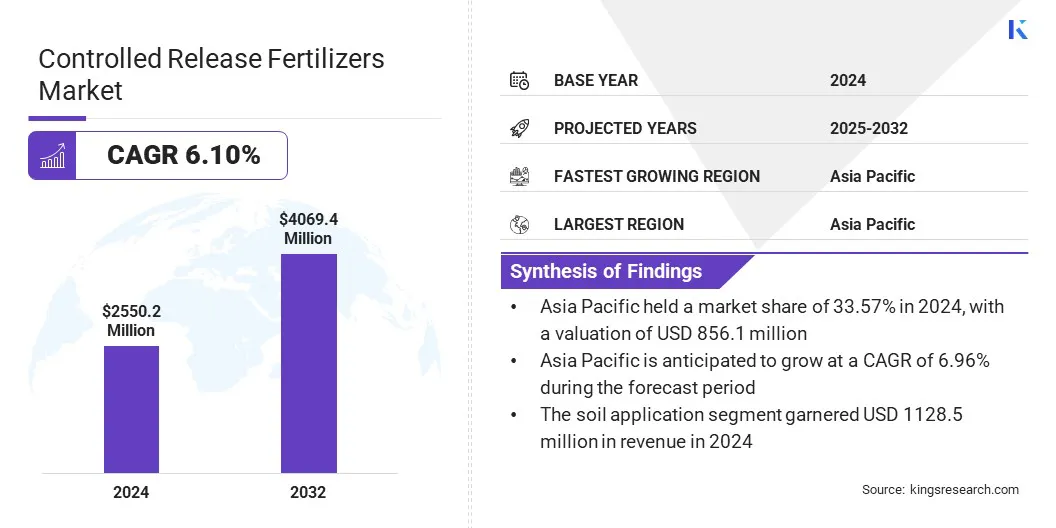

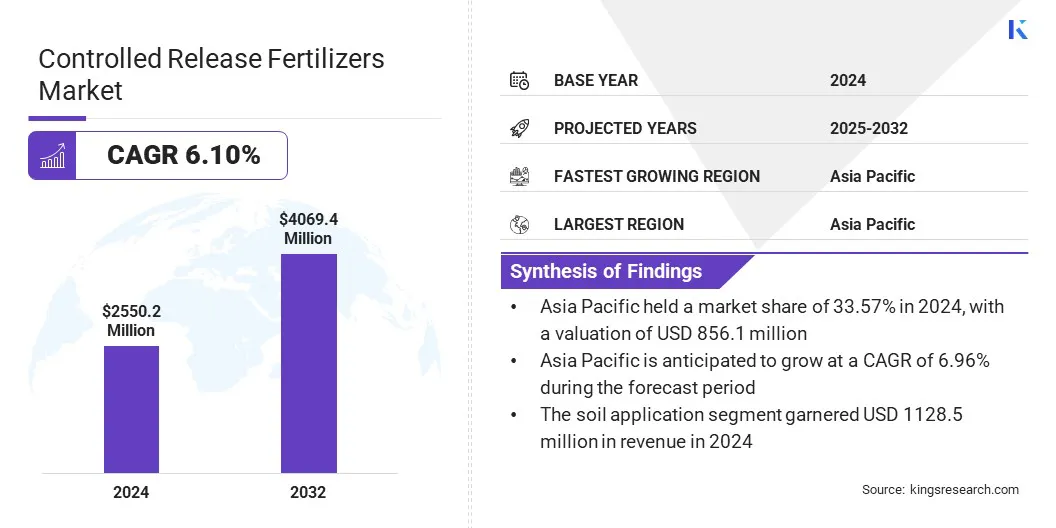

The global controlled release fertilizers market size was valued at USD 2,550.2 million in 2024 and is projected to grow from USD 2,688.9 million in 2025 to USD 4,069.4 million by 2032, exhibiting a CAGR of 6.10% during the forecast period.

The growth of the market is driven by the rising cultivation of high-value crops that require precise nutrient management for improved yield and quality. Additionally, the adoption of IoT-enabled smart fertilizers enhances nutrient delivery efficiency, boosting market expansion.

Key Highlights

- The controlled release fertilizers industry size was valued at USD 2,550.2 million in 2024.

- The market is projected to grow at a CAGR of 6.10% from 2025 to 2032.

- Asia Pacific held a market share of 33.57% in 2024, with a valuation of USD 856.1 million .

- The coated & encapsulated fertilizers segment garnered USD 1,180.7 million in revenue in 2024.

- The soil application segment is expected to reach USD 1,922.7 million by 2032.

- The cereals & grains segment secured the largest revenue share of 34.55% in 2024.

- North America is anticipated to grow at a CAGR of 5.85% over the forecast period.

Major companies operating in the controlled release fertilizers market are Nutrien, Mosaic, Yara, ICL, Kingenta, SQM, Haifa Negev technologies LTD, Pursell Agri-Tech, LLC, Florikan, COMPO EXPERT GmbH, Nufarm, The Scotts Company LLC, Koch Fertilizer, LLC, JNC Corporation, and Helena Agri-Enterprises, LLC.

Increasing population growth is driving the need for higher crop yields and efficient nutrient delivery in modern agriculture. Farmers are increasingly adopting controlled release fertilizers to ensure steady nutrient availability throughout the crop cycle. Limited arable land is fueling the use of fertilizers that optimize nutrient use efficiency and minimize wastage.

Additionally, controlled release formulations help reduce nutrient leaching and runoff, promoting sustainable farming practices. The growing demand for staple crops such as rice, wheat, and maize is accelerating the use of advanced fertilizers to meet food security requirements.

- In September 2024, Malaysia’s National Farmers' Association (NAFAS) introduced Peladang 25, a new controlled release liquid fertilizer. The product is formulated for crops such as oil palm, Napier grass, rice, and pineapple. It is compatible with herbicides and fungicides, facilitating integrated application workflows. This launch supports steady nutrient delivery across diverse staple and high-yield crops.

Market Driver

Growth in High-Value Crops

Increasing adoption of controlled release fertilizers is enabling steady nutrient delivery for fruits, vegetables, and horticultural crops. High-value crop growers are focusing on maintaining quality, appearance, and shelf life, which are supported by precise nutrient management.

Rising demand for premium produce in domestic and export markets is promoting the use of advanced fertilizers that enhance yield consistency. The fertilizers reduce application frequency, lowering labor costs, and improve resource efficiency by minimizing nutrient losses in intensive cropping systems.

- In October 2024, ICL introduced the Peters Professional Canna+ Fertilizer System for controlled-environment agriculture (CEA), including high-value crops such as cannabis. The system consists of a tailored nutrient program, including controlled-release formulations, designed for each crop stage in indoor cultivation. It simplifies nutrient delivery and enables efficient plant development in high-value, sensitive crops.

Market Challenge

High Production Costs

A key challenge hampering the progress of the controlled release fertilizers market is the high production cost associated with advanced coating and encapsulation technologies. These processes involve specialized materials such as polymers and resins, which raise manufacturing expenses compared to conventional fertilizers. Additionally, the complexity of production and limited economies of scale contribute to higher pricing, restricting wider adoption in cost-sensitive agricultural regions.

To address this challenge, market players are investing in process optimization, exploring bio-based coating alternatives, and scaling up production capacities to enhance cost efficiency. These measures are enabling gradual price reduction and improving the accessibility of controlled release fertilizers for broader agricultural use.

- In January 2024, Yara expanded its partnership with Pursell Agritech to launch PurMidas, a new controlled-release fertilizer for turf applications. PurMidas combines Pursell’s coating technology with Yara’s product development capabilities to deliver controlled nitrogen and sulfur release.

Market Trend

Adoption of Smart Fertilizers with IoT Integration

The controlled release fertilizers market is experiencing a notable trend toward the adoption of smart technologies that combine nutrient delivery with digital monitoring. IoT-enabled sensors embedded in soil or irrigation systems track parameters such as moisture, temperature, and nutrient levels to optimize fertilizer release in alignment with crop growth stages.

This enhances nutrient use efficiency, reduces leaching losses, and minimizes environmental impact. By connecting real-time data with precision agriculture platforms, smart controlled release fertilizers support higher yields, cost-effective input management, and sustainable farming practices.

- In March 2025, ARB IOT Group Limited unveiled Smart AI Robot, an AI-driven system integrating IoT-based soil NPK measurement with automated fertilizer application. The robot features centimeter-level positioning, autonomous fertilizing functionality, real-time soil moisture and nutrient data capture, and connects to cloud-based dashboards for analytics and insights. Designed for high-value crops such as palm oil and fruit orchards, the system supports fully automated, data-informed fertilization aligned with precision agriculture practices.

Controlled Release Fertilizers Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Coated & Encapsulated Fertilizers, Slow-release Fertilizers, Nitrogen Stabilizers

|

|

By Mode of Application

|

Soil Application, Foliar Application, Fertigation, Others

|

|

By End-use

|

Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Turf and Ornamentals, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Coated & Encapsulated Fertilizers, Slow-release Fertilizers, and Nitrogen Stabilizers): The coated & encapsulated fertilizers segment earned USD 1,180.7 million in 2024, mainly due to their ability to provide precise nutrient release, reduce losses from leaching and volatilization, and comply with sustainability-focused regulations.

- By Mode of Application (Soil Application, Foliar Application, Fertigation, and Others): The soil application segment held a share of 44.25% in 2024, fueled by its wide use in field crops and ability to provide consistent nutrient availability directly to plant roots over an extended period.

- By End-use (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, and Turf and Ornamentals): The cereals & grains segment is projected to reach USD 1,403.3 million by 2032, owing to the extensive acreage under cultivation and the high demand for consistent nutrient supply to maximize yield and productivity.

Controlled Release Fertilizers Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific controlled release fertilizers market share stood at 33.57% in 2024, valued at USD 856.1 million. This growth is propelled by the region’s heavy and seasonal rainfall that causes high nutrient losses from conventional fertilizers. Farmers experience leaching and runoff during monsoon periods, which reduces fertilizer efficiency.

- In July 2025, the Philippines Department of Agriculture reported USD 18.7 million in agriculture losses due to adverse weather, with rice being the most affected crop. High-value crops, corn, and fisheries also suffered, including 918 hectares of high-value crops affected and 4,509 metric tons lost.

The predictable nutrient supply is particularly important for cereals and grains that dominate Asia Pacific agriculture. This alignment between weather patterns and technology needs strengthens regional market expansion.

Moreover, authorities have placed clear limits on excessive fertilizer application to control pollution and improve sustainability. Controlled release fertilizers are promoted as a solution that fits these efficiency goals. Farmers adopting these fertilizers gain compliance with regulations and access to subsidy or incentive programs, fostering regional market growth.

The North America controlled release fertilizers industry is estimated to grow at a CAGR of 5.85% over the forecast period. This growth is fueled by the expansion of the turf and ornamental industry. Golf courses, sports fields, and landscaping companies require fertilizers that provide consistent feeding and reduce frequent applications.

Controlled release fertilizers meet these needs by offering long nutrient release cycles that cut labor costs. Professional turf managers rely on these products to maintain healthy and visually appealing grounds. The regional market further benefits from steady institutional spending in landscaping and recreational infrastructure. This steady demand creates a strong non-agricultural growth base for controlled release fertilizers.

- In January 2025, Origin Amenity Solutions (OAS) launched its Xtend Controlled Release Fertiliser (CRF) range at BTME 2025, a premier turf and amenity exhibition. The Xtend CRF collection incorporates ProTect technology, which combines temperature-responsive nutrient release with inhibited nitrogen.

Regulatory Frameworks

- In the U.S., the market is regulated under the Federal Insecticide, Fungicide, and Rodenticide Act by the Environmental Protection Agency for products with pesticidal claims, and by state fertilizer control offices for conventional fertilizers.

- In Europe, regulation is governed by the European Union (EU) through Regulation (EU) 2019/1009 on EU fertilizing products, along with national rules implementing the Nitrates Directive (91/676/EEC). The regulation sets harmonized requirements for conformity, CE marking, permitted input materials, contaminant limits, and categories for products with enhanced nutrient release.

- In Germany, the Fertilizer Act (Düngemittelgesetz) and the Fertilizer Ordinance (Düngemittelverordnung) implement the EU Nitrates Directive at the national level. These rules require product registration, nutrient application limits, and mandatory nutrient bookkeeping for farms.

- In China, the Ministry of Agriculture and Rural Affairs (MARA) regulates the market through national standards such as GB/T 23348 for slow and controlled release fertilizers. Policies such as the Action Plan for Zero Growth of Fertilizer Use integrate standards, demonstration projects, and subsidy schemes to support water quality and productivity goals.

- In Japan, the Fertilizer Control Act, administered by the Ministry of Agriculture, Forestry and Fisheries (MAFF) mandates registration, labeling, quality standards, contaminant limits, and efficacy and safety requirements for all fertilizers.

Competitive Landscape

Major players in the controlled release fertilizers industry are adopting strategies such as investment in research and development to create biodegradable coatings, partnerships with regional distributors to strengthen market access, and collaborations with financial investors to scale production capacity.

They are also focusing on technological advancements in coating materials and release mechanisms that align with evolving environmental regulations. These strategies are enabling firms to remain competitive, meet sustainability requirements, and secure long-term growth opportunities.

- In July 2025, Cropcision secured investment from Northern Light Capital (NLC) and Partnerinvest Norr. The funding is intended to speed up the global launch of Cropcision’s plastic-free controlled-release fertilizer and align with upcoming European Union rules prohibiting non-biodegradable polymers in agriculture by 2028.

Key Companies in Controlled Release Fertilizers Market:

- Nutrien

- Mosaic

- Yara

- ICL

- Kingenta

- SQM

- Haifa Negev technologies LTD

- Pursell Agri-Tech, LLC

- Florikan

- COMPO EXPERT GmbH

- Nufarm

- The Scotts Company LLC

- Koch Fertilizer, LLC

- JNC Corporation

- Helena Agri-Enterprises, LLC

Recent Developments (Product Launch)

- In April 2025, Wastech Group and Pursell Agri-Tech announced plans to establish a coating facility in Malaysia for advanced controlled release fertilizers (CRFs). The collaboration combines Wastech’s expertise in agricultural solutions with Pursell’s advanced technology to deliver sustainable fertilizers for Malaysia and the wider Southeast Asian region.