Market Definition

The contract lifecycle management (CLM) system is a digital solution that helps manage contracts from initiation to renewal. It supports functions such as drafting, negotiation, approval, compliance tracking, and reporting. The market is segmented by deployment, which includes on-premises solutions offering internal control over data and systems, and cloud-based platforms that enable scalability, remote access, and integration with enterprise systems.

The market is further segmented by organization size into large enterprises and small and medium enterprises (SMEs). These segments reflect varying contract volumes, process complexities, and operational needs across businesses of different scales. The market includes verticals such as banking, financial services and insurance (BFSI), government, healthcare, retail, manufacturing, and IT and telecommunications.

Contract Lifecycle Management Market Overview

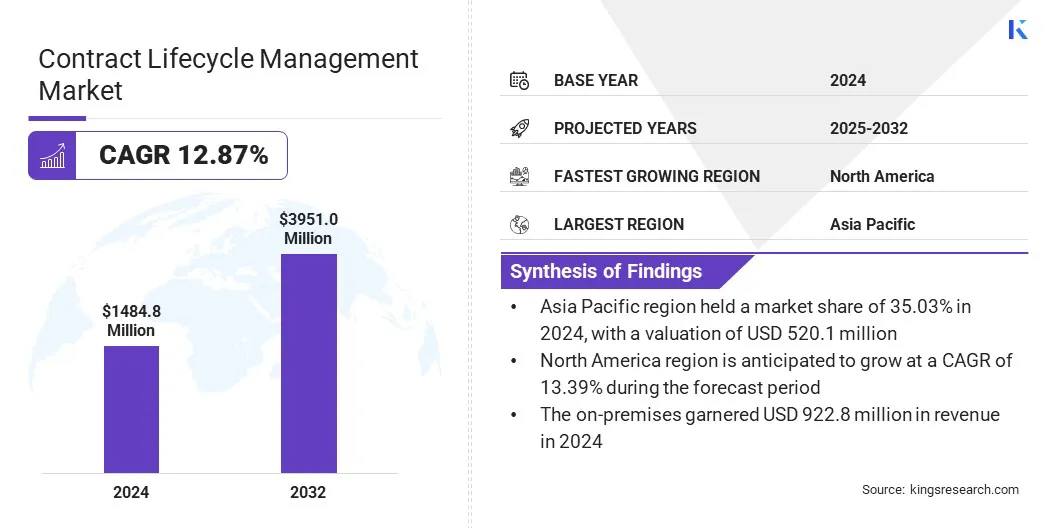

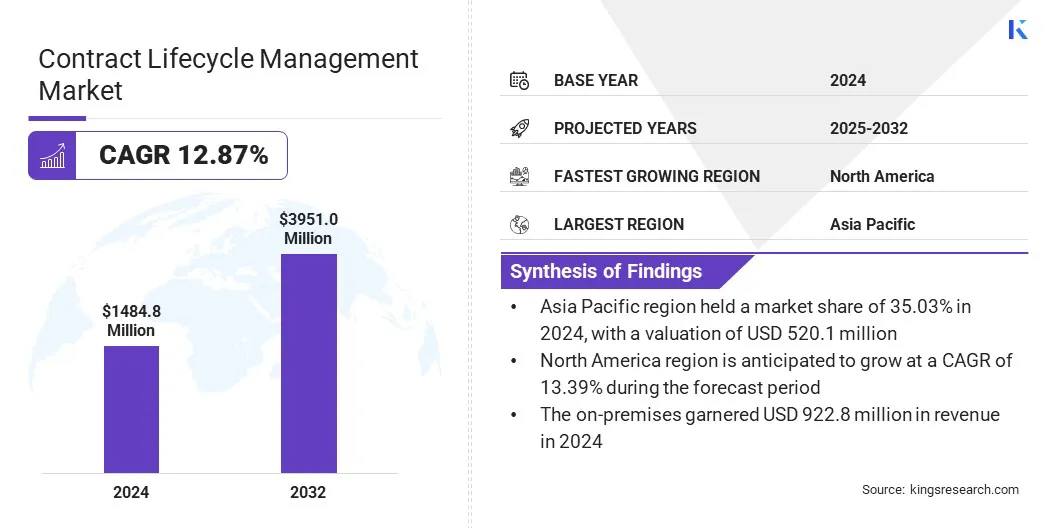

The global contract lifecycle management market size was valued at USD 1,484.8 million in 2024 and is projected to grow from USD 1,665.1 million in 2025 to USD 3,951.0 million by 2032, exhibiting a CAGR of 12.87% during the forecast period. The market growth is driven by the growing demand for end-to-end lifecycle management solutions that centralize and streamline contract processes across domains.

Increasing adoption of AI-enhanced solutions that support automated clause extraction, risk evaluation, and intelligent contract generation is driving the adoption of CLM Systems. These tools enable companies to manage increasing contract volumes with greater speed, accuracy, and compliance.

Major companies operating in the contract lifecycle management industry are Zycus Inc., Conga, Luminance Technologies Ltd., Agiloft Inc., Coupa, PandaDoc Inc., Oracle, Summize Ltd., Icertis, GEP, SAP, Evisort, LinkSquares, Inc., Docusign, Inc., and Ironclad, Inc.

Companies are focusing on developing contract lifecycle management solutions that help organizations maintain accountability for healthcare compliance and meet regulatory standards in government-related operations. These platforms include features such as automated audit trails and role-based access. These capabilities help companies ensure contract terms align with strict legal frameworks while reducing the risk of non-compliance and operational delays.

- In October 2024, ProviderTrust and Ntracts announced their strategic partnership to align healthcare vendor compliance with contract lifecycle management. The collaboration aims to improve compliance data hygiene and ensure continuous vendor eligibility throughout contract execution.

Key Highlights:

- The global contract lifecycle management market size was recorded at USD 1,484.8 million in 2024.

- The market is projected to grow at a CAGR of 12.87% from 2025 to 2032.

- Asia Pacific held a market share of 35.03% in 2024, with a valuation of USD 520.1 million.

- The on-premises segment garnered USD 922.8 million in revenue in 2024.

- The large enterprises segment is expected to reach USD 2,249.3 million by 2032.

- The BFSI segment is expected to reach USD 959.7 million by 2032.

- North America is anticipated to grow at a CAGR of 13.39% during the forecast period.

Market Driver

Growing Demand for End-To-End Lifecycle Management Solutions

The contract lifecycle management market is driven by the growing demand for end-to-end lifecycle management solutions that support efficient contract creation, execution, and monitoring.

Enterprises are adopting systems that consolidate contract data, ensure compliance, and reduce administrative workload. The need to eliminate manual errors, shorten approval timelines, and maintain full visibility across contract stages is accelerating the adoption of contract lifecycle management solutions.

- In March 2025, VendorPM launched its Contract Management module, becoming the first platform to unify eTendering, vendor credentialing, and contract management into a single workflow. The expansion aims to eliminate fragmented systems, centralize contract storage, and automate renewals with AI-driven insights, enabling property managers across North America to manage vendor relationships more efficiently and reduce operational risks.

Market Challenge

Integration Complexities with Existing Enterprise Systems

The contract lifecycle management market faces a major challenge in integrating with traditional enterprise systems. Many organizations use older versions of enterprise resource planning (ERP), customer relationship management (CRM), and procurement platforms that lack compatibility with modern contract lifecycle management architectures.

This results in delays during implementation, limited data visibility, and reduced automation efficiency. To address this, companies are developing pre-configured connectors for widely adopted enterprise software. They are also introducing low-code integration tools and middleware platforms to simplify system compatibility and enable end-to-end contract process automation. These solutions support seamless data flow and help accelerate adoption of CLM systems.

Market Trend

Shift Toward AI-Enhanced Solutions

The contract lifecycle management market is shifting toward AI-enhanced solutions. Companies are integrating artificial intelligence into contract platforms to streamline review, standardize clause language, and detect potential risks. These tools automate manual tasks such as clause classification, term comparison, and version tracking.

AI also improves visibility across contract portfolios by providing insights into performance, renewal schedules, and compliance gaps. This supports faster approvals and improves collaboration across legal, procurement, and business teams.

- In June 2024, Conga launched a Contract Lifecycle Management offering on the Conga Platform, introducing a full SaaS-based alternative to its Salesforce interface. The AI-enhanced solution integrates with any CRM, ERP, or procurement platform and is designed to reduce contract cycle time, improve accuracy, and streamline document processing.

Contract Lifecycle Management Market Report Snapshot

|

Segmentation

|

Details

|

|

By Deployment

|

On-premises, Cloud-based

|

|

By Organization

|

Large Enterprises, Small & Medium Enterprises

|

|

By Vertical

|

BFSI, Government, Healthcare, Retail, Manufacturing, IT and Telecommunications, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Deployment (On-premises and Cloud-based): The on-premises segment earned USD 922.8 million in 2024 due to greater control over data security and regulatory compliance in highly regulated industries.

- By Organization (Large Enterprises and Small & Medium Enterprises): The large enterprises segment held 57.70% of the market in 2024, due to their high contract volumes and need for integrated, scalable contract lifecycle management solutions.

- By Vertical (BFSI, Government, Healthcare, Retail, Manufacturing, IT and Telecommunications, and Others): The BFSI segment is projected to reach USD 959.7 million by 2032, owing to the increased adoption of contract lifecycle management tools to manage risk, compliance, and complex vendor agreements.

Contract Lifecycle Management Market Regional Analysis

Based on region, the contract lifecycle management industry has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific contract lifecycle management market share stood at 35.03% in 2024 in the global market, with a valuation of USD 520.1 million. The dominance is due to the rapid digital transformation across sectors such as BFSI, manufacturing, and IT services.

Enterprises in the region are adopting contract management solutions to improve visibility, minimize legal risks, and streamline high-volume transactions. Additionally, the presence of cloud-based service providers, coupled with rising investment in enterprise automation is driving market growth across the region.

North America contract lifecycle management industry is poised to grow at a significant CAGR of 13.39% over the forecast period. The growth is driven by continuous product launches by the key market players with new features tailored for procurement and legal teams.

Market players in this region are introducing AI-powered tools for clause extraction, risk detection, and contract authoring to improve speed and accuracy.The region’s emphasis on innovation, along with increasing demand for advanced compliance management, positions North America as a dominant region for the market.

- In April 2025, Ironclad launched new capabilities on its AI-powered contract lifecycle management platform to address contract value leakage and enhance collaboration between procurement and legal teams. The update introduced Obligation and Entity Management, a unified dashboard, and custom AI data extraction to ensure visibility into supplier commitments.

Regulatory Frameworks

- In the U.S., contract lifecycle management solutions must comply with the Electronic Signatures in Global and National Commerce (E-SIGN) Act and the Uniform Electronic Transactions Act (UETA). These regulations establish the legal validity of electronic contracts and digital signatures.

- In Europe, contract management tools must adhere to the General Data Protection Regulation (GDPR), which governs how personal data is processed and stored within contracts.

Competitive Landscape

Key players in the global contract lifecycle management industry are focusing on expanding platform capabilities to address the increasing complexity of contract operations. A core strategy includes integrating e-signature workflows directly into the tool, enabling seamless execution of agreements across departments.

Leading vendors are also enhancing intelligent contract repositories with AI features that enable clause recognition, automated tagging, and full-text search to streamline contract retrieval and compliance tracking. To manage third-party contracts efficiently, providers are deploying tools that allow side-by-side comparisons of external papers, redline tracking, and smart risk scoring.

Click wrap agreement functionality is also being embedded to capture user consent at scale, particularly for digital-first customer interactions. These strategies reflect the growing shift toward automation, collaboration, and compliance-focused design across the contract lifecycle.

- In February 2025, SpotDraft raised USD 54 million in a Series B funding round led by Vertex Growth and Trident Growth Partners. The investment aims to accelerate global expansion and advance SpotDraft’s AI-powered contract lifecycle management platform. The solution supports in-house legal teams by managing contract workflows, including redlining, e-signatures, third-party papers, intelligent repositories, and clickwrap agreements.

List of Key Companies in contract lifecycle management:

- Zycus Inc.

- Conga

- Luminance Technologies Ltd.

- Agiloft Inc.

- Coupa

- PandaDoc Inc.

- Oracle

- Summize Ltd.

- Icertis

- GEP

- SAP

- Evisort

- LinkSquares, Inc.

- Docusign, Inc.

- Ironclad, Inc.

Recent Developments (Product Launch)

- In March 2025, Malbek launched Conversational Contracts using Agentic AI to simplify contract lifecycle management. The solution enables natural language interactions and automates workflows by extracting key terms and obligations, reducing manual input and accelerating contract execution.

- In February 2025, ContractPodAi launched Leah Marketplace, a platform built on agentic AI to deliver customizable legal AI applications. Developed in collaboration with PwC, KPMG, and Integreon, the platform addresses compliance, contract analysis, and regulatory challenges.

strong