Market Definition

A market refers to the manufacturing of device or system designed to detect illegal or prohibited items, known as contraband, within luggage, cargo, vehicles, or even on individuals. These detectors are often used in security contexts, such as airports, border crossings, prisons, and customs checks.

They are designed to identify items such as weapons, drugs, explosives, or other items that are illegal or restricted. The report presents a comprehensive analysis of the key market drivers, emerging trends, and the competitive landscapeshaping growth through the forecast period.

Contraband Detector Market Overview

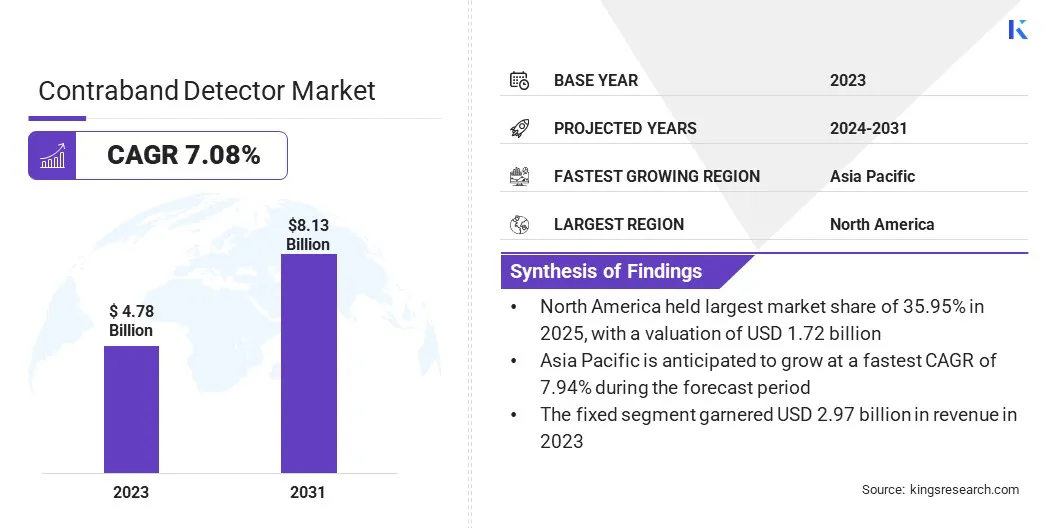

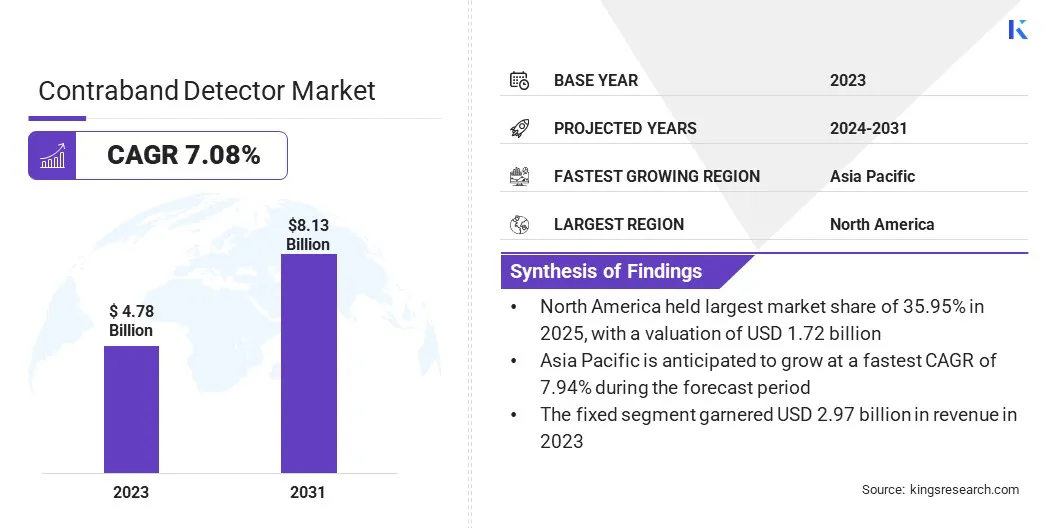

Global contraband detector market size was valued at USD 4.78 billion in 2023, which is estimated to be valued at USD 5.04 billion in 2024 and reach USD 8.13 billion by 2031, growing at a CAGR of 7.08% from 2024 to 2031.

Growing investments in security for airports, seaports, and public facilities are vital for safeguarding critical infrastructure. This is boosting the demand for advanced contraband detection systems, supporting market expansion and technological advancements.

Major companies operating in the contraband detector industry are Leidos, Smiths Group plc., NUCTECH COMPANY LTD, Metrasens, C.E.I.A. S.p.A., Berkeley Varitronics Systems, Godrej Enterprises, CSECO, Garrett Metal Detectors, PKI Electronic Intelligence, Vidisco, Astrophysics Inc, Autoclear, OSI Systems Company, KAPRI CORP, and others.

Growing security concerns due to terrorism, smuggling, and illegal activities are stimulating demand for advanced contraband detection systems. High-risk areas such as airports, border security, and prisons icreasingly require sophisticated technologies to detect explosives, drugs, and weapons.

As threats evolve, the need for reliable and innovative detection solutions is fueling market expansion and global investments in advanced technologies.

- In February 2025, the Virginia Department of Corrections (VADOC) became the first corrections system globally to pilot ScanTech AI’s state-of-the-art drug and contraband detection scanner. This AI-powered device enhances mail screening and prevents contraband from entering correctional facilities.

Key Highlights:

- The contraband detector industry size was recorded at USD 4.78 billion in 2023.

- The market is projected to grow at a CAGR of 7.08% from 2024 to 2031.

- North America held a share of 35.95% in 2023, valued at USD 1.72 billion.

- The X-ray imaging segment garnered USD 1.79 billion in revenue in 2023.

- The people segment is expected to reach USD 3.39 billion by 2031.

- The fixed segment held a share of 62.15% in 2023.

- The airports segment is anticipated to grow at a CAGR of 7.66% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 7.94% through the projection period.

Market Driver

Rising Demand in Critical Infrastructure

The increasing focus on securing critical infrastructure, such as airports, seaports, and public facilities, is propelling the growth of the contraband detector market. Rising threats from terrorism, smuggling, and trafficking are prompting government and organizational investment in advanced security technologies.

Demand for reliable, efficient, and AI-powered detection systems is accelerating market growth, as industries seek effective solutions to prevent contraband entry into secure areas.

- In December 2023, Vehant Technologies deployed cutting-edge scanning machines at Ayodhya Airport, enhancing security measures. This reflects the growing adoption of innovative detection systems in critical infrastructure to prevent illegal activities in high-security zones.

Market Challenge

Occurance of False Positives and False Negatives

A major challenge hampering the progress of the contraband detection market is the occurrence of false positives and false negatives. False positives lead to operational delays and resource wastage, while false negatives increases the risk of undetected threats.

To address this challenge, industry players are focusing on continuous improvements in detection algorithms, particularly through AI and machine learning, to enhance the accuracy of detection systems. Regular calibration and real-time learning also help in reducing errors, while integrating multi-layered scanning technologies can ensure more precise and reliable identification of contraband.

Market Trend

Surging Adoption of Non-Intrusive Inspection (NII) Technologies

A key trend influencing the contraband detection market is the rise of Non-Intrusive Inspection (NII) technologies, such as muon tomography. These technologies enable the detection of hidden contraband without generating harmful radiation.

NI allows for the examination of objects or cargo without physical damage, utilizing advanced techniques to idnetify contraband, explosives, or illegal substances.

These passive systems offer a safer alternative to traditional X-ray machines, particularly for dense cargo such as produce, frozen goods, and metals, which can obstruct traditional detection methods. NII technologies enhance detection accuracy while reducing safety risks, operational costs, and the need for complex radiation protection.

- In March 2024, Decision Sciences unveiled a passive human detection feature for its Discovery system, marking a breakthrough in contraband detection. Using Non-Intrusive Inspection (NII) technology, the sytem employs muon tomography to safely detect hidden contraband and individuals within dense cargo, without emitting harmful radiation.

Contraband Detector Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

X-ray Imaging, Metal Detection, Spectroscopy/Spectrometry, Others

|

|

By Screening

|

People, Baggage & Cargo, Vehicle

|

|

By Deployment

|

Fixed, Portable

|

|

By Application

|

Government & Law Enforcement, Airports, Critical Infrastructure, Transportation & Logistics, Retail & Commercial, Education, Hospitality, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Technology (X-ray Imaging, Metal Detection, Spectroscopy/Spectrometry, and Others): The X-ray imaging segment earned USD 1.79 billion in 2023 due to its widespread adoption for screening luggage, cargo, and people, offering effective contraband detection in security applications.

- By Screening (People, Baggage & Cargo, and Vehicle): The people segment held a share of 42.17% in 2023, largley attributed to increased security measures in public spaces, airports, and border crossings, boosting the demand for effective personal contraband detection.

- By Deployment (Fixed and Portable): The fixed segment is projected to reach USD 5.01 billion by 2031, fuled by the growing need for permanent security installations at airports, government buildings, and transportation hubs, enhancing continuous contraband detection.

- By Application (Government & Law Enforcement, Airports, Critical Infrastructure, Transportation & Logistics, Retail & Commercial, Education, Hospitality, and Others): The airports segment is anticipated to grow at a CAGR of 7.66% over the forecast period, mainly due to rising security concerns, increasing air travel, and the need for more robust screening technologies.

Contraband Detector Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America contraband detector market share stood at around 35.95% in 2023, valued at USD 1.72 billion. This dominance is reinforced by the region's strong regulatory frameworks, advanced technological infrastructure, and high investments in security systems.

Rising focus on safeguarding critical infrastructures, such as airports, borders, and correctional facilities, has fueled the demand for advanced detection technologies. Additionally, the growing prevalence of illegal activities and stringent safety protocols have fostered by regional market growth, as government agencies and private sectors adopt cutting-edge solutions to enhance security and detection capabilities.

- In February 2024, Leidos, an American company, received ECAC EU Standard 2.1 certification for its Pro:Vision 3 people screening system. This certification ensures compliance with European Union regulations, enhances detection accuracy, reduces false alarms, and improves passenger comfort and throughput at airports.

Asia Pacific contraband detector industry is estimated to grow at a CAGR of 7.94% over the forecast period. This notable expansion is bolstered by rapid urbanization, increasing security concerns, and expanding industrial sectors. Countries in this region are heavily investing in advanced security technologies to combat growing threats at airports, seaports, and border checkpoints.

The rise in cross-border trade, coupled with stricter regulatory measures, has further amplified the need for efficient detection systems. Additionally, government initiatives to enhance national security and the adoption of smart infrastructure are fueling domestic market growth.

Regulatory Frameworks

- In India, the Bureau of Indian Standards (BIS) sets safety and quality standards for contraband detection devices, ensuring compliance with national security protocols and supporting security measures across critical infrastructure.

- In the EU, Regulation No. 2015/1998 governs technical specifications for airport screening equipment, defining measures to implemen common aviation security standards, enhance contraband detection, and ensure passenger safety.

Competitive Landscape

Companies in the contraband detector market are increasingly focusing on the integration of advanced technologies, such as artificial intelligence (AI), machine learning (ML), and X-ray diffraction, to enhance detection capabilities. These technologies allow for more accurate identification of illicit substances and materials, improving efficiency in high-volume screening environments.

Manufacturers are further developing non-intrusive systems that ensure safety, reduce false alarms, and automate the detection process. Additionally, there is a strong emphasis on improving system adaptability to detect emerging contraband methods and meet evolving security demands across various industries.

- In April 2024, Smiths Detection launched the SDX 10060 XDi X-ray Diffraction technology scanner, designed to enhance the detection of narcotics and contraband. Featuring AI interation, the scanner improves screening at airports, ports, and customs control points, boosting detection rates while automating processes and reducing manual inspections. its high sensitivity also strengthens security by identifying threats such as explosives, aiding in the fight against illegal trafficking..

List of Key Companies in Contraband Detector Market:

- Leidos

- Smiths Group plc.

- NUCTECH COMPANY LTD

- Metrasens

- E.I.A. S.p.A.

- Berkeley Varitronics Systems

- Godrej Enterprises

- CSECO

- Garrett Metal Detectors

- PKI Electronic Intelligence

- Vidisco

- Astrophysics Inc

- Autoclear

- OSI Systems Company

- KAPRI CORP

Recent Developments (Deployment/Agreements)

- In March 2025, Westminster Group secured a 15+ year, multi-million USD contract for comprehensive airport security services in Gabon. This agreement includes advanced detection equipment, surveillance, screening, and ongoing training, enhancing security standards across three international and one domestic airport to foster growth in air traffic.

- In November 2024, LINEV Systems deployed its advanced CLEARPASS C.i. partial body scanner at Hubbard County Jail, enhancing security by detecting contraband such as narcotics and weapons. This technology integrates AI-driven software, including DruGuard and A-EYE, ensuring high-efficiency detection with portable, flexible solutions for correctional facilities and beyond.