Market Definition

Consumer IoT refers to a network of smart, internet-connected devices used in personal and home environments. These devices collect and share data to enable automation, remote control, and real-time monitoring.

It includes smart speakers, fitness wearables, connected home appliances, and security systems. Consumer IoT enhances convenience, improves efficiency, and supports a connected digital lifestyle.

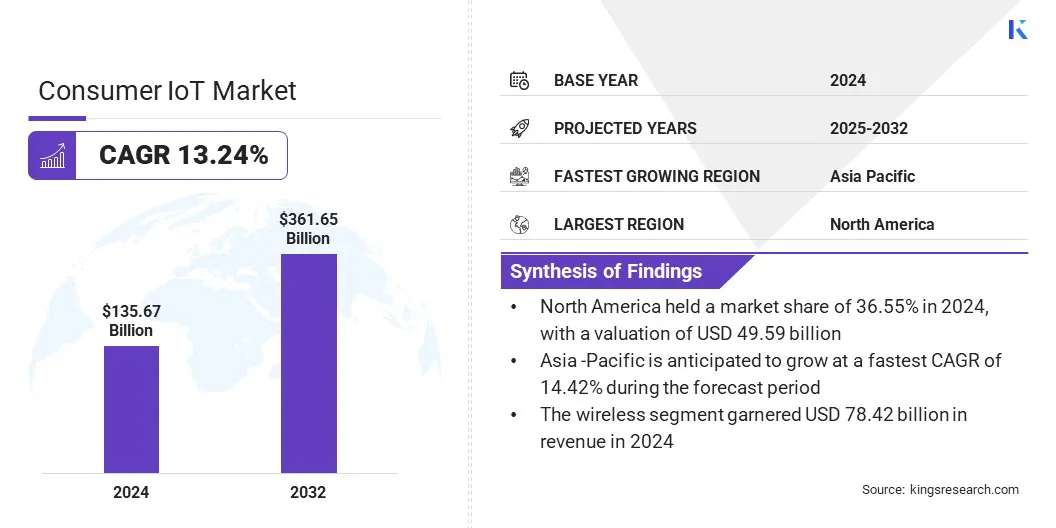

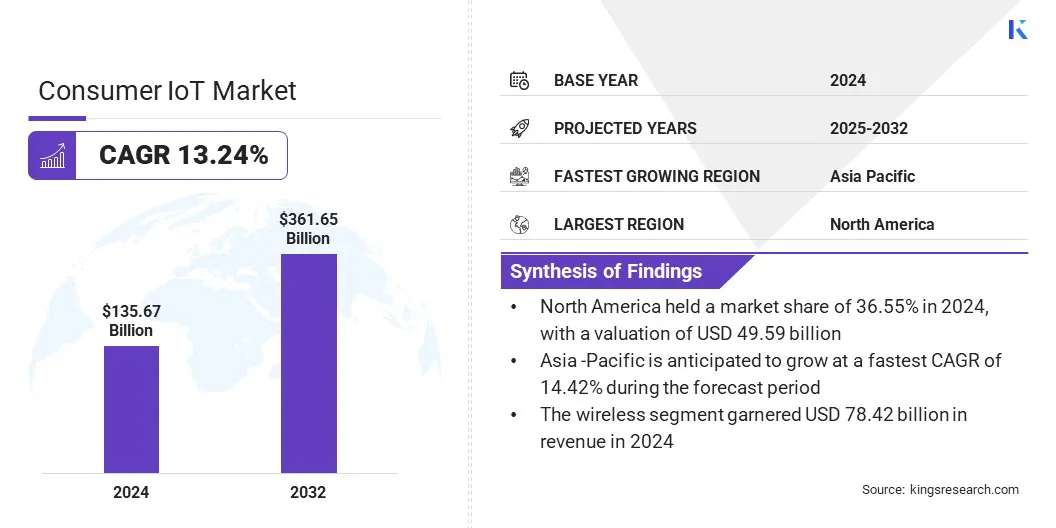

The global consumer IoT market size was valued at USD 135.67 billion in 2024 and is projected to grow from USD 151.45 billion in 2025 to USD 361.65 billion by 2032, exhibiting a CAGR of 13.24% during the forecast period. Market progress is fueled by the expansion of cloud and connectivity infrastructure, which supports seamless integration and real-time data exchange across connected devices.

The integration of advanced wireless technologies further aids market growth by providing faster data speeds, lower latency, and stable connections essential for high-performance consumer applications.

Key Market Highlights:

- The global consumer IoT industry size was recorded at USD 135.67 billion in 2024.

- The market is projected to grow at a CAGR of 13.24% from 2025 to 2032.

- North America held a market share of 36.55% in 2024, with a valuation of USD 49.59 billion.

- The hardware segment garnered USD 62.87 billion in revenue in 2024.

- The wireless segment is expected to reach USD 232.17 billion by 2032.

- The consumer electronics segment held a market share of 35.46% in 2024 .

- Asia Pacific is anticipated to grow at a CAGR of 14.42% over the forecast period.

Major companies operating in the consumer IoT market are Cisco Systems, Inc, Intel Corporation, Amazon Web Services, Inc, IBM Corporation, Microsoft, C3.ai, Inc, HQSoftware, Huawei Technologies Co., Ltd, Oracle, Samsara Inc, Siemens, Verizon, Robert Bosch GmbH, Telit Cinterion, and Xiaomi Inc.

Consumer IoT Market Report Scope

|

Segmentation

|

Details

|

|

By Component

|

Hardware, Software, Services

|

|

By Connectivity

|

Wired, Wireless

|

|

By Application

|

Consumer Electronics, Healthcare, Wearable Devices, Automotive, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Consumer IoT Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America consumer IoT market accounted for a share of 36.55% in 2024, valued at USD 49.59 billion. This dominance is attributed to the widespread deployment of advanced network infrastructure and the integration of eSIM-based connectivity solutions.

Regional players are enabling high-performance applications by offering seamless local network access, which supports consistent device functionality and regulatory compliance. The regional market is experiencing steady improvements in latency and data throughput, which are critical for consumer-near use cases such as digital payments and smart home devices.

Moreover, domestic market expansion is propelled by strong cross-border connectivity initiatives that simplify device management and enhance international deployment. Enterprises in the region are adopting unified platforms to manage global IoT operations, which ensures scalable consumer IoT services and supports regional market expansion.

- In December 2024, Telenor IoT partnered with Verizon Business to expand its presence in the U.S. market. The collaboration enables its customers to use eSIM-based local connectivity on Verizon’s IoT network, improving performance for consumer-near applications such as payment solutions by offering lower latency and higher data throughput. This initiative supports global deployment of connected consumer devices.

The Asia-Pacific consumer IoT industry is set to grow at a robust CAGR of 14.42% over the forecast period. This growth is attributed to rising investments in AI-driven connected devices, 5G infrastructure, and embedded systems.

Regional companies are advancing their capabilities in full-cycle product development by acquiring firms specializing in Android-based smart devices. The integration of software and hardware expertise is enabling companies to deliver more sophisticated and interoperable consumer solutions.

- In April 2025, Sasken acquired Borqs Enterprises to expand its presence in AI, 5G, and consumer IoT technologies. The acquisition enhances Borqs’ expertise in Android-based smart devices and embedded software, supporting end-to-end product development and expanding its presence.

Additionally, increasing demand for connected home systems, wearable technology, and mobile-enabled services is supporting market expansion.

Regional enterprises are accelerating product rollouts through expanded design and development operations, which is boosting adoption across multiple segments, including smart home automation and wearable devices. The regional market is further benefiting from growing internet accessibility.

Consumer IoT Market Overview

Regulatory alignment and certification are boosting adoption by simplifying compliance and enhancing consumer trust in connected devices.

The introduction of unified security specifications is enabling manufacturers to meet multiple international requirements through a single framework, supporting broader deployment of secure consumer IoT products.

- In March 2024, the Connectivity Standards Alliance launched the IoT Device Security Specification 1.0, accompanied by a global certification program and Product Security Verified Mark. The initiative aims to unify cybersecurity requirements across key international markets, enabling manufacturers to meet multiple regulatory standards with a single framework. It helps strengthen consumer trust by ensuring secure device design, secure communications, and transparent security practices for consumer IoT products, particularly in categories such as smart home devices and connected appliances.

Market Driver

Expansion of Cloud and Connectivity Infrastructure

The growth of the market is fueled by the expansion of cloud and connectivity infrastructure to support the growing demand for seamless device integration and real-time data processing. Enterprises are deploying advanced network technologies and scalable cloud platforms to ensure consistent performance, low latency, and high availability across connected ecosystems.

This infrastructure development is enabling the large-scale deployment of smart home systems, wearables, and voice-enabled devices. It is also improving interoperability, reducing downtime, and supporting continuous data flow across diverse consumer IoT applications.

- In May 2024, Airtel partnered with Google Cloud to deliver AI-powered cloud solutions and launched an integrated IoT platform combining connectivity, AI services, and application software. The initiative supports fast deployment and intelligent operation of IoT solutions for consumer and utility use cases.

Market Challenge

Rising Security and Privacy Concerns

A key challenge impeding the expansion of the consumer IoT market is the ongoing concern over security and privacy. Several devices collect sensitive personal data, lack robust encryption, secure authentication protocols, or consistent security standards.

These weaknesses increase the risks of unauthorized access, data breaches, and cyberattacks, undermining user trust and slowing adoption.

To address this challenge, market players are implementing stronger security frameworks, including end-to-end encryption and multi-factor authentication. They are designing devices with built-in privacy controls that allow users to manage data-sharing preferences.

Manufacturers are also aligning their products with global data protection regulations and conducting regular security audits. Additionally, they are adopting secure firmware update mechanisms and partnering with cybersecurity firms to enhance threat detection, aiming to build user trust and ensure safe device ecosystems.

Market Trend

Integration of Advanced Wireless Technologies

A key trend influencing the market is the integration of advanced wireless technologies to enhance device performance and connectivity. Manufacturers are increasingly implementing next-generation standards such as Wi-Fi 7 to support faster data transfer, lower latency, and more reliable networks.

This is facilitating the development of high-bandwidth applications such as AR/VR headsets, smart home systems, and connected entertainment devices, enhancing user experiences and expanding IoT capabilities.

- In January 2024, Ceva launched its RivieraWaves Wi-Fi 7 IP platform, incorporating IEEE 802.11be features such as 4K QAM modulation and Multi Link Operation. The platform enables faster data transmission and lower latency, helping semiconductor companies and OEMs accelerate the development of next-generation consumer IoT devices with enhanced connectivity and shorter time-to-market.

Market Segmentation

- By Component (Hardware, Software, and Services): The hardware segment earned USD 62.87 billion in 2024, mainly due to increased demand for smart devices and IoT-enabled equipment.

- By Connectivity (Wired and Wireless): The wireless segment held a share of 57.80% in 2024, propelled by the growing adoption of 5G and Wi-Fi technologies.

- By Application (Consumer Electronics, Healthcare, Wearable Devices, Automotive, and Others): The consumer electronics segment is projected to reach USD 113.28 billion by 2032, owing to the rising consumer demand for connected home and entertainment devices.

Regulatory Frameworks

- In the U.S., the Federal Trade Commission (FTC) regulates the market by overseeing data privacy, consumer protection, and security standards under the Federal Trade Commission Act, ensuring companies avoid deceptive practices and protect user data.

- In China, the Ministry of Industry and Information Technology governs consumer IoT sector by setting technical standards, regulating cybersecurity, and enforcing compliance with the Cybersecurity Law and IoT-specific policies. MIIT also supervises domestic manufacturers and promotes the localization of core technologies to strengthen national technological sovereignty.

- In India, the Ministry of Electronics and Information Technology (MeitY) oversees the market through policies on data privacy, digital security, and device interoperability. It is responsible for implementing the personal data protection framework and driving IoT policy initiatives.

Competitive Landscape

Major players in the consumer IoT market are expanding their wireless connectivity portfolios to enhance device interoperability and performance. They are strengthening 5G and edge compute capabilities to support faster and more efficient data processing for connected devices.

Organizations are also broadening their hardware offerings by incorporating advanced gateways, routers, and modems to improve connectivity infrastructure.

Additionally, they are entering new customer segments such as home automation users, health and fitness consumers, and connected lifestyle adopters to diversify applications and boost adoption.

They are expanding their reach across various use cases and streamlining device deployment and connectivity management to simplify operations and enhance user experience.

- In November 2024, Lantronix acquired NetComm’s Enterprise IoT business from DZS to strengthen its 5G and edge compute capabilities. The acquisition expands Lantronix’s wireless connectivity portfolio, including gateways, routers, and modems, and expands its enterprise customer base.

Key Companies in Consumer IoT Market:

- Cisco Systems, Inc

- Intel Corporation

- Amazon Web Services, Inc

- IBM Corporation

- Microsoft

- ai, Inc

- HQSoftware

- Huawei Technologies Co., Ltd

- Oracle

- Samsara Inc

- Siemens

- Verizon

- Robert Bosch GmbH

- Telit Cinterion

- Xiaomi Inc.

Recent Developments (Partnerships/Agreements/New Product Launch)

- In February 2025, Amazon introduced Alexa+, a next-generation AI assistant powered by generative AI. Alexa+ is designed to enhance user experience through conversational intelligence and personalized responses. It enables a wide range of functions such as smart home management, voice-assisted commerce, entertainment control, appointment scheduling, and autonomous task execution via internet navigation.

- In April 2024, ROSHN Group signed a memorandum of understanding (MoU) with Cisco to explore the use of IoT technologies for developing smart, sustainable buildings across Saudi Arabia. The partnership focuses on integrating advanced technologies into ROSHN’s future Innovation Hub to enhance energy efficiency, building automation, and smart community management.