Global Construction Wearables Market Size

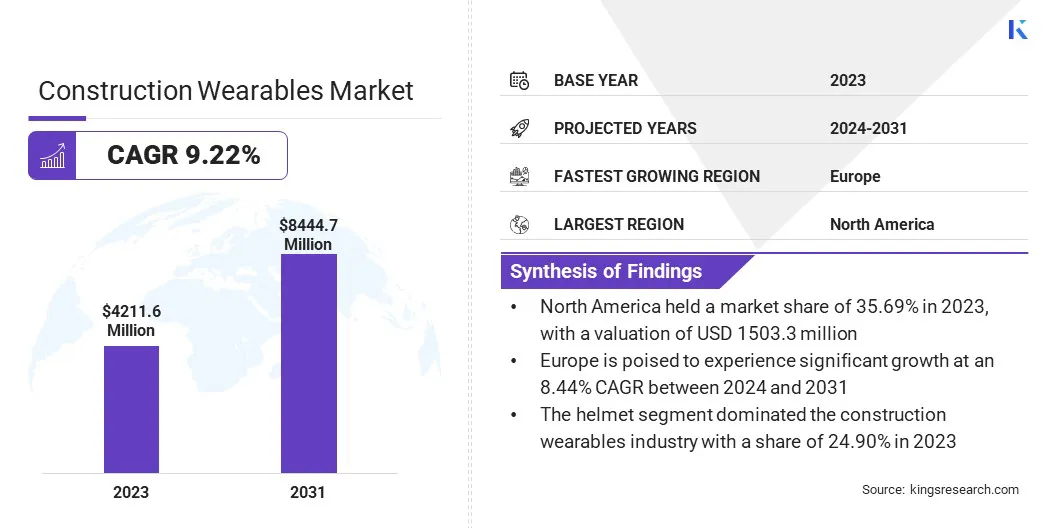

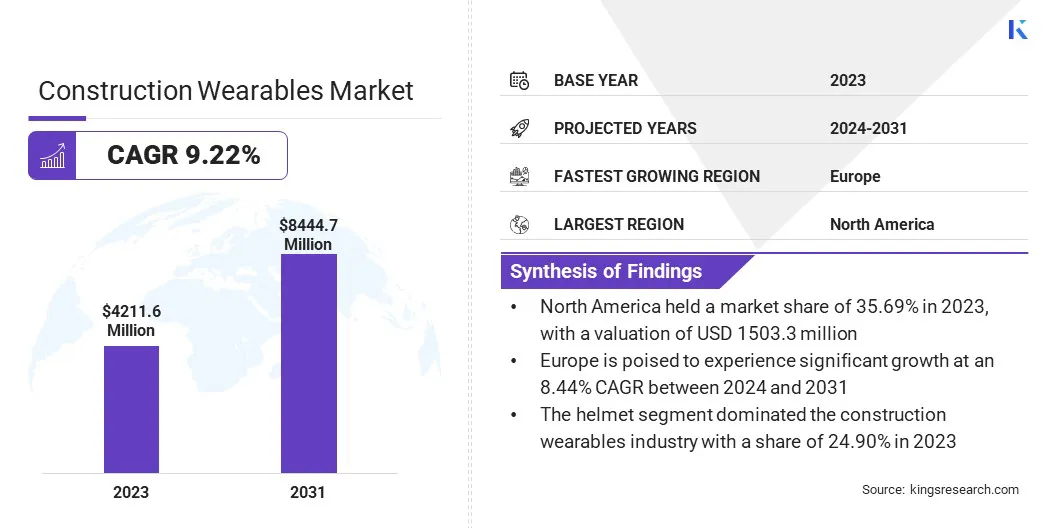

The global Construction Wearables Market size was valued at USD 4,211.6 million in 2023 and is projected to reach USD 8,444.7 million by 2031, growing at a CAGR of 9.22% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as Ekso Bionics, Arm Limited, Panasonic, GERMAN BIONIC SYSTEMS GMBH, Wenco International Mining Systems Ltd., Proxgy, Trimble Inc., XREAL, Inc., RealWear Inc, SUITX by Ottobock and Others.

Increasing demand for enhanced productivity and efficiency in construction projects stems from the industry's constant drive for optimization and profitability. With rising competition and project complexities, construction firms are pressured to deliver projects faster and more efficiently while maintaining quality standards. This demand is fueled by various factors, such as tight project schedules, labor shortages, and the need to meet client expectations within budget constraints.

To address these challenges, construction companies are increasingly turning to technology-driven solutions, including construction wearables, to streamline workflows, improve communication, and enhance task management.

Wearable technologies equipped with sensors, communication devices, and data analytics capabilities play a crucial role in boosting productivity and efficiency by providing real-time insights into workforce performance, safety compliance, and equipment utilization. By utilizing these innovations, construction firms aim to optimize resource allocation, minimize downtime, and ultimately achieve better project outcomes.

Construction wearables refer to wearable devices specifically designed for use in construction settings to enhance safety, productivity, and efficiency. These wearables encompass a range of products, including smart helmets, vests, glasses, and wearable sensors. Smart helmets are equipped with built-in cameras, communication systems, and sensors to monitor environmental conditions and provide augmented reality overlays for visualizing construction plans.

Smart vests and jackets may incorporate sensors for monitoring vital signs and GPS tracking for location monitoring. Wearable sensors can be attached to clothing or worn as accessories to monitor various aspects of workers' health and safety, such as posture, fatigue levels, and exposure to hazardous substances. These wearables aim to improve worker safety, optimize workflows, and provide real-time data to enhance decision-making on construction sites.

Analyst’s Review

The perspective of the construction wearables market is optimistic. Currently, the market is witnessing increasing adoption of wearables in the construction industry, driven by a growing emphasis on worker safety, regulatory requirements, and the need for improved productivity and efficiency. Technological advancements in sensors, connectivity solutions, and data analytics are fueling market growth, enabling the development of innovative wearable solutions tailored to the unique needs of construction professionals.

With the advent of wearable robotics, augmented reality, and AI-powered analytics, construction wearables are enhancing worker well-being and operational performance. As construction companies recognize the potential benefits of these technologies, the demand for construction wearables is expected to continue growing steadily, positioning the market for significant expansion in the coming years.

Construction Wearables Market Growth Factors

Advancements in sensor technology and connectivity solutions have been driving innovation in the construction wearables market. Sensors embedded in wearable devices are becoming increasingly sophisticated, allowing for real-time monitoring of various parameters such as environmental conditions, worker health, and equipment performance.

These sensors enable construction companies to gather valuable data insights, analyze them to optimize workflows, improve safety protocols, and enhance project efficiency. Furthermore, advancements in connectivity solutions, such as wireless communication networks and cloud-based platforms, facilitate seamless data transmission and remote monitoring of construction sites.

This connectivity empowers project managers and supervisors to access critical information in real time, enabling informed decision-making and proactive intervention when necessary. Overall, advancements in sensor technology and connectivity solutions are driving the development of smarter, more efficient construction wearables that are reshaping the future of the construction industry.

Cost concerns associated with the implementation and maintenance of construction wearables are hindering market expansion. While these wearables offer significant benefits in terms of improving safety, productivity, and efficiency on construction sites, their initial acquisition costs and ongoing maintenance expenses are substantial. Additionally, there may be additional costs associated with training workers to properly use and integrate wearable technologies into their workflows.

For some construction firms, especially smaller ones with limited budgets, these upfront costs may pose a barrier to adoption. Furthermore, concerns about the durability and reliability of wearables in harsh construction environments may also deter investment. To address these challenges, stakeholders in the construction wearables market need to focus on developing cost-effective solutions that deliver measurable ROI to construction companies, thereby product adoption and market growth.

Construction Wearables Market Trends

The integration of augmented reality (AR) technology in construction wearables represents a significant trend shaping the industry. AR technology overlays digital information onto the physical world, providing construction workers with valuable visualizations and instructions directly within their field of view.

In the context of construction wearables, AR-enabled devices such as smart glasses or helmets aim to enhance worker productivity and safety by providing real-time access to construction plans, equipment manuals, safety protocols, and other relevant information. This hands-free access to critical data improves efficiency on the job site, reduces errors, and facilitates better communication among team members.

Additionally, AR technology enables immersive training experiences, allowing workers to practice complex tasks in a virtual environment before executing them in the field. As AR technology continues to advance and become more accessible, its integration into construction wearables is expected to accelerate, thereby driving innovation and transforming traditional construction processes.

Segmentation Analysis

The global market is segmented based on product, end user, and geography.

By Product

Based on product, the market is segmented into watch, boot, helmet, AR glasses, body wear/vest, exoskeleton, and others. The helmet segment dominated the construction wearables industry with a share of 24.90% in 2023 owing to its pivotal role in ensuring worker safety and facilitating the integration of various advanced technologies.

Helmets are a fundamental component of personal protective equipment (PPE) in the construction industry, mandated by safety regulations to protect workers from head injuries. However, recent innovations have transformed traditional helmets into smart helmets equipped with cameras, sensors, and communication systems. These smart helmets provide real-time monitoring of environmental conditions, such as temperature and hazardous gases, and enable enhanced communication among workers on the job site.

Additionally, they offer augmented reality (AR) overlays, allowing workers to visualize construction plans and identify potential hazards. As a result of these advanced features, the helmet segment has witnessed significant adoption, which is driving its dominance in the construction wearables market.

By End User

Based on end user, the market is classified into residential, commercial, industrial, and others. The others segment, including government, defense, and infrastructure, is anticipated to witness considerable construction wearables industry growth at a 10.26% CAGR over the forecast period.

This growth is primarily prompted by increasing investments in infrastructure development projects, government initiatives aimed at improving workplace safety standards, and the growing demand for advanced technologies to enhance productivity and efficiency in these sectors. Governments around the world are allocating substantial budgets for infrastructure projects, such as transportation networks, utilities, and public facilities, driving the adoption of construction wearables to ensure worker safety and optimize project outcomes.

Similarly, defense organizations are investing in wearable technologies to enhance the capabilities of personnel engaged in various operations. Moreover, the infrastructure sector is embracing construction wearables to streamline construction processes, reduce costs, and minimize project delays. These factors are collectively contributing to the anticipated growth of the others segment in the construction wearables market.

Construction Wearables Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

The North America Construction Wearables Market share stood around 35.69% in 2023 in the global market, with a valuation of USD 1503.3 million, due to several key factors driving the adoption of construction wearables in the region. The region boasts a robust construction industry, characterized by extensive infrastructure development projects, residential and commercial construction activities, and a strong focus on workplace safety.

Secondly, stringent regulatory frameworks mandate the use of personal protective equipment (PPE), including construction wearables, to ensure worker safety and mitigate occupational hazards. Thirdly, technological advancements and early adoption of innovative solutions have propelled the integration of wearables into construction workflows across the region.

- Increasing investments in research and development initiatives aimed at enhancing the capabilities of construction wearables have thereby bolstered their adoption in North America, solidifying the region's position as a leader in the construction wearables industry.

Europe is poised to experience significant growth at an 8.44% CAGR between 2024 and 2031 primarily owing to an upsurge in construction activities, driven by urbanization, population growth, and infrastructure renewal initiatives.

Stringent regulatory frameworks mandating adherence to safety standards and the adoption of advanced technologies are fostering the uptake of construction wearables across European construction firms. Increasing investments in research and development, coupled with collaborations between industry stakeholders and technology providers, are further fueling innovation in the construction wearables market, thereby driving market growth in Europe.

- The growing emphasis on sustainability and efficiency in construction practices is prompting the adoption of wearables to optimize resource utilization and minimize environmental impact, which is expected to foster regional market development.

Competitive Landscape

The construction wearables market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Construction Wearables Market

- Ekso Bionics

- Arm Limited

- Panasonic

- GERMAN BIONIC SYSTEMS GMBH

- Wenco International Mining Systems Ltd.

- Proxgy

- Trimble Inc.

- XREAL, Inc.

- RealWear Inc

- SUITX by Ottobock

Key Industry Development

- March 2024 (Partnership): German Bionic partnered with SuperDroid Robots, Grainger, and The Ergonomics Center to host the Raleigh Robotics & Automation Showcase. The event was purposed to introduce innovative wearable robotics, specifically e-exoskeletons, aimed at improving employee performance and ensuring physical well-being during manual tasks.

The global Construction Wearables Market is segmented as:

By Product

- Watch

- Boot

- Helmet

- AR Glasses

- Body Wear/Vest

- Exoskeleton

- Others

By End User

- Residential

- Commercial

- Industrial

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America